Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Battery Energy Storage Systems (BESS) can have multiple functions. From stabilising the grid, supporting greater integration of renewables, or acting as a backup power source during rare disruptions. Beyond these core roles, BESS can also participate in balancing markets, ancillary services, and cross-market arbitrage, unlocking revenue streams that go well beyond spot price trading – with the Nordic countries offering some of the best examples.

In our previous articles about BESS, we explored how country-specific factors, technical aspects, and regulatory frameworks shape the growth of standalone BESS across Europe and their potential in different countries, Mapping Europe’s Battery Storage Potential for 2025 and Latest BESS Policy Updates in Europe: Spain, Germany & Romania. Building on that foundation, we now turn to their role within Power Purchase Agreements (PPAs), particularly when co-located with solar parks. Our case study analyzes the impact of integrating BESS into PPAs across seven countries – Portugal, Germany, Spain, Italy, Greece and Romania – by comparing how PPAs prices evolve when moving from a standard solar PPA to a solar plus BESS setup.

Co-located BESS investments are capital intensive and the additional generated revenues need to be carefully analysed to define the financial feasibility of a project. For this study, Synertics existing Solar PV PPA prices were used as a benchmark to quantify the relative PPA price difference to a Solar PV co-located BESS project. The following project assumptions were used to compute the Solar PV plus co-located BESS PPA price curves:

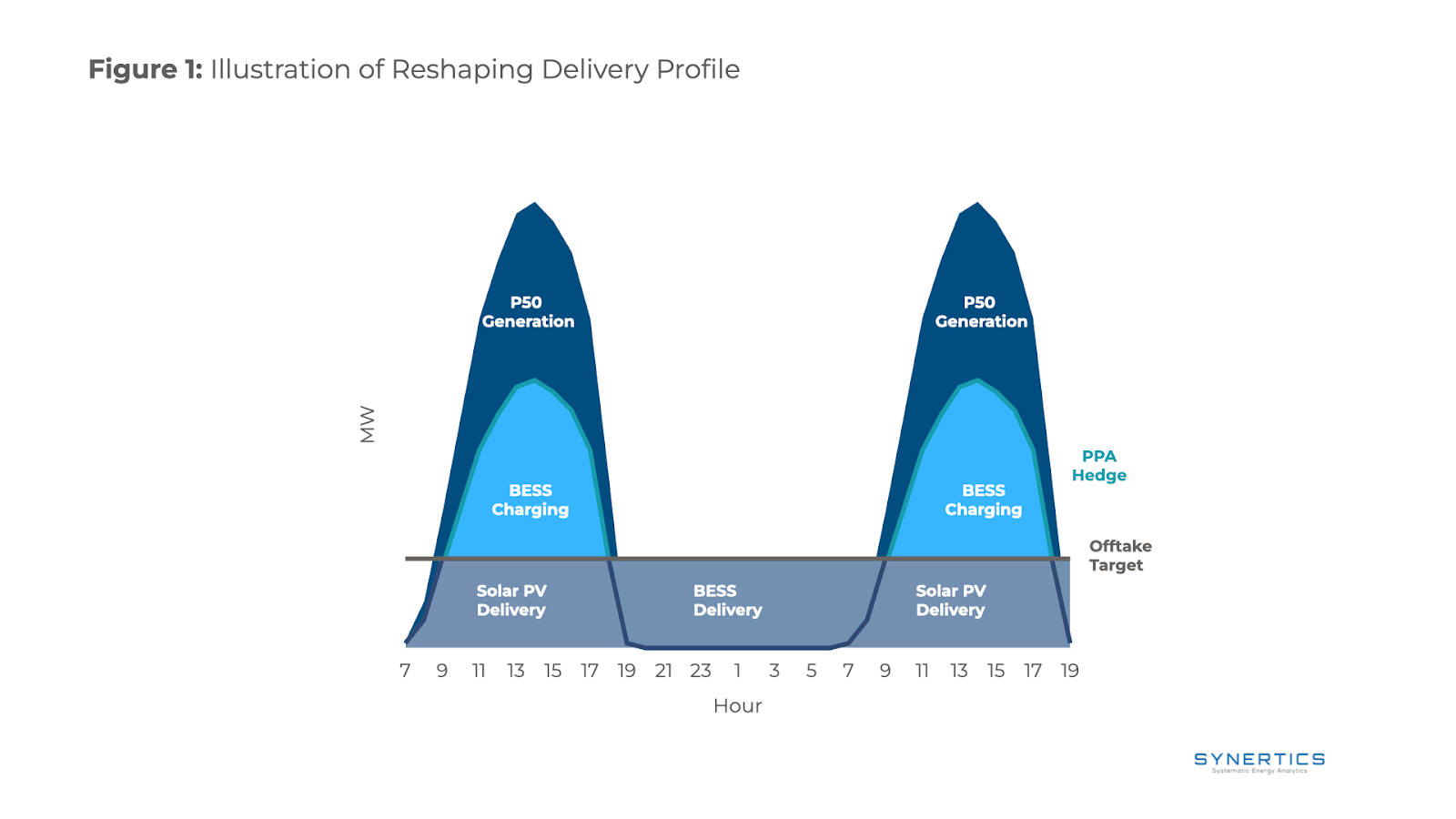

As seen in the illustration of Figure 1, the production delivery profile is aimed at maximising the offtaker quantity minimising their exposure to high market prices.

From the portion of the producer's total generated power that is transferable. During peak solar production hours, the energy generated may either fall short of or exceed the offtaker's demand. When production is below the required threshold, no surplus is available to charge the battery system. However, when there is excess generation, the surplus can be stored in the battery and later discharged during periods of higher market prices, increasing the value per MWh delivered to the offtaker. This has a direct impact on the PPA price for the hybrid park, as it increases the coverage of the offtaker’s demand during high-price periods in the market. By reducing exposure to market volatility, the hybrid setup lowers risk for the offtaker and strengthens the overall value of the contract.

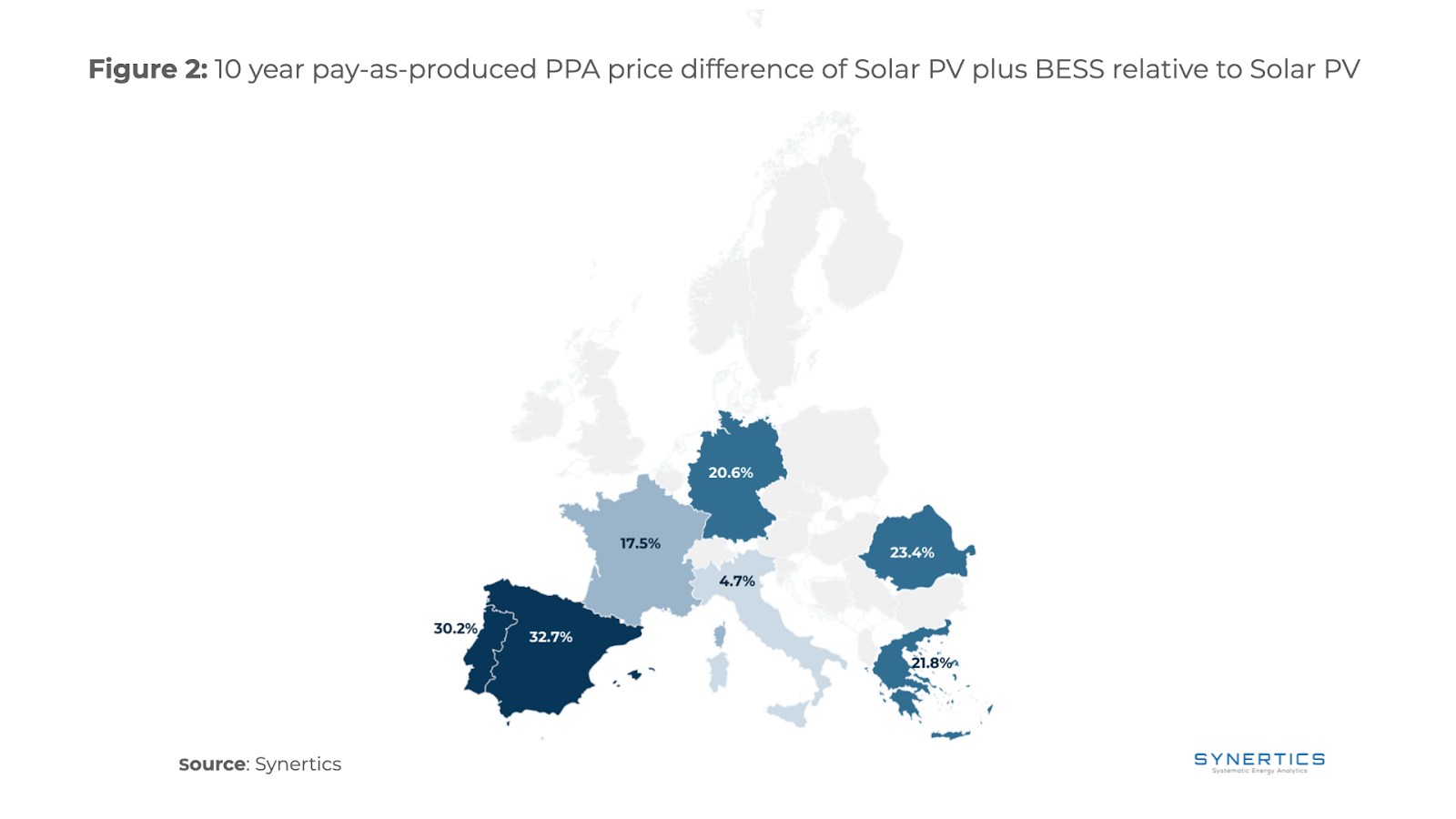

Taking into account the relevant considerations for this case study, we analyzed the percentage increase across seven countries. The price difference between Solar PV plus BESS PPAs and the respective country-specific Solar PV prices is illustrated in Figure 2.

In the Iberia Region, Portugal and Spain show the highest increase in PPA prices, mainly thanks to their favourable solar resources. The abundance of sunlight creates frequent surpluses, which can be stored in BESS and later discharged during peak demand hours, where the PV modules can’t interact because of no sunlight. This common use of BESS, will imply more coverage of the offtaker’s demand during high-price periods resulting in the increase of the PPA price. It is important to note that Solar PV PPA prices in Iberia have been gradually decreasing over the last 12 months, meaning that the relative increase might be lower in absolute values compared to a country in which the Solar PV PPA prices are higher.

For Romania, Greece and Germany, the improvements of PPA prices of a solar park with BESS are significant, with percentual variations ranging between 20% and 23%. In the Southeastern countries, the effect is stronger than in Central Europe, driven by wider daily price spreads of roughly 190-170 EUR/MWh. Here, BESS proves valuable in shifting delivery from low-price periods, where the solar takes action of the park, to high-price hours. This allows the offtaker to benefit directly from battery discharging instead of relying on volatile market purchases. In Germany, the improvement is slightly smaller, as daily price spreads are lower, around 120 EUR/MWh. This effect is especially pronounced in markets with high average daily prices, where even a small percentage gain translates to meaningful financial returns.

France shows a smaller improvement on the PPA price for hybrid parks, which can be linked to the strong presence of nuclear power in its generation mix. Nuclear provides stable baseload supply reducing price volatility and therefore limiting the relative added value that BESS can deliver compared to more volatile markets.

Italy presents the opposite scenario of Portugal and Spain: high electricity prices, relatively low cannibalization risk anticipated and price fluctuations throughout the day are limited, with fewer sharp peaks and dips. As a result, the percentage improvement from adding BESS to solar PPAs is more modest compared to other regions, since there is less opportunity for the battery to shift energy into significantly higher-priced hours.

Based on our case study, all countries show an increase in PPA prices when hybridizing a solar park with BESS. The strongest percentage gains are seen in Iberia, where Portugal and Spain benefit from favorable solar conditions that allow significant shifting of surplus generation. Italy, by contrast, presents the lowest increase, reflecting its market characteristics of high prices but limited intraday volatility. Meanwhile, Romania, Greece, and Germany demonstrate the greatest potential for hybrid parks. Although their percentage increase is about 10% lower than in the Iberian Peninsula, the impact is larger in absolute terms because these markets have higher average daily prices and greater volatility.

Market-trends, Projects

27th Nov, 2025

Projects

22nd Jan, 2024

Projects

5th Jul, 2023