Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

As Europe accelerates its energy transition, battery energy storage systems (BESS) are playing a growing role in grid flexibility and renewable integration. Over the past few years, we’ve seen a significant decline in lithium BESS costs, with average prices decreasing by 30% each time production doubles. This trend has led to more compelling business cases for BESS investments. However, revenue potential is highly dependent on market opportunities, and not all markets are equally attractive. In this article, we rank EU countries based on their potential for storage investment, focusing on the most relevant indicators for arbitrage and revenue stacking.

To assess the attractiveness of energy storage across EU countries, we considered the following indicators:

We placed greater weight on the daily spread, as it better reflects arbitrage potential, the core revenue stream for most BESS projects. While negative prices signal oversupply and potential charging opportunities, they don’t necessarily indicate consistent profit potential. In contrast, the daily spread captures market volatility, revealing when batteries can buy low and sell high.

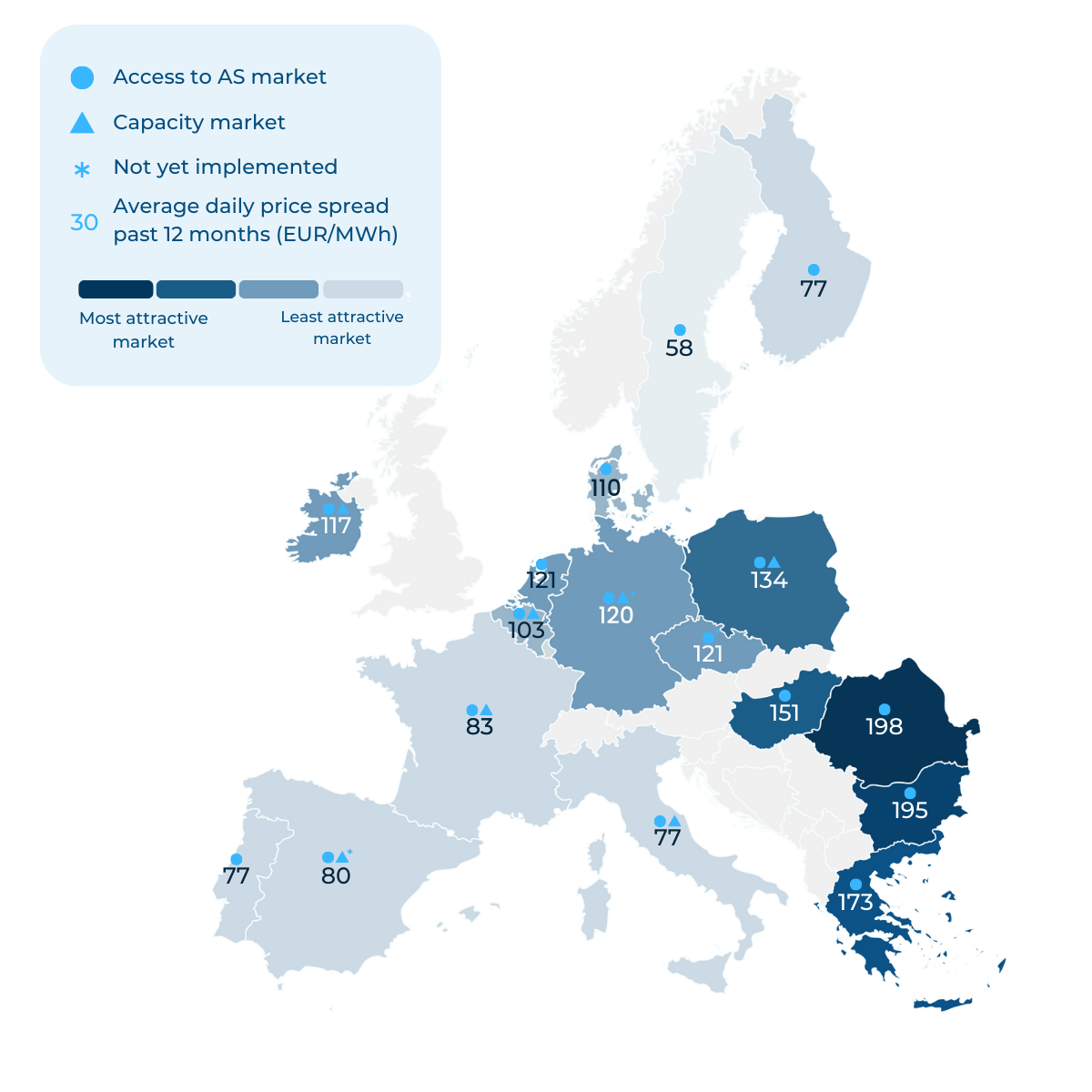

Southeast Europe, Romania, Bulgaria and Greece, emerges as a highly attractive region for BESS deployment. All three countries rank at the top in terms of mean daily price spread, with Romania leading the entire EU dataset. This strong price volatility indicates excellent opportunities for energy arbitrage.

These record price spreads are primarily driven by insufficient electricity interconnections in Southeast Europe, which limit the efficient transport of energy from major European markets into the region. This structural weakness creates persistent price imbalances. Although these countries have made significant investments in renewable energy to reduce their reliance on imported fossil fuels, these efforts are insufficient to offset the impact of limited transmission capacity and the inefficiencies in regional electricity markets. Recognising these challenges, the governments of Greece, Romania, and Bulgaria announced in 2024 that they would work together to develop a regional mechanism aimed at mitigating electricity price fluctuations, reflecting their view that the EU’s single market framework is ill-suited to address the specific conditions of Southeast Europe.

While the occurrence of negative prices is lower compared to Western and Nordic markets, the high spreads suggest that batteries can still capitalise on significant intra-day price fluctuations. In Romania, the mean 2-hour daily price spread for the last 12 months stands at €198/MWh, while Greece and Bulgaria follow closely with €195/MWh and €173/MWh, respectively. These elevated spreads underscore the region's potential for profitable energy storage operations.

Access to the ancillary services markets is progressing, although regulatory frameworks remain in development. Notably, Bulgaria only recently, in 2024, recognised BESS as independent market participants through amendments to its Energy Act and Electricity Trading Rules, allowing standalone and co-located storage projects to engage directly in energy trading and grid balancing activities. Overall, the fundamentals point to a promising investment outlook for storage in the region.

Central Europe, comprising the Czech Republic, Poland and Hungary, shows solid potential for BESS deployment, especially driven by strong mean daily price spreads. Hungary and Poland rank among the top five in Europe, with average daily spreads of €151/MWh and €134/MWh respectively, while the Czech Republic also posts a competitive spread at €121/MWh. These figures indicate attractive opportunities for energy arbitrage. Negative price occurrences are moderate, particularly in Poland and the Czech Republic, which supports some additional arbitrage upside.

While regulatory progress varies, all three countries have begun integrating BESS into broader energy strategies, with improving access to ancillary services. This is especially recent in the Czech Republic, where BESS has only been recognised as an independent energy source in December 2024, allowing standalone facilities to connect to the distribution grid at any location instead of being restricted to existing sources. It is important to note that these new regulations won’t come into effect till possibly the end of summer 2026.

The Nordic region, particularly Finland, Sweden and Denmark, shows high number of hours with negative prices in the last 12 months, 754 hours in Finland and 649 hours in Sweden, both the second two highest in Europe. However, with some of the lowest daily price spreads, €77/MWh in Finland, €58/MWh in Sweden, and €110/MWh in Denmark, arbitrage opportunities are more limited. As a result, ancillary services have demonstrated strong upside potential and continue to be a key revenue stream for BESS in the region.

In Sweden, BESS deployment was limited until 2022, but recent growth has been driven by high ancillary market prices, especially for FCR-D. While market saturation is now putting pressure on FCR-D prices, this segment remains the main income stream for Swedish battery operators.

The Western European markets of Ireland, the Netherlands, Belgium, Germany and France exhibit moderate daily price spreads ranging from 83 to 121 €/MWh, alongside varying occurrences of negative prices and evolving ancillary service opportunities. While each market offers some potential for BESS deployment, Ireland, the Netherlands and Germany stand out due to their higher daily spread prices.

The Irish BESS market is experiencing substantial growth. Most currently operational batteries were developed under the DS3 ancillary services framework called DS3 system services. It is important to note that this framework is set to expire at the end of 2026 and will be replaced by a competitive auction model, likely reshaping revenue opportunities.

Germany hosts one of Europe’s largest BESS markets and led Europe in new battery storage capacity additions in 2024. Extensive participation opportunities in ancillary services continue to generate interest in the market, as well as the presence of a favourable regulatory framework. It is also worth noting that Germany is currently working on designing a capacity market that will become operational in 2028, which could further improve investment attractiveness for battery storage projects.

In Southern Europe, Italy, Spain and Portugal present diverse opportunities for BESS, albeit with generally lower mean daily price spreads, Italy and Portugal both around €77/MWh and Spain at about €80/MWh, compared to other regions.

Italy’s strong commitment to expanding renewable energy has created important opportunities for BESS, with investors mainly relying on two key mechanisms: long-term auctions like MACSE and shorter-term Capacity Market auctions. The MACSE programme, managed by grid operator Terna, offers 15-year contracts that provide high revenue certainty, making it particularly well-suited to southern Italy where abundant renewable resources coincide with weaker grid infrastructure. In contrast, the Capacity Market auctions, more common in the industrialized north, provide shorter-term opportunities aligned with the region’s robust infrastructure and higher electricity demand. Given that Italy also operates a zonal electricity market, the location of BESS installations is therefore a critical factor influencing their financial performance and choice of strategy.

Spain has announced ambitious renewable expansion plans and is beginning to see increased interest in BESS deployment, especially after the recent blackout event. However, progress has lagged due to the absence of a clear and comprehensive regulatory framework. The introduction of a capacity market is set to improve the availability of contractable revenue streams and enhance the environment for BESS. The market is expected to be fully operational by early 2026.

Based on our comparative assessment, Southeast Europe emerges as the most attractive region for new BESS deployment, primarily due to exceptionally high daily price spreads that create strong arbitrage opportunities. However, this promising outlook comes with important caveats, as the long-term attractiveness of BESS projects depends on a much more complex interplay of factors. These include the country’s electricity generation mix, grid capacity and interconnectedness, market saturation levels and the robustness of national regulatory frameworks. Consequently, investors should carefully weigh these fundamental market and policy considerations to ensure sustainable and resilient returns on battery storage investments.

Market-trends

6th Feb, 2026

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025