Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Ever wondered what those bidding zones in Europe's electricity market are all about?

A bidding zone refers to the largest area or region within which electricity producers and consumers submit their bids and offers without any technical constraints.

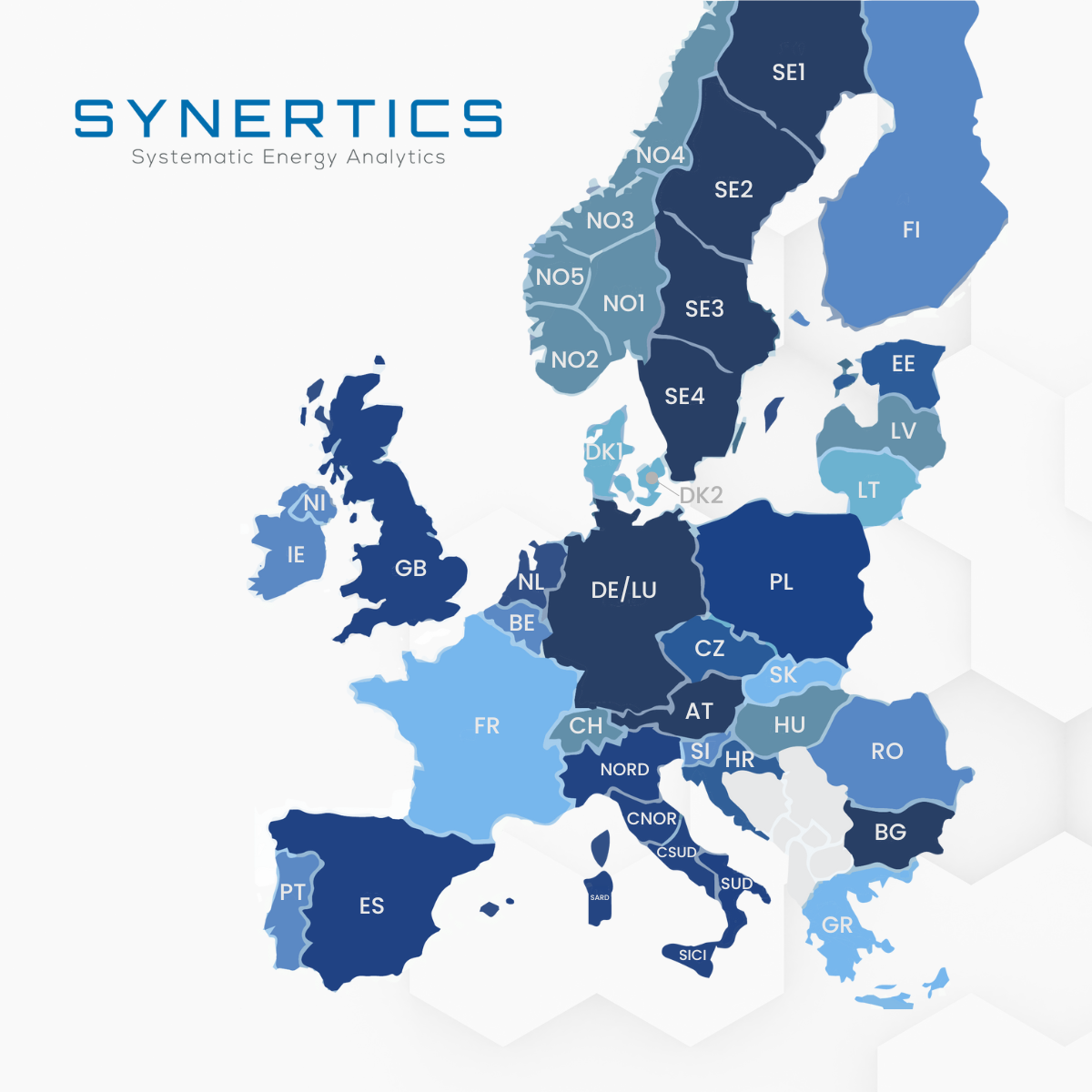

Bidding zones in Europe are currently defined according to differing criteria. The majority are defined by national borders (eg, France or the Netherlands); however, some are larger than national borders (Austria, Germany, and Luxembourg or the Single Electricity Market for the island of Ireland) and some are smaller zones within individual countries (Italy, Norway or Sweden).

Bidding areas can have different electricity prices due to the national grid's physical limitations. According to Svenska kraftnätthe, boundaries between bidding areas are drawn where there are limitations as to how much electricity can pass. When the entire transmission capacity at such a limitation is utilized for electricity trade between two bidding areas, there will be different electricity prices in the different areas.

So, it means that France, for example, is defined as one bidding zone: from a market point of view, a consumer in the North of France can trade any amount of electricity with any French power plant, independent of its location. Transmission capacity is assumed to be unlimited within each bidding zone (as if the zone were a copper plate), resulting in the definition of a uniform electricity price. Differently, if the market participant wants to trade electricity between Spain and France (two different bidding zones)

The European bidding zones division according to ENTSO-E

As per Commission Regulation (EU) 2015/1222 (CACM), it is important to define bidding zones (BZs) in such a way that it promotes efficient congestion management and overall market efficiency. Commission Regulation (EU) 2019/943 supports this.

Bidding zones should not have any structural congestion unless they do not affect the neighboring BZs. If it is a temporary exemption, then the impact on the neighboring BZs should be mitigated with remedial actions. These structural congestions should not result in a decrease in cross-zonal trading capacity in accordance with the requirements of Article 16 of the Electricity Regulation.

The optimal delineation of bidding zones should encourage robust price signals for efficient short-term utilization and long-term development of the power system. It should also restrict system costs such as balancing costs and redispatch actions taken by TSOs.

Renewable energy production, especially from wind and solar (PV), is increasing. However, this energy is often generated in remote areas with better climate conditions, far from consumption centers. As a result, there is a higher chance of congestion within the same bidding zone, and this requires constant planning and analysis.

ENTSO-E suggests that alternative bidding zone configurations should be studied for the year 2025. Changing the bidding zone configuration is a complex decision that involves a trade-off analysis based on four categories: network security, market efficiency, stability, and robustness of the bidding zones, and energy transition.

Alterations in bidding zone configurations can profoundly influence energy prices and associated hedging strategies in the market. Given this, it's crucial for market participants to vigilantly track potential changes, recalibrating their prediction and hedging models accordingly.

To minimize disruptions, a three-year lead time for any zone adjustments is recommended, especially since many forward contracts last between three to five years. However, it's vital to recognize that these changes, whether positive or negative, will inevitably impact longer-term investments such as generation plants, storage solutions, and demand-response providers. Furthermore, long-term PPAs for renewable energy, which often span five to ten years, remain particularly vulnerable to bidding zone modifications.

Synertics provides advisory services and develops digital data-driven solutions for the energy industry with the purpose of driving productivity and transferring knowledge.

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026