Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

France is gradually taking on a larger role in the European PPA market, backed by a strong decarbonisation agenda. While nuclear power still dominates the French electricity mix, solar and wind are steadily expanding their share, creating new opportunities for PPAs to play a larger role in project development and long-term energy procurement.

In this article, we take a closer look at the factors shaping the French PPA landscape. We start off with an overview of the country’s energy mix and the current PPA landscape. Then we explore how the regulatory environment, including government support schemes and regulations related to PPAs affect the attractiveness of PPAs in the country. We also examine key market dynamics, including capture price trends, baseload futures, curtailments, negative prices and imbalance costs, that directly impact PPA negotiations and project bankability.

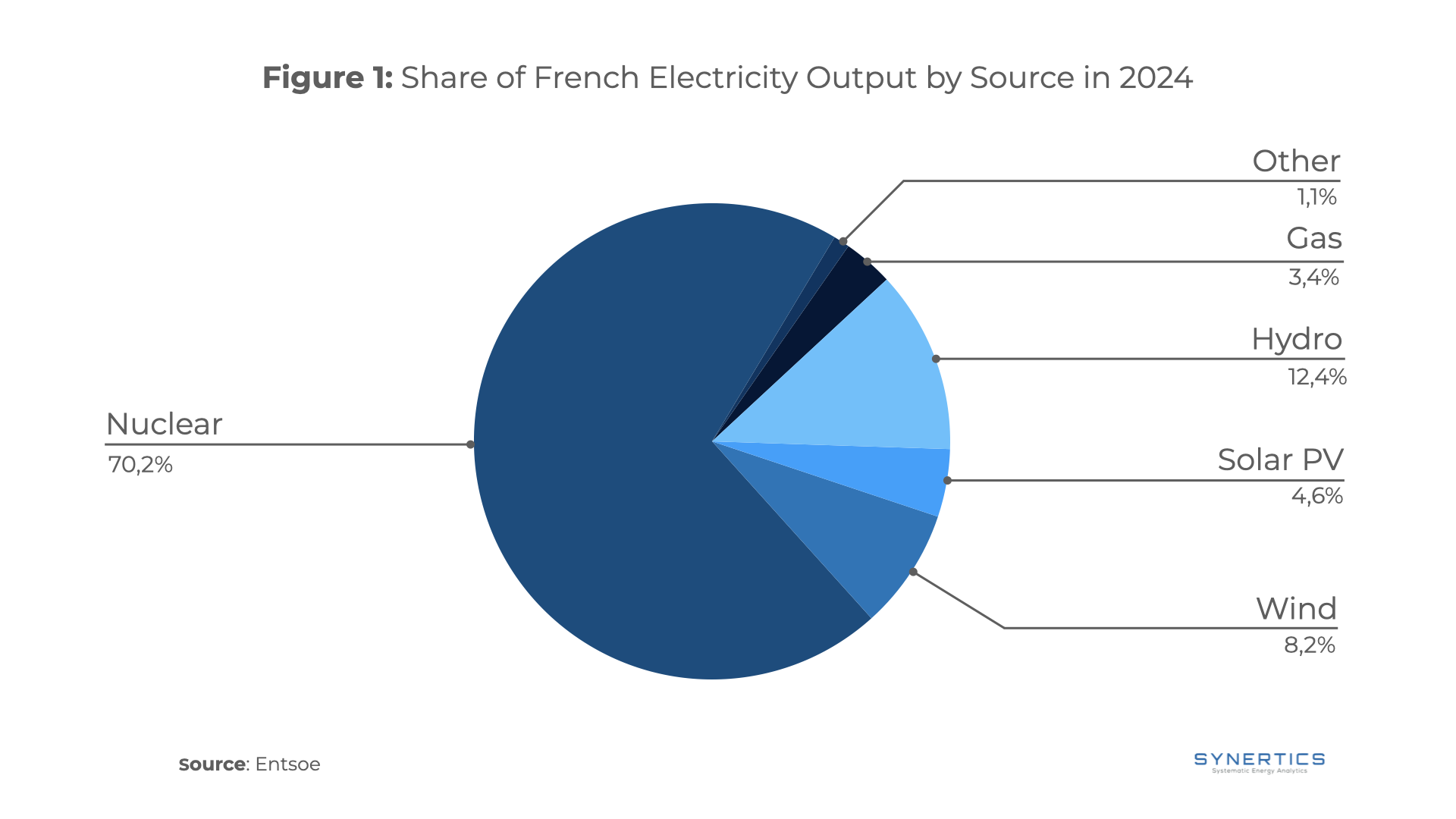

In 2024, France produced more electricity than it had in each of the past five years, reaching 536.5 terawatt-hours (TWh), according to the French grid operator RTE. The majority came from nuclear power, which bounced back strongly after two weaker years and made up 70% of the total. Hydropower also had its best year since 2013, contributing 74.7 TWh or 12% of the mix. Wind and solar together produced 70 TWh, about 13%. Altogether, low-carbon sources like nuclear and renewables provided 95% of the electricity.

Renewable Energy Expansion in 2024

In 2024, France added 4.6 GW of new solar capacity, increasing its total to 22.1 GW. This strong growth is expected to continue, with the organisation SolarPower Europe predicting that France’s solar capacity could reach 52 GW by 2028, an increase of 30 GW in just four years. On the wind side, France added 1.1 GW of new capacity, slightly less than the 1.3 GW installed in 2023.

Renewable energy targets under PPE3

France’s latest multi-year energy strategy, the PPE3 (Programmation Pluriannuelle de l’Énergie), outlines the country’s roadmap for accelerating its renewable energy transition through 2035 and beyond.

Offshore wind will play a major role, with plans to reach 18 GW of installed capacity by 2035, 26 GW by 2040, and over 45 GW by 2050.

Solar energy is also a key focus. The government expects solar capacity to reach 54 GW by 2030 and between 65 and 90 GW by 2035. New installations will mainly be built on already developed areas like parking lots and unused land, as well as on farms through agrivoltaics.

For onshore wind, the plan is to add around 1.5 GW of new capacity each year. This will include both new wind farms and upgrades to older ones (repowering), with a goal of spreading development more evenly across the country.

France’s PPA market has developed slowly compared to other major European countries. By the end of 2024, a total of 4 GW of renewable capacity has been contracted under PPAs. According to France’s Energy Regulatory Commission (CRE), the market remains immature, with most of the growth driven by the 2022–2023 wholesale price crisis, which made long-term electricity contracts more attractive for both buyers and sellers.

PPAs in France are predominantly for solar PV projects, with only a small share involving onshore wind. The most common format is the corporate PPA, with around two-thirds of contracts signed directly with industrial consumers. These are typically large companies with annual consumption above 100 GWh, and the most active sectors include commerce (mainly mass distribution), transportation, and retail. Notable corporate buyers include Orange, Carrefour, SNCF, Les Mousquetaires, and Leroy Merlin.

A key characteristic of the French market is the long contract duration. The average PPA in France lasts 19 years, significantly above the European average of 13 years. This benefits renewable energy producers by offering stable, long-term revenue streams, making project financing more viable.

France has seen several major corporate PPAs that highlight growing commitments to renewable energy across various sectors. Renault and Voltalia signed the country’s largest PPA in 2022, a 15-year solar agreement starting at 100 MW and scaling up to 350 MW by 2027, supporting Renault’s carbon neutrality goal by 2040. Additionally, EDF Renewables has signed multiple PPAs totaling over 600 MW in France by 2023, with clients like L’Oréal and Leclerc, offering long-term contracts that ensure stable pricing and support decarbonisation efforts

In France, the support mechanisms for renewable energy have evolved significantly to balance the interests of producers and consumers while promoting green growth. Initially, under Article L.314-1 of the French Energy Code, a power purchase obligation scheme mandated designated buyers such as EDF, France’s main electricity producer and supplier, or local distributors to purchase renewable electricity at fixed feed-in tariffs (FIT), which were set above market prices, ensuring predictable revenues for producers.

However, following the EU Commission’s 2014 revision of State aid guidelines this system shifted towards a more market-oriented approach. The current framework centers on contracts for difference (CfDs), introduced as part of the 2015 reforms.

Under the CfD mechanism, renewable producers sell their electricity directly on the wholesale market and receive a variable feed-in premium (FIP) on top of the market price through an ex-post monthly remuneration from EDF. This premium, calculated based on a reference tariff set by ministerial order, guarantees a reasonable return on investment. When market prices fall below the strike price, producers receive a top-up payment, and conversely, if prices exceed it, producers reimburse the difference to EDF, which acts as a State agency. Since December 2021, reimbursements are uncapped to reflect market realities amid the energy crisis.

These mechanisms are funded through the Contribution au Service Public de l'Électricité (CSPE), a levy on electricity consumers, thereby promoting renewable energy deployment while ensuring cost-efficiency and market integration

What type of support a project receives depends on the size:

Corporate PPAs are still relatively new in France, and companies have often faced challenges due to the lack of standardised contracts or well-established market practices. To help address this issue, France Énergie Éolienne (FEE) released a standard corporate renewable power purchase agreement in late 2019. Developed over the course of a year by a dedicated FEE working group, the template was created in collaboration with a wide range of industry stakeholders including producers, consumers, lenders, investors, legal and tax experts, and is available as an open-source resource.

Corporations seeking to adopt green energy in France still face the significant influence of nuclear power. Nuclear energy plays a central role in the country’s electricity system, providing stable prices and accounting for the largest share of the French energy mix. This reliance stems from the “Messmer Plan,” a decisive political move made in response to the 1974 oil crisis. With a total nuclear capacity of 62.9 GWe, France ranks as the world’s second-largest producer of nuclear electricity. This long-term commitment has enabled France to maintain one of Europe’s lowest-carbon electricity mixes.

Despite the increasing appeal of renewables and corporate PPAs, it remains challenging to predict how much nuclear power will contribute to the French energy mix between 2025 and 2030.

However, a recent policy shift in France could significantly boost the appeal of corporate PPAs: the phasing out of the ARENH mechanism (Accès Régulé à l'Électricité Nucléaire Historique). Introduced in 2011, ARENH allowed electricity suppliers to purchase up to 100 TWh per year of nuclear power from EDF at a regulated price of €42/MWh, offering corporates access to low-cost, stable electricity. The ARENH mechanism faced increasing criticism from the European Commission, which viewed it as a distortion of competition and incompatible with EU internal market rules. As a result, the French government has confirmed that ARENH will be discontinued by the end of 2025, removing a key source of price stability for corporate buyers.

While PPAs in France often resemble public support contracts in structure, particularly in their long durations, they typically include stricter conditions on delays and early termination to safeguard private investment. A key difference is also the timing: public support contracts are typically awarded more than two and a half years before a project becomes operational, enabling early-stage financing. In contrast, PPAs in France are generally signed about 1 year and 10 months before commissioning.

It's also important to note that if a producer receives any type of state support, producers are not allowed to sell Guarantees of Origin (GOs), the certificates that prove the electricity is renewable. This rule exists to prevent double compensation: since producers are already paid through subsidies like feed-in tariffs or contracts for difference, they are not allowed to also make extra money by selling the GOs on the market.

From the buyers’ perspective (both suppliers and consumers), several structural factors help explain the relatively slow growth of PPAs in France:

Public policy choices also influence PPA development. For example, the broad eligibility and strong protections of public support schemes tend to discourage producers from opting for PPAs. This dynamic favors more secure state contracts, which can strain public finances and limit options for consumers or suppliers wishing to engage in PPAs.

However, this situation can improve with targeted public policy reforms. For instance, as shown in the planned phase-out of the ARENH will increase market exposure for corporates, making PPAs a more attractive option to secure predictable electricity costs and hedge against market risks, all while meeting decarbonisation goals.

France's electricity mix is characterized by a strong presence of nuclear energy, providing a steady and dispatchable energy source. For a country with such a high share of nuclear power in its electricity generation, integrating renewable energy presents a challenge, as the fluctuating nature of wind and solar PV is often incompatible with high levels of nuclear output.

In France, solar PV and wind accounted for just about 13% of total electricity generation last year. However, the recent rapid growth of renewables has started to put downward pressure on the market prices that renewable generators can capture. This trend suggests that the renewable energy market, particularly for solar PV, may face saturation sooner than in countries with different electricity mixes.

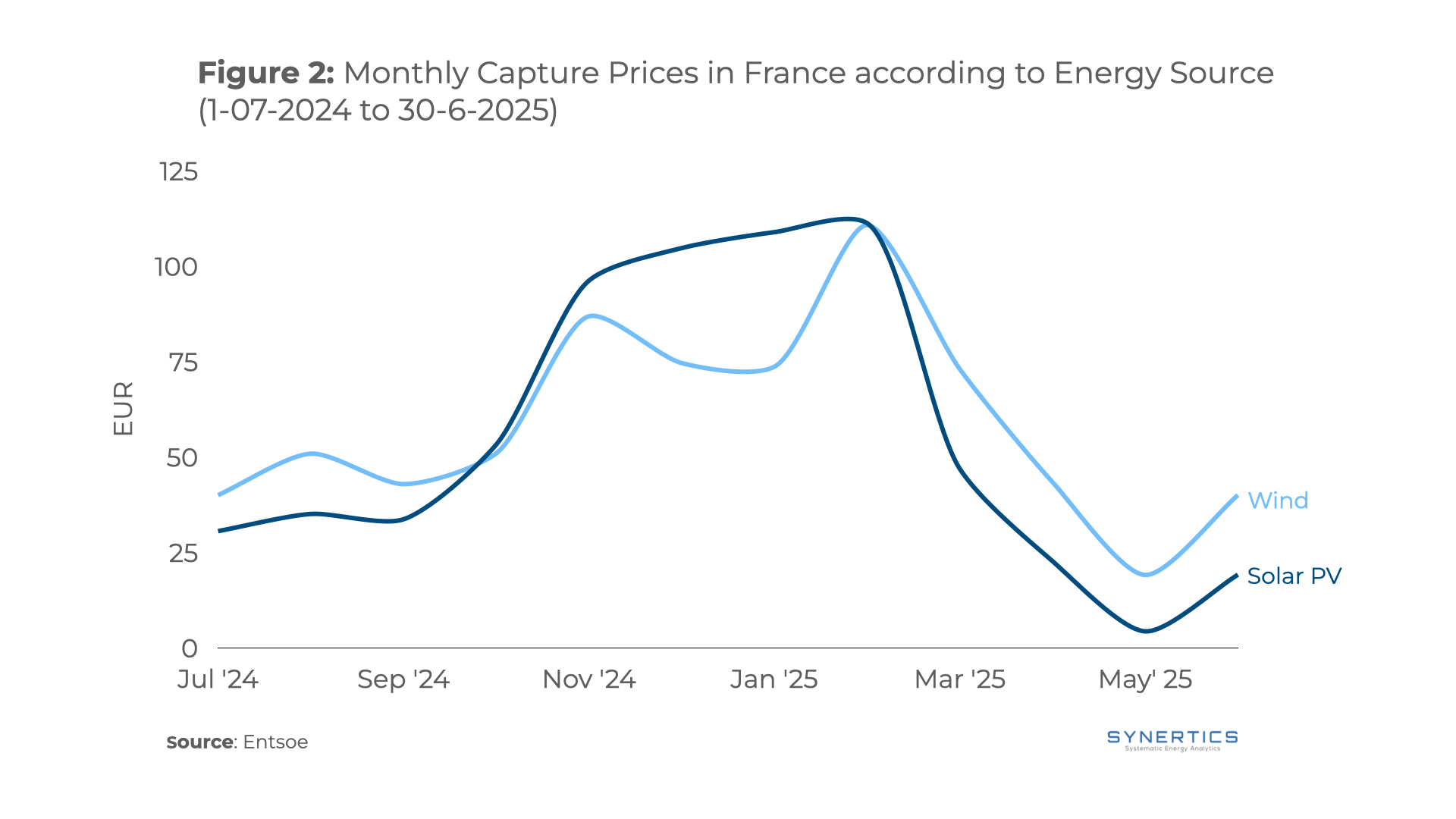

Figure 2 illustrates the evolution of capture prices over the last 12 months. Notably, there was a sharp decrease during this year's spring, with solar capture prices falling as low as €4.34/MWh in May, representing a capture rate of only 22%. Wind power generators came out better, with capture prices during this period ranging from €19 to €74/MWh and capture rates reaching as high as 98.8%. Despite this higher ability to capture wholesale prices, wind generation still feels the impact of low prices caused by high solar output in a country with constrained baseload flexibility due to its reliance on nuclear energy.

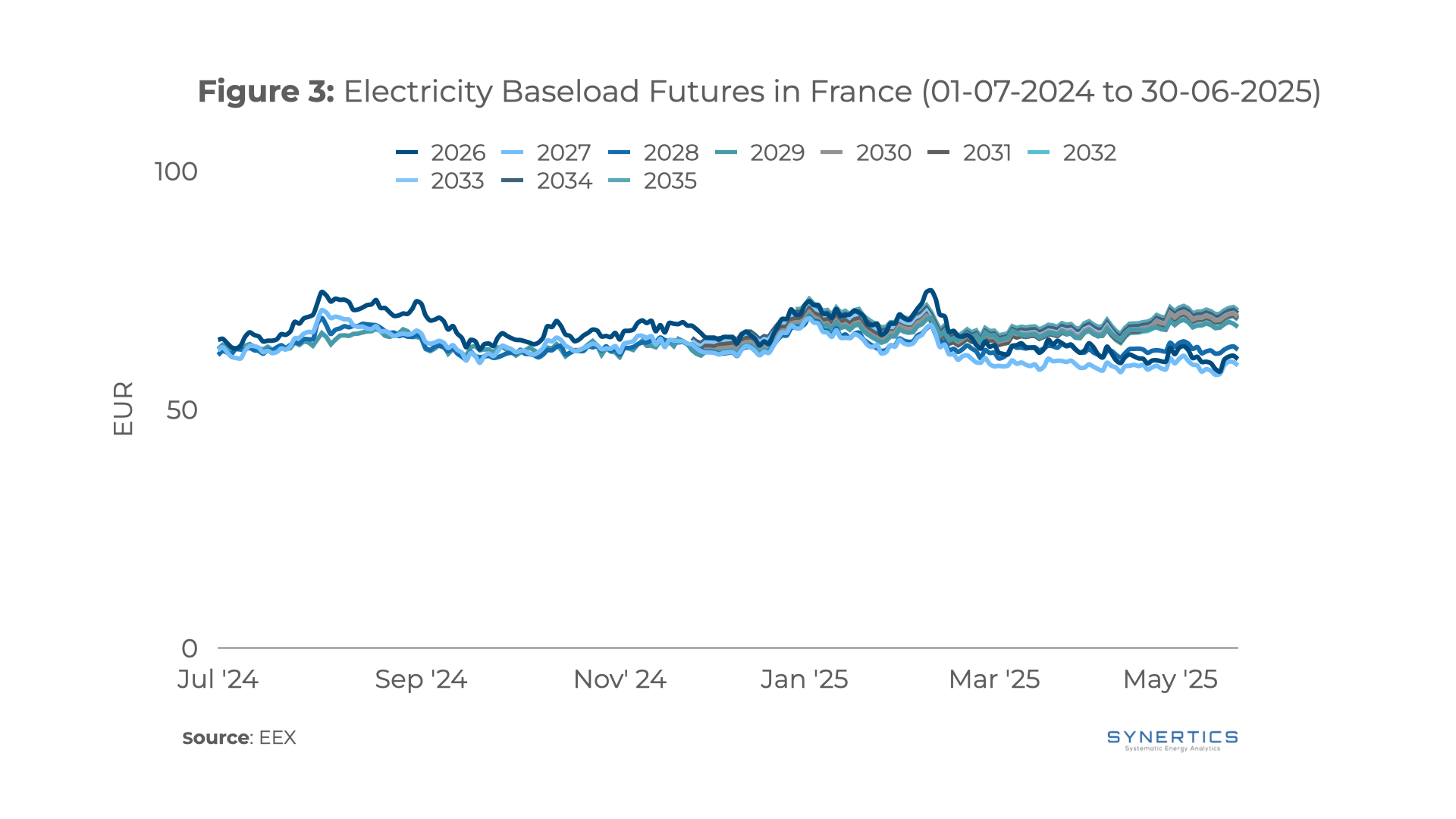

The baseload electricity futures market in France is characterized by strong liquidity, second only to Germany on the EEX. The high share of nuclear energy is particularly attractive for long-term hedgers, with significant volumes of electricity being traded on a long-term basis.

Over the past 12 months, the French futures market has closely followed price fluctuations observed across Europe, with futures prices peaking at the beginning of the year, as illustrated in Figure 3. From that point onward, a gap has emerged between long-term contracts and short-term products, with later years being priced higher. This suggests a market expectation of rising baseload prices in the long term.

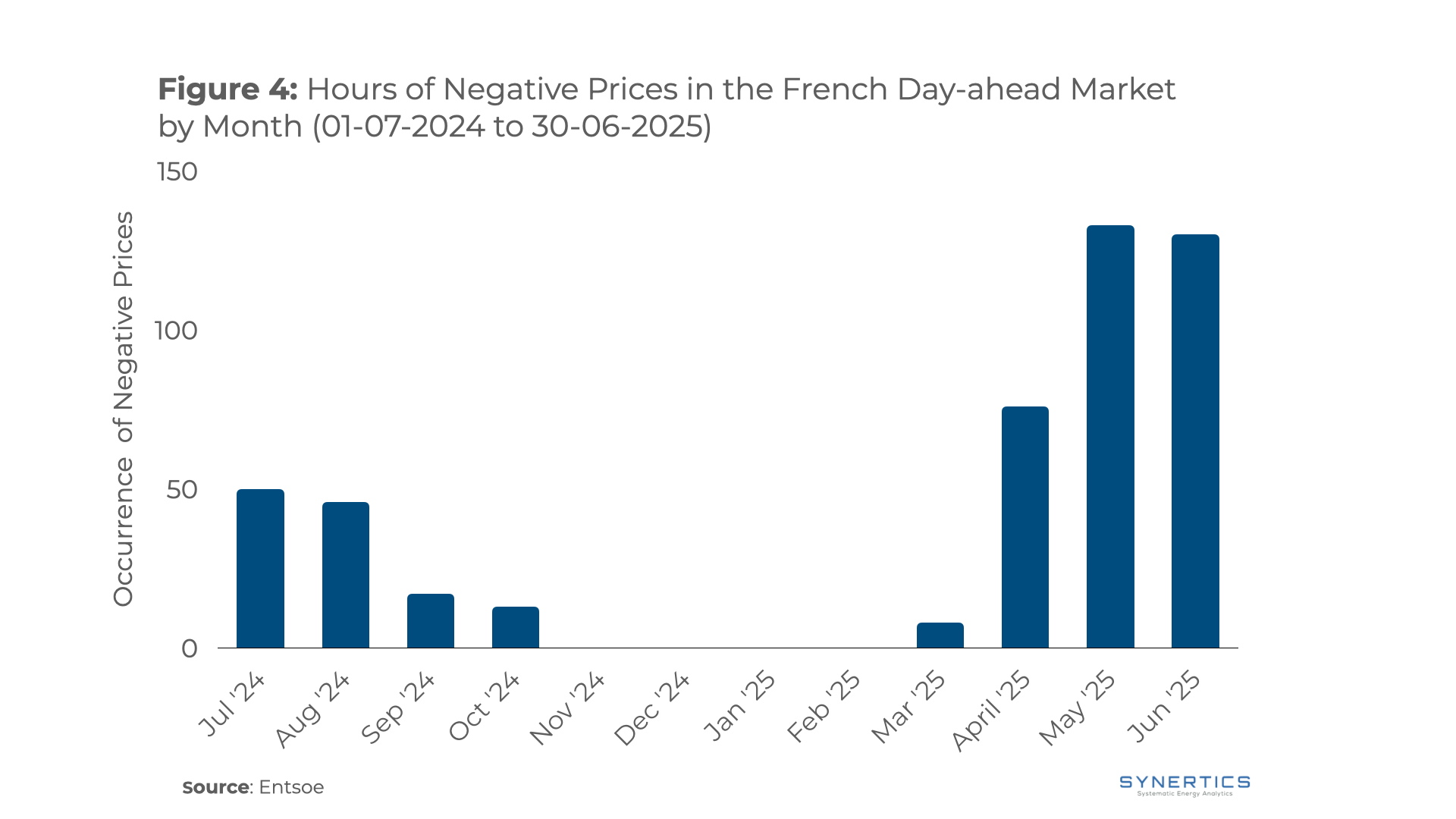

Negative electricity prices in France have become a persistent reality, with the first occurrences recorded in 2023. Since then, such events have grown increasingly frequent, particularly during the spring and early summer months, when renewable generation is high and consumption is moderate. In 2025, the situation worsened, reaching a historic peak in the number of negative price occurrences during the first six months of the year. In May alone, there were 133 instances of negative prices, as shown in Figure 4, not including the numerous hours priced at exactly €0/MWh, which were also significant. Beyond frequency, the depth of these price drops is also notable, with Day-Ahead market prices falling below –€100/MWh in some cases.

Despite having a lower share of renewable generation than other European countries, such as neighboring Spain, France has experienced more severe negative pricing events. This is only partially offset by the relatively higher capture prices. This situation further supports the argument of a structural incompatibility between high shares of nuclear and renewable energy, as discussed in the previous section.

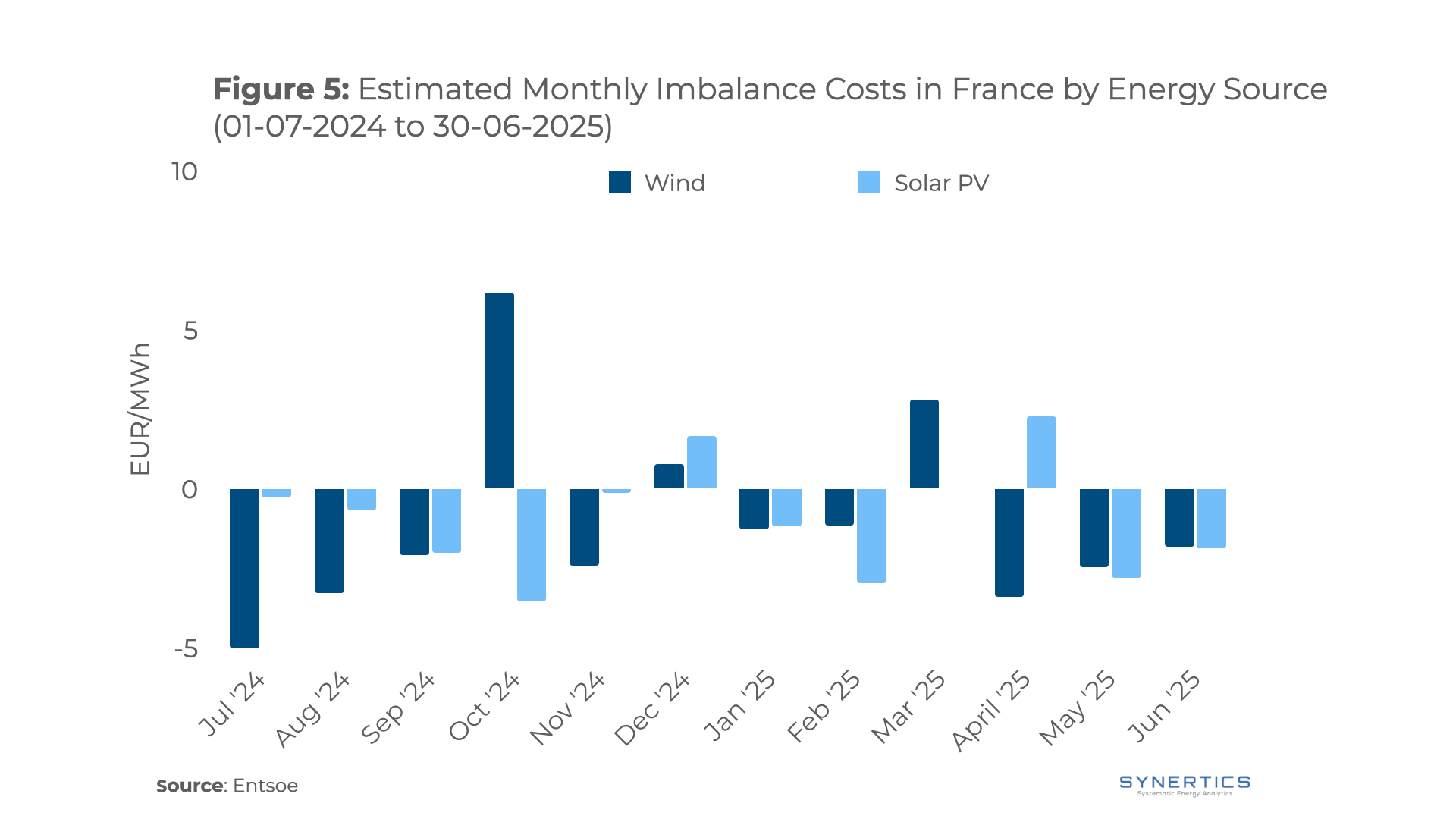

When there are deviations between forecast and actual generation, producers must compensate for the shortfall or surplus by settling volumes in the imbalance market.

In France, the imbalance market distinguishes between positive and negative deviations, with prices reflecting the cost of restoring system stability in each direction. To estimate the average imbalance costs borne by generators, we analysed the gap between forecasted and actual production by technology, applying the corresponding imbalance price based on the deviation direction.

Figure 5 illustrates the evolution of imbalance costs over the past 12 months. As shown, imbalance prices have not posed significant costs for renewable generators, with most values hovering around 0 EUR/MWh, and negative when considering the error forecast direction of the whole country. The high share of nuclear energy in France's electricity mix may positively impact imbalance costs, as it provides the system with greater capacity to manage frequency deviations.

While France’s electricity mix remains dominated by nuclear power, recent trends point to a growing role for renewables, which are starting to carve out more space in the energy landscape. This shift is slowly opening the door to a more dynamic PPA market. Though still relatively immature compared to other European countries, the French PPA market has begun to gain momentum, driven by corporate buyers seeking long-term price stability and decarbonisation solutions. The fact that France has already contracted around 4 GW under PPAs, mostly with corporate offtakers and in solar PV, demonstrates growing corporate appetite.

France’s regulatory framework has evolved to integrate renewables more competitively into the power market, transitioning from fixed feed-in tariffs to contracts for difference (CfDs) and competitive tenders. These mechanisms provide predictability for producers while aligning better with market signals. However, the availability of generous state support has arguably slowed the uptake of PPAs by offering less risky alternatives. Yet, policy developments, such as the phasing out of the ARENH mechanism, are shifting market dynamics. As corporations lose access to low-cost nuclear electricity under ARENH by the end of 2025, PPAs will likely become a more attractive hedging tool to secure clean and competitively priced electricity.

France’s electricity market presents both opportunities and challenges for renewable PPAs. The growing frequency of negative prices and the sharp springtime drop in solar capture prices point to saturation risks and structural tension between variable renewables and inflexible nuclear baseload. At the same time, wind energy has shown stronger capture performance, and baseload futures indicate a long-term expectation of rising prices, both favourable signals for PPA pricing strategies. Imbalance costs have remained modest, thanks in part to the stabilising role of nuclear, reducing one potential source of financial risk for renewable generators. Lastly, the current incompatibility of nuclear and renewable energy sources could push France into looking at flexibility solutions, such as battery energy storage systems (BESS), in order to support the planned growth of renewable energy.

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026