Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

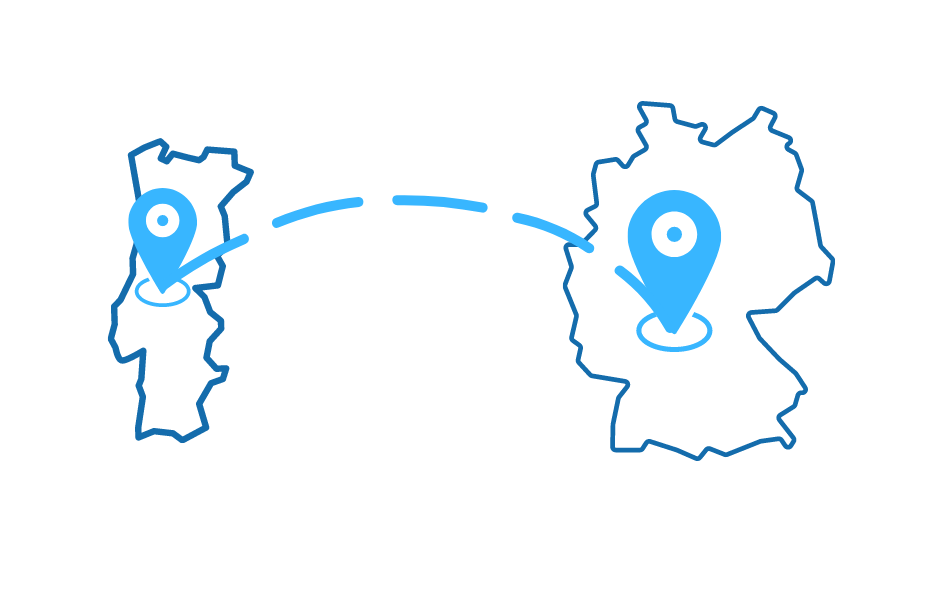

Opening up a range of possibilities for corporate offtakers, Cross-Border PPAs have been gaining momentum throughout the European PPA market. In this post, we will briefly overview how Cross-Border PPAs are processed in their virtual form and list some of their pros and cons.

A contract that enables a corporate offtaker to purchase renewable electricity, along with its corresponding Guarantees of Origin (GoOs) in a distinct electricity market.

Cross Border PPAs can take 2 forms:

How do they work?

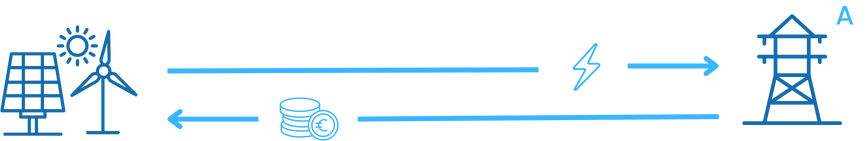

Power producer transfers GoOs to corporate offtaker under the PPA.

The power producer delivers electricity to the electricity market A at the spot price and settles the positions with the corporate offtaker.

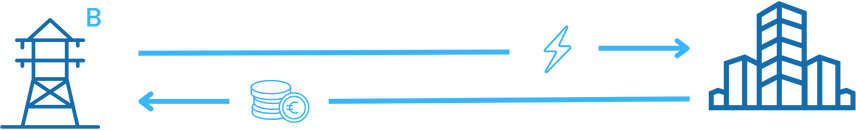

Corporate offtaker buys electricity from utility/retailer in market B to fulfill its local demand.

Increase pool of PPA options

By procuring energy in countries where renewable energy projects are not dependent on government subsidies, thus with a more flexible marketability and not restricted by bureaucratic barriers.

Secure seasonal demand

By accessing projects in countries where the production seasonality may be a better match to an offtaker's seasonal consumption patterns.

Combine electricity load from multiple markets

By bundling energy and GoOs from different markets into a single cross-border PPA, the number of overlapping contracts and its associated fees are reduced.

Chance of an increased basis risk

The risk associated to the fact that production and consumption are sitting in different price zones.

Uncertainty of obtaining grid capacity rights for the duration of the PPA

Physical cross border PPAs transmission capacity is usually secured in one year intervals under auctions. These short term intervals can therefore put long-term PPAs at risk.

Currency exchange

The involvement of transactions in different currencies can create risks related to exchange rate fluctuations.

Regulatory and legal frameworks

Changes in law in either the production or consumption electricity markets can impact the feasibility and terms of the PPA.

Synertics provides advisory services and develops digital data-driven solutions for the energy industry with the purpose of driving productivity and transferring knowledge.

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026