Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Europe is undergoing a significant transition in electricity generation, marked by growth in renewable energy installations and the gradual phase-out of fossil fuel-based power plants. This shift offers environmental benefits, and helps Europe to decarbonise its economic activity. However, this transition also introduces challenges for operation of the grid. The intermittent nature of solar and wind energy makes the balance between supply and demand more difficult. Additionally, these renewable sources can reshape the merit-order curve in daily electricity auctions, potentially changing electricity price dynamics. In this article, we examine how solar and wind generation impact day-ahead electricity prices in Germany and Spain—two leading renewable energy producers in the European Union.

Residual load: a key metric

To assess the impact of renewables, we often use the concept of residual load. Residual load is defined as the total electricity demand (gross load) minus the generation from variable renewable sources like solar and wind. It essentially represents the portion of electricity demand that must still be met by conventional power plants, such as those powered by natural gas, coal, or nuclear energy.

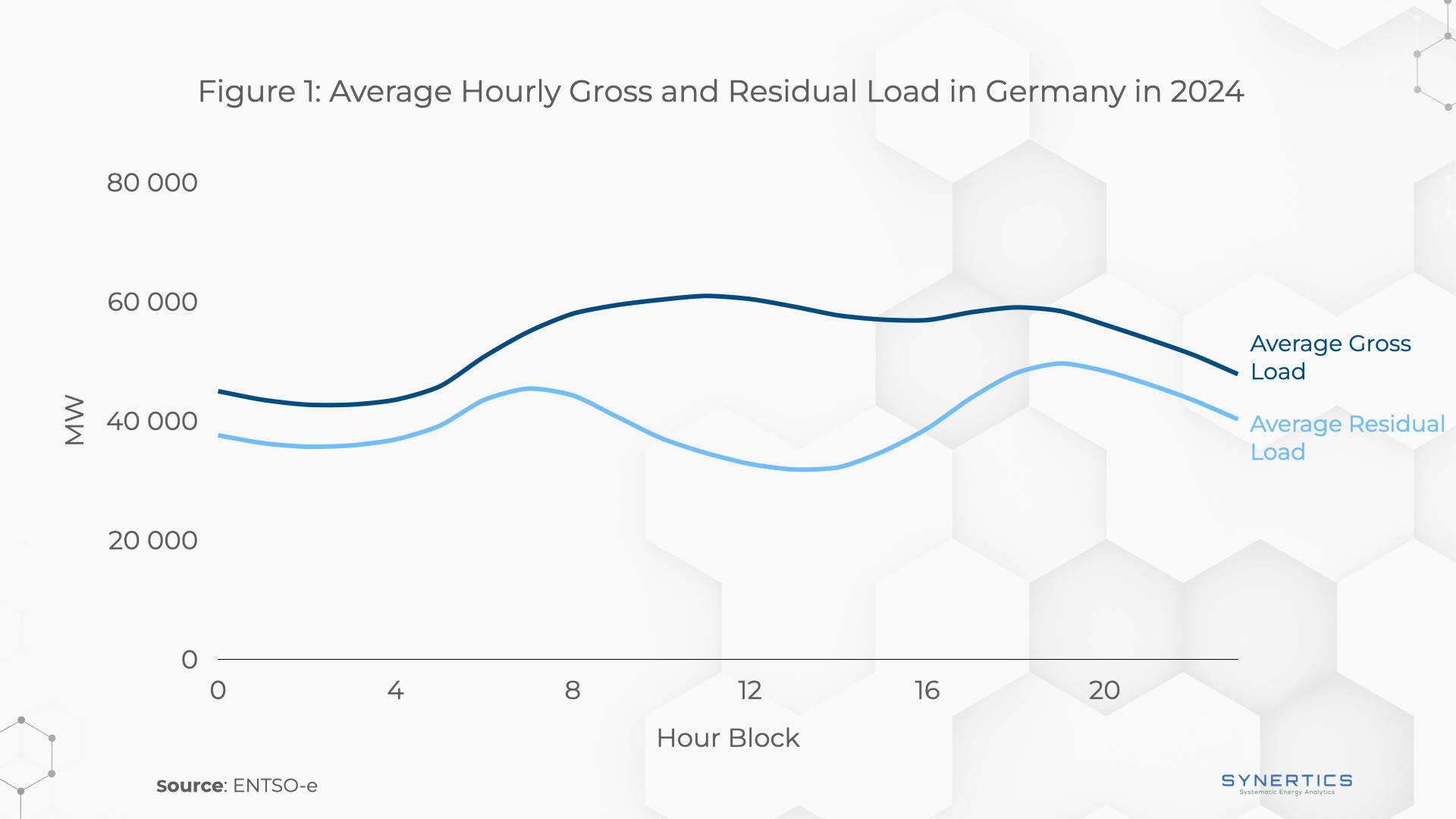

The lower the residual load, the less conventional power generation is needed. Figure 1 illustrates this concept with data of average load and residual load in 2024 in Germany. Throughout the day, the residual load remained consistently below the gross load. As the sun rose, solar photovoltaic (PV) plants began generating electricity, widening the gap between gross and residual load. Contrary, as the sun set, solar generation declined, and the residual load got closer to the gross load. Wind generation, which was available throughout the day, ensured that residual load never equaled gross load.

Impact on day-ahead prices

Solar and wind technologies rely on weather conditions to produce electricity. Unlike thermal power plants, these renewables have no fuel costs and minimal marginal operating expenses. As a result, they are prioritised in the merit-order for daily electricity auctions. When significant amounts of renewable energy enter the market, bids from conventional power sources are pushed further along the merit-order curve, reducing the clearing price. This phenomenon is also called cannibalisation effect, as the introduction of new renewable assets reduces market revenues for similar assets by driving prices down.

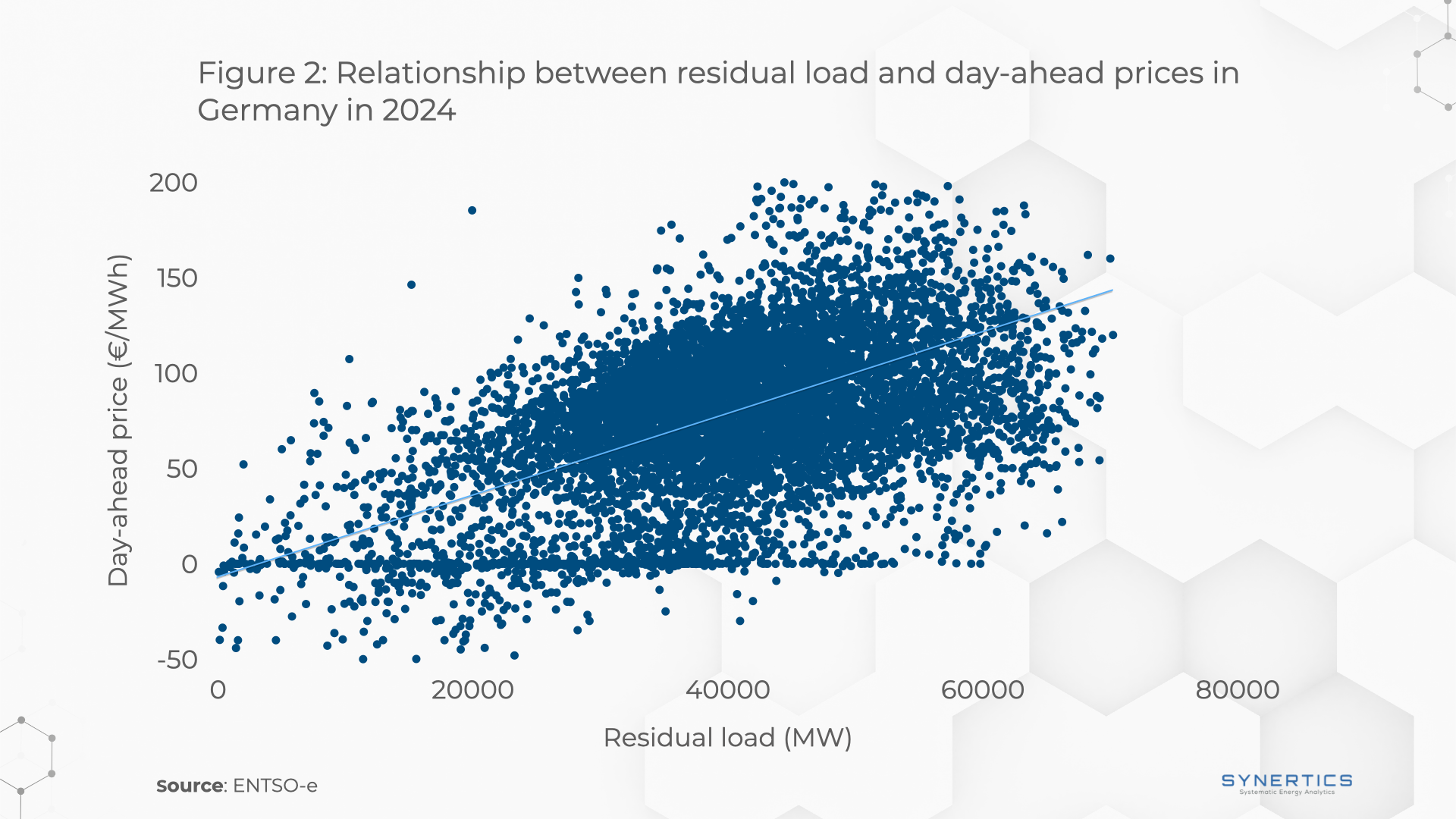

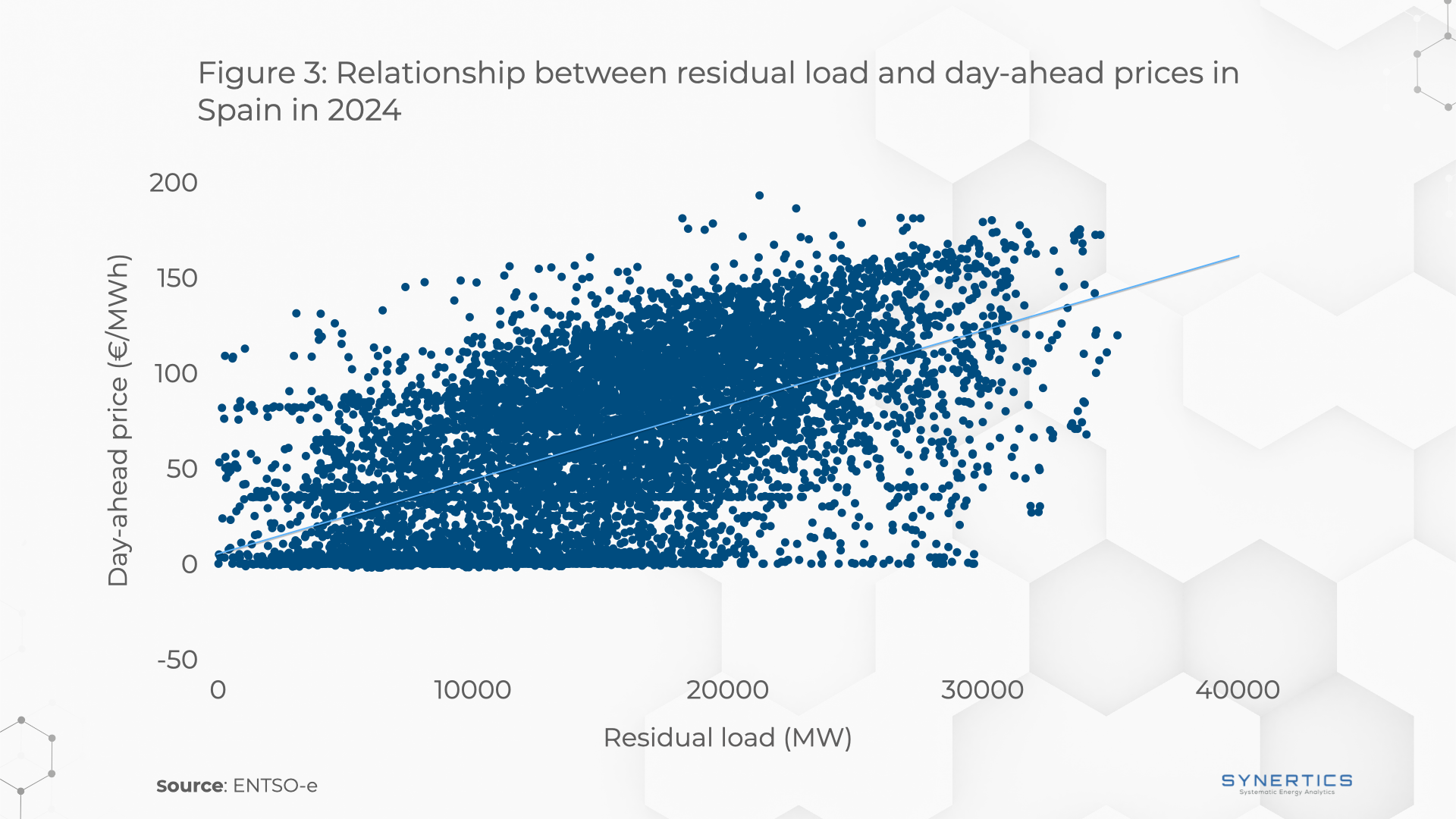

Figures 2 and 3 present the relationship between residual load and day-ahead electricity prices in Germany and Spain, respectively, during 2024. Despite some variability, both countries exhibit a clear trend: as residual load decreases, electricity prices also tend to fall. The linear correlation between these variables highlight the relevant influence of renewable energy on market prices.

Problems with excess of renewable power and mitigation strategies

One of the challenges posed by renewable energy integration occurs during periods of high wind and/or solar generation, causing electricity supply to exceed demand. This often leads to problems and grid operators usually request renewable producers to curtail their generation to maintain system stability. Curtailment not only wastes clean energy but also reduces the financial attractiveness for renewable investments, as producers lose revenue from the electricity they could have sold. Additionally, excess power can drive electricity prices below zero during times of low demand, such as sunny afternoons or windy nights, if conventional power plants are unable to decrease production quickly enough.

Energy storage systems, such as batteries and hydrogen technologies, are essential to tackle the challenges of solar and wind variability. Batteries can store excess electricity generated during periods of high renewable production and release it during times of high demand, effectively smoothing supply and demand fluctuations. This helps prevent curtailment and reduces the chances of having negative prices. Meanwhile, the surplus of renewable electricity could also be used to produce green hydrogen via electrolysis, which can later be used as a fuel for power generation, transportation, or industrial processes.

Conclusions

Renewable energy sources are fundamentally reshaping energy markets by driving down electricity prices. The analysis of residual load and its relationship with day-ahead electricity prices in Germany and Spain confirm that a greater adoption of renewables lowers electricity prices.

While these lower prices might be beneficial for consumers, it also challenges the economic viability of both conventional and renewable power assets, necessitating innovative solutions for a sustainable energy transition. Additionally, the increased share of renewables creates operational challenges for the grid, such as curtailments, which can compromise grid stability.

These challenges underscore the need for Europe to increase investments in storage technologies to ensure both a reliable and low emissions electric system. Simultaneously, these investments will benefit renewable generators by reducing risks, allowing for arbitrage and other services.

Insights

3rd Mar, 2026

Insights, Market-trends

27th Feb, 2026

Insights

29th Jan, 2026