Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

In a recent article we discussed how there is a frequent occurrence of curtailments, negative prices and a rising daily spread on the day-ahead market in Germany. While this brings negative consequences, such as curtailment of renewables, it can also provide opportunities for Battery Energy Storage Investment Systems (BESS) investors. Thanks to their technical flexibility, battery energy storage systems (BESS) can provide a variety of services. They can take part in day-ahead and intraday markets to benefit from price fluctuations, a practice known as energy arbitrage. Additionally, BESS contributes to grid stability by offering ancillary services.

To make the most of the opportunities available in the AS market, a solid understanding of current trends and their impact on future BESS development in Germany is essential. This article examines market opportunities, focusing on the Frequency Containment Reserve (FCR) and automatic Frequency Restoration Reserve (aFRR) markets, the most established AS markets for BESS in Germany. We’ll explore prospects for BESS investors, assess potential risks, and discuss strategies for effective risk mitigation.

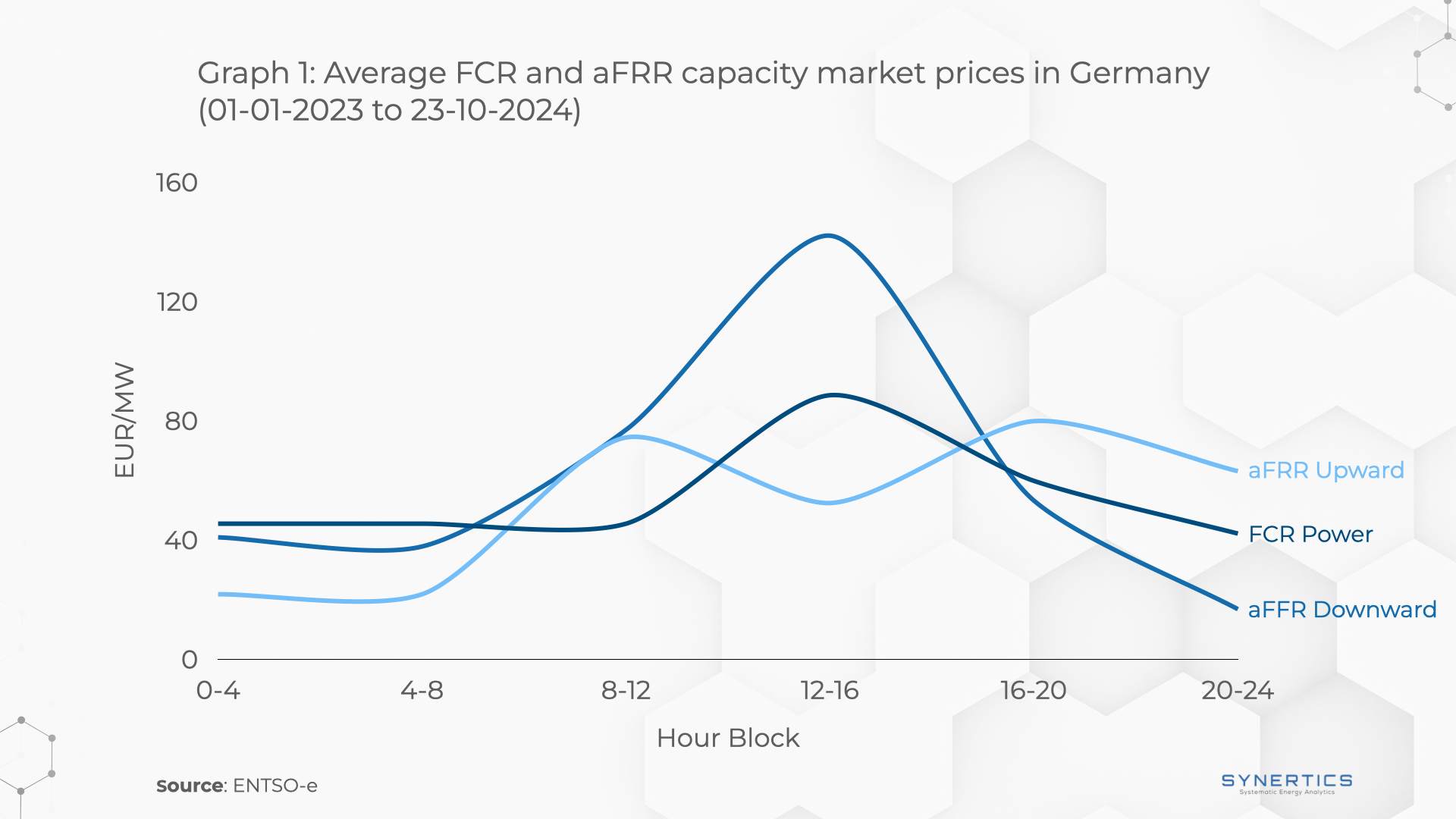

In Germany, the Ancillary Services (AS) capacity market is organised into 4-hour blocks, where generators offer their available power for four consecutive hours. In the FCR market, bids are made for a symmetric band, allowing the Transmission System Operator (TSO) to request an increase or decrease in generation as needed to balance the system. For the aFRR market, generators can bid separately for upward or downward regulation, as each is treated as a distinct product.

Graph 1 illustrates the average capacity prices for each 4-hour block since 1 January 2023. These prices are particularly appealing for low-operational-cost assets like battery storage systems, as participation in these services does not require additional energy procurement costs.

Additionally, prices tend to peak during solar production hours, as shown in Graph 1. This trend likely occurs because a high share of renewables, especially solar, increases the need for grid stabilisation services, which in turn drives up AS market prices. As more renewable energy is added to the grid, AS market prices are expected to rise in the short term due to this growing need for stabilisation. Considering the synergy between the market structure and BESS technical capabilities, and the expected rise in the AS capacity market prices, a prospective scenario for BESS owners participating in AS markets is expected. The remaining question is: Are BESS owners taking advantage of this opportunity? Let's take a closer look at the prequalified power for ancillary services (AS) in Germany.

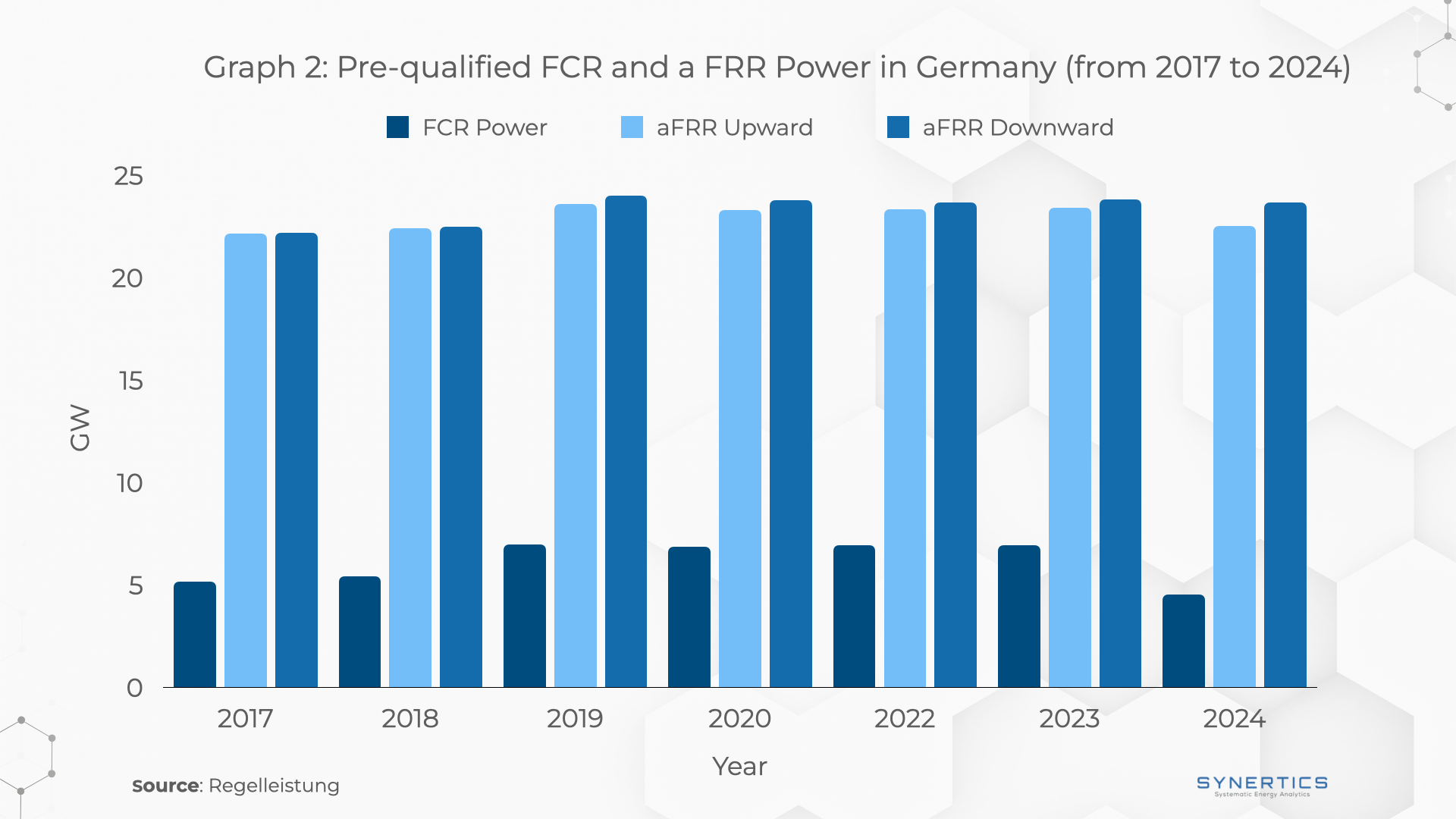

Prequalified power includes all generators that meet the technical requirements for participating in a specific market. Although it doesn’t reflect the actual market share of each technology, prequalified power gives insight into market trends and the types of technologies being used. Until last year, BESS were active only in the aFRR and FCR markets. Graph 2 shows the changes in prequalified power volume in these markets over the past seven years. As depicted in the graph, FCR shows a considerable decrease of 35% in the total prequalified power over the last year, largely due to the phase-out of nuclear energy and a notable decline in hydropower, while aFRR has been steady. The mFRR market is not included in this analysis, as BESS only started entering it this year.

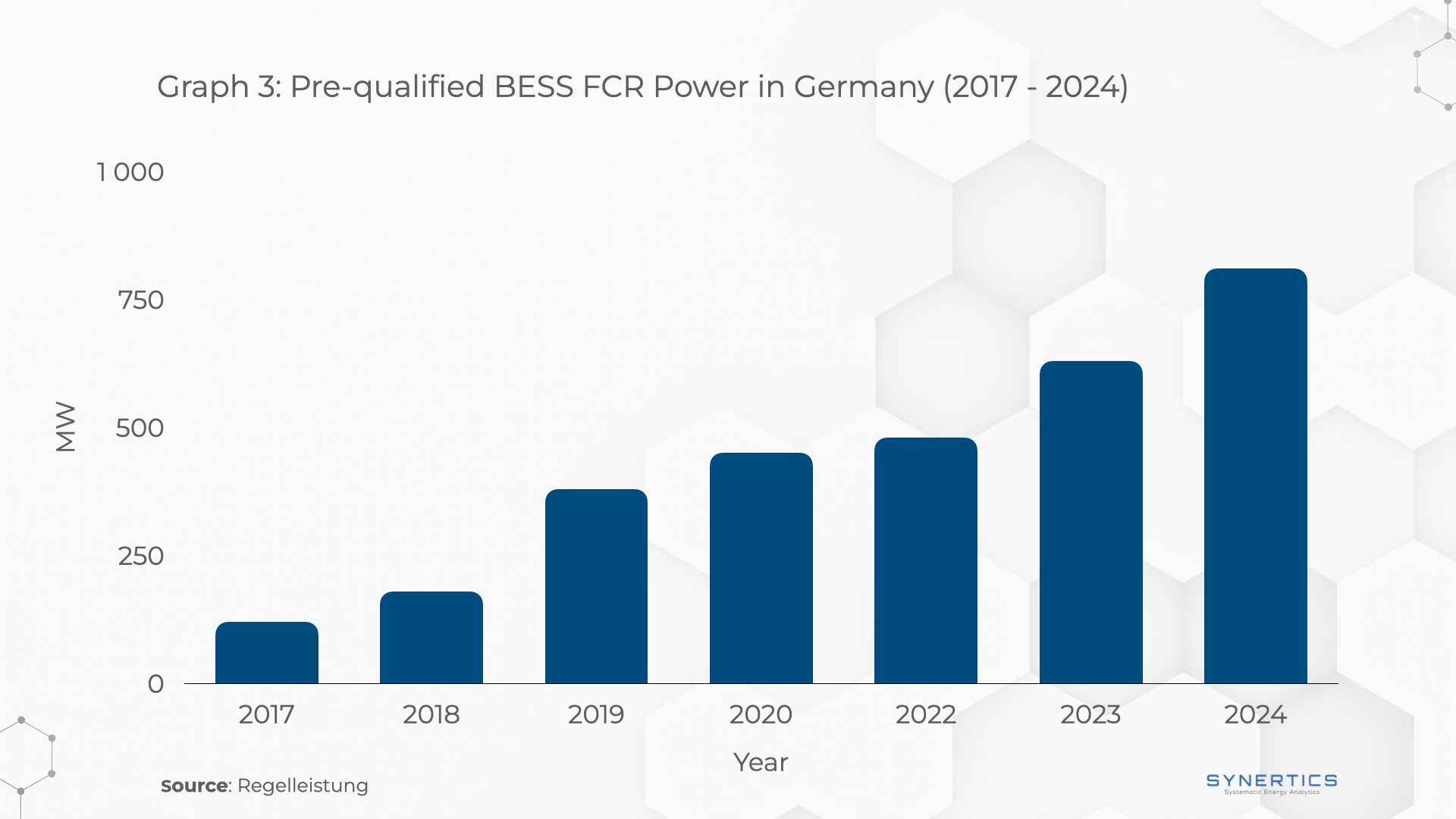

FCR is a popular choice for BESS asset owners in the ancillary services market, with BESS participation steadily growing since 2017, as shown in Graph 3. With a significant decline of 35% in the total prequalified power, BESS now represents nearly 18% of the total prequalified power in FCR, making it the second most common technology in this market. However, as BESS continues to grow, the risk of cannibalisation—where increased competition drives down prices and profits—rises, underscoring the importance of exploring alternative markets.

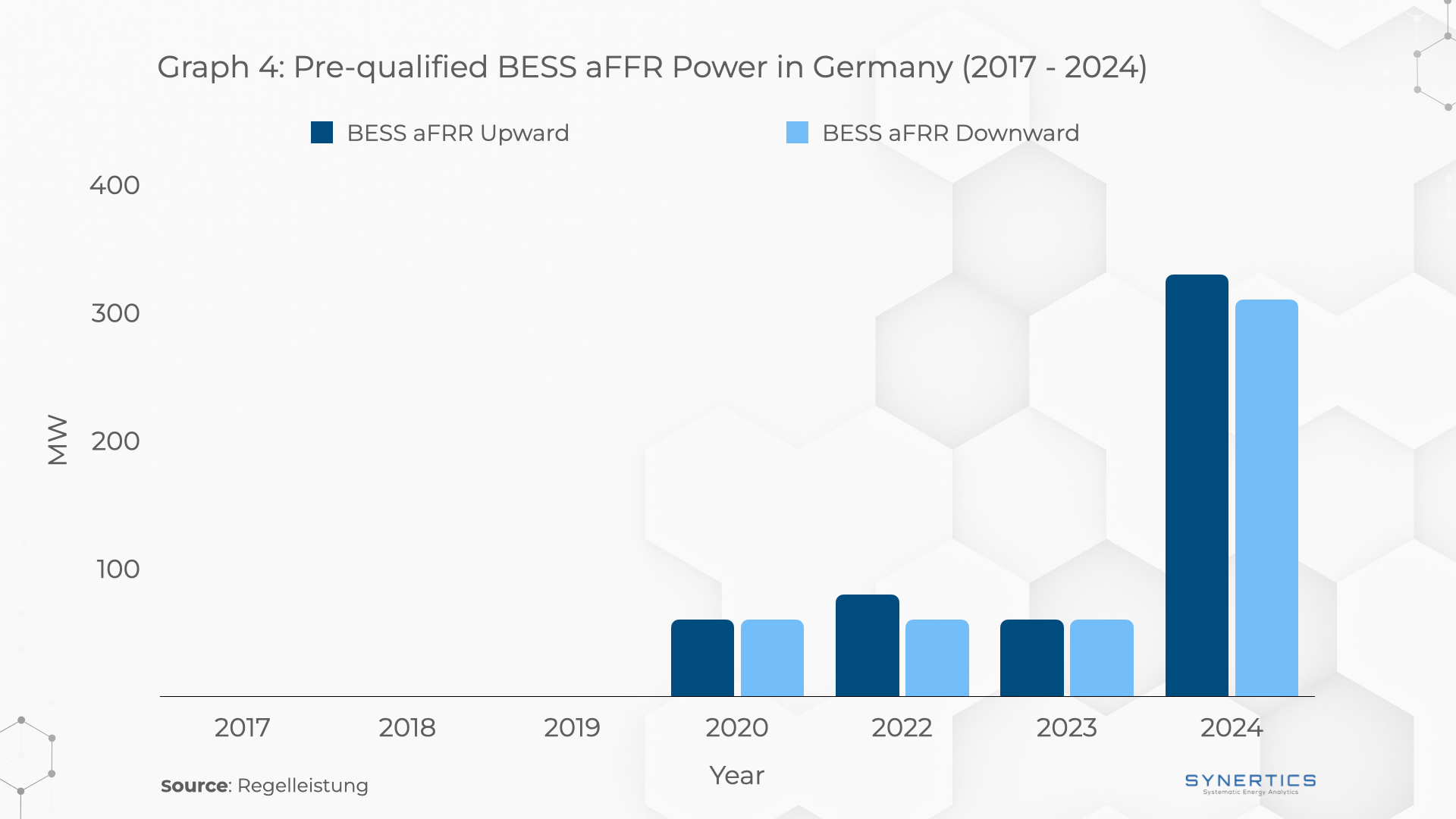

BESS owners have only recently entered the aFRR market, which is becoming increasingly attractive for them, partly due to the higher energy prices shown in Graph 1. As illustrated in Graph 4, the number of pre-qualified BESS units quadrupled in 2024 compared to 2023. With BESS currently making up just 1.5% of the total prequalified power in aFRR, there is substantial growth potential. As conventional energy sources decline, BESS is well-positioned to capture a greater share of the aFRR market.

We began by highlighting the attractiveness of prices in capacity markets and drawing a parallel between the growing share of renewable electricity and the rise in prices. Additionally, BESS has been benefiting from favourable market conditions and making significant strides in the ancillary services (AS) market, especially in FCR and aFRR.

However, these market dynamics might encourage flexible generators, which meet the technical needs of AS, to enter these markets This could lead to competition and reduce the profitability for BESS owners. The fact that the market follows an inverse trend to the day-ahead price profile—reaching its minimum during solar peak hours, when AS markets typically peak—further highlights this concern.

To mitigate these risks, BESS owners already adopted some strategies like participating in multiple markets. This strategy allows BESS owners to take advantage of favourable conditions while minimising risks by avoiding reliance on a single market. To further protect BESS investments from future market saturation, entering into Energy Storage PPAs can be a viable option. PPAs help BESS owners maximise their investment potential while protecting against possible market saturation in the future. This approach allows owners to benefit from the current market conditions while simultaneously reducing risks.

Are you interested in discovering how a PPA can safeguard and optimise your investment in BESS? Don’t hesitate to contact us!

Insights

3rd Mar, 2026

Insights, Market-trends

27th Feb, 2026

Insights

29th Jan, 2026