Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

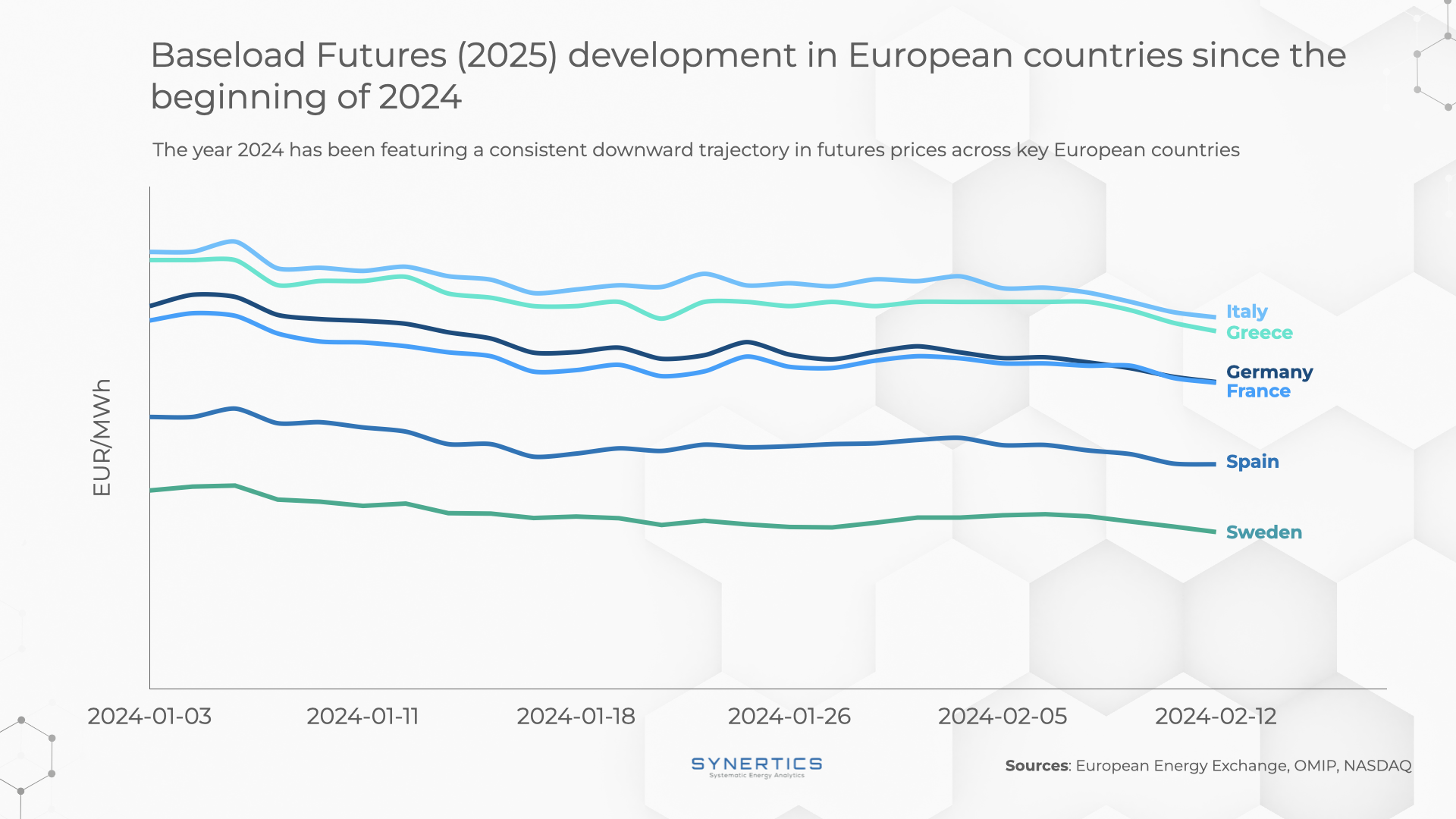

Today we looked at a notable trend shaping the energy markets across Europe, particularly within the Baseload Futures for 2025.

Over the period spanning from January 1st, 2024, to February 13th, 2024, we've observed a consistent downward trajectory in Futures prices across key European countries.

This trend is more than just a fluctuation in market dynamics; it holds significant implications, particularly for sellers relying on PPAs. Therefore, it's crucial to dissect these developments and understand their potential impact on risk mitigation strategies.

Last week, the 2025 annual contract featured price swings from 81.39 €/MWh down to 77.10 €/MWh, reflecting its lowest level since the beginning of 2022.

The current decline in Baseload Futures prices signals a shift in the energy landscape and can be associated with the following factors:

For sellers reliant on PPAs, the declining Futures prices raise concerns regarding the profitability and viability of long-term contracts. Lower Futures prices imply tighter margins and increased pressure to secure favourable terms with buyers. This necessitates a proactive approach to risk management, pricing strategies, and contractual negotiations.

To effectively navigate these challenges, sellers must adopt a multifaceted approach. This may involve recalibrating pricing models, implementing robust risk mitigation strategies to hedge against price fluctuations, and exploring diversified revenue streams to offset potential revenue impacts.

Thus, engaging with industry experts, leveraging data analytics and predictive modeling, and staying on top of regulatory developments can provide valuable insight for strategic adaptation.

At Synertics we’re fully equipped to guide you through periods of price volatility such as the one we’re currently experiencing. Our expertise comes not only from past projects and transactional challenges but also from the analytical power of our PPA Evaluation Tool. This combined approach allows us to offer precise insights to our partners, empowering them to develop PPA strategies that maximise revenue in uncertain times.

Market-trends

6th Feb, 2026

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025