Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

In the dynamic world of energy, Financial PPAs have emerged as a pivotal tool for businesses with significant energy demands striving to harmonize with eco-friendly practices and navigate the uncertainties of energy price fluctuations. Particularly, Financial PPAs featuring a Collar structure present a well-rounded strategy, skillfully merging market volatility shields with the prospect of capitalizing on advantageous pricing.

Financial PPAs (also known as Virtual or Synthetic PPAs) stand out as non-physical energy trading agreements, hinging on the differential between a predetermined fixed price and the fluctuating market rate. This setup empowers companies to virtually procure energy, often from renewable sources, bypassing the need for direct linkages with the generation points.

Within this domain, options like Call options, Put options, or Collars, serve distinct protective and opportunistic functions.

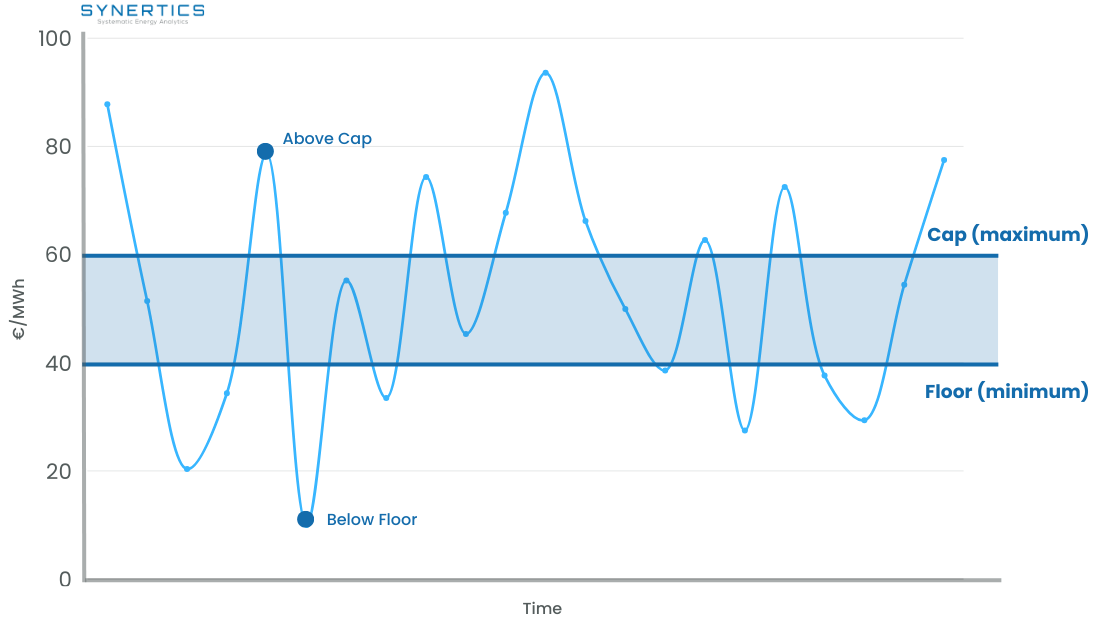

The "collar" structure in a Financial PPA adds a level of protection and predictability. A "collar" is essentially a combination of a Call option (Call) and a Put option (Put). This establishes a maximum (cap) and minimum (floor) price for the cost of energy.

From the producer's view, it's the combination of buying a put option (cap) and selling a call option (floor). Thus, if market prices move out of this range, the collar protects the company against excessively low prices, ensuring a minimum if prices drop dramatically, i.e., below the exercise price of the call option (floor).

As an example, let's consider a cost-free collar in the electric energy spot market, with a 𝗰𝗮𝗽 (upper limit) at 60 €/MWh (Call option) and a 𝗳𝗹𝗼𝗼𝗿 (lower limit) at 40 €/MWh (Put option).

In this scenario, a renewable energy producer is protected against a drop in prices below 40 €/MWh, while their potential profit would be capped at 60 €/MWh. Between 40 €/MWh and 60 €/MWh, the producer would be able to sell their production at the current market price.

1. Minimum price protection (Floor)

Benefit: Guards against abysmal market rates, promising baseline revenue.

Risk: High market scenarios might limit profit potential due to the set cap.

2. Revenue predictability

Benefit: Offers revenue certainty even amidst market turbulence, aiding in strategic planning and operational sustainability.

Risk: This stability might come at the cost of missed opportunities in soaring market conditions.

3. Risk management

Dampens the impact of market volatility, ensuring a steadier revenue flow.

Financial PPAs with Collar agreements are a testament to innovative thinking in the complex energy landscape, allowing for balanced risk management. Such financial instruments are poised to be crucial in guiding businesses toward their energy and sustainability objectives.

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026