Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Our recent study seeks to understand the intricacies of energy storage systems, exploring how their efficiency can spell the difference between profit and loss in the day-ahead electricity market.

Simply put, arbitrage translates to buying energy when it's cheap and selling it when it's at a premium. Yet, the success of this strategy hinges on a delicate balance of factors. The price difference, the accuracy of price predictions, and the efficiency and capacity of your storage system are all crucial pieces of the puzzle.

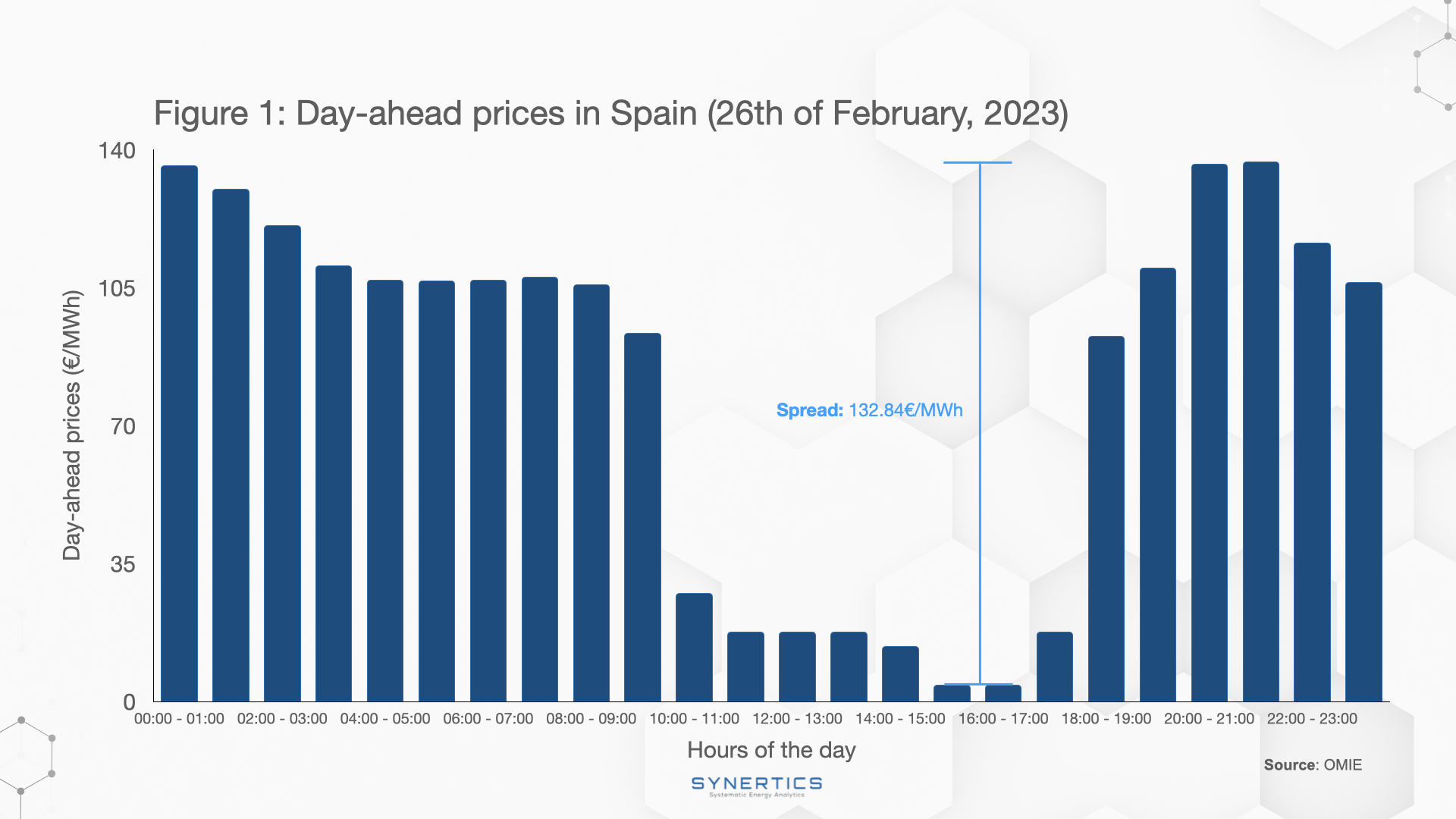

The energy market is undergoing a profound transformation, thanks to the soaring prominence of renewable resources like solar power. Witnessing this transition, we often find ourselves in front of the "Duck Curve" phenomenon.

This visual representation mirrors the impact of solar energy on traditional supply and demand, with daytime prices plummeting (the duck's belly) and nighttime prices surging (the duck's head).

But what's the key to maximising the potential of this renewable revolution?

Not all the energy drawn from the grid can be stored, and not all stored energy can be utilized due to efficiency losses. Therefore, to maximize profits, one must seek to store electricity when prices are low and discharge it when prices are high.

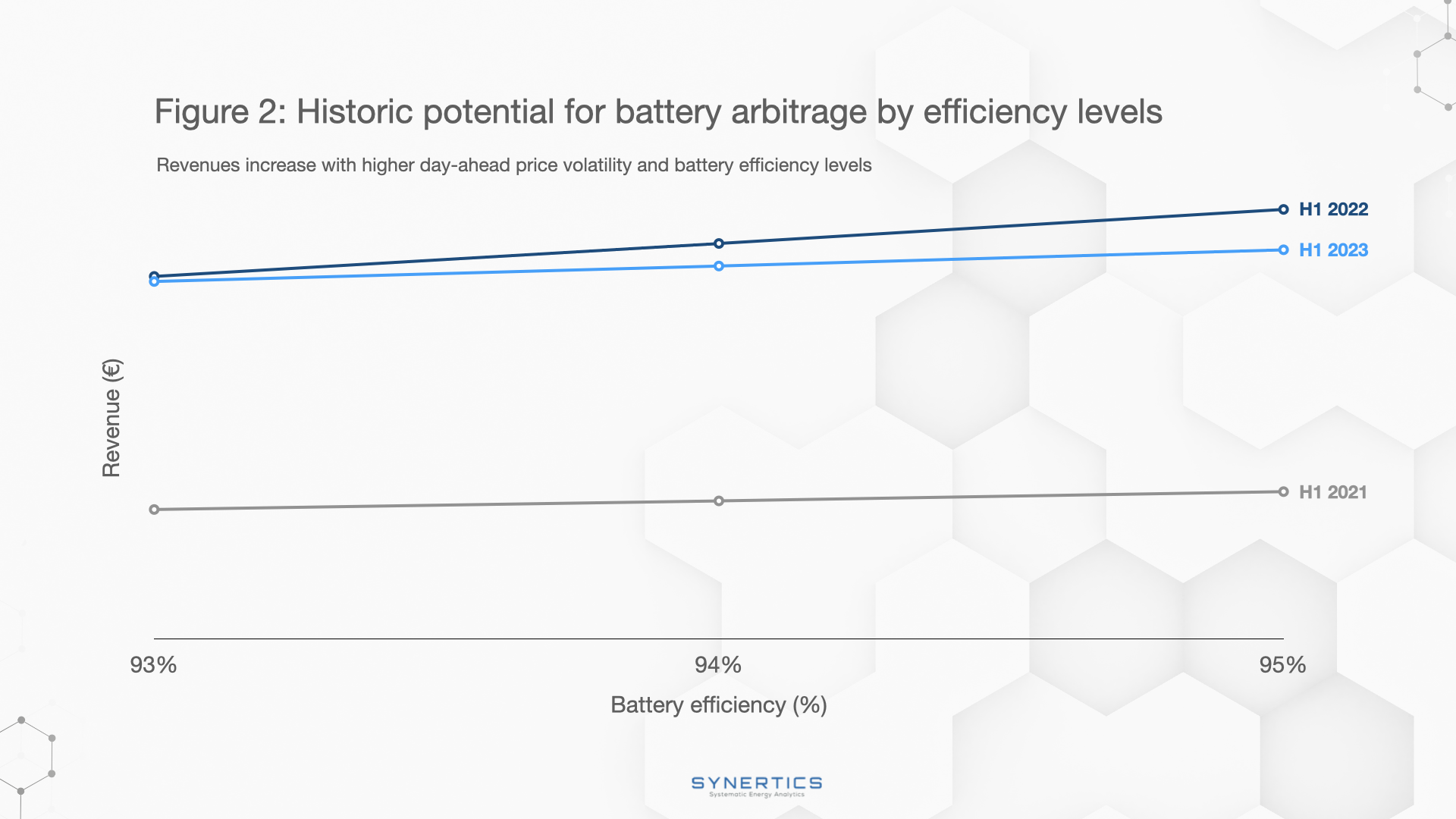

Our analysis, using Spanish price data from the first half of 2021, 2022, and 2023, revealed an intriguing pattern:

Higher price fluctuations, or deviations, offer more extensive opportunities for energy arbitrage. In other words, the potential to buy low and sell high increases.

While keeping other variables constant on the model, we observed substantial price deviations of 25.56 (H1 2021), 67.61 (H1 2022), and 44.88 (H1 2023) on the day ahead prices. As these deviations indicate the level of price volatility and unpredictability, 2022 stood out with a deviation of 67.61. Also, a battery efficiency increase from 93% to 95%, enabled a comparably higher revenue.

This highlighted a robust connection between electricity price volatility and battery performance. The fluctuating prices in 2022 paved the way for enhanced arbitrage opportunities, emphasizing the significance of high-quality batteries in effectively leveraging market fluctuations.

Key takeaway

As renewable energy claims the spotlight, understanding the nuances of battery efficiency and market deviations is paramount as greater price swings unlock strategic trading potential in the energy market.

Synertics provides advisory services and develops digital data-driven solutions for the energy industry with the purpose of driving productivity and transferring knowledge.

Market-trends

6th Feb, 2026

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025