Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Understanding the nuances within the Power Purchase Agreements field.

Essential to anyone in the current renewables industry, Power Purchase Agreements (PPAs) are a topic one should always keep in mind when adding revenue stability to assets.

Power Purchase Agreements can be a very powerful tool for companies looking to reduce their electricity costs while offsetting greenhouses emitted during their operations. Being one of the most efficient and affordable ways to include renewable energy in your company strategy, these agreements often seem like a complicated process that requires a lot of time and expertise. In this guide, we will answer many common doubts about PPAs and make sure you understand what to look out for when entering one.

An electricity supply agreement between two parties, usually between an electricity producer and an offtaker (direct consumer or trader), in which the price, structure, and duration of the electricity supply are defined. Direct consumer offakers tend to close physical PPAs and traders usually undergo financial PPAs. But, why should they?

The reasons listed above help us understand why PPAs are becoming increasingly popular among corporations seeking a sustainable outlook. Further, as PPA structures often become more complex as electricity markets evolve, we will walk you through the most common types and structures.

Through a PPA, a corporate off-taker enters into a long-term agreement to take part or all of the energy produced by a renewable energy generator at a predetermined price per production unit (MWh), structure, and duration, usually ranging between 5 to 15 years. Within Physical PPAs, there are three categories of contracts, with the main difference being how the energy provider agrees to supply a client with electricity.

On-site PPA: Here the buyer has direct access to the electricity supply through its close physical proximity. No public grids are required to transport the electricity, often avoiding grid fees, which make these types of agreements financially attractive.

Off-site PPA: In this case, the renewable energy generator is not located at the buyer's site. Electricity will be transported directly through public grids.

In a Virtual PPA, there is no physical supply of electricity between the supplier and offtaker. Instead, the electricity is sold directly to the market at the spot price. The electricity producer settles the amounts with the offtaker, which depends on the variations between the spot price and the PPA price.

Without an actual physical delivery between the contracting parties, Virtual PPAs serve customers from multiple sites, who aren’t confined to a given energy market. Seen as more flexible, Virtual PPAs are a cost-effective option since there aren’t dispatch costs and no limits on load points.

Having sorted out the differences among PPAs types, one must also be aware of the existent hedging structures and what implications these might have on revenue risks.

Various hedging structures amount vary in terms of volume and price risk. Volume risk entails carrying the risk of a renewable energy project producer less than the expected amount, while price risk defines, what party carries the risk of spot price variations. The following table defines the risks and returns each structure traditionally carries.

| Pay-as-produced | Production Profile | Baseload | |

|---|---|---|---|

| Price | Low | Medium | High |

| Risk | Low | Medium | High |

| Hedge computation | % x Actual Production | % x Forecasted Production | % x Forecasted Production / 365 x 100 |

| Volume hedge | Variable | Fixed | Fixed |

| Volume risk carrier | Offtaker | Producer | Producer |

| Price risk carrier | Offtaker | Producer/Offtaker | Producer/Offtaker |

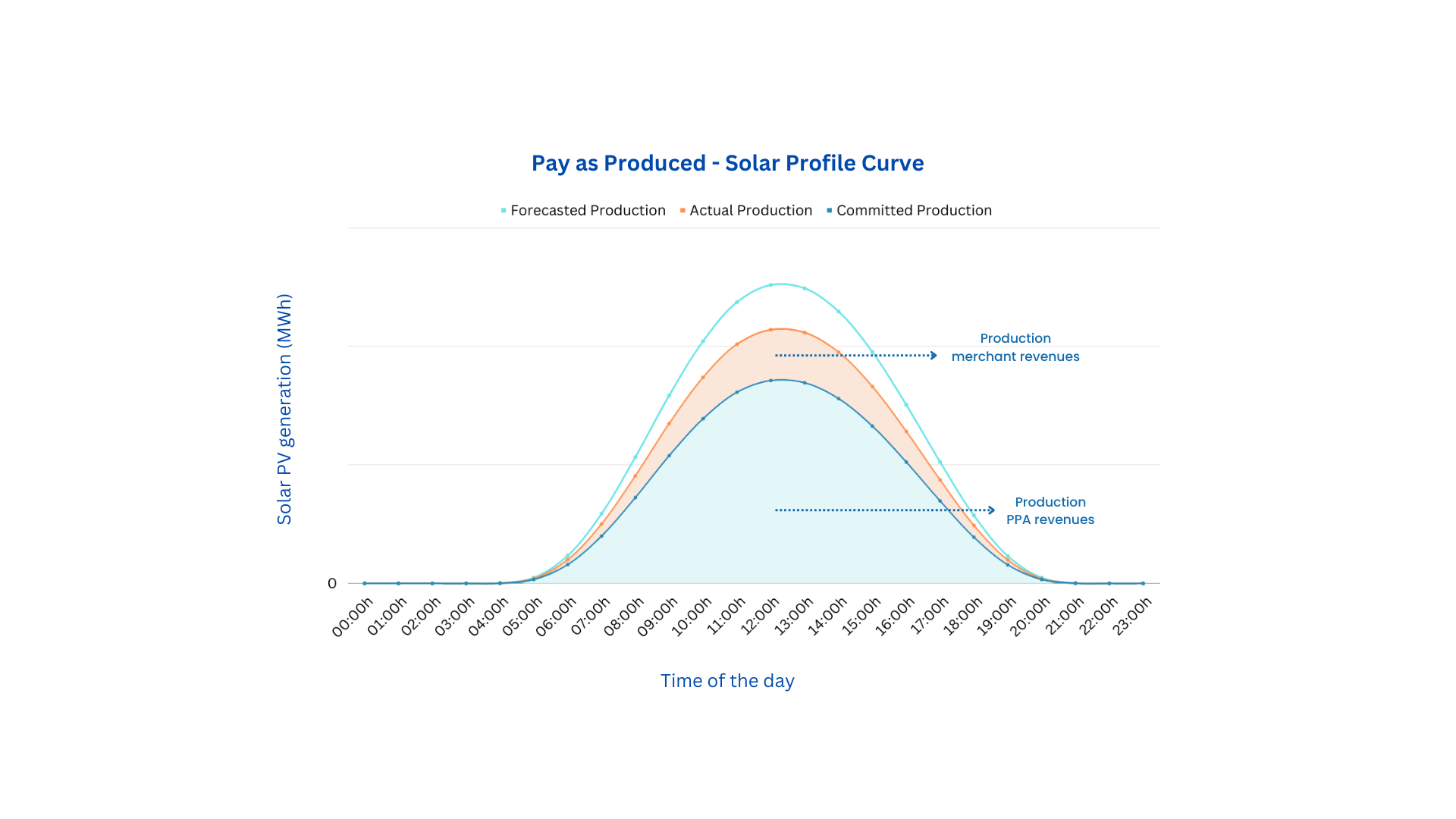

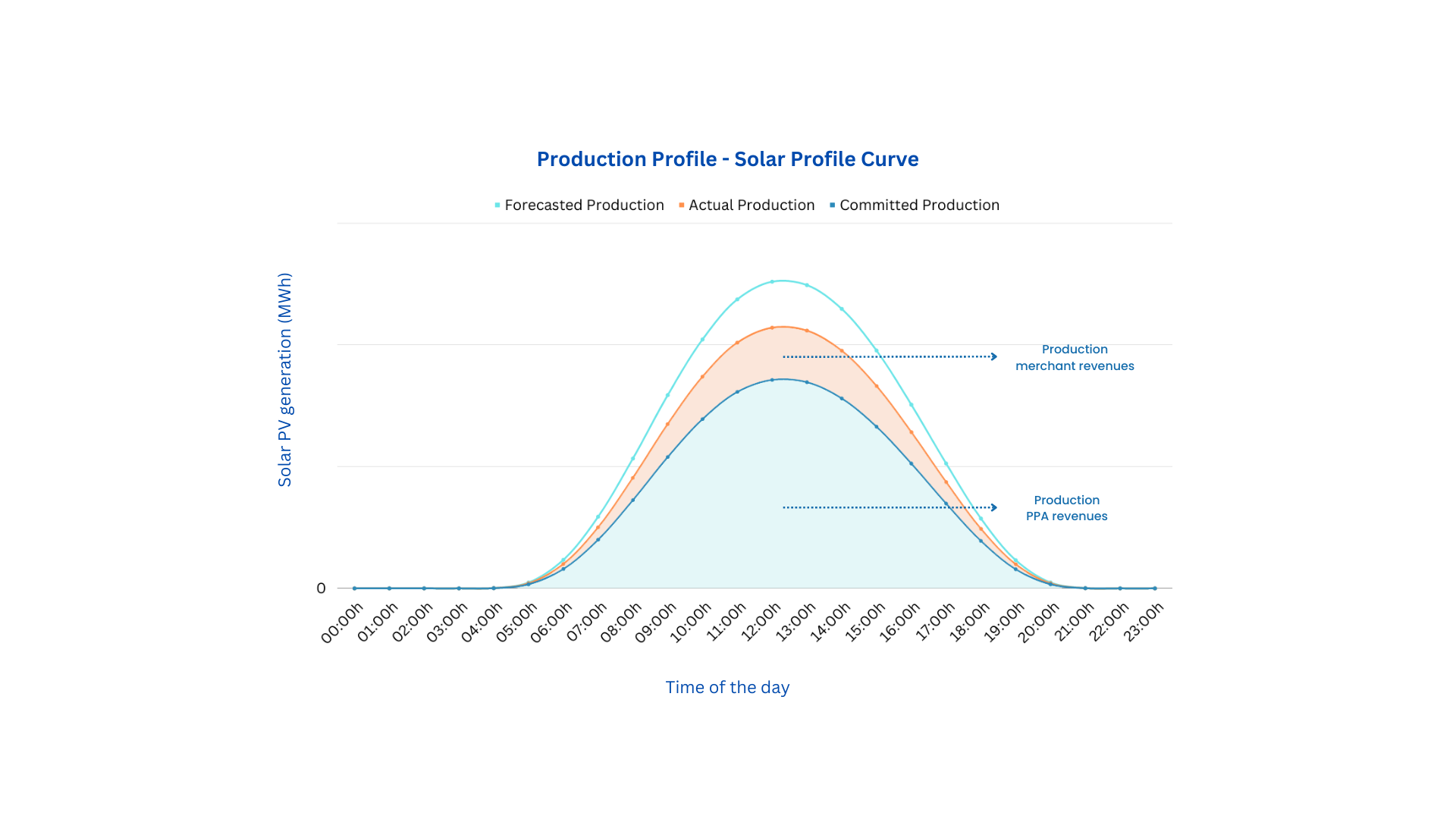

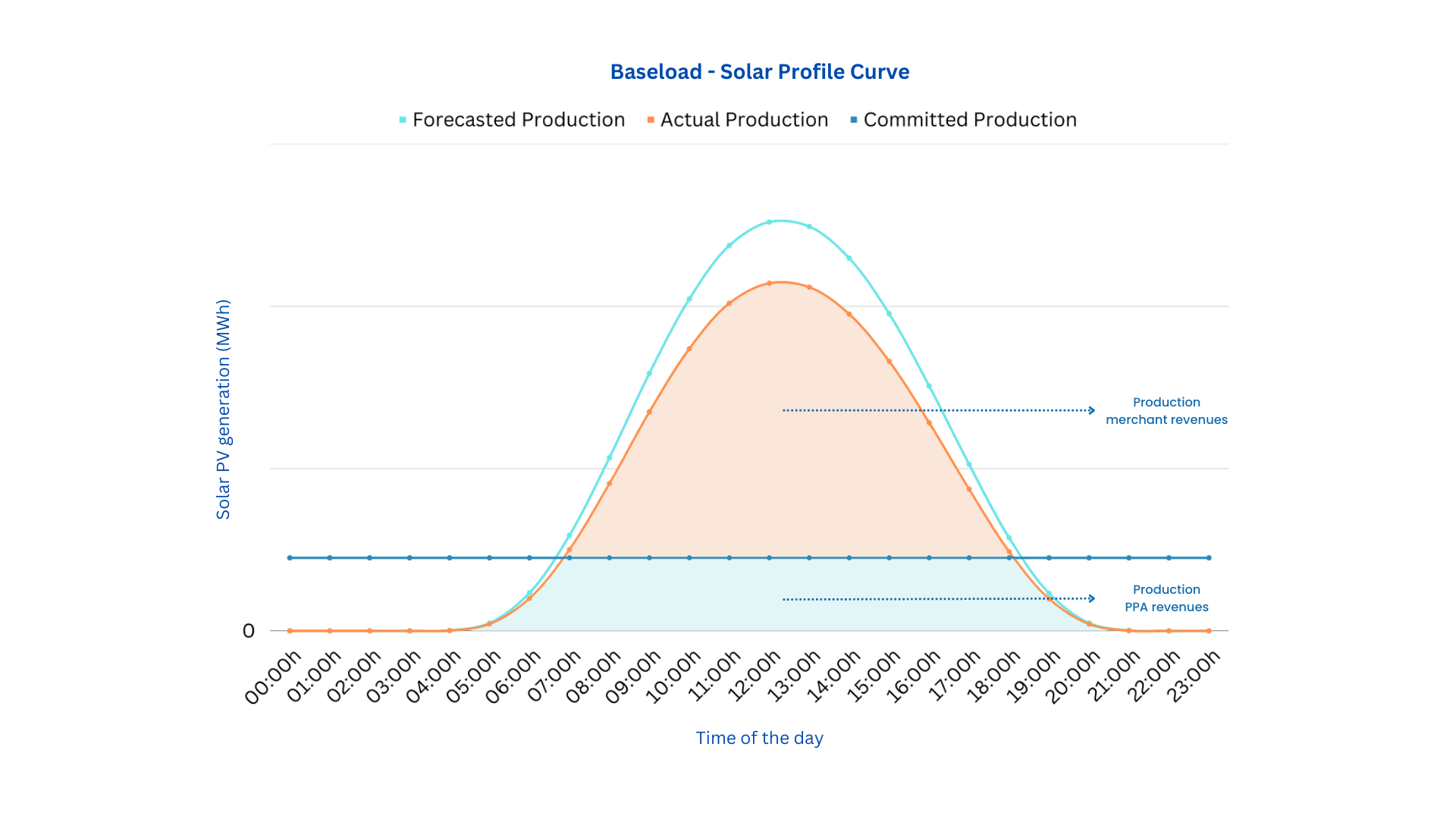

In the example below you will be able to observe how different hedging structures might impact the revenues of a solar PV project based in Germany. We will show you how under a stressed scenario in which the actual production is lower than the forecasted production, the revenues for each hedging structure look like. In addition, we will also decipher the formulas to be used to calculate the hourly revenues under each hedging structure. In this scenario, the actual hourly production for a specific day is 85% on a linear level of the forecasted hourly production. Each hedging structure assumes an 80% hedge, which results in committed production. The Spot Prices are usually referred to as country/market-specific intraday prices.

Formula: (Actual Production x Hedged Production x PPA Price) + (Actual Production x (1 - Hedged Production) x Spot Price)

The offtaker agrees to purchase a percentage of the actual produced electricity. In this structure, the electricity supply variations risk, also called volume risk, is born by the offtaker.

Due to its simplicity and risk properties, it is usually a preferred structure for sellers and banks.

Formula: ((Forecasted Production x Hedged Percentage x PPA Price) + ((Actual Production - Forecasted Production) x Spot Price)

The offtaker agrees to purchase a percentage of the forecasted electricity production on an hourly basis (the committed production).

In this case, the volume risk is born by the seller. In addition, the seller bears the price risk during periods where the actual production is lower than the committed production. This structure is becoming more popular among renewable technologies such as PV solar, where electricity supply variations are relatively low.

Formula: (Actual Production - Committed Production) x Spot Price + If(Committed Production >= Actual Production; (Committed Production - Actual Production) x PPA Price; Committed Production x PPA Price)

The offtaker agrees to purchase a fixed amount of electricity production throughout every hour of a month/year (monthly and yearly baseload PPAs).

The seller undergoes electricity price risk in periods where the actual production is lower than the fixed production. This structure is most commonly seen in renewable technologies such as wind onshore.

At this stage, we can assume that Power Purchase Agreements (PPAs) are a great way to reduce volume and price risks within the electricity market, but do you know how to maximize the benefits of these agreements?

The commercial energy supply market is highly competitive, with many providers offering a large range of products, services, and tariffs. In order to select the best value for a specific renewable energy project and the electricity generator risk appetite, it is important to efficiently and transparently evaluate every option.

Synertics PPA Evaluation Tool will enable you to focus on stabilizing and maximizing asset revenues, while comprehensively understanding the inherent risks of various PPA options. It is a comprehensive, scalable, and easily manageable tool that will allow your organization to professionalize and standardize PPA tenders while transferring knowledge within your organization. It was built with the purpose to serve transaction, asset, and portfolio managers throughout the lifecycles of renewable energy assets (acquisition, operation, and exit).

As solar and wind technologies play an increasingly relevant role in generation mixes, understanding various revenue hedging options through power purchase agreements becomes empirical. Synertics PPA Evaluation Tool helps transaction, asset, and portfolio managers transparently and efficiently evaluate revenue and risk relationships of various PPA options to stabilize and maximize the value of assets.

Synertics provides advisory services and develops digital data-driven solutions for the energy industry with the purpose of driving productivity and transferring knowledge.

Insights

3rd Mar, 2026

Insights, Market-trends

27th Feb, 2026

Insights

29th Jan, 2026