Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

On the 3rd of September 2025, the transmission system operators (TSOs) of Austria, Germany, and Czechia launched ALPACA – the Allocation of Cross-Zonal Capacity and Procurement of aFRR Cooperation Agreement. This trans-European mechanism marks the latest step in Europe’s ongoing efforts to harmonise cross-border electricity markets, this time focusing on the joint capacity procurement for automatic Frequency Restoration Reserve (aFRR).

In this article, we explore the motivations behind the creation of this new market, its operational framework, and the potential implications for generators currently active in or considering participation in ALPACA.

ALPACA is the second transeuropean capacity market following the FCR Cooperation. Conceptualised in 2022 and built on the earlier cooperation between Austria and Germany, this market now allows for cross-border energy allocation between Germany, the Czech Republic and Austria. The go-live of ALPACA (for delivery day) occurred on the 3rd of September 2025, enabling exchange of aFRR balancing capacity across the AT–CZ and DE–CZ borders. This platform is linked to the aFRR energy project – the PICASSO.

The objectives are well known and in line with those of other European balancing platforms:

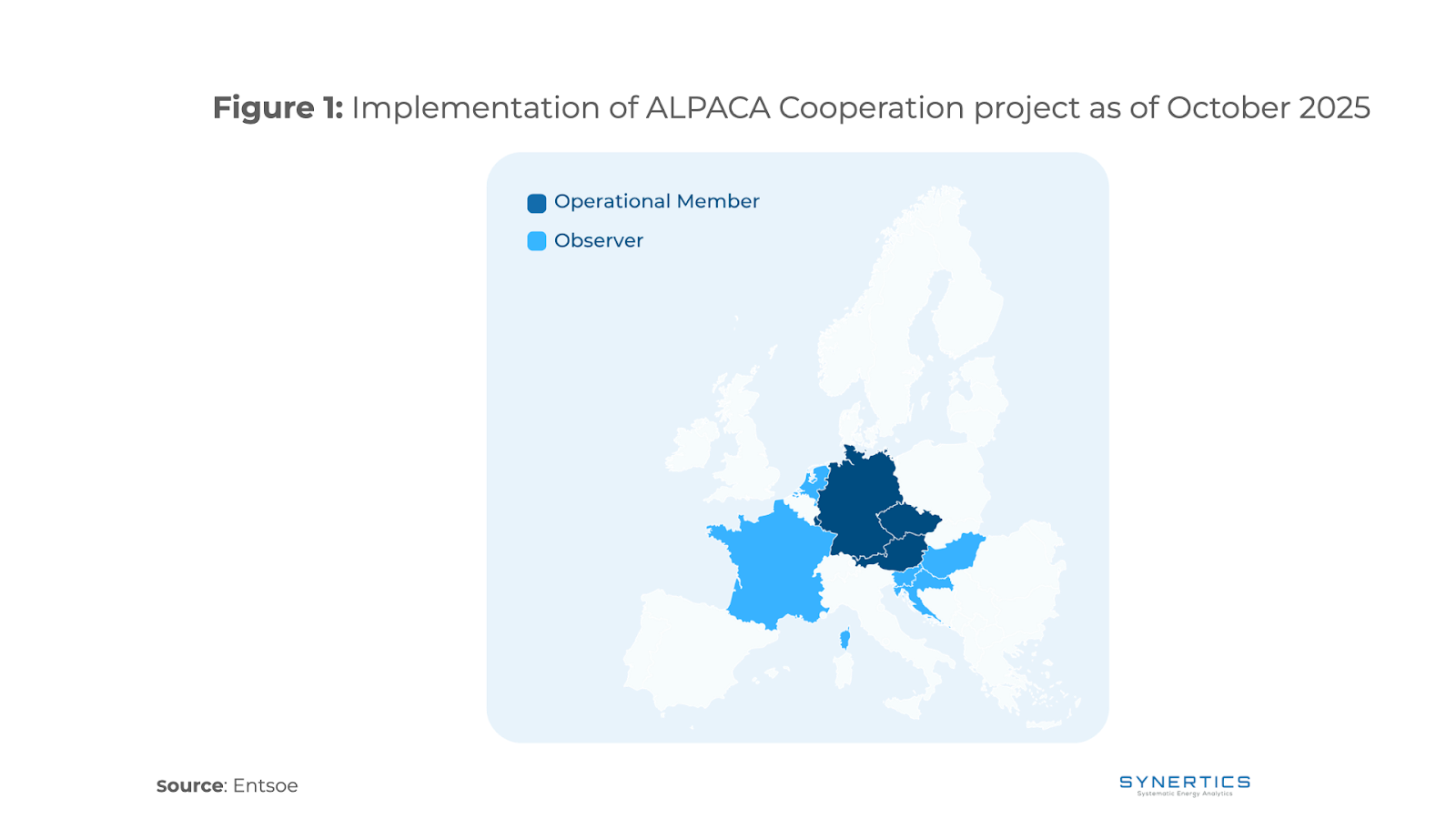

By optimising the use of available cross-border transmission capacity, each TSO gains better access to aFRR balancing capacity. This reduces redundancies over time and leads to lower overall procurement costs. Figure 1, depicts the active and observer countries of ALPACA as of today.

In the ALPACA scheme, the remuneration structure for balancing capacity is addressed in the product specification and bidding rules. The features are similar to the ones currently in place on the aFRR balancing in Germany and are as follows:

These structures mean that providers of balancing capacity commit to availability for the designated blocks and receive remuneration for the capacity available. The “pay-as-bid” model means each bidder sets its own capacity price and, if successful, receives that price.

If the units awarded in ALPACA are called to activate, the settlements of energy will follow the protocol of the energy market, in this case, the PICASSO.

Here is a step-by-step overview of how ALPACA works from bidding to allocation:

Cross-border cooperation can open access to larger markets and enable more flexible resources—such as renewables and storage– to contribute to balancing capacity. By expanding the pool of capacity providers, cross-border procurement helps lower entry barriers and can drive down capacity prices. For renewable producers, this may translate into more competitive conditions and narrower profit margins, but also into more frequent opportunities to participate in balancing services.

In this case, Germany and the Czech Republic display notably different aFRR dynamics. The Czech Republic’s energy mix is dominated by conventional thermal and nuclear generation, whereas renewables are more prevelent in Germany. Consequently, German aFRR prices are more volatile and tend to average higher levels. This creates potential opportunities for Czech operators, aligning with the broader goal of harmonising aFRR capacity across borders.

Over the past two months, activation flows have occurred in both directions, confirming that market expansion has a positive impact. However, it is important to note that transmission capacity between TSOs remains a key bottleneck for deeper integration. Significant improvements in market efficiency will therefore take time to materialise as these constraints are gradually addressed.

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026