Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

The transition to 15-minute trading intervals in the Day-Ahead (DA) market is a key structural shift designed to better integrate renewable energy, enhance system optimization and boost overall efficiency. While the long-term benefits are clear, the initial adaptation phase presents market challenges. Synertics analyzed the immediate impacts of this transition on the Iberian market, specifically investigating whether the change has affected the magnitude of imbalance penalties incurred by participants who fail to deliver the energy committed in their DA and Intraday (ID) bids.

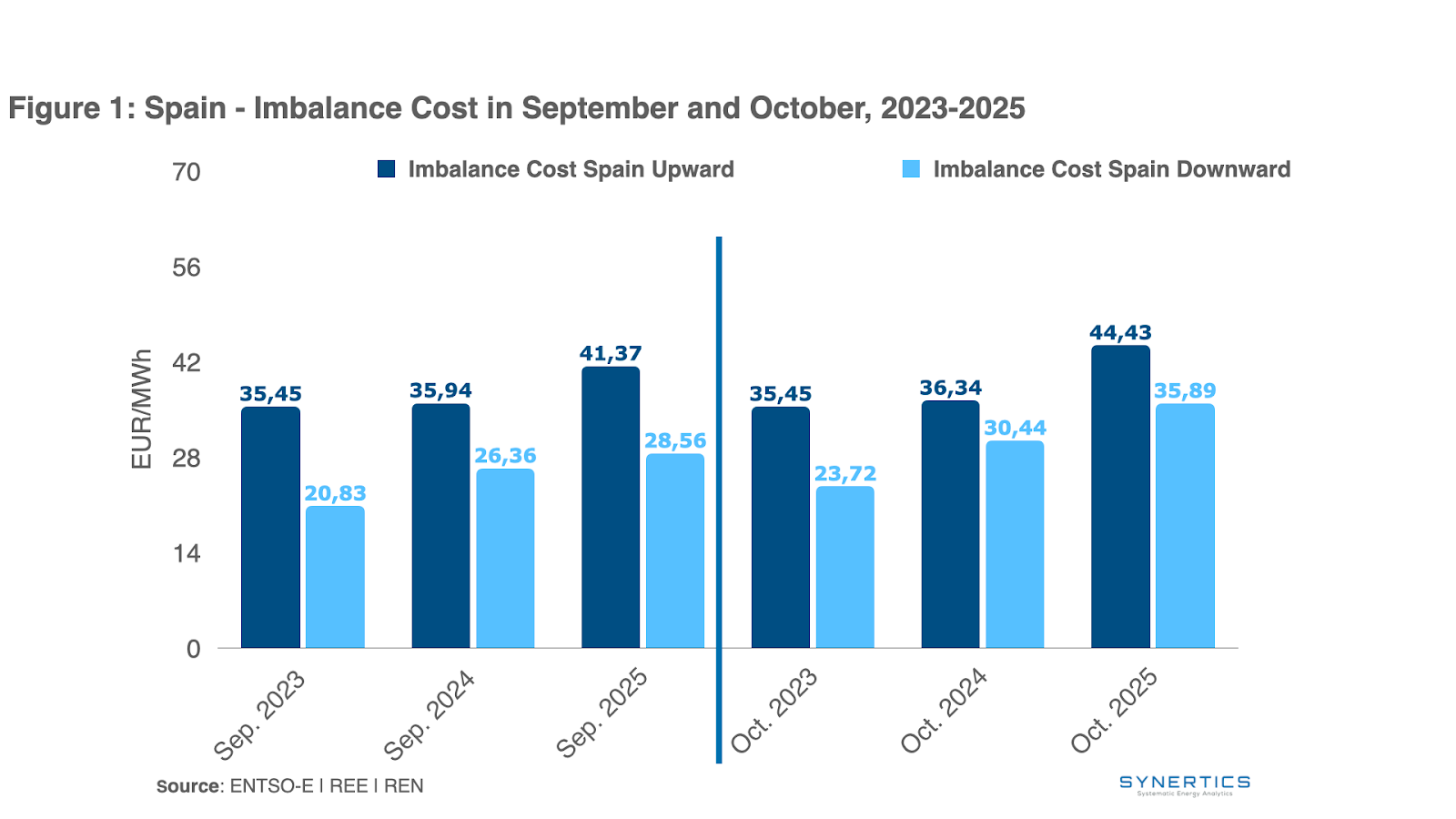

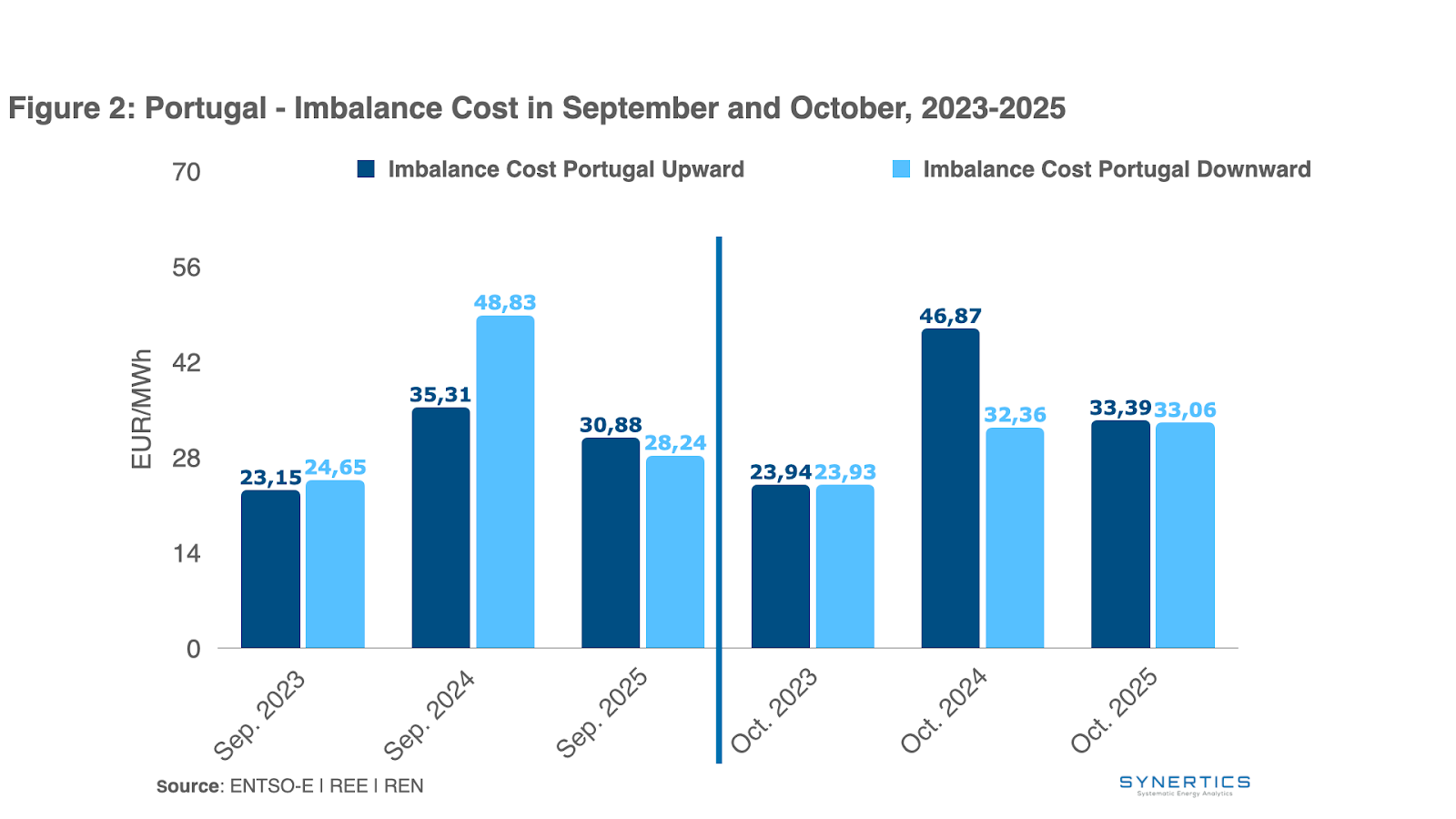

To assess the impact of the day-ahead (DA) resolution change, Synertics analyzed the variation in imbalance costs between September and October 2025, with October marking the implementation of the new resolution. The analysis also includes the same period in 2023 and 2024 to determine whether the 2025 results deviate from historical patterns. If the variation observed in 2025 aligns with previous years, the differences between September (pre-change) and October (post-change) may be attributed to typical seasonal behavior rather than the resolution change itself.

Imbalance costs represent the financial penalties incurred when a market participant’s actual generation deviates from its DA market commitments. The larger the deviation between forecasted and actual values, the higher the imbalance penalty – leading to reduced revenues. Depending on market conditions, these costs can range from just a few cents per MWh to several hundred euros.

This analysis focused on the Iberian region, which encompasses Spain and Portugal. Although both countries participate in the Iberian Electricity Market (MIBEL) and therefore share the same DA and intraday (ID) prices, each operates its own balancing market with distinct imbalance pricing.

While both systems mainly use a single-price mechanism, occasionally shifting to dual-pricing, each TSO (REE in Spain and REN in Portugal) applies its own methodology for calculating imbalance prices, due to local system conditions such as imbalances, reserve availability and interconnection constraints. Nonetheless, both remain aligned with the EU Imbalance Settlement Harmonisation (ISH) framework.

The analysis relied on publicly available data from each country’s TSO and on historical DA prices from ENTSO-E. To draw meaningful conclusions:

In Spain, as it’s illustrated in Figure 1, there was an increase of 3 €/MWh for upward and over 7 €/MWh for downward deviations between this year and last year October. However, September over the last three years also registered an increase similar to October, leading to a conclusion that this small increase happens each year and it can't conclude a direct relation to the DA market new shift. The yearly increase in imbalance severity is likely driven by the growing volume of energy traded in the electricity market and by unfavourable weather conditions, which leads to larger forecasting errors and, consequently, higher imbalance costs.

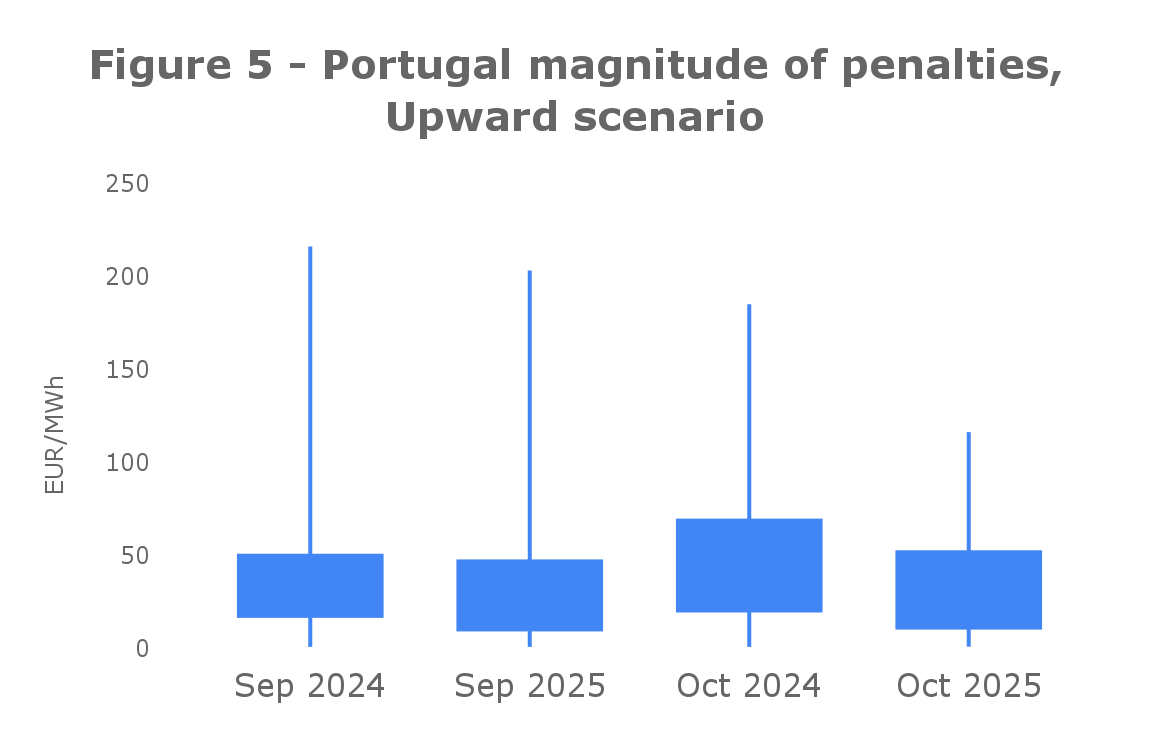

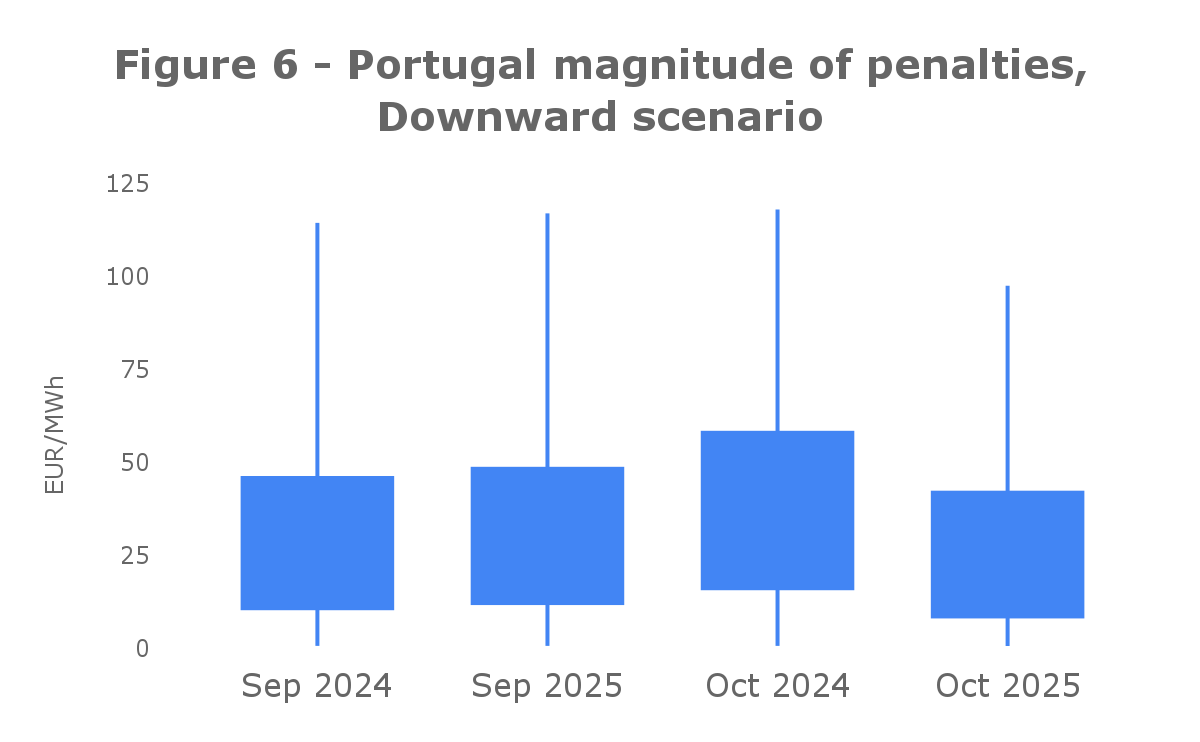

For Portugal, a reduction of about €13/MWh can be observed in the upward imbalance severity, with no significant change in the downward case for the period of October 2025 and 2024. However, comparing 2025 October to 2023, the behaviour is the same, meaning that 2024 was more of a distinct year than 2025, which is the first month of the new change in the DA market. The same behaviour can be seen in September, where 2024 was more out of the pattern in the last three years, meaning of bigger penalization to market participants in 2024 than in 2025. Although Portugal shows a different behaviour from Spain, the overall conclusion remains the same: there is no clear relationship between the new shift and the change in imbalance cost overall.

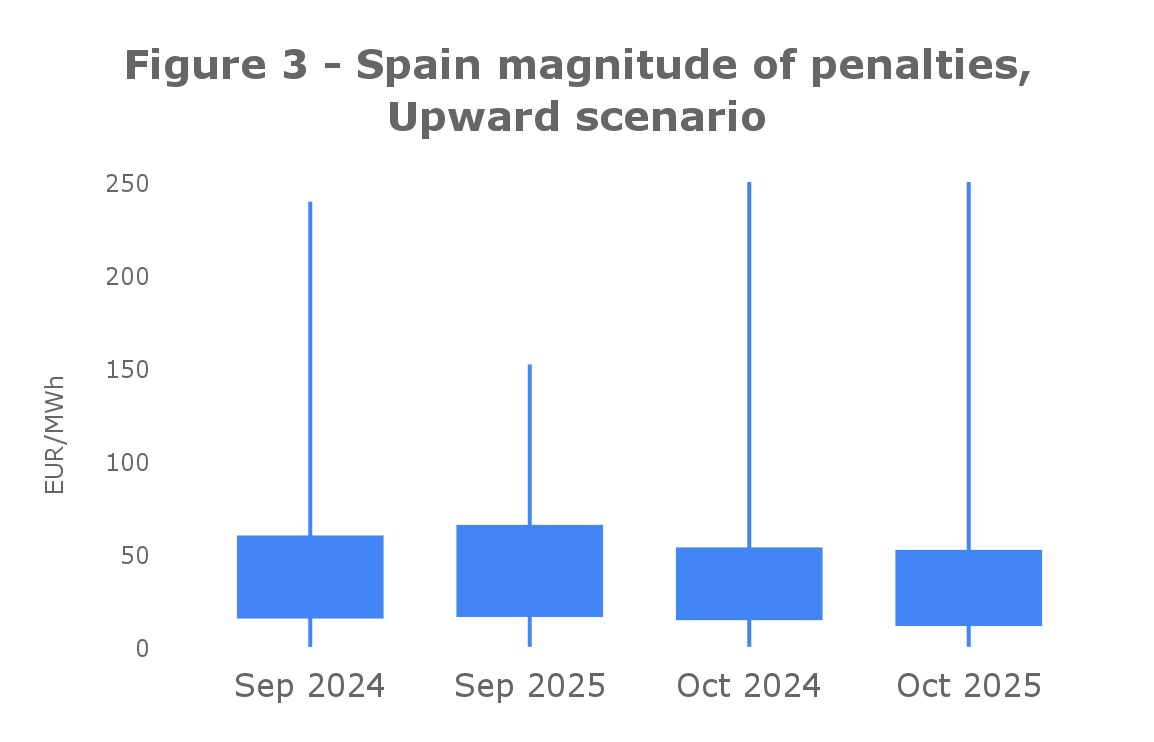

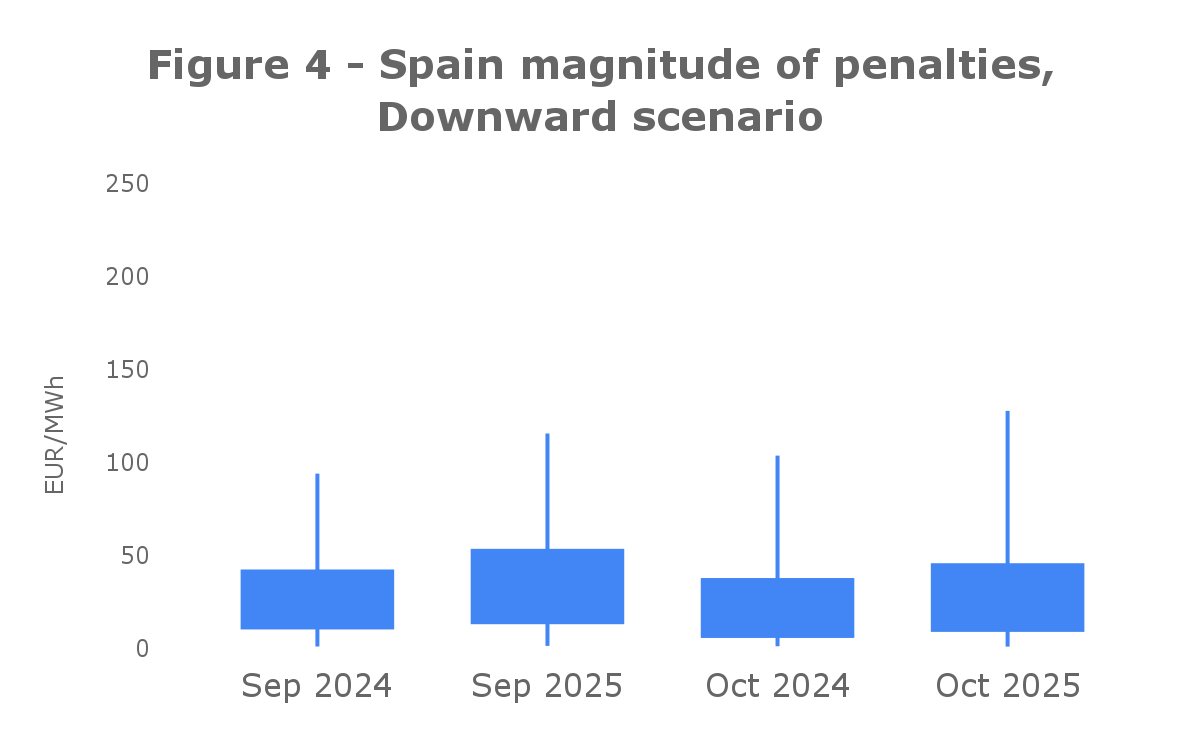

From the monthly average values of imbalance cost shown in the previous figures, no significant difference in the imbalance cost can be observed. However when examining the intra-month dynamics, changes might have happened, meaning an impact on volatility, possible higher peaks and lower dips in the magnitude of penalties.

|

|

|

|

When examining Figures 3 to 6, which shows the range that contains most of the observed values before and after the change, it appears that the levels of volatility remained consistent. This conclusion is supported by the fact that all four months display similar value intervals throughout their respective periods.

The first month of this new transition didn’t correspond to a noticeable impact to conclude that the changes on the imbalance costs we see, from October last years and this year, aren’t related with the passing of the DA to 15 minute auctions. Consequences of other events that happen in Iberia between last year and this year, may also contribute to the observed changes, such as:

In summary, as this first month of change on the day-ahead market comes to an end, drastic changes in the imbalance market didn’t occur. This suggests no major effect in the penalties that renewable park owners will receive in their imbalances and the small variation in the imbalance severity that happened can be because of other events that appear in Iberian electricity markets. As this shift is intended to have long-term effects and just one month has passed, effects on other electricity markets can appear later on where a more detailed and focused study needs to be done.

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026