Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

The intraday markets are presented as one of the most exciting and dynamic electricity markets, driven by the increasing share of intermittent renewable energy sources and Battery Energy Storage Systems (BESS). These markets are at the forefront of electricity market integration with 22 countries members of the Trans-European platform for Intra-day scheduling – the European Single Intraday Coupling (SIDC). This article explores the SIDC and its role in creating a more efficient and integrated continental power market. We cover the different market products available across Europe and the market dynamics since the market formation while identifying potential opportunities for market agents.

Across Europe, intraday markets provide market participants with the opportunity to adjust their trading positions in response to updated demand forecasts, renewable generation predictions or unexpected capacity outages after the closure of the day-ahead markets. Throughout the day, participants can place and modify bids on a continuous basis, in some cases with varying time resolutions, up to almost real time.

Trading platforms for intraday markets include OMIP in the Iberian region and EPEX and Nord Pool in Central Europe and the Nordic countries. Most European countries currently participate in the Single Intraday Coupling (SIDC), which enables cross-border energy trading and ensures a harmonised market structure across its members.

Intraday markets allow renewable energy producers to manage the variable nature of renewable generation by continuously balancing their positions and hedging against market risk. For the overall power system, these markets reduce the need for reserves and lower the costs associated with generation imbalances.

The Single Intraday Coupling (SIDC) is a collaborative initiative between Nominated Electricity Market Operators (NEMOs) and Transmission System Operators (TSOs) aimed at enabling cross-border intraday electricity trading across European countries. This integrated intraday market supports the EU’s objectives of creating a more efficient and competitive electricity market in Europe by promoting competition, increasing liquidity and reducing redundant generation through the more efficient allocation of cross-border capacity. It also contributes to better congestion management of the power grid infrastructure.

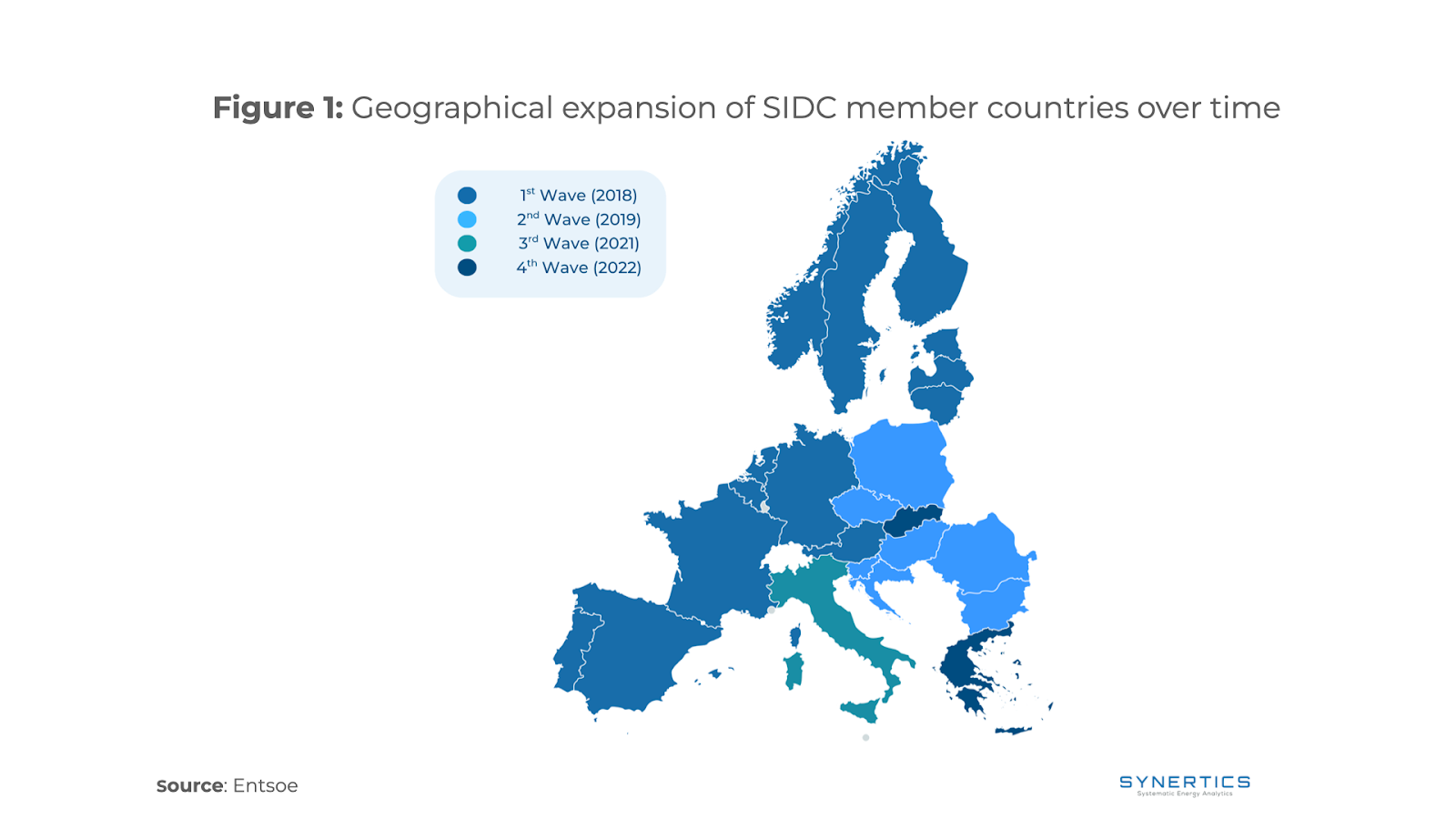

The predecessor of SIDC — the Cross-Border Intraday Project (XBID) — was launched in 2018 with the participation of 15 countries. Since then, SIDC has undergone four expansion phases, and currently includes 25 countries, facilitating cross-border capacity allocation and congestion management. This ongoing expansion enhances market integration and cooperation across Europe, in line with the EU’s energy market harmonization goals. Figure 1 illustrates the evolution of countries participating in the SIDC.

As of March 2025, with the adoption of 15-minute settlement periods in Iberia and the Nordic countries, all SIDC member countries now offer products with the same time resolution. However, some markets still provide additional products with 30- or 60-minute intervals.

Beyond time resolution differences, intraday markets are further categorised into continuous intraday trading (ID) and intraday auctions (IDAs). These two mechanisms are described in more detail in the following sections.

The Continuous Intraday Market is the most widely used mechanism within the intraday trading framework. It has been operational since the first go-live wave of the SIDC. While it shares the same trading platforms as the Day-Ahead Market, the Continuous Intraday Market operates under a different price settlement mechanism.

Whereas day-ahead prices are determined through a pay-as-cleared system, the intraday market follows a pay-as-bid approach. This means that a trade is executed when a buyer accepts a specific sell offer, following a first-come, first-served principle.

Market participants can start trading in the continuous intraday market a few hours after the closure of the day-ahead market. The market remains open until one hour before delivery for cross-border bids, although some countries allow trading closer to real time; for example, in Germany, bids can be placed up to five minutes before delivery.

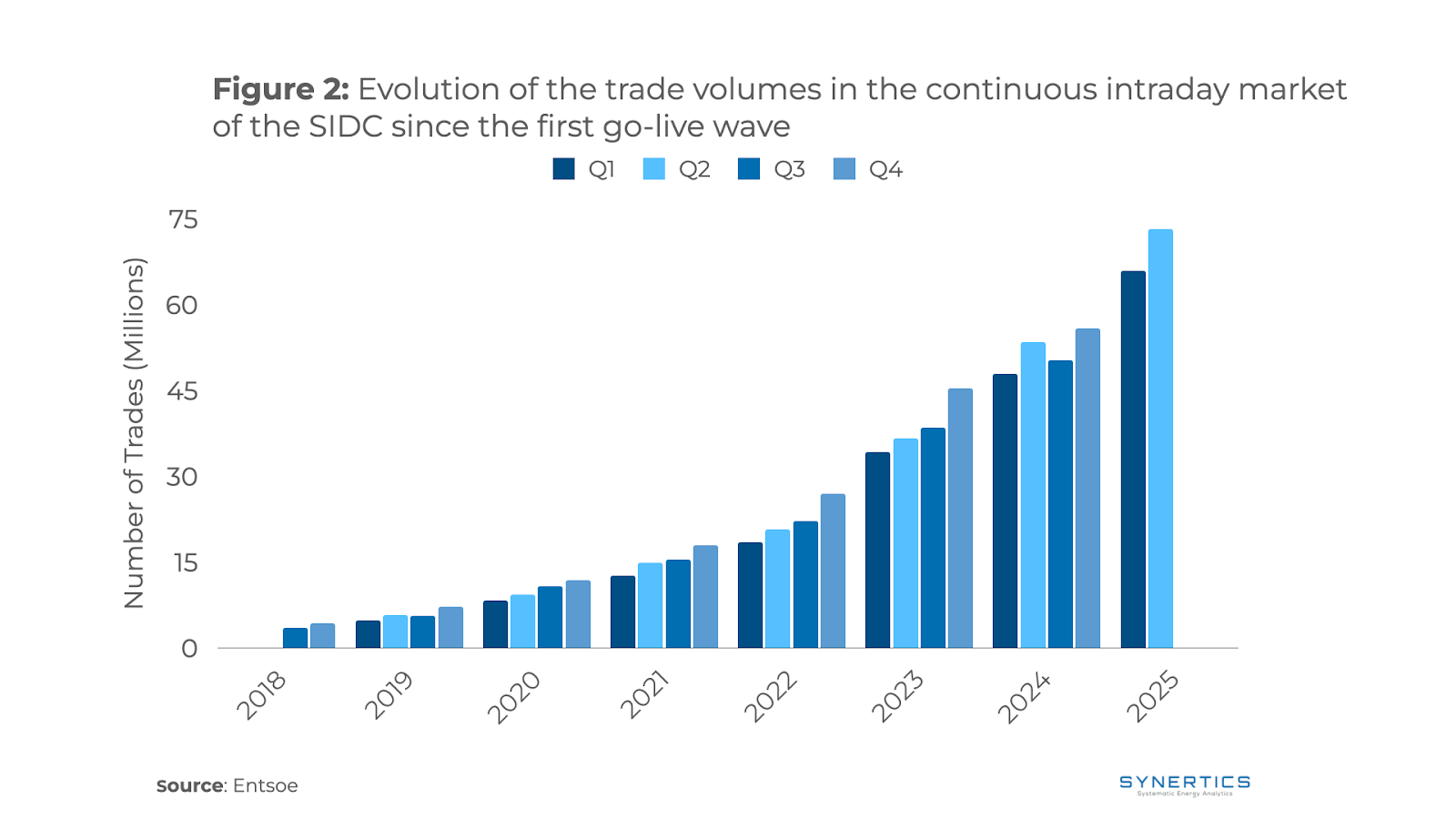

In recent years, the Continuous Intraday Market has experienced significant growth, showing an exponential increase in trading volumes since its inception, as illustrated in Figure 2. This expansion has been primarily driven by the rising share of renewable generation and the progressive extension of SIDC coverage, culminating in almost 75 million trades in Q2 2025.

Since 14 June 2024, the Intraday Market has been complemented by a new trading mechanism, the Intraday Auctions (IDAs). These auctions operate alongside the continuous intraday market and follow a structure similar to that of the Day-Ahead Market.

In the IDAs, all bids are aggregated and matched with corresponding offers, allowing for the allocation of available capacity across different bidding zones. The highest matched offer determines the clearing price for each bidding zone.

By explicitly pricing intraday cross-border capacities, IDAs better capture capacity scarcity between zones, providing more accurate market signals and ultimately enhancing overall market efficiency and welfare for end consumers.

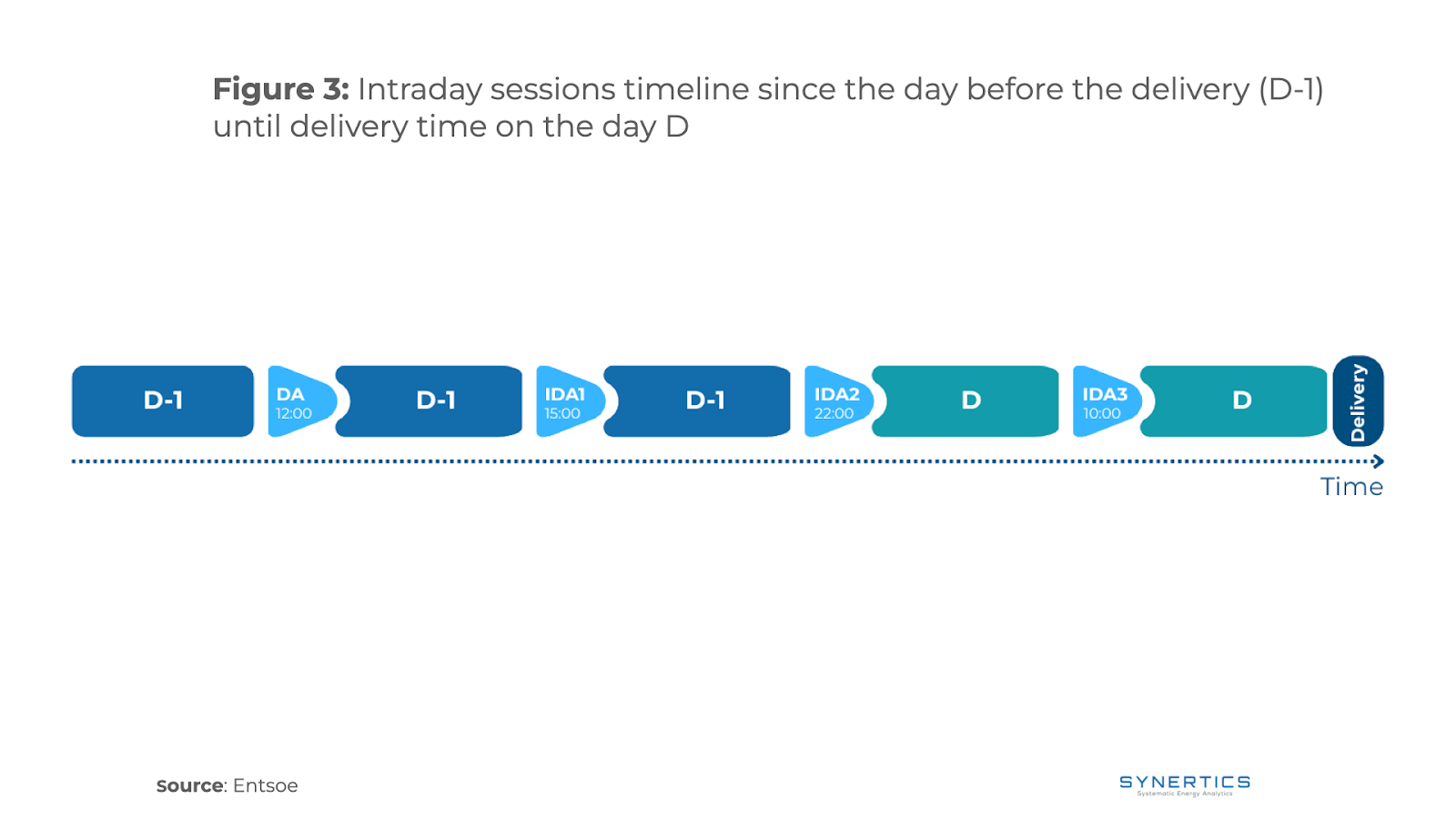

There are three distinct IDA sessions, as illustrated in Figure 3. To perform market clearing, the continuous intraday market is temporarily suspended for 20 minutes before each auction session to prevent double capacity allocation.

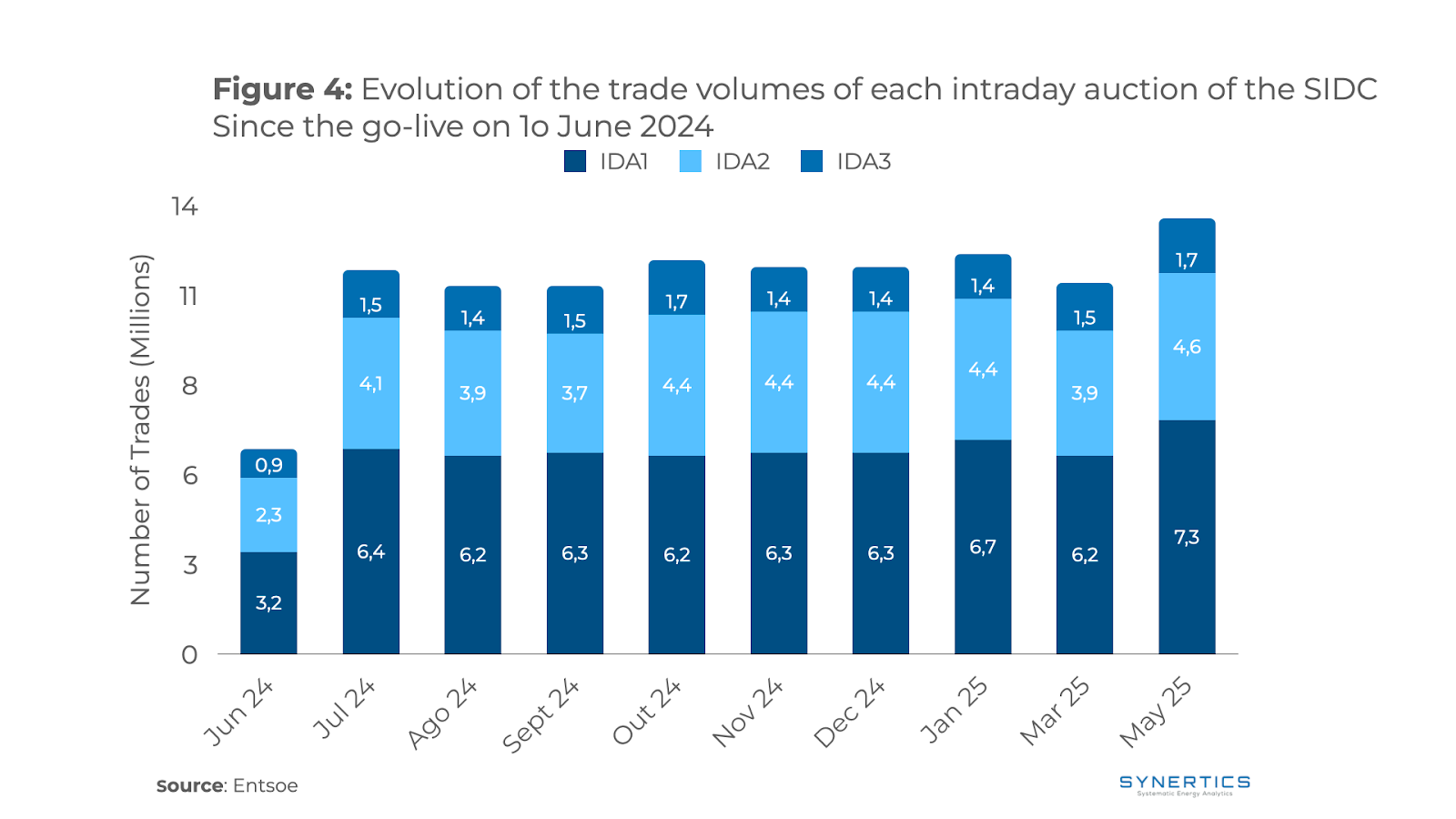

Figure 4 shows the number of trades per market session from the go-live in mid-June 2024 until May 2025. The results indicate that trading activity decreases as delivery time approaches, likely reflecting the reduction in available transmission capacity closer to real time.

Intraday markets play a crucial role in managing electricity imbalances, enabling participants to adjust production in response to updated forecasts or unexpected outages, particularly for renewable energy sources. Beyond improving renewable integration, these markets create revenue opportunities for BRPs and battery storage operators, especially in the continuous intraday market with its pay-as-bid structure, which rewards strategic and timely trading.

However, intraday trading comes with significant challenges. Market prices are highly volatile, affected by supply-demand fluctuations, commodity price swings, weather events, and grid constraints. The variable nature of renewable generation adds further uncertainty, making accurate forecasting difficult. Additionally, the high volume of real-time data from multiple sources, combined with same-day trading and delivery, demands robust analytical tools and agile decision-making.

https://www.entsoe.eu/network_codes/cacm/implementation/sidc/

https://www.nordpoolgroup.com/en/the-power-market/Intraday-market/

https://www.entsoe.eu/network_codes/cacm/implementation/ida/#

https://www.nemo-committee.eu/assets/files/cacm-annual-report-2024.pdf

https://www.tennet.eu/market-types

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026