Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

After the 30th of September 2025, the European Market Coupling Steering Committee (MCSC) implemented a 15-minute resolution support in the Day-Ahead (DA) market through the Single Day-Ahead Coupling (SDAC). This upgrade allows market participants to submit 15-minute orders across participating bidding zones, improving price accuracy, renewable integration, and system flexibility. While 15-minute Market Time Unit (MTU) will be supported market-wide, some zones, such as Ireland, will retain longer period orders of 30-minutes and exchanges may continue to permit 30-minute or 60-minute period orders, depending on bidding zones. The transition was originally planned for the 11th of June 2025 but was postponed to the 1st of October 2025 due to technical readiness challenges, faced by some parties who tested the new system to ensure a smooth and reliable transition.

This transition presents both opportunities and challenges for producers. This week, Synertics highlights the key areas that renewable energy producers and asset owners should be aware of. These include the evolving market dynamics aligning more closely with renewable generation profiles, the increasing role and impact of Imbalance and Ancillary Services (AS), the implications for current and future Power Purchase Agreements (PPAs) and possible investments and resources for a comfortable change.

With the introduction of a 15-minute resolution in the Day-Ahead market, the bidding structure will transition from a rigid hourly system to a more dynamic model that better reflects real-world conditions. This change is especially significant for renewable energy producers, whose generation is inherently more variable. The new structure allows bids to more accurately match the actual generation profiles of wind and solar assets, which are influenced by rapidly changing weather conditions. Instead of being constrained to 1-hour blocks, producers can now align their bids more closely with short-term forecasts, giving a better integration of renewables.

The new transition of the DA market will not require structural changes to the imbalance market or AS. The biggest impact is that forecast deviations within these shorter intervals become more visible. Rapid weather shifts, especially affecting renewables generation, can lead to unexpected shortages or surpluses within a single 15-minute block, increasing the need for corrective actions through the imbalance market and a greater reliance on AS.

For producers participating in AS, the introduction of the new regulation may bring initial uncertainty and fluctuations in the market's revenues. During the early adaptation phase, larger imbalances and price peaks might occur, as it was observed when the imbalance settlement period shifted to 15-minute resolution in the Nordics. Whether revenues increase or decrease will largely depend on how effectively producers adapt to participating in these evolving market structures. However, in the long term, overall revenues from both Ancillary Services and imbalance settlements are expected to stabilise.

The introduction of 15-minute settlement transactions, designed to enhance renewable integration, directly affects renewable generators’ ability to capture market prices. Greater volume precision reduces the capture price, as market outcomes now more accurately reflect the aggregated renewable output.

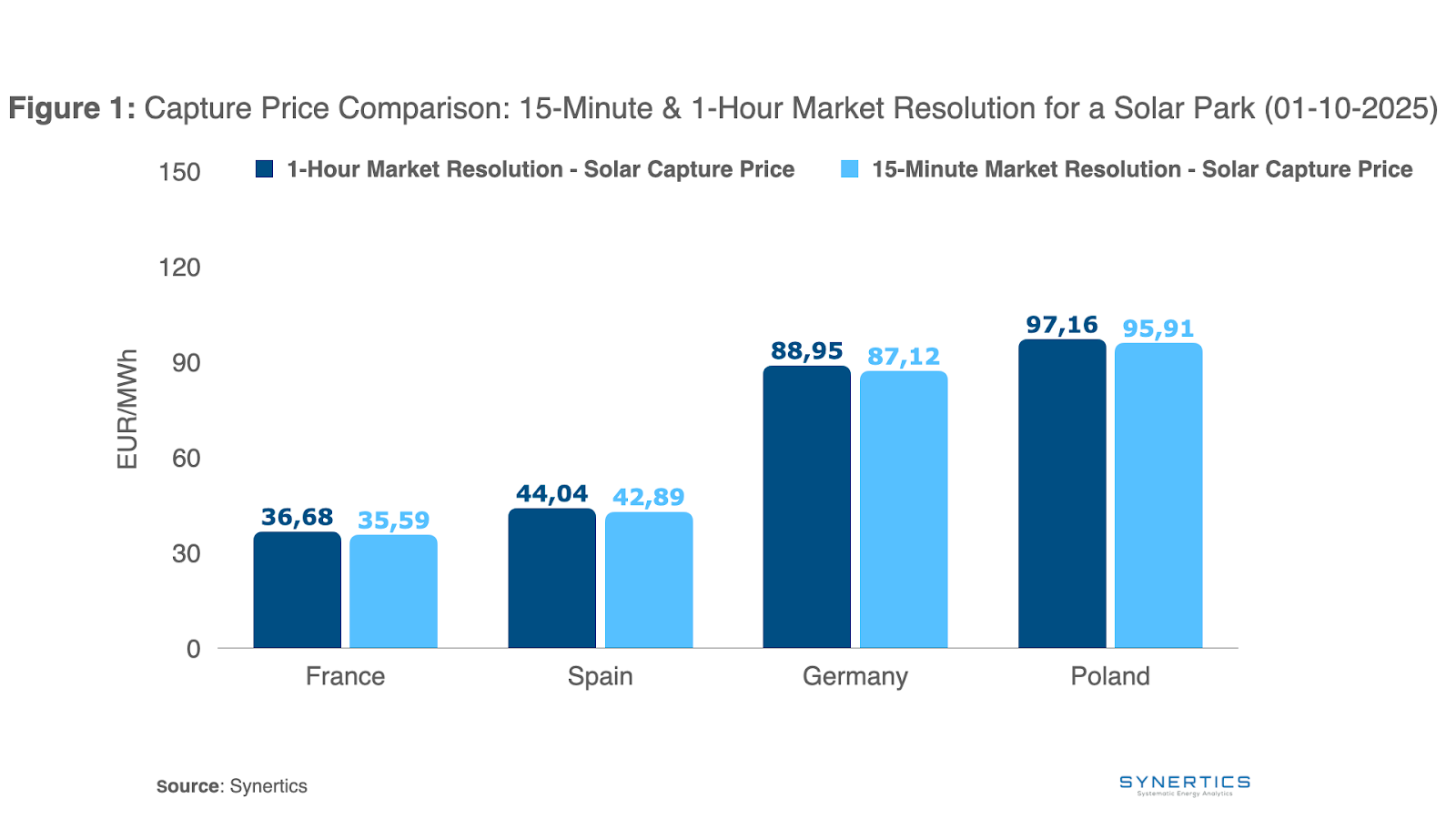

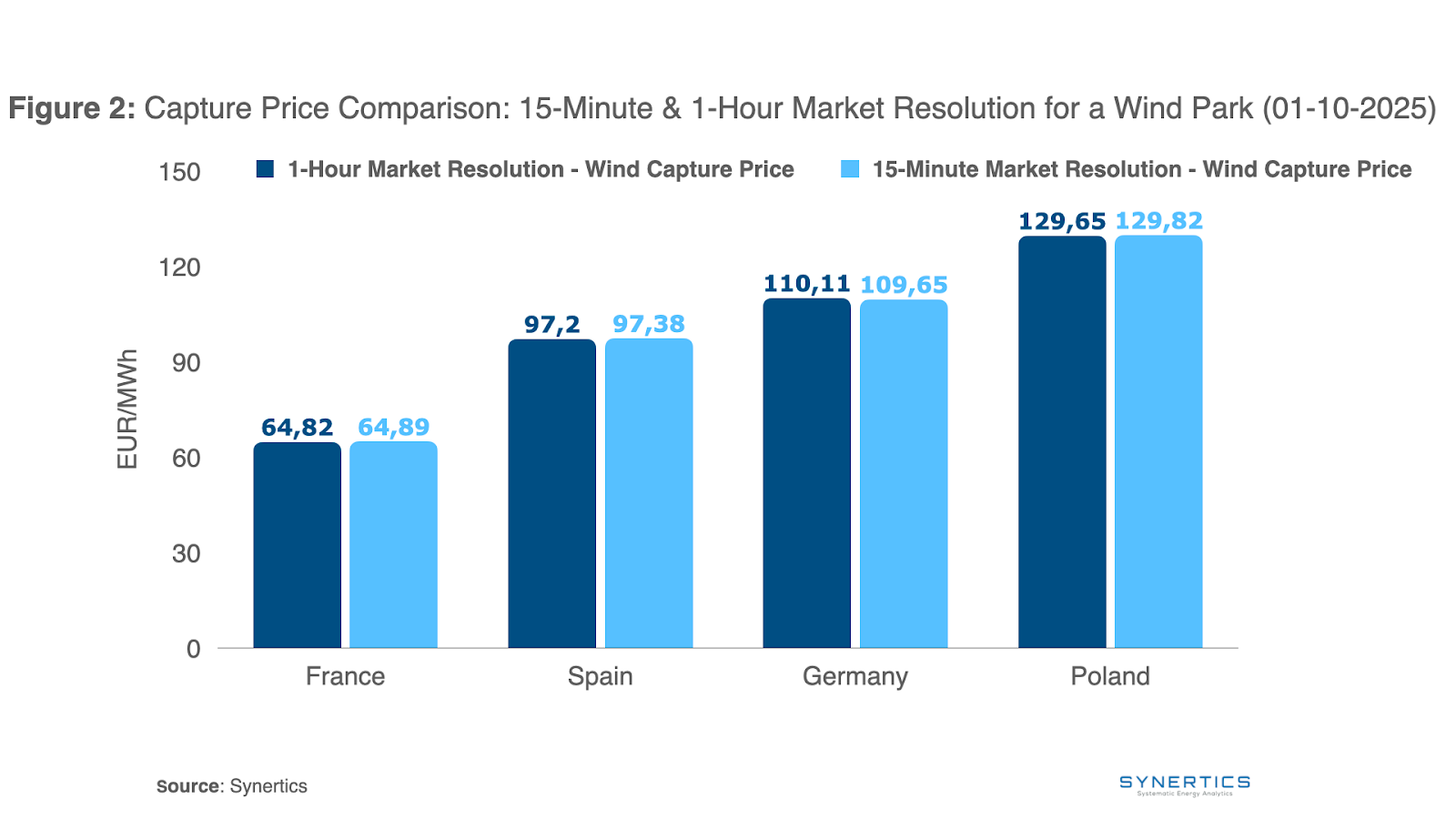

Figures 1 and 2 show how shifts in Day-Ahead market resolution can influence capture prices. A difference of roughly €2 is observed, which may impact the profitability of PPAs.

For renewable generators with Power Purchase Agreements (PPAs) – particularly solar PPAs, it is essential to carefully review how settlement clauses are defined. Depending on the contract structure, the financial implications could be significant. For example, if calculation periods are set hourly, revenues may diverge from theoretical settlement values, since market payments are now determined on a 15-minute basis. In such cases, invoking a change-in-law clause may be necessary to adjust terms and mitigate potential revenue deviations arising from this transition.

On the other hand, for Route-to-Market agreements, the shift to 15-minute settlement may also influence the evolution of imbalance prices. If this factor was not accounted for at the time of signing, particularly in longer-term BRP contracts, the parties may invoke a change-in-law clause, depending on the extent of the impact on imbalance markets. This could provide grounds for renegotiating BRP contracts that have become unprofitable due to the recent rise in imbalance costs across Europe.

Generators should closely monitor imbalance price developments to strengthen their position in disputing any change-in-law claims and to ensure they are not exposed to unfavourable contract revisions.

For a full commitment to this change, producers should also anticipate potential future investments. The new regime brings higher operational intensity, where forecasting accuracy becomes even more critical, as it directly impacts financial results in the market. As a result, the selection of the market agent becomes critical, since the quality of forecasting algorithms will significantly influence a producer’s ability to capture market value. Production forecasts may require upgrades or modifications, while metering and measurement systems might need adjustments to ensure timely and detailed data for improved optimisation of the real production profile. Beyond technical upgrades, additional resources must be allocated to handle the greater number of daily bids, reducing the risk of errors and missed opportunities. These requirements might place a heavier burden on smaller producers, while larger market agents are generally better equipped to absorb the associated costs.

This change is aimed at creating a more efficient and flexible market in the long run, but in the beginning it will bring uncertainty and unpredictability, as participants test different approaches. Over time, the shift to 15-minute bidding will strengthen renewable integration by aligning market schedules more closely with real production. For producers, the impact will depend on their readiness: active participation in Ancillary Services, timely investments, resource allocation, and careful management of PPA renegotiations or potential terminations will all be key.

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026