Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Spain has emerged as the leading PPA market in Europe, driven by its rapid renewable energy expansion. As solar and wind continue to gain ground in the country’s energy mix, Power Purchase Agreements (PPAs) are playing a central role in enabling new project development and attracting investment.

In this article, we take a closer look at the factors shaping the Spanish PPA landscape. We start off with an overview of the country’s energy mix and the volume of PPAs contracted to date. Then we explore how regulatory shifts, such as the move away from feed-in tariffs and supportive government policies, have opened up space for PPAs. We also examine key market dynamics, including capture price trends, baseload futures, curtailments, negative prices and imbalance costs, that directly impact PPA negotiations and project bankability. By unpacking these elements, we aim to provide a comprehensive snapshot of Spain’s PPA market today, highlighting both the opportunities and the emerging challenges in one of Europe’s most mature and dynamic renewable energy markets.

Spain’s Electricity Mix

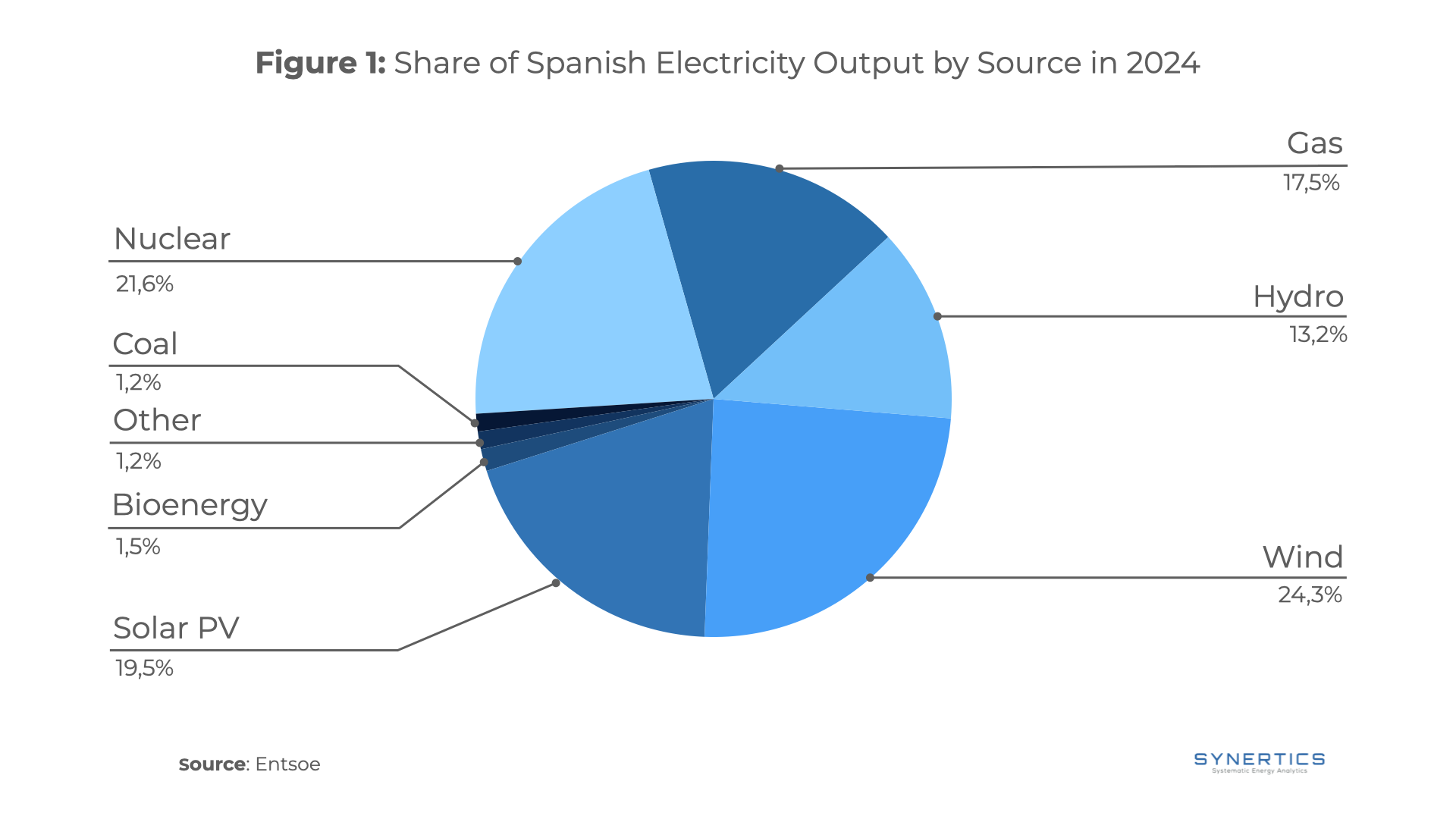

In 2024, renewables generated a record of approx. 60% of Spain’s electricity, up by around six percentage points from the previous year. This growth was driven by an increase in installed renewable capacity, now accounting for 64% of total generating capacity and favorable weather conditions. Wind remained the largest source of clean electricity at 24,3%, followed closely by nuclear at 21,6% and solar PV 19,5%, giving Spain a combined wind and solar share of 44%, nearly triple the global average of 15%. Fossil fuels provided just around 19% of the electricity mix, and per capita emissions remained below the global average, continuing a two-decade decline as wind and solar increasingly displaced coal and gas. Electricity demand rose by 1% to approximately 248 TWh.

The country has set an ambitious target of generating 81% of its energy from renewable sources by 2030.

Spain’s Renewable Energy Expansion in 2024

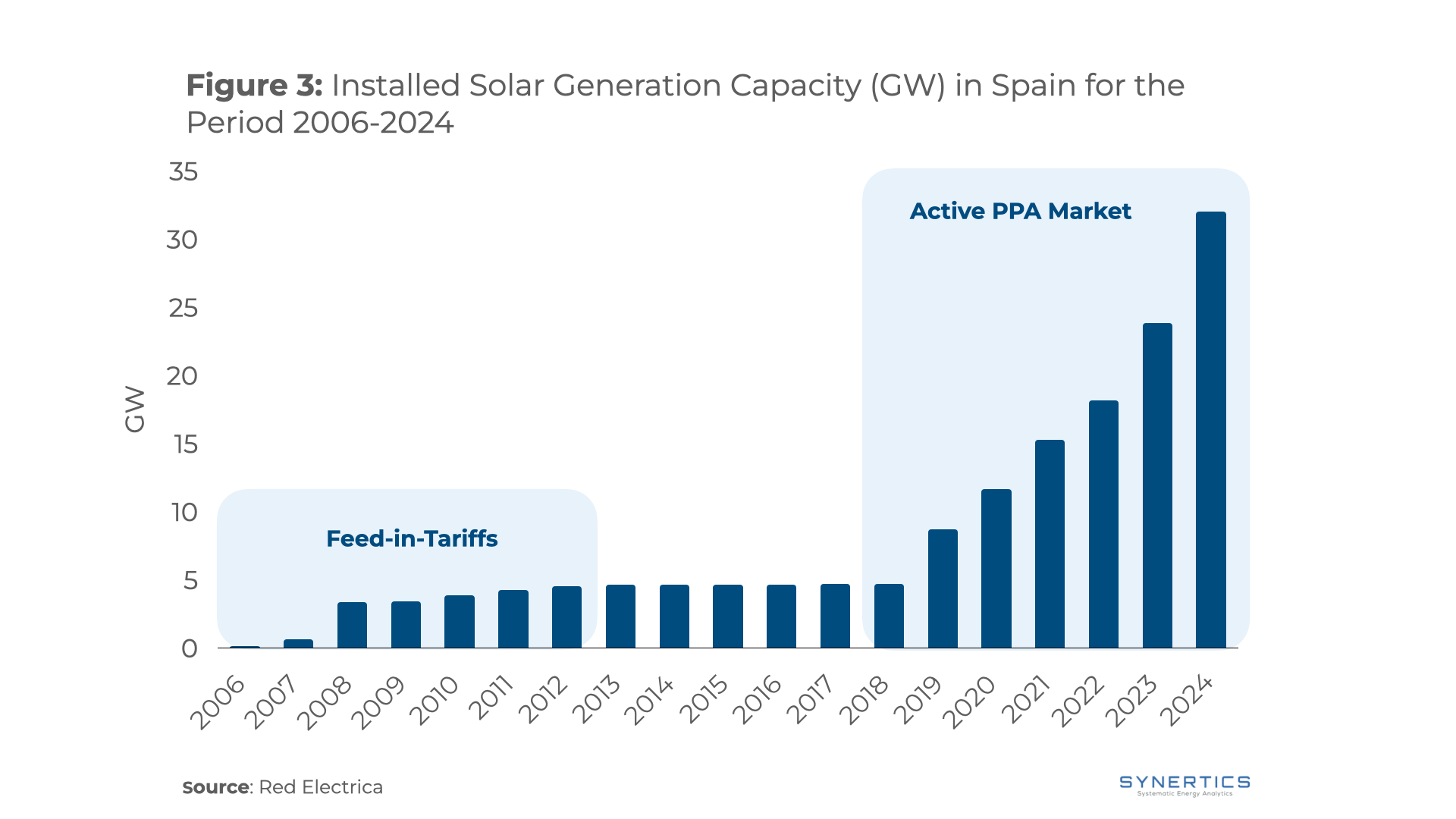

Spain also made substantial progress in expanding its renewable energy capacity in 2024, adding a record 7.3 GW, the highest annual increase ever. This growth was driven largely by solar PV, which added 6.46 GW to reach a total of around 32 GW. Wind power also grew modestly, with 1.3 GW of new capacity bringing the total to approximately 32 GW. However, experts warn that this pace must accelerate if Spain is to meet its ambitious 2030 target of 62 GW of wind capacity. The country also aims for 76 GW of solar PV and 22.5 GW of storage by 2030.

The Growth of the Spanish PPA Market

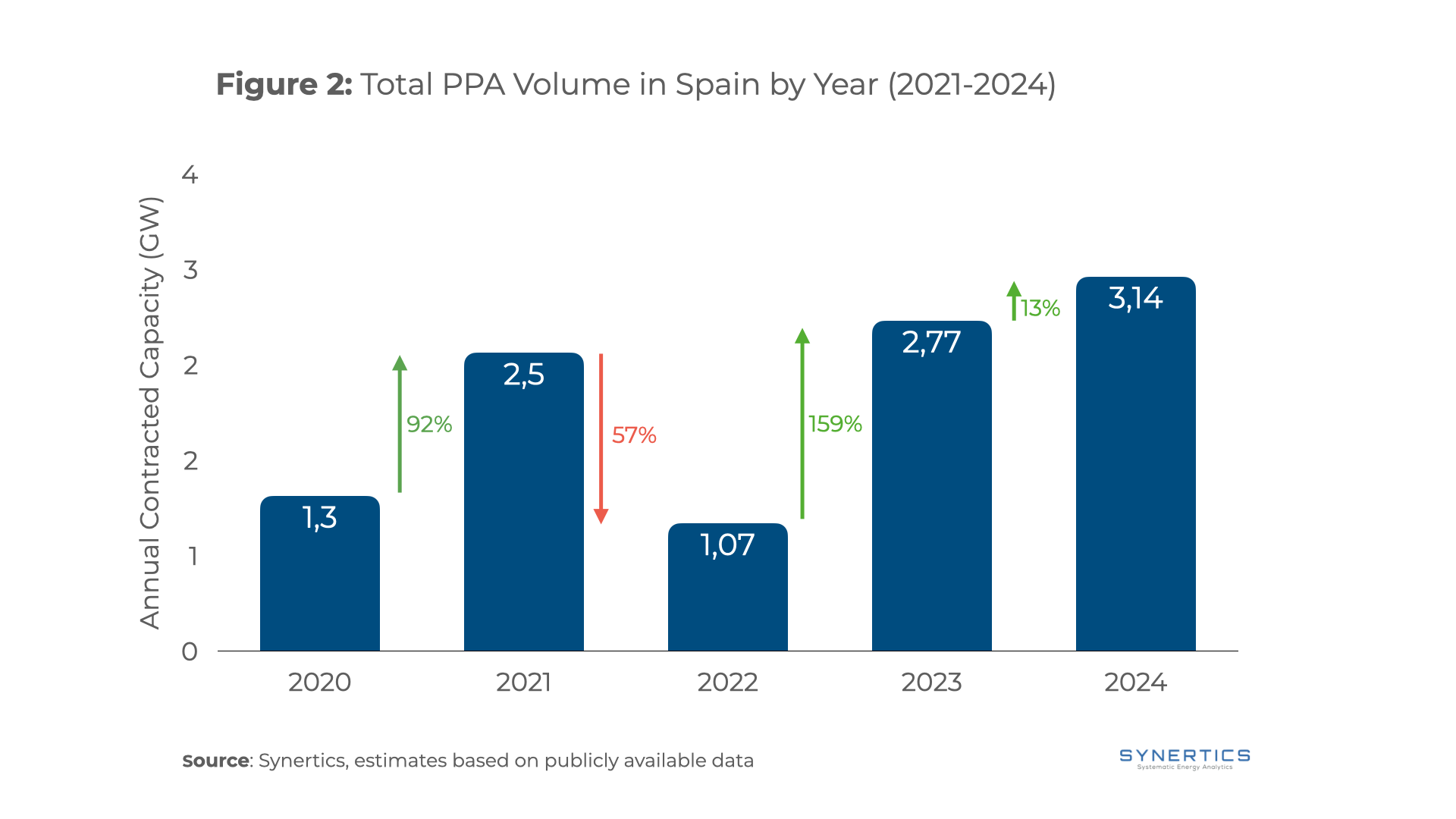

Since Spain signed its first corporate PPA in 2018, the market has grown rapidly to become the leading PPA market in Europe. By 2020, Spain accounted for over 1.3 GW of the nearly 4 GW of PPAs signed in Europe, around one-third of the total, earning recognition as Europe’s most active PPA market.

The growth accelerated in 2021, as Spain added 2.5 GW that year to reach a total contracted capacity of 4.2 GW, driven predominantly by solar energy. In 2022, Spain added another 1.07 GW, maintaining close to a third of the European market share. Activity rebounded strongly in 2023, with 2.77 GW in newly signed PPAs, positioning Spain as the European leader in both total contracted volume and number of deals.

In 2024, Spain recorded its highest annual addition yet, signing 3.1 GW of new PPAs. Despite some market experts expecting Germany to take the lead, Spain remained the leading country in Europe. By that year, the country’s cumulative contracted capacity had reached 11.6 GW, comprising 7.4 GW of solar, 1.9 GW of wind, 1.8 GW of combined wind and solar, and 0.5 GW from renewable energy portfolios.

Major Deals in Spain’s 2024 PPA Market

In 2024, Spain’s PPA market was largely driven by demand from the tech and manufacturing sectors, which signed some of the country’s largest PPAs. Amazon played a leading role, announcing 17 new solar and wind projects in Spain. Part of the PPA for these new projects was signed with Iberdrola, a Spanish utility company. Amazon has not yet revealed the developers behind the other projects it is backing in the country. Amazon’s new projects expand its existing portfolio of 94 renewable energy initiatives backed by PPAs. Together, the current portfolio provides over 3.7 GW of clean energy. These additions support the company’s commitment to powering its operations and data centers entirely with renewable energy, advancing its goal of reaching net zero by 2040.

Microsoft also expanded its renewable energy footprint in Spain in 2024 by signing six new 12-year virtual PPAs with Repsol, totaling 230 MW of wind and solar capacity and bringing their total contracted capacity in the country to 320 MW. Another major 2024 deal came from Recurrent Energy, which signed a 10-year, 300 MW solar PPA with an unknown major U.S. technology company.

The manufacturing sector also saw significant activity in 2024. ACCIONA Energía signed a 10-year PPA with Vidrala, a leading manufacturer of glass containers, which will cover 20–25% of the company’s electricity needs with renewable energy. Additionally, MET Energía España signed two PPAs to supply 100% green electricity to Atlantic Copper, one of the world’s largest copper producers.

Feed-in-Tariffs

Spain introduced feed-in tariffs (FiTs) for renewable energy through two key legislative acts: Royal Decree 661/2007, which applied to most renewable technologies, and Royal Decree 1578/2008, which specifically targeted photovoltaic (PV) installations in response to their rapid growth. Under these laws, PV systems were divided into two main categories: building-integrated installations, which received 340 €/MWh for systems up to 20 kW and 310 €/MWh for systems above 20 kW up to 2 MW; and non-integrated installations, which received 320 €/MWh for systems up to 10 MW. For other technologies, such as wind, tariffs were offered at up to 73.2 €/MWh for the first 20 years.

These generous tariffs led to a dramatic surge in solar PV deployment, as can be seen in Figure 3, from 0.125 GW in 2007 to 4.561 GW by 2012, representing approximately 3,549% growth. However, due to the absence of a dedicated renewable energy levy, the Spanish electricity market became severely underfunded, resulting in a €29 billion tariff deficit. In response, the government introduced retroactive tariff cuts, some as high as 30%, and halted FiT support for new plants from 2012 onward.

Following these changes, solar PV expansion slowed considerably. Between 2012 and 2018, installed capacity grew only modestly, from 4.561 GW to 4.707 GW, a mere 3% increase over six years, highlighting the significant impact of the policy shift. Significant growth in solar capacity only resumed after 2018, when Spain began embracing power purchase agreements (PPAs) as a new route to market for renewable projects.

Auctions

After suspending feed-in tariffs, the country reinstated renewable energy support through technology-neutral auctions in 2016 and 2017, which prioritised cost competitiveness. However, these auctions faced criticism for being oversubscribed and for lacking adequate prequalification requirements,

Building on this experience, Spain implemented a new remuneration framework known as the Economic Regime of Renewable Energies (REER, as per its name in Spanish) in 2021. This framework focuses on supporting new renewable power projects, enables the hybridisation of technologies, allows for the extension or alteration of existing facilities, and is designed to be compatible with energy storage.

The Spanish government initially planned to hold annual renewable energy auctions from 2020 to 2025 to support its national energy and climate goals by adding new wind, solar, and other clean power capacity. However, only four auctions took place in 2021 and 2022, with none held since. The ones held in October and November 2022 barely allocated any capacity due to the government’s cap on bidding prices that many project developers considered to be too low.

In 2021, pay-as-bid auction prices ranged between €14.89/MWh and €28.90/MWh, substantially below the prevailing reference prices for CPPAs, which were typically above €30/MWh (around €33/MWh for pay-as-produced solar PV and €39/MWh for baseload solar or wind contracts).

However, it's also important to note that CPPA prices cannot be directly compared to auction prices. Auction contracts are typically fixed 12-year agreements with regulated grid entities, whereas CPPAs involve private corporate offtakers and offer greater flexibility, ranging from shorter terms of around 7 years to longer commitments of 15 to 20 years. CPPAs are also tailored to specific needs, unlike the standard terms of auction contracts. Additionally, corporates may pay more to meet “additionality” goals, for example, Corporate Social Responsibility Goals.

The Electro-Intensive Facilities Statute: A new Reserve Fund for energy (FERGEI)

On 26 June 2020, to promote renewable energy development in Spain, the Ministry of Industry established the Fondo Español de Reserva para Garantías de Entidades Electrointensivas (FERGEI). This fund targets electro-intensive consumers, companies that have used over 1 GWh annually in at least two of the previous three years and consume at least 50% of their energy during off-peak hours. The Electro-intensive Statute lets these companies save up to 85% on certain energy costs.

To qualify for this special regime, industrial electricity consumers must source at least 10% of their annual power demand through a renewable energy CPPA with a minimum contract term of five years.

The fund initially had an annual budget of €200 million, totaling €600 million over its first three years. In December 2024, the government announced an increased allocation of €600 million for 2025 to further support the electro-intensive sector and help offset CO₂ emissions.

In practice, the law allows the government to guarantee payments to suppliers under CPPAs if an offtaker is unable to fulfill its obligations, such as in cases of insolvency.

Important to Note: Sleeved PPAs

In Spain, regulatory requirements make 'sleeved' or physical CPPAs challenging. These contracts involve a renewable energy generator selling electricity directly from a specific asset to an end user. However, since electricity must be delivered through regulated wires, the end user cannot fulfill their purchase obligation unless they are physically connected to the generator via a private wire. To address this, the end user typically appoints a regulated entity, usually an energy supplier, to 'sleeve' the electricity from the generator to the end user's location. Because of these complexities, Spanish CPPAs are often financially settled to avoid or balance out some of the stricter regulatory requirements.

Capture Prices

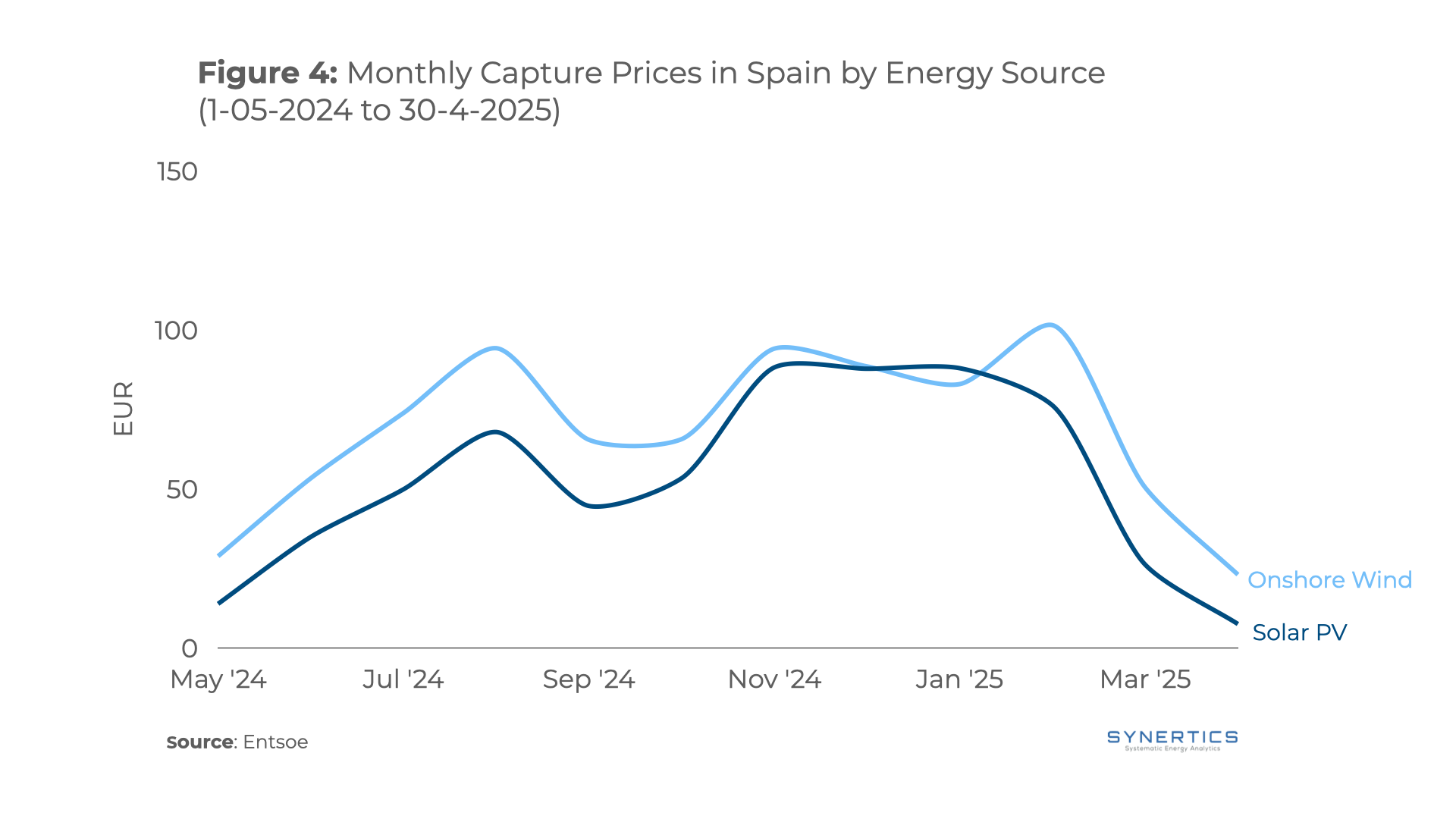

Since 2023, Spain has seen a 56% increase in installed solar capacity, bringing it nearly on par with the country's nuclear and onshore wind capacity. With variable renewable sources now accounting for over 40% of electricity generation since the start of the year, Spanish wind and solar producers are increasingly feeling the pressure on their ability to capture wholesale market prices.

As illustrated in Figure 4, capture prices in Spain have seen a sharp decline over the past four months. Since the start of the year, the pricing environment has been challenging for renewable generators, with solar and wind capture prices plunging to record lows of €7.54/MWh and €23.08/MWh, respectively.

This historic drop in capture prices is largely attributed to the growing penetration of renewable generation in the system. Additionally, the limitations on electricity imports from the Portuguese TSO, following the Iberian blackout, may have worsened the situation by reducing demand during peak hours over the past month.

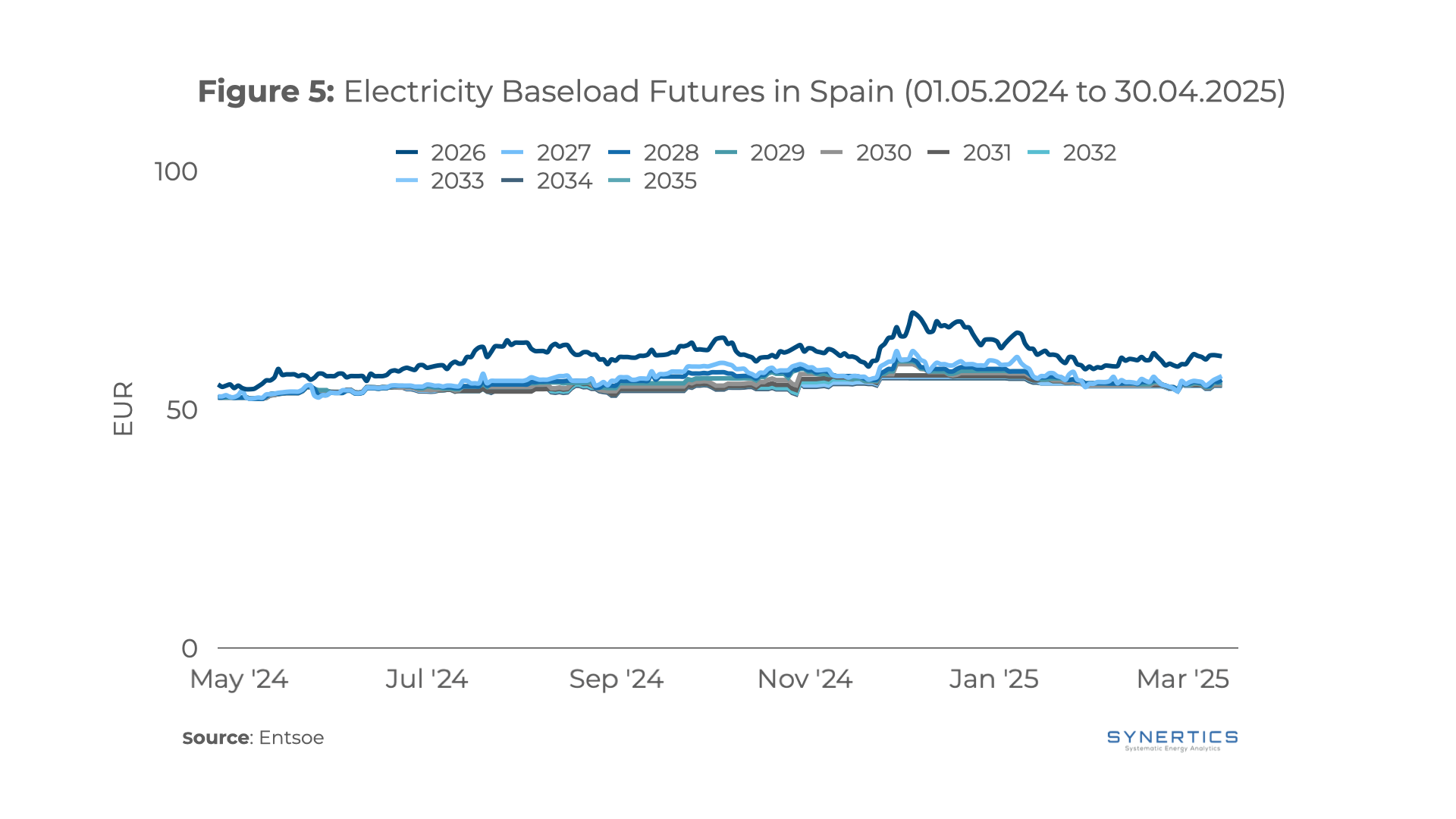

Baseload Futures

The Baseload electricity futures market in Spain is characterised by strong short-term liquidity, with significant trading volumes observed up to three years in advance. While long-term trading activity remains well below the levels seen in the Nordic and German markets, Spanish futures still offer valuable insights into market expectations.

Over the past 12 months, the Spanish futures market has mirrored price fluctuations seen across Europe, with futures prices peaking at the beginning of the year, as illustrated in Figure 5. Since then, prices have followed a downward trend, driven primarily by mild weather conditions and concerns over a potential economic recession, influenced by geopolitical uncertainty surrounding the U.S. administration. More recently, the market appears to be stabilising.

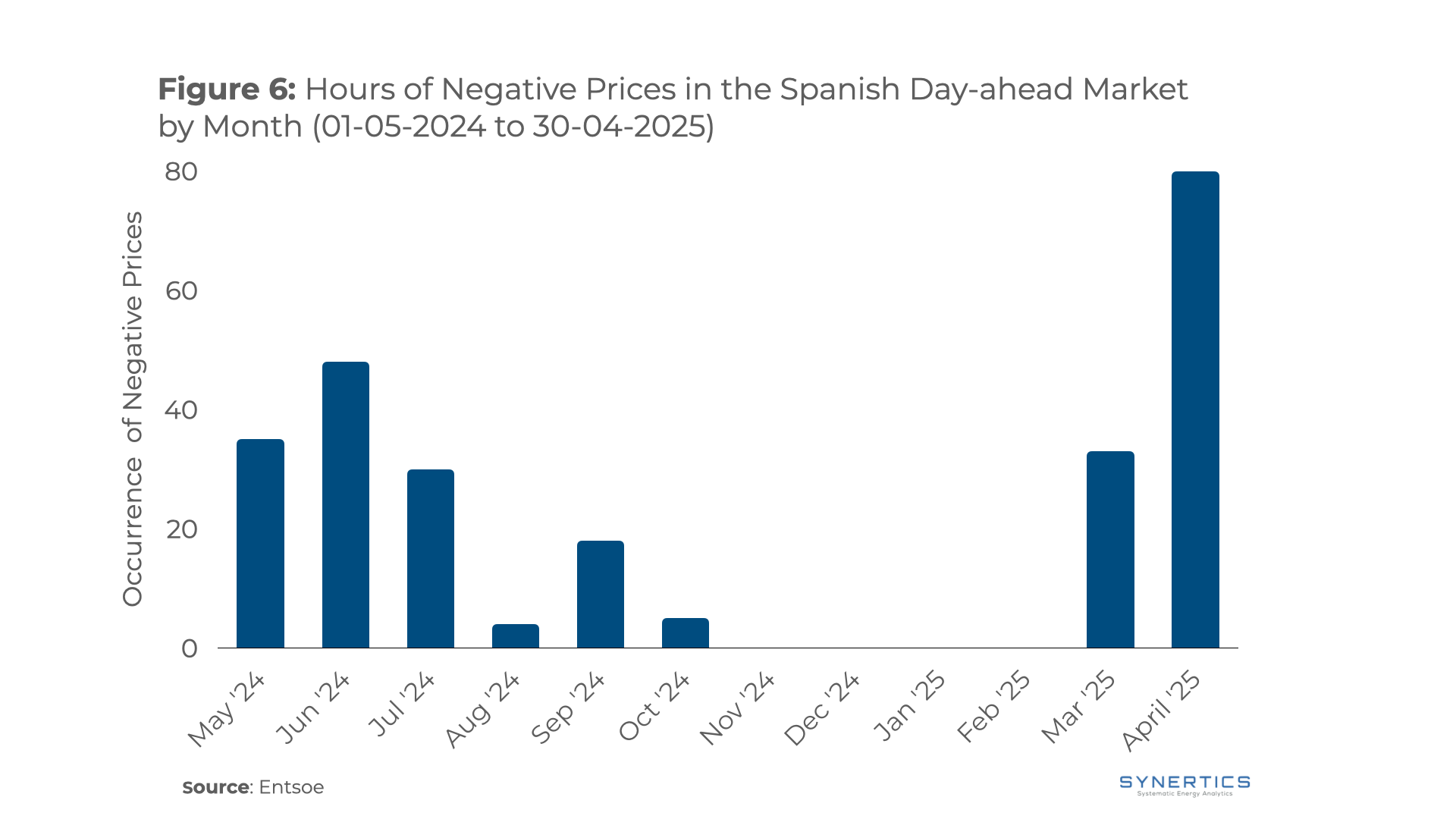

Negative prices

On April 1st of last year, Spain recorded its first-ever negative prices in the Day-Ahead market. Since then, such events have become increasingly frequent, particularly during the early summer months when solar generation peaks. However, the situation has deteriorated significantly in 2025. In April alone, there were 113 instances of negative prices, as shown in Figure 6. That record has already been surpassed in May, with 155 occurrences to date.

Moreover, the severity of negative pricing has intensified. While in 2023 Day-Ahead market prices never fell below -2 €/MWh, this year prices have already plunged to lows of -14 €/MWh.

From a financial perspective, this trend raises serious concerns about how to effectively manage such volatility. The increasing frequency and depth of negative pricing poses a direct challenge to the viability and bankability of renewable energy projects, particularly those in the solar sector.

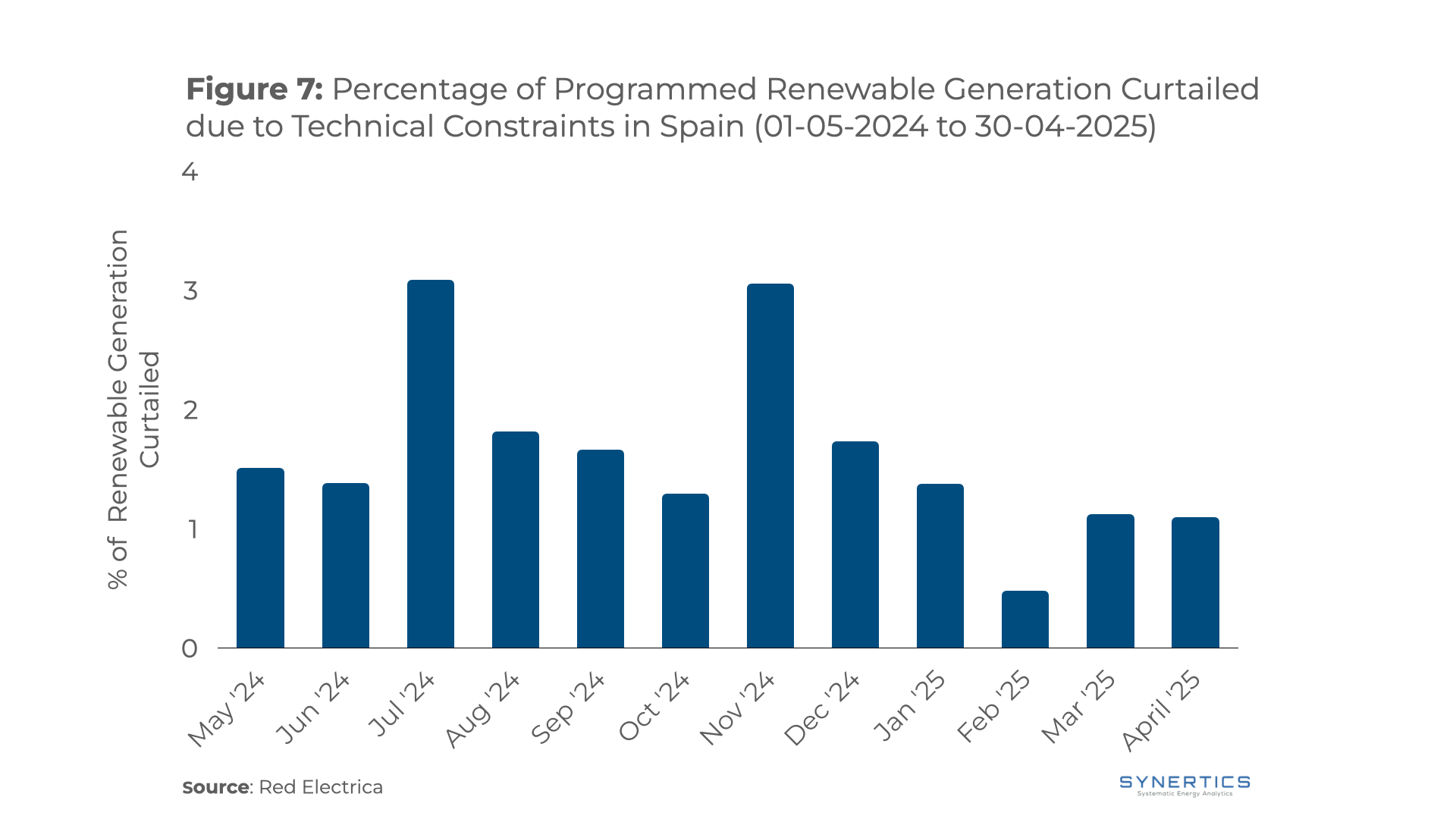

Curtailments

Renewable curtailment in Spain for technical reasons typically occurs due to two main factors: congestion management in either the transmission or distribution grid. When the Spanish TSO anticipates congestion in the transmission network, it issues dispatch orders to reduce scheduled generation in order to maintain system stability, often resulting in lost output and revenue for renewable generators.

In Spain, curtailment on the transmission grid is significantly more common than on the distribution system, with maximum recorded values slightly exceeding 3%, as illustrated in Figure 7.

To mitigate such curtailments, Spain's power sector is in need of strategic measures, including further investment in grid infrastructure, enhanced cross-border interconnections and the deployment of battery energy storage systems (BESS).

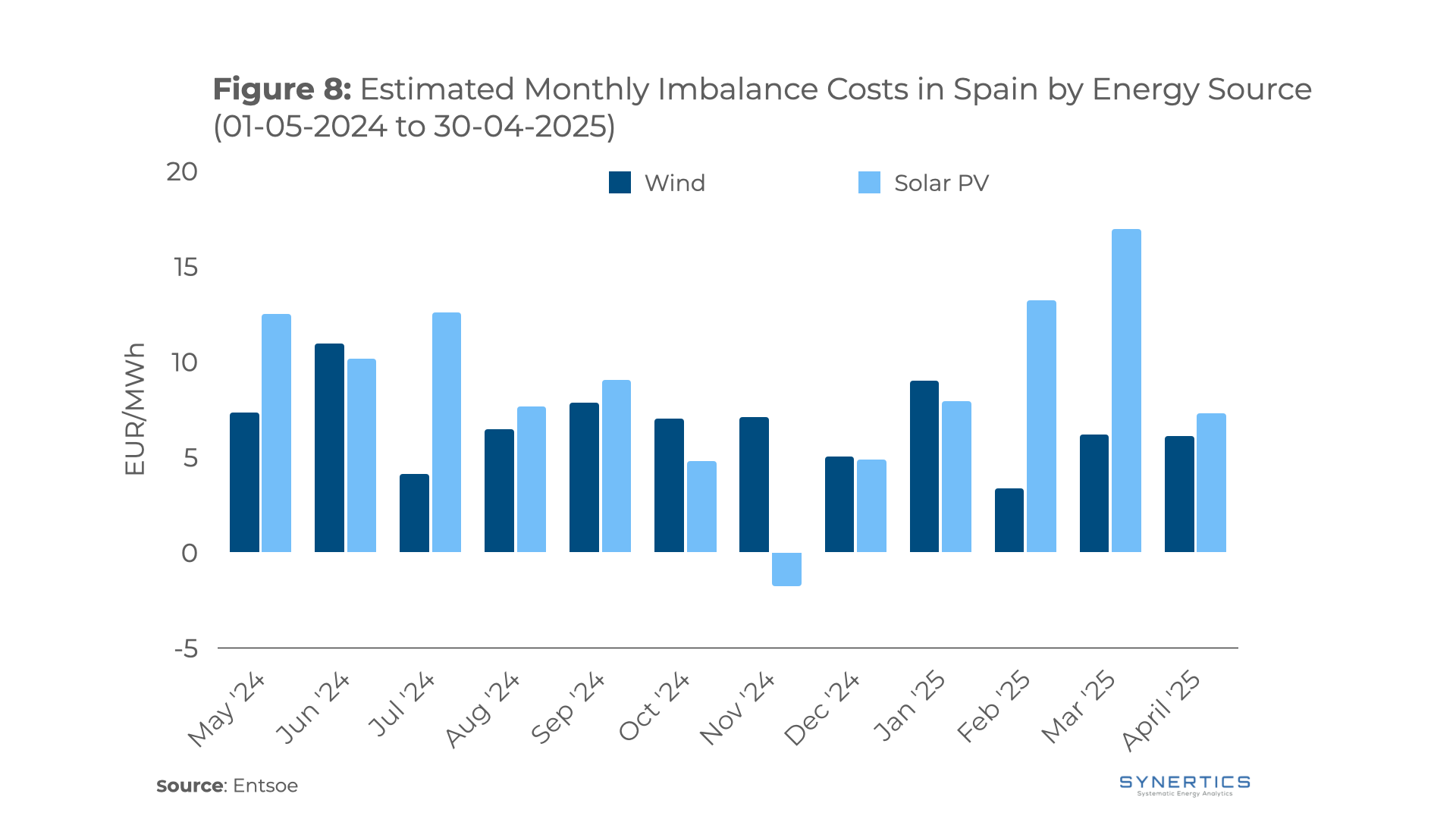

Imbalance costs

Imbalance costs represent a significant expense for renewable energy generators. When there are deviations between forecast and actual generation, producers must compensate for the shortfall or surplus by settling volumes in the imbalance market.

In Spain, the imbalance market distinguishes between positive and negative deviations, with prices reflecting the cost of restoring system stability in each direction. To estimate the average imbalance costs borne by generators, we analyzed the gap between forecasted and actual production by technology, applying the corresponding imbalance price based on the deviation direction.

Figure 8 illustrates the evolution of imbalance costs over the past 12 months. Wind generation has incurred more consistent costs, while solar generators experienced greater monthly fluctuations, with peaks during the summer months, as expected.

Spain’s PPA market stands as a dynamic and rapidly evolving landscape shaped by its ambitious renewable energy expansion. The country’s impressive growth in solar and wind capacity, now comprising a significant share of the electricity mix, continues to drive strong demand for PPAs as a key mechanism to finance and enable new renewable projects. Over the past five years, Spain has consistently been Europe’s leading PPA market, reflecting its maturity and attractiveness.

Regulatory shifts, including the transition away from feed-in tariffs towards auctions and innovative schemes like FERGEI, have made PPAs a more attractive option and encourages corporate participation. However, challenges remain regarding regulatory complexities around sleeved PPAs.

The current market conditions in Spain, marked by record low capture prices and unprecedented frequency and severity of negative pricing events, pose significant challenges for renewable energy producers. Alongside grid curtailments and imbalance costs, these factors have substantially increased revenue uncertainty and financial risk, making it difficult for generators to rely solely on wholesale market sales. Spain’s solar PPA market is currently experiencing one of its most challenging periods, with these market stresses putting pressure on PPA pricing and overall market dynamics.

However, favourable regulatory conditions remain and could support the development of alternative PPA structures and complementary solutions, such as the integration of battery energy storage systems (BESS), to help manage market volatility and maintain long-term revenue stability. In this context, while PPAs remain a vital mechanism supporting Spain’s ambitious renewable energy transition, their role and design may need to evolve in response to changing market realities.

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026