Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

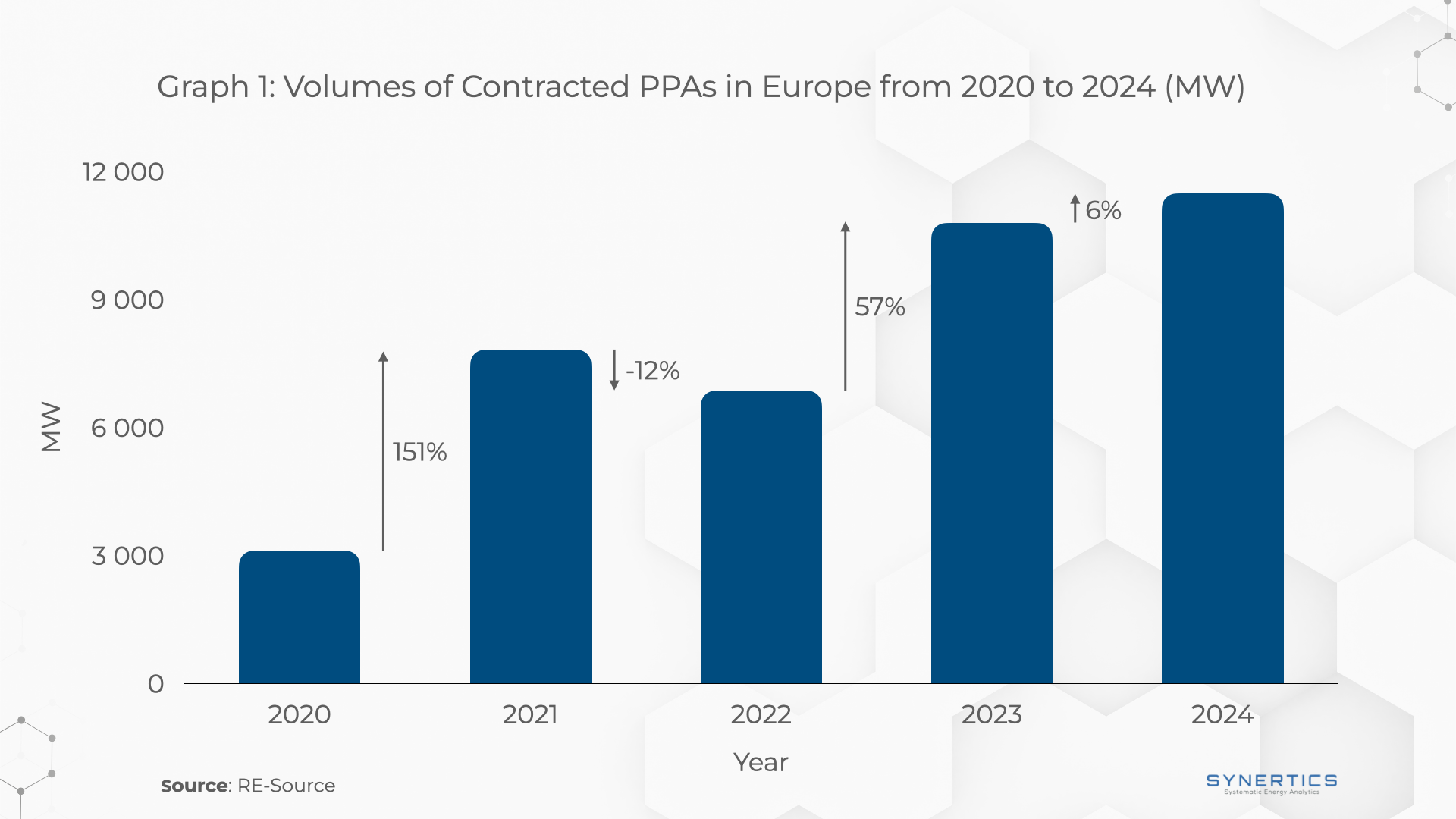

The year of 2024 marked another pivotal moment for the PPA market, with the volume of contracted capacities surpassing the amount of 2023, setting a new record for Europe. In this article we will explore the evolution of this market over the past year, highlighting key countries and their outcomes. Moreover, we will also examine how the growth of the PPA market compares to the expansion of the installed capacity of solar and wind power facilities.

Evolution of PPA market

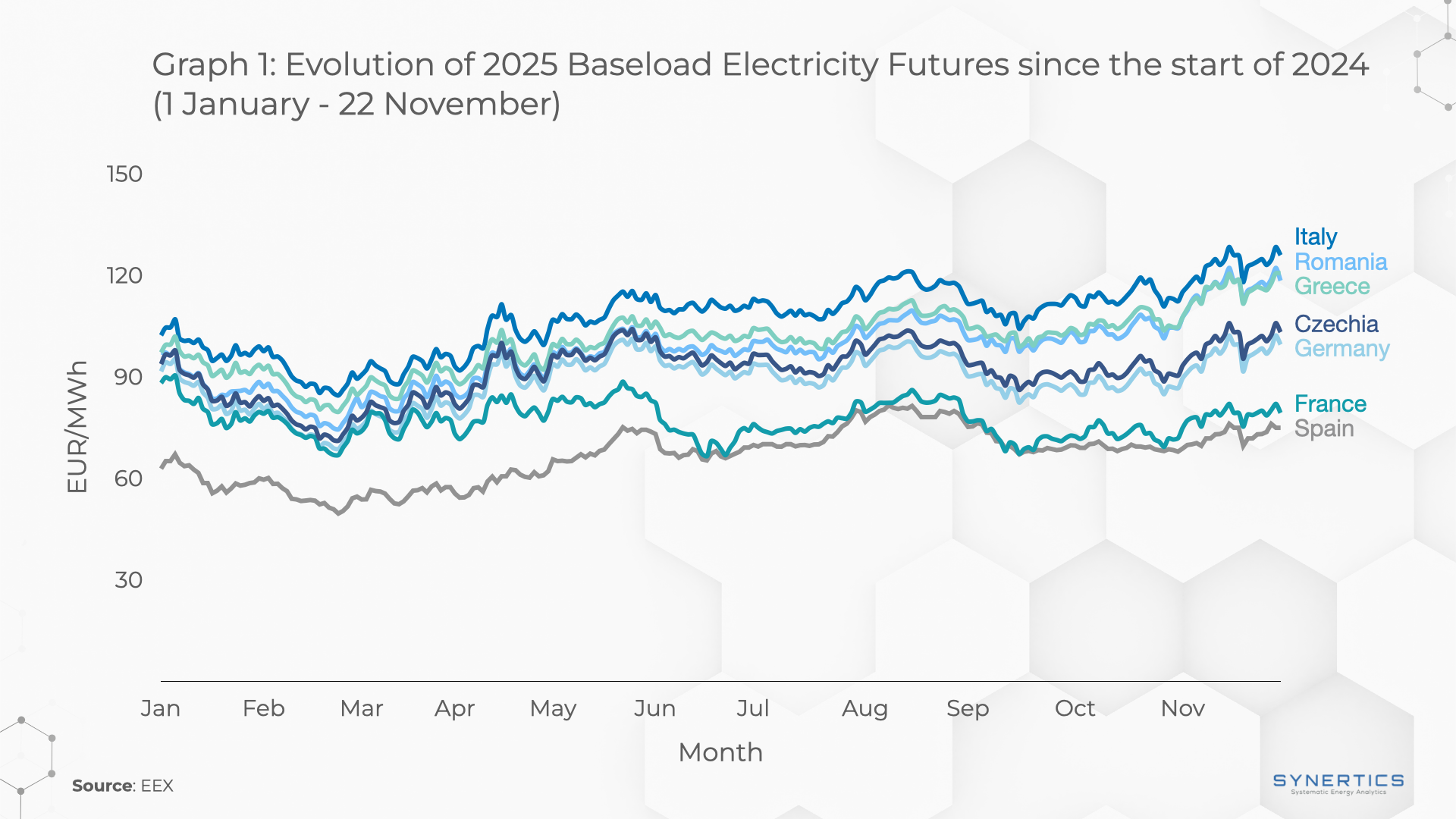

The volume of contracted capacities in Europe reached an all time high of 11.5 GW in 2024, representing a year on year growth of about 6%from the 10.8 GW recorded in 2023.. Spain continues to be the leading market, surpassing 3.1 GW of contracted volumes and totaling 11.2 GW of total PPA capacity. Solar power constitutes the major source, although wind is also significant. The United Kingdom experienced an outstanding year. Its contracted capacity more than doubled from the volumes presented in 2023, going from about 0.6 GW to 1.4 GW, totaling 4.3 GW of contracted capacities. Wind technologies, both onshore and offshore, contribute to more than half of this amount, but solar generation is not far behind. Denmark, Greece and the Netherlands also had noteworthy growth compared to the previous year. Their cumulative contracted volumes reached 1.9, 1.2 and 2.9 GW respectively. The Netherlands is the only of the three countries where solar PPAs are less prominent, while in Greece and Denmark the technology has the major share.

Germany, on the other hand, did not follow Europe’s trend. Although the country continued as the second largest PPA market, the volumes reduced from 2023 to 2024, with almost 0.3 GW less contracted capacity and staying below the 2 GW. This result might be connected to the current economic situation the country has been facing. The crisis has put large industries in recession, such as the automotive and steel sectors. An uncertain economic environment might have delayed decisions in signing long-term contracts like PPAs.

Solar and wind new installations

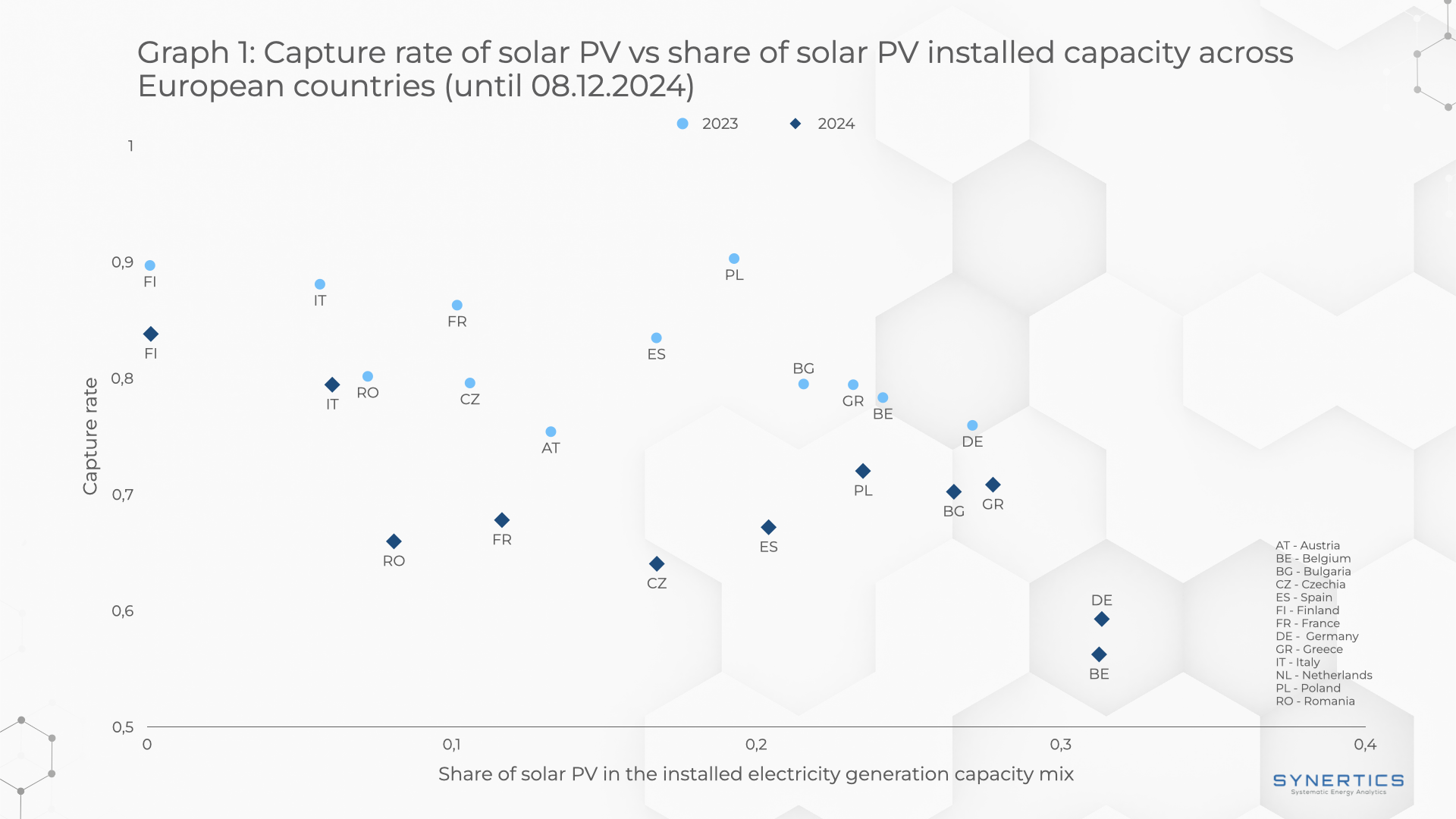

The cumulative installed capacity of variable renewable energy projects continued to grow in the European Union in 2024. The installed capacity of solar PV projects in 2024 had a modest growth rate of 4%, reaching 65.5 GW. Unlike the rapid expansion seen in previous years, the growth in 2024 was more restrained. Notably, Germany and Spain experienced contrasting trends that diverged from the evolution of their PPA markets. Germany's solar PV market continued to grow, albeit at a modest pace, while Spain's solar PV installations declined compared to 2023 levels.

Onshore wind installations also faced challenges, with annual growth in capacity decreasing from 18.3 GW in 2023 to 15 GW in 2024. This decline highlights a significant setback for the European Union, as wind capacity remains far below the capacity required to meet the EU's renewable energy targets. Delayed investments in grid infrastructure, together with inefficient permitting processes, have been slowing down wind investments.

In 2024 Europe recorded its lowest emissions to date, mainly driven by the growth in installed renewable capacity. Emissions were reduced by 13% compared to the previous year. However, demand has not increased, mainly due to slower industrial activity.

Conclusions

The European PPA market in 2024 demonstrated resilience and growth, setting new records for contracted capacities despite challenges in certain regions. Spain maintained its leadership, with substantial contributions from solar power, while the UK, Denmark, Greece, and the Netherlands presented impressive growth. However, contrasting trends in Germany, where economic challenges slowed down progress, highlight the varied dynamics across the continent. The disparity between PPA growth, the modest growth in new solar, and lower wind installations, indicate the need for accelerated investments in grid infrastructure and better permitting processes. As the EU continues to pursue its ambitious renewable energy targets, ensuring that the momentum of PPAs aligns with the pace of project developments will be crucial to maintaining progress along this trajectory.

Market-trends

13th Dec, 2024

Market-trends

11th Dec, 2024

Market-trends

29th Nov, 2024