Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

In November 2024, baseload Futures for 2025 supply saw a significant upward trend in several European countries. This rise reached the highest price levels of the year in markets like Germany, Italy, Greece, Romania, and Czechia, with near-record levels in France and Spain as well.

Electricity futures are contracts used in the electricity market that allow buyers and sellers to lock in a fixed price for electricity to be delivered during a specific period in the future. These contracts are traded on regulated exchanges, such as OMIP, EEX, and Nasdaq, and are typically settled daily to align with fluctuations in market prices. These Futures allow market participants to hedge electricity costs and serve as a reflection of their expectations regarding wholesale electricity prices. This article focuses specifically on baseload Futures, which is a type of electricity Future where electricity is delivered at a constant power during the entire period of the contract, 24 hours per day.

In this article we will further explore the rising prices across Europe, and try to understand the reasons that lead to this trend.

Evolution of Baseload Prices

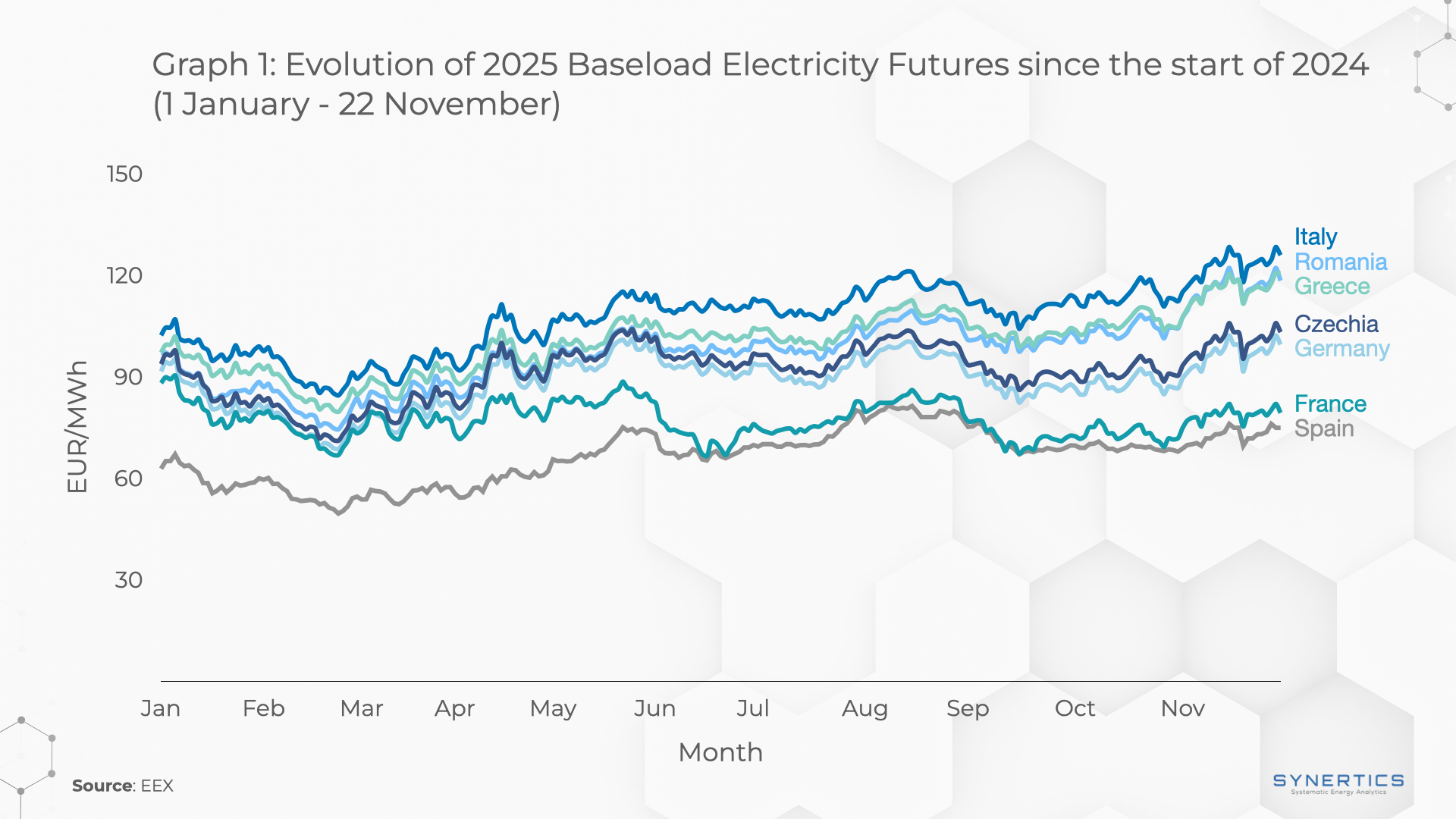

Graph 1 presents the evolution of prices for baseload electricity Futures of 2025 traded during the year of 2024. As can be seen, the countries’ prices follow similar trends, and have faced a steady rising since the beginning of November. Germany, for example, went from about 85 EUR/MWh on the 1st of November to about 102 EUR/MWh on the 21st, representing a growth of more than 20%. Similar percentage growths occurred in all countries analysed, with Romania presenting the highest value of about 20.6%.

Causes for Rising Baseload Prices

Several factors could be contributing to the rising baseload electricity Futures prices observed in November 2024. One significant driver is seasonal dynamics, as colder months typically increase electricity demand for heating, putting upward pressure on future prices. Additionally, surging natural gas prices—linked to power generation costs—are amplifying these trends. Natural gas prices reached a one-year high after Gazprom halted supplies to Austria on November 16 and amid uncertainty over a major Russia-Ukraine gas transit contract set to expire on January 1, 2025, risking a significant reduction in EU pipeline gas.

November's colder-than-expected weather drove withdrawals of nearly 4% of Europe’s gas storage, and it is predicted storage levels may drop below 50% by winter's end, compared to 60% in April 2024. This supply tightness and elevated gas prices directly impact electricity generation costs, further driving up baseload electricity Futures prices.

While the overall trend in baseload Futures prices is rising, there are notable differences across the countries. Spain, with the highest share of renewables (63%) among these markets, experienced the smallest percentage increase, likely benefiting from its renewable energy capacity that shields it from gas price volatility. However, Germany, which also has a significant share of renewables (56%), saw a larger price increase due to higher coal and oil use driven by colder weather and low wind output in November. France, on the other hand, has experienced less impact, with its reliance on nuclear energy mitigating the effects of rising gas prices.

Conclusion

The steady rise in baseload electricity Futures prices since November reflects growing seasonal demand, natural gas market disruptions, and a tightening energy supply across Europe. As these factors drive market volatility, they present a critical moment for stakeholders in the energy sector. These conditions highlight the strategic advantage of securing PPAs now; they provide a pathway to lock in prices, ensuring stability and mitigating risks in an increasingly unpredictable energy landscape.

Market-trends

4th Mar, 2026

Insights, Market-trends

27th Feb, 2026

Market-trends

6th Feb, 2026