Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

As countries progress toward carbon neutrality, renewable energy sources are achieving a more prominent role in the electricity mix. Over the past year, European countries have significantly increased the share of renewables in electricity generation, particularly solar PV, driven largely by the substantial decline in solar PV costs over time. While this shift enhances sustainability and energy independence, it also introduces challenges for renewable energy producers, such as heightened cannibalisation risks.

In this article, we explore the growth of renewable energy sources, focusing on wind and solar PV, between 2023 and 2024 and analyse their impact on capture rates for each technology.

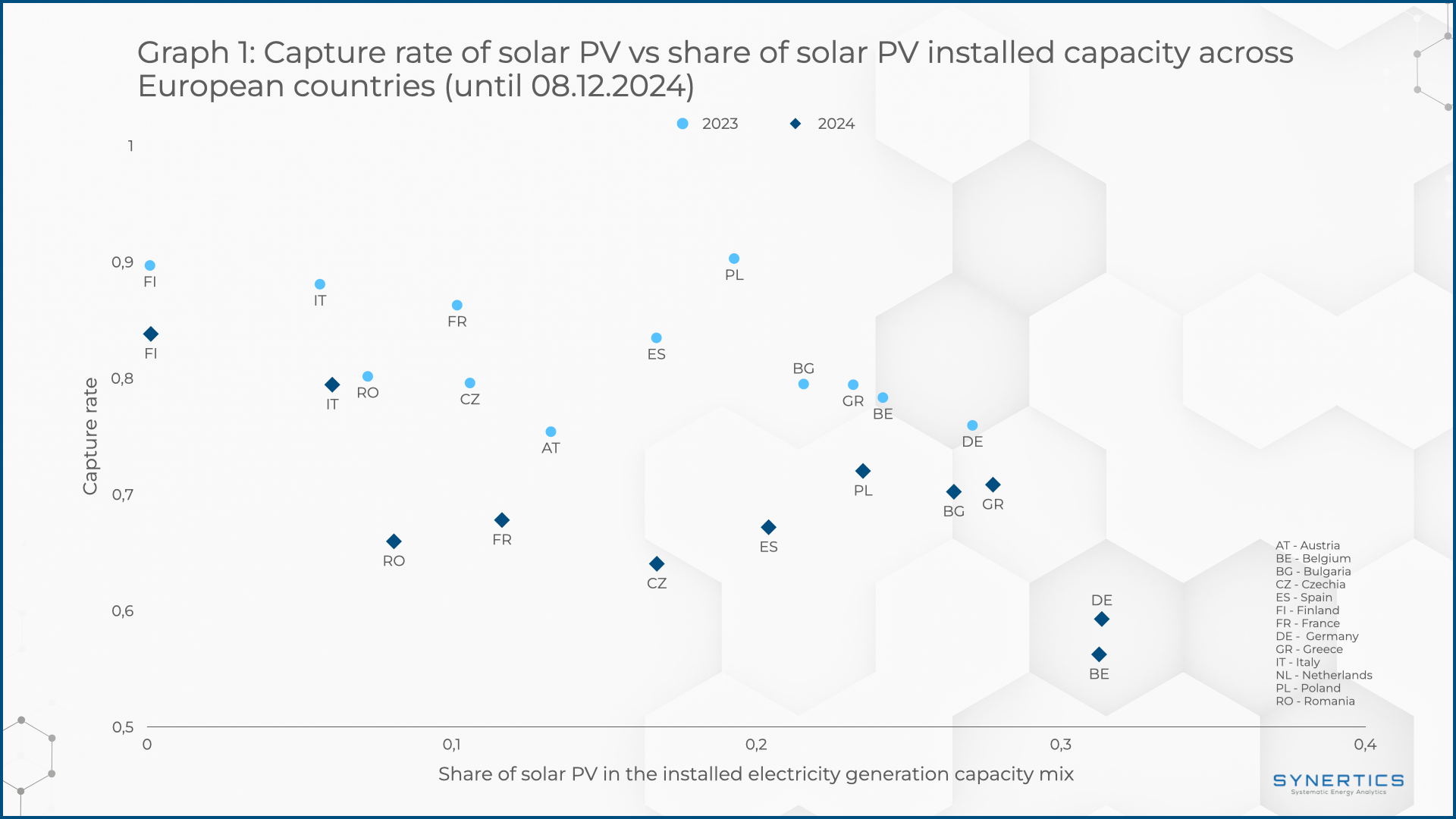

Graph 1 illustrates the capture rates for the full year of 2023 and for 2024 (up to December 8th) across 13 European countries. While data for the remaining 23 days of 2024 is unavailable, the current figures provide sufficient insight into capture price trends. As shown in the graph, there is a clear inverse relationship between the increasing share of solar PV in installed capacity and declining capture rates, as anticipated.

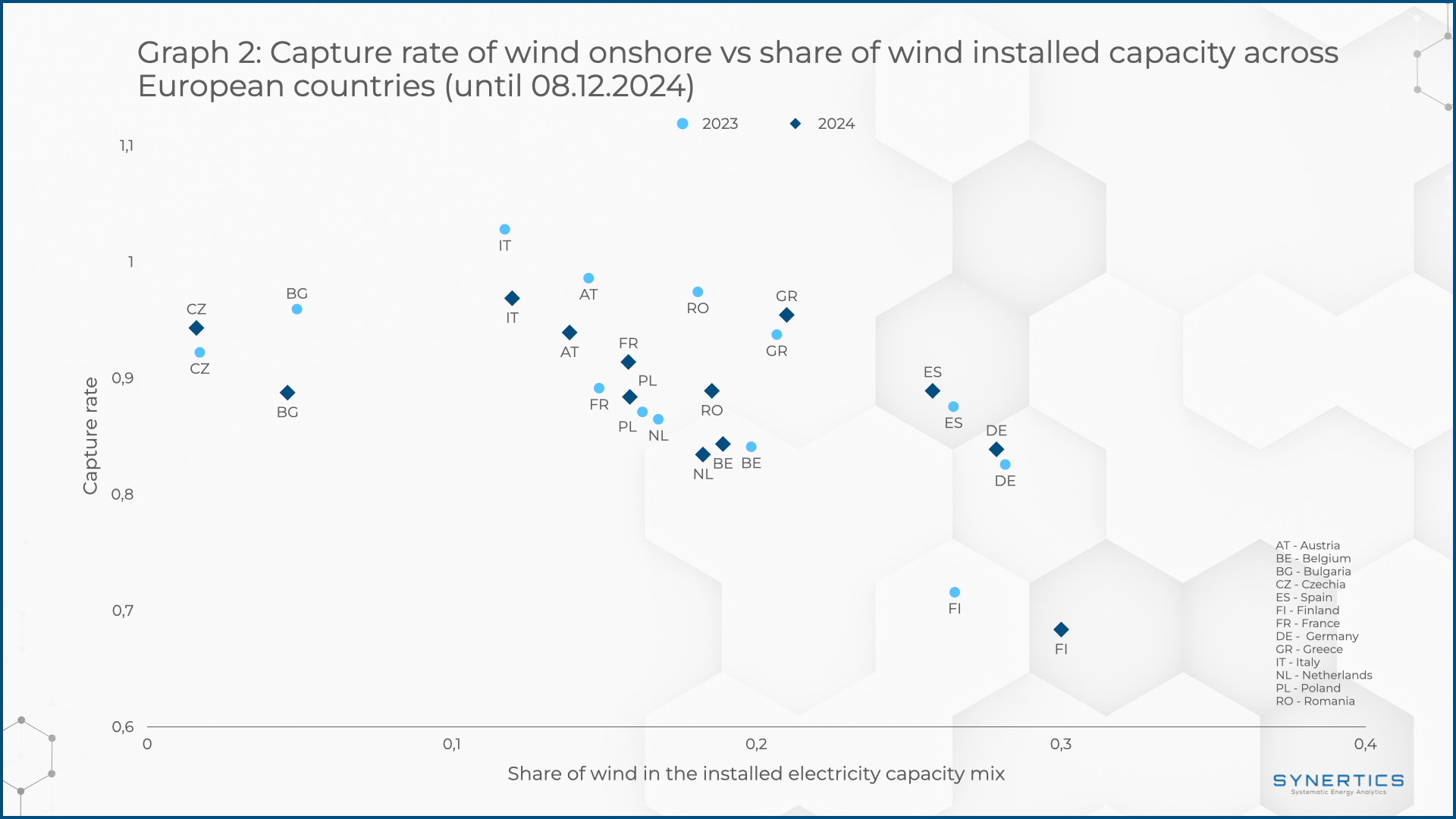

However, no similar pattern can be observed for wind capture rates. Graph 2 presents the evolution of wind generation capture rates in the same European countries for the same periods. In some cases, a decrease in wind's share of the installed capacity mix is observed from 2023 to 2024. This change is not due to a reduction in wind capacity but rather the significant expansion of solar capacity, which has made wind's share less representative within the overall mix. The data indicates a weaker correlation between wind's share in installed capacity and its capture rates. For instance, in countries where wind’s share decreased, capture rates either fell (e.g., Austria) or rose (e.g., Spain). Similarly, in countries with increased wind shares, capture rates either rose (e.g., France) or showed a decrease (e.g., Italy). Since wind generation is more stochastic, operates around the clock, and is highly location-dependent, an equivalent increase in installed capacity compared to solar PV is expected to have a smaller impact on its capture rate. Consequently, the relationship between wind's share in installed capacity and capture rates is understandably weaker compared to solar PV. Nevertheless, it's clear that countries with higher wind share exhibit lower capture rates.

Across the 13 countries analysed, it is evident that solar PV generators face higher exposure to cannibalisation risk. In 2024, capture rates for solar PV were below 0,75 in most countries. With no significant changes in the day-ahead market structure in the foreseeable future, the current trend shows no signs of slowing, underscoring the increasing vulnerability of solar PV assets to price cannibalisation.

In contrast, wind assets have maintained relatively stable capture rates in the day-ahead market over the last year. However, the growing share of renewable energy in electricity generation will likely exert downward pressure on wind capture rates over time, similarly as in countries with a high proportion of wind generation in their mix.

In this context, Power Purchase Agreements (PPAs) are becoming a critical strategy to ensure the financial viability of renewable energy projects. By securing stable revenues, PPAs help mitigate the risks associated with fluctuating capture rates and enhance long-term project profitability.

Market-trends

6th Feb, 2026

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025