Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

On December 10th, Spain's TSO, Red Eléctrica, officially joined the Manually Activated Reserves Initiative (MARI), enabling Portugal—an operational member of MARI since November—to participate in the mFRR European market. The integration of both Iberian TSOs into this European platform marks a significant milestone in advancing cross-border cooperation as part of the EU's strategy to support the renewable energy transition in the electricity sector.

In this article, we explore the mechanisms facilitating trade between the Iberian Peninsula and Central European countries, as well as the opportunities and risks associated with joining MARI.

Since our article on Europe’s Ancillary Services Market platforms, three new countries (Portugal, Spain, and Slovakia) have become operational members of MARI. Portugal and Spain’s integration into the European platform was prepared throughout 2024, including the transition from an hourly to quarterly bid resolution, in compliance with European mFRR service regulations.

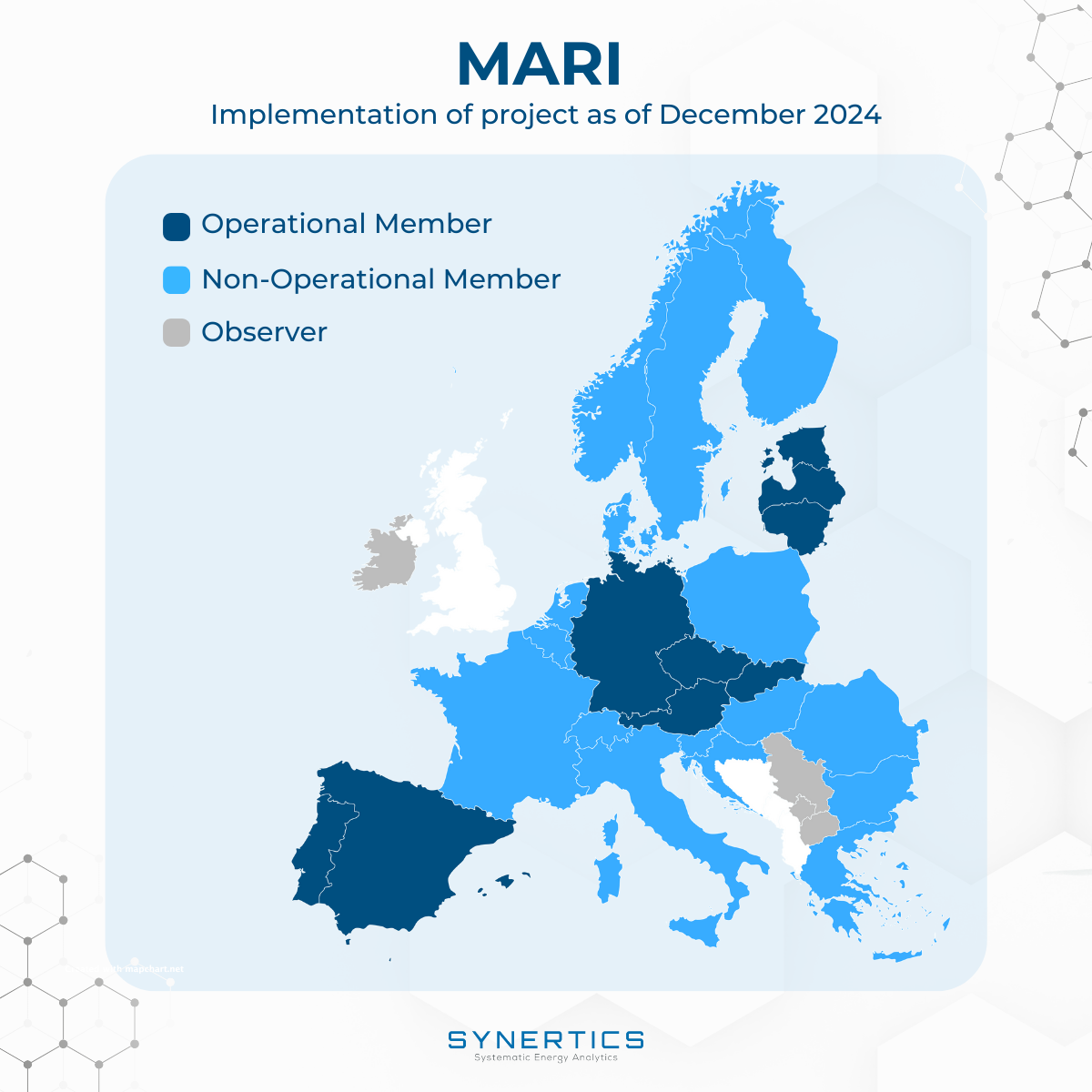

As of now, the MARI platform includes 9 operational members and 15 non-operational members, as shown in Figure 1.

Participation in the MARI platform provides Balancing Services Providers (BSPs) with access to a larger pool of balancing offers. Since joining, Red Eléctrica has successfully registered trades with Czechia, demonstrating the effectiveness of this solution in opening access to new markets.

This success was made possible by the French TSO voluntarily adopting the Available Transmission Capacity (ATC) sharing framework. This framework allows any unused transmission capacity, after meeting grid requirements, to be allocated for commercial use. Although France is a non-operational member of MARI, this framework facilitates the transmission of regulation services between the Spanish and German borders. However, cross-border trading remains subject to the limitations of the Cross-Border Capacity Limit (CBCL); i.e. the maximum amount of power that can be transferred between bidding zones; and economic competitiveness.

The MARI platform facilitates cross-border trading of mFRR services, providing Iberian BSPs with access to a larger pool of balancing offers. Additionally, the growing share of renewable energy over the next years is expected to drive higher demand for balancing services. This expanded market access combined with a higher demand, increases the likelihood of bid activation, thereby enhancing the revenue potential for renewable generators.

However, this opportunity comes with the challenge of increased competition. By integrating with MARI, Iberian balancing needs are exposed to a bigger market, potentially leading to downward pressure on prices.

Whether the trade-off between the higher chance of activation and decreased mFRR prices improves the revenue of renewable generators, depends on the relative competitiveness of Iberian markets compared to the MARI operational countries. Keeping this in mind, it will be essential to keep in check market developments to assess how these changes might affect revenue streams.

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026