Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Battery Energy Storage Systems (BESS) play a versatile role in the electricity market. They can engage in energy trading by storing excess electricity during periods of high production and low demand and then selling it when demand and prices are higher, a process known as energy arbitrage. Additionally, their short ramp-rate makes them suitable to participate in the ancillary services market selling products such as FCR, aFRR and mFRR. These services are essential for maintaining a stable and high-quality electricity supply

However, BESS assets have a limited energy storage capacity, making their optimal management strategy challenging in a market with multiple opportunities. In colocated systems, maybe the first idea is to just participate in arbitrage, yet this approach can exclude more attractive markets. Furthermore, participating in multiple markets can mitigate risks associated with single-market exposure.

In this article, we explore what is revenue stacking, its advantages, and how this strategy can increase the potential revenue for collocated BESS assets. To illustrate its application, we will use a case study involving co-located solar and wind plants in Germany.

Revenue stacking in BESS consists of combining multiple revenue streams from a single BESS asset. This approach maximises the financial returns by allowing the BESS to perform various functions simultaneously or in sequence, depending on market opportunities and technical capabilities. By tapping into multiple opportunities, revenue stacking can often make BESS investments more economically viable. When depending on just one revenue stream it is often difficult to justify the investment, whereas combining several opportunities increases the overall financial return. For example, the same asset can expect revenues from a PPA and allocate some storage capacity to participate in other markets. This way, it can guarantee the delivery of the contracted volume of the colocated plant and reserve part of its capacity to optimise its revenue through the spot and ancillary services markets.

This can be achieved by reserving a set portion of the BESS capacity for each revenue stream. Alternatively, asset managers can perform revenue staking by dynamically changing the share of capacity allocated to each market in real-time based on market conditions, a method called cross-market optimisation. This method ensures that the potential of revenue is increased while the risk exposure of the asset is decreased.

Two co-located systems were analysed:

- Solar PV power plant + BESS

- Wind power plant + BESS

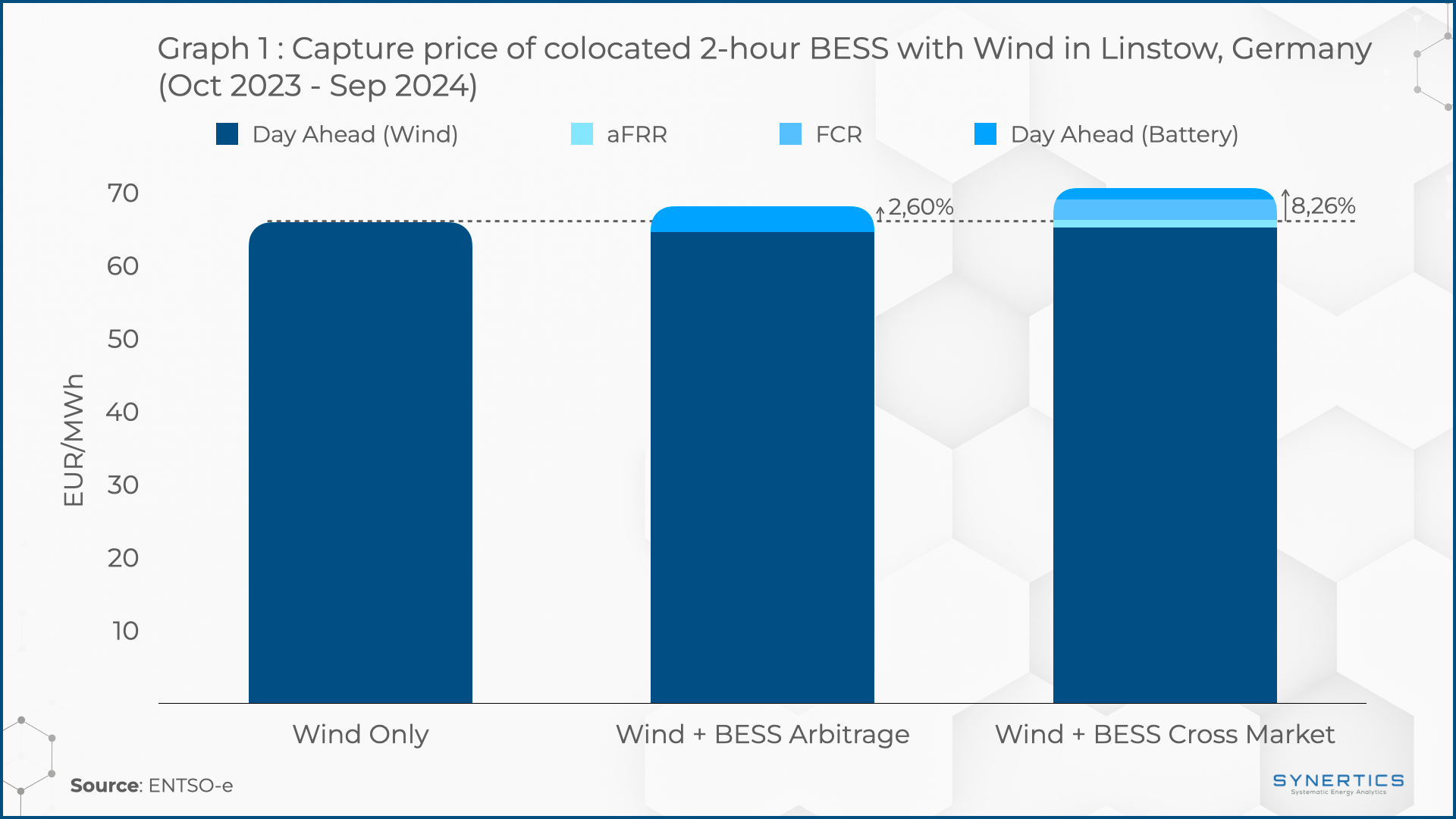

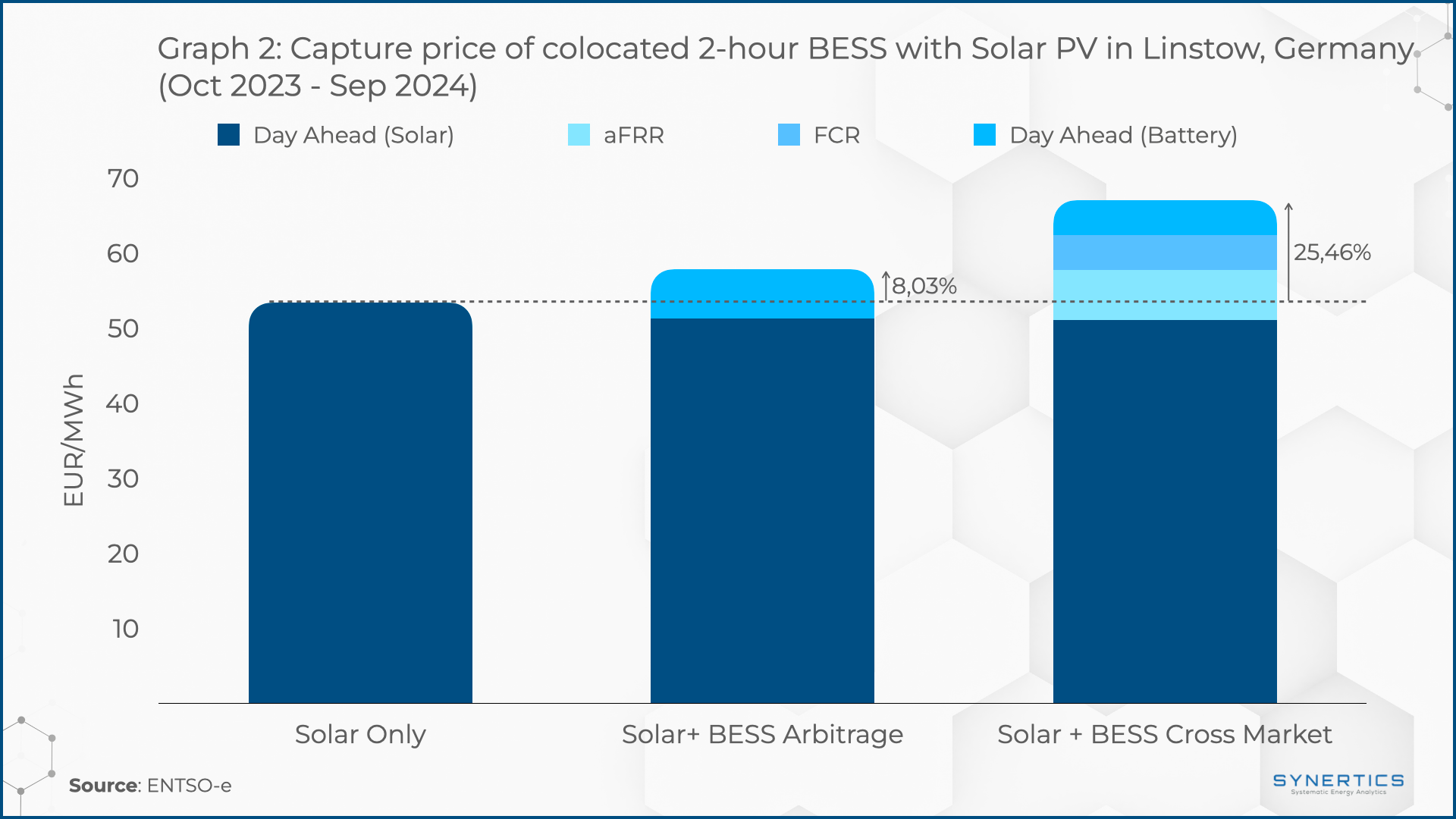

For each case, we compare the potential revenue of 3 different scenarios: A stand-alone renewable unit; A colocated system with BESS performing only arbitrage; and a co-located system with a BESS performing cross-market optimisation.

We assume that the battery can only charge from the renewable asset, that it is sized to 20% of the renewable installed capacity. Furthermore, the system will perform arbitrage in the day-ahead market and participate in the FCR and aFRR capacity market. Finally, we fixed the State of Charge (SoC) between 5-95% with storage capacity of 2-hours.

The results presented in this article arise from a 1-year simulation between the 1st of October 2023 and the 31st of September 2024. The solar profile assumes a solar PV power plant with an installed capacity of 50 MWp. For the wind power profile, we assume an installed capacity of 50 MW. Both assets are located in Linstow, Germany.

Graph 1 illustrates the capture price for the colocated wind case. Naturally, the BESS performing only arbitrage increases the revenue potential (2,60%). Nevertheless, the increase is less than one-third if considering revenue stacking with cross-market optimisation strategy (8,26%).

For the solar co-located case, the improvement is notably larger than that observed in the wind co-located, as shown in Graph 2. In this scenario, colocating a BESS with solar performing cross-market optimisation experiences the greatest boost in revenue by increasing the capture price by 25,46% to the solar stand-alone case. The ratio is again an improvement of over 3 times compared to a BESS performing only arbitrage in the day-ahead market (8,03% increase).

Revenue stacking is an effective strategy to boost the revenue of colocated systems. For BESS investors, it makes these assets more financially attractive and secure. For those considering PPAs to their renewable assets, adding a BESS under revenue stacking strategy might be a game changer. It ensures a stable revenue flow while unlocking opportunities across various market segments. This approach allows investors to adapt to unpredictable energy markets by securing a portion of their income through a PPA while boosting additional revenue through ancillary services and spot market participation.

Do you want to find out more on how to enhance your co-located BESS investment? Don’t hesitate to contact us!

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026