Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

In a previous post, we discussed how the electricity market is experiencing an increase in the occurrence of negative prices and a widening average daily price spread. These trends are creating a more favourable environment for investment in Battery Energy Storage Systems (BESS).

However, investing in BESS has a lot of subtleties that need to be taken into account in order to optimise the investment. Understanding the technical factors that influence BESS performance is essential for maximising the system's value.

One of the principal technical decisions when choosing a utility-scale BESS is its Storage Capacity, i.e. the total amount of energy that can be stored. This feature has a strong impact on the cost of the system, since the higher the capacity, the more expensive it becomes.

In this article we explore the impact of changing the battery storage capacity when co-located with two types of non-dispatchable renewable assets, Wind and Solar PV, in Germany.

Main Assumptions

For this analysis we perform three simulations for each of two co-located systems: one with a solar PV power plant + BESS, and other with a wind park + BESS. We assume that the battery can only charge from the renewable asset, is sized to 10% of its installed capacity, and will only perform arbitrage in the day-ahead market. Finally, we fixed the State of Charge (SoC) between 5-95%, adjusting only the battery’s capacity to 1-hour, 2-hour and 4-hour charge intervals.

The results presented in this article arise from a 1 year simulation between the 7th of October 2023 and the 6th of October 2024. The solar profile assumes a solar PV power plant with an installed capacity of 100 MWp located in southern Germany (Buchhofen). As for the wind power profile we assume a wind park with an installed capacity of 100 MW in northern Germany (Treuenbrietzen).

Effect of battery capacity on the revenue stream

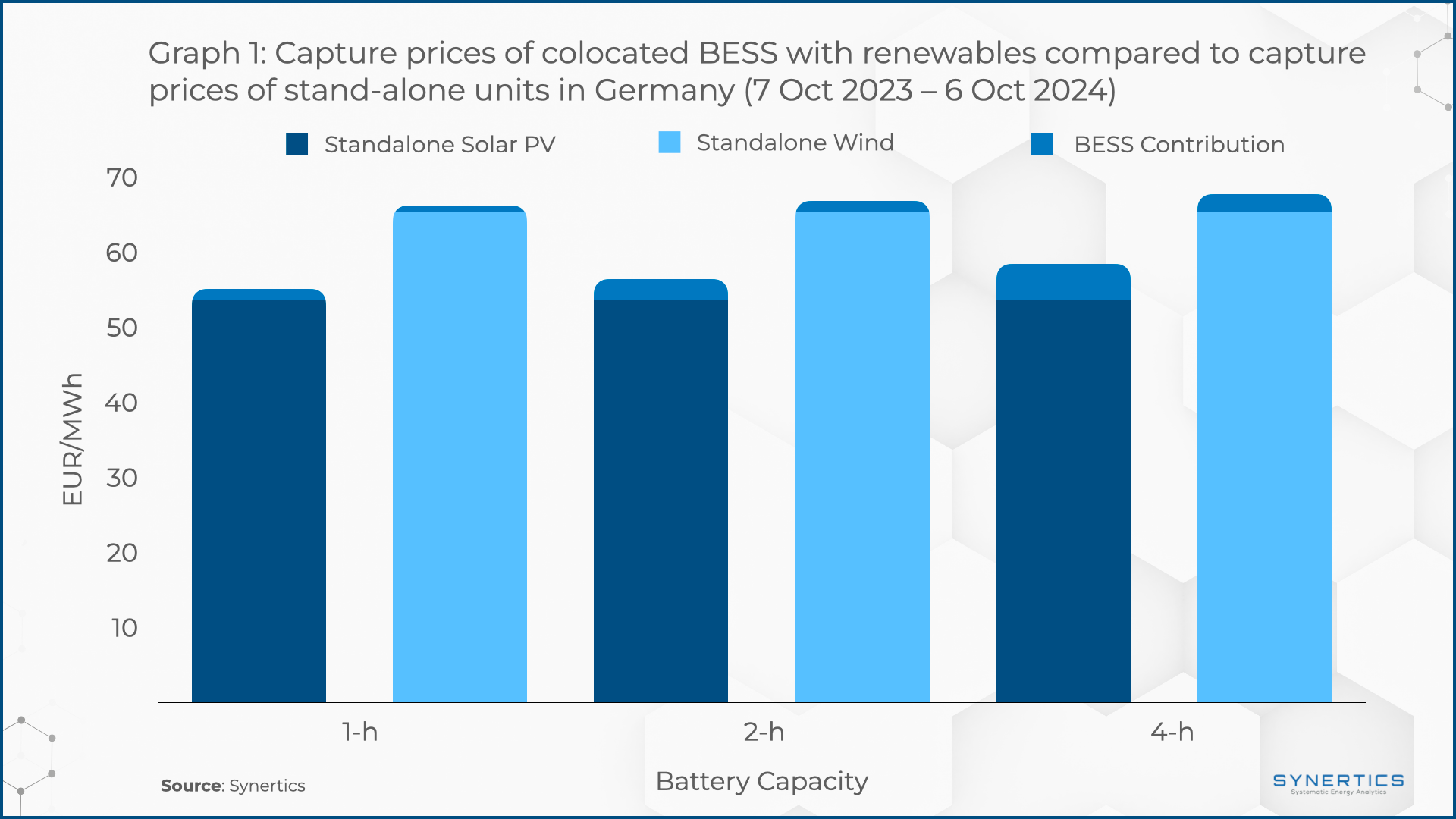

Graph 1 illustrates the average revenue for both co-located cases at varying battery capacities. As shown, increasing battery capacity leads to overall revenue growth in each scenario.

The solar PV co-located system experiences a greater boost in revenue with increased battery capacity compared to the stand-alone unit, with a rise from 2.78% to 8.93% (for 1-hour vs. 4-hour BESS capacity). This improvement is notably larger than that observed in the wind co-located case, where revenue only increased from 1.31% to 3.65%. While it is clear that expanding BESS capacity enhances revenue for the solar plant, the key question remains: is this investment worthwhile?

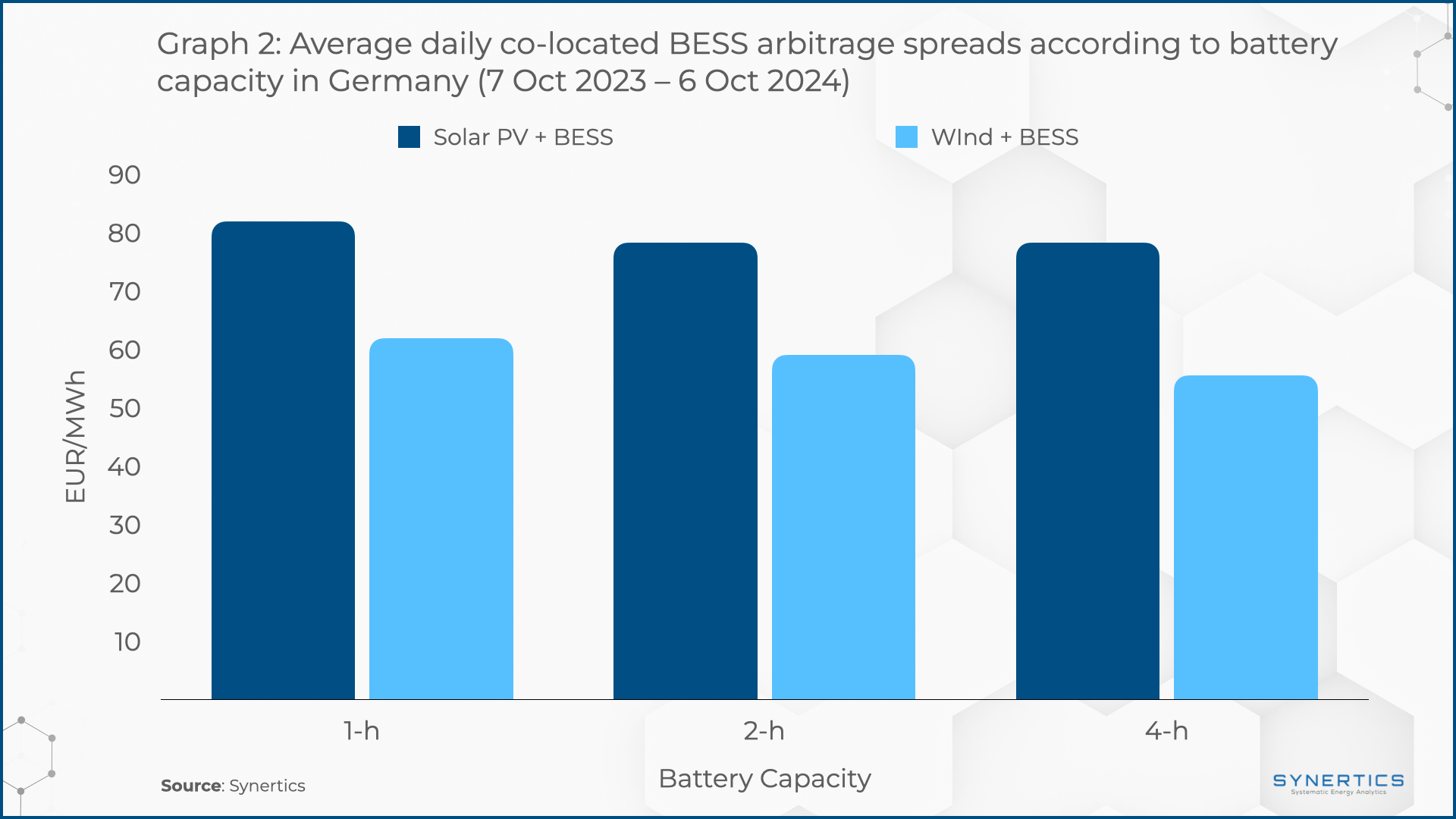

Graph 2 presents the average merchant electricity price from the BESS system alone. As shown, increasing battery capacity results in a decline in revenue for both cases, with a more significant variation occurring between the 2-hour and 4-hour capacities (8.11% for solar PV and 5.86% for wind), compared to the change from 1-hour to 2-hour capacity (4.41% for solar PV and 4.64% for wind). This indicates that while increasing storage capacity can enhance the overall system revenue, its marginal value diminishes, potentially jeopardising the return on investment.

How does the production profile of different renewable assets impact the BESS capacity choice?

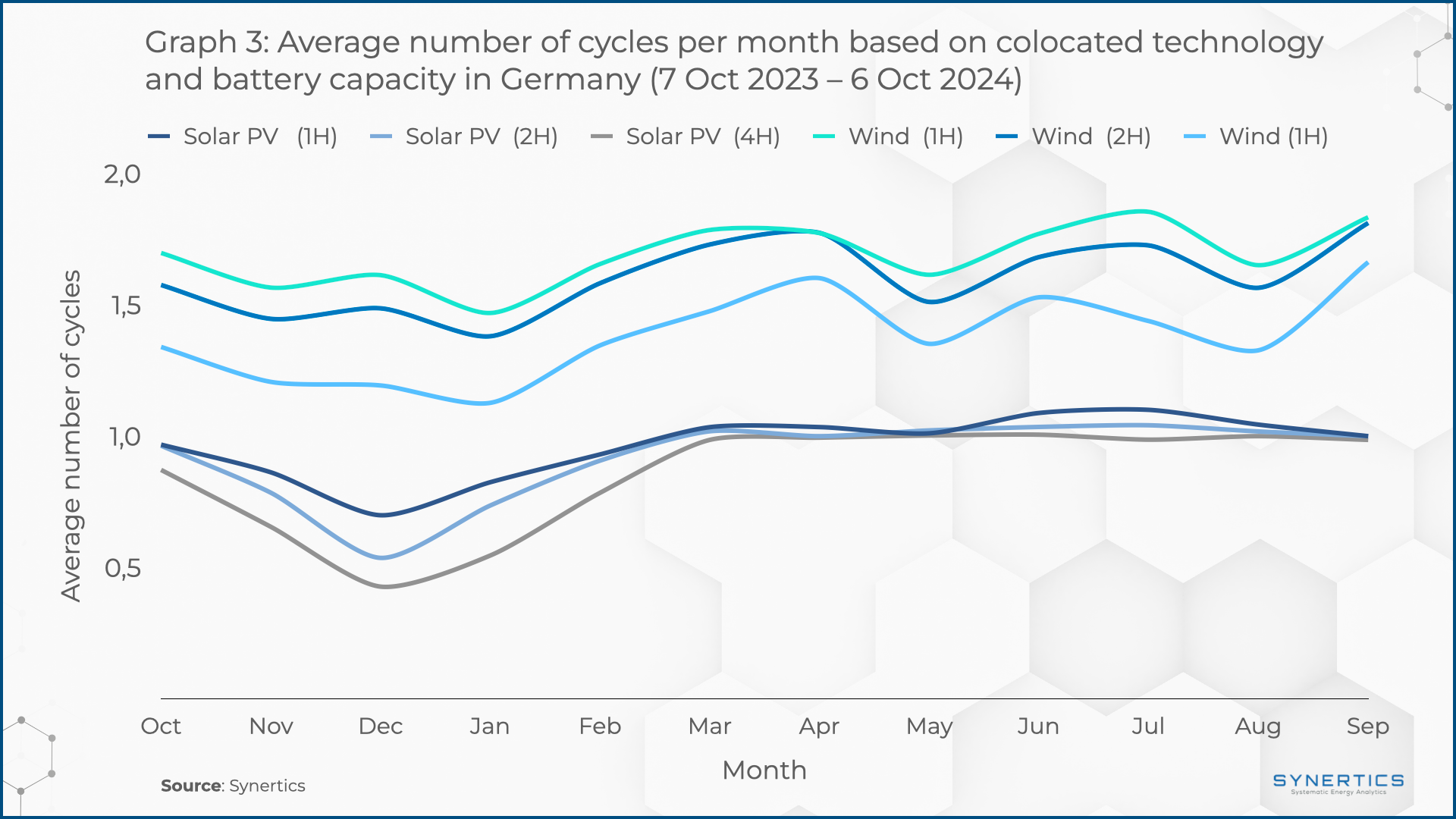

The production profile of different renewable assets significantly impacts the optimal BESS capacity choice. The charging and discharging pattern of a BESS is closely tied to the characteristics of the renewable asset. Wind power, with its more round-the-clock generation profile, allows for more frequent charge-discharge cycles when paired with a BESS for arbitrage. However, its fluctuability can affect the battery's ability to fully charge during periods of sustained low energy prices. In contrast, the solar PV generation profile is more well behaved, with production concentrated during daylight hours. Since solar production typically coincides with lower energy prices, the BESS predominantly charges during solar peak hours and discharges in the evening when electricity prices rise.

As a result, a BESS co-located with wind tends to experience greater variation in the number of cycles as its capacity increases, while the solar PV co-located BESS shows less variation, especially during periods of high solar production. Graph 3 supports this analysis, displaying the average number of cycles per month for both cases. The data shows that the variation in cycling is less pronounced in the solar PV system, particularly during high solar production months like summer.

Conclusion

The choice of capacity needs to take into account the desired system configuration. For wind colocated systems, a smaller capacity battery can take advantage of the daily fluctuation of the price, by charging and discharging full cycles more frequently. On the other hand, a colocated BESS system with solar typically will only perform 1 cycle a day, once the production profile is coincident with the lower energy prices, which can make the most of a bigger capacity storage.

Although this analysis is limited to day-ahead arbitrage, it underscores the importance of a thorough analysis tailored to the specific characteristics of each case study or market when making investment decisions.

Do you want to find out more on how to enhance your co-located BESS investment? Don’t hesitate to contact us!

Insights

3rd Mar, 2026

Insights, Market-trends

27th Feb, 2026

Insights

29th Jan, 2026