Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

In recent years, Europe’s energy markets have increasingly experienced negative electricity prices, a phenomenon where electricity supply exceeds demand to such an extent that producers pay consumers to absorb excess power.

This trend, driven by the rapid integration of renewable energy sources, highlights the challenges of balancing supply and demand in a shifting energy landscape.

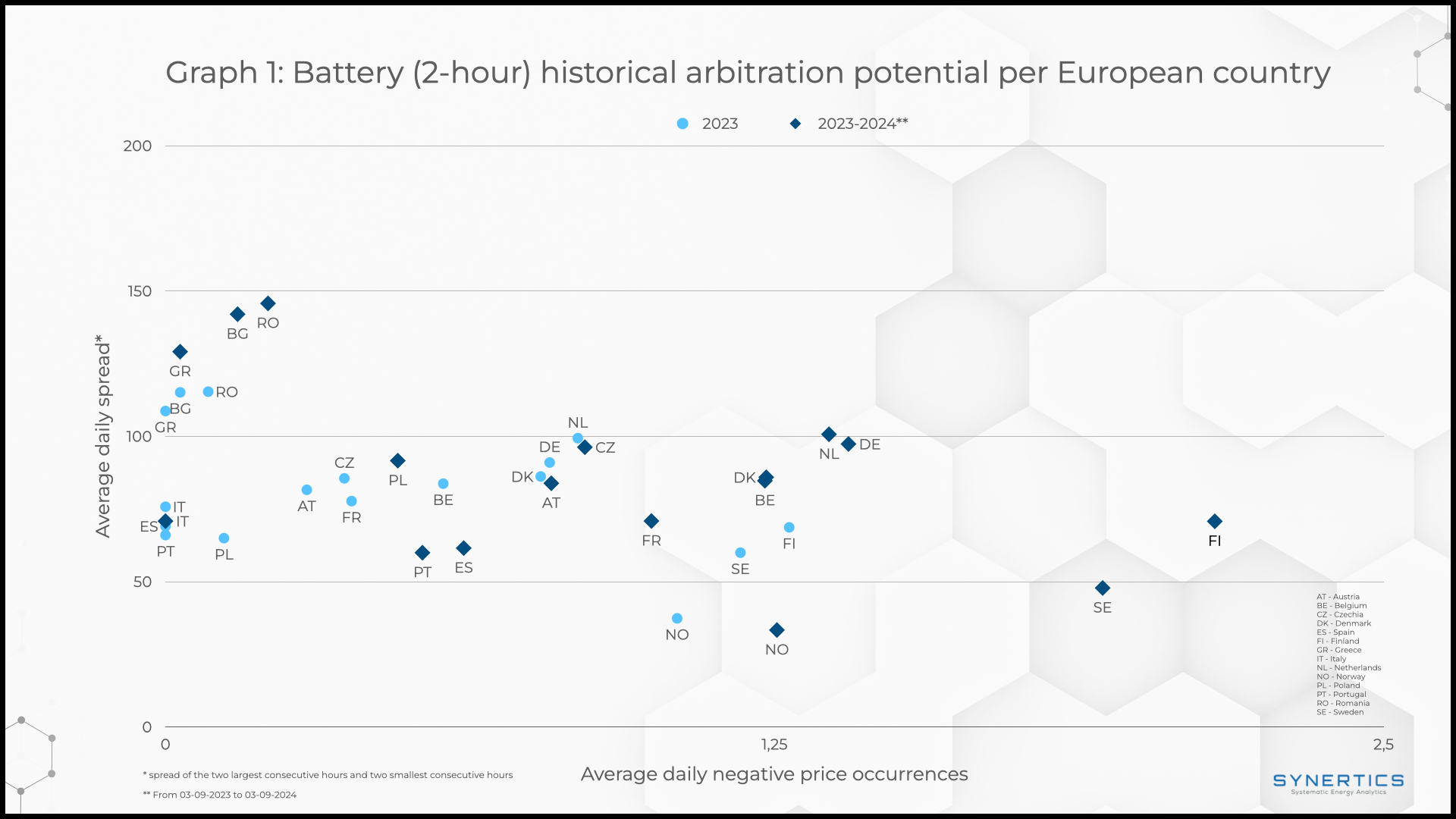

In this post, we analyse data from the past years across 17 European countries to rank these markets by the average 2-hour daily spread and daily negative price occurrences. Our aim is to identify the most commercially attractive markets for energy storage solutions, which could transform the challenge of average daily electricity price spreads and negative prices into an opportunity for greater grid stability and sustainability.

Ranking criteria

In our analysis, we use two different criteria: the average daily negative price occurrence and the daily average spread. In our analysis of the best markets for energy storage we give more weight to the daily average spread over the occurrence of negative electricity prices when ranking the countries.

While negative prices indicate oversupply, they don’t fully reflect the potential profitability of energy arbitrage. The daily spread, measuring the difference between the highest and lowest prices of the day, offers a clearer view of market volatility and highlights opportunities for batteries to maximise profits by charging at low prices and discharging at higher ones. This makes the daily spread a more reliable indicator for investment decisions. It is important to note that while arbitrage is a prime focus on deploying batteries, there are other revenue sources such as the participation in the ancillary services markets allowing for revenue stacking.

The analysis is focused on both the full calendar year of 2023 and the period between 3 September 2023 and 3 September 2024. This allows us to use the most recent data available, while simultaneously avoiding data from the year 2022, which may not be representative due the energy crisis caused by the Ukraine-Russia conflict.

Key Insights: Most promising candidates for energy storage solutions

Before identifying the top five markets for energy storage potential, several general observations emerge from this graph. Notably, the occurrence of negative prices is higher in 2024 compared to 2023. Romania (RO) and Bulgaria (BG) exhibit the highest average daily spreads in 2024, while Sweden (SE) and Finland (FI) have experienced the greatest number of hours with negative prices. Despite more frequent negative price events in Northern Europe, the daily spread is weighted more heavily when assessing storage potential, making Romania and Bulgaria particularly attractive for energy storage systems.

Countries like Finland and Netherlands show high arbitration potential due to frequent negative prices and considerable daily price spreads (over 100). However, Romania and Bulgaria, with their significant daily price spreads (125-150), stand out as the most lucrative for energy storage, despite fewer negative price occurrences. Germany, Belgium, and Poland represent a moderate range of opportunities with balanced spreads and negative price events, while Norway and Sweden, despite frequent negative prices, have lower spreads, reducing their attractiveness for storage systems.

Some support programs are available across different European countries. Such schemes may allow for projects in less ideally located countries to still be profitable, or may allow profitable projects to increase profitability further.

In summary, the analysis of Europe’s energy markets shows that while negative electricity prices are increasingly common, especially in Northern Europe, the daily price spread is a more reliable measure of energy storage potential. Romania and Bulgaria, with their wide price spreads, stand out as the most attractive markets for energy storage investments, offering substantial arbitrage opportunities. Finland and the Netherlands also show strong potential due to their combination of frequent negative prices and significant price spreads. Conversely, despite support programs across Europe, markets with smaller spreads, such as Norway and Sweden, appear less commercially viable for energy arbitrage.

Moreover, in markets with large price spreads like Romania and Bulgaria, energy storage systems could also enhance ancillary services such as frequency regulation and grid stability. In Finland and the Netherlands, where negative prices are more common, storage can be utilised for both arbitrage and ancillary services. Even in markets with smaller spreads, like Norway and Sweden, energy storage can still play a vital role in supporting grid reliability and integrating renewable energy, providing value beyond just commercial returns.

Market-trends

6th Feb, 2026

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025