Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

In the quest for a sustainable energy landscape, the Czech Republic's emerging PPA market is in a key position to play a pivotal role in transforming its energy sector. This article will provide the reader with all necessary key matrices to fully understand the PPA trend in this market.

The Czech Republic’s share of renewable energy consumption lies below the EU average of 23%, at only 18.2% as of 2022. However, the country’s National Energy and Climate Plan (NECP) targets an increase to 41% by 2030, meaning the installed capacity would have to double in less than a decade.

At the same time, the PPA market in Czechia is not as mature as in other EU nations, and the country has seen only a limited number of PPAs signed to date. The first was signed in 2021 for an on-site solar PV project with a capacity below 50 kW.

Although the electricity consumption in Czechia’s industrial sector has dropped in recent years, its share in the country’s total consumption is still higher when compared to other European countries that have seen more PPAs signed, such as Portugal and Greece, which indicates a potential demand of large offtakers. Automotive, chemicals, steel and non-metallic industries represent a significant share of the industry’s total electricity consumption. Some of the largest volume PPAs signed in Cechia thus far have been in the automotive industry, demonstrating a rising interest in decarbonisation mechanisms in Czechia

From the producer’s perspective, corporate PPAs are the most attractive mechanism for securing financing for renewable projects. The feed-in tariff scheme existing in the country does not include power plants that entered into operation after 2022. Additionally new subsidy mechanisms are unlikely to come into effect. Thus analysing electricity prices for merchant activity is essential in assessing the potential revenues from solar or wind PPAs.

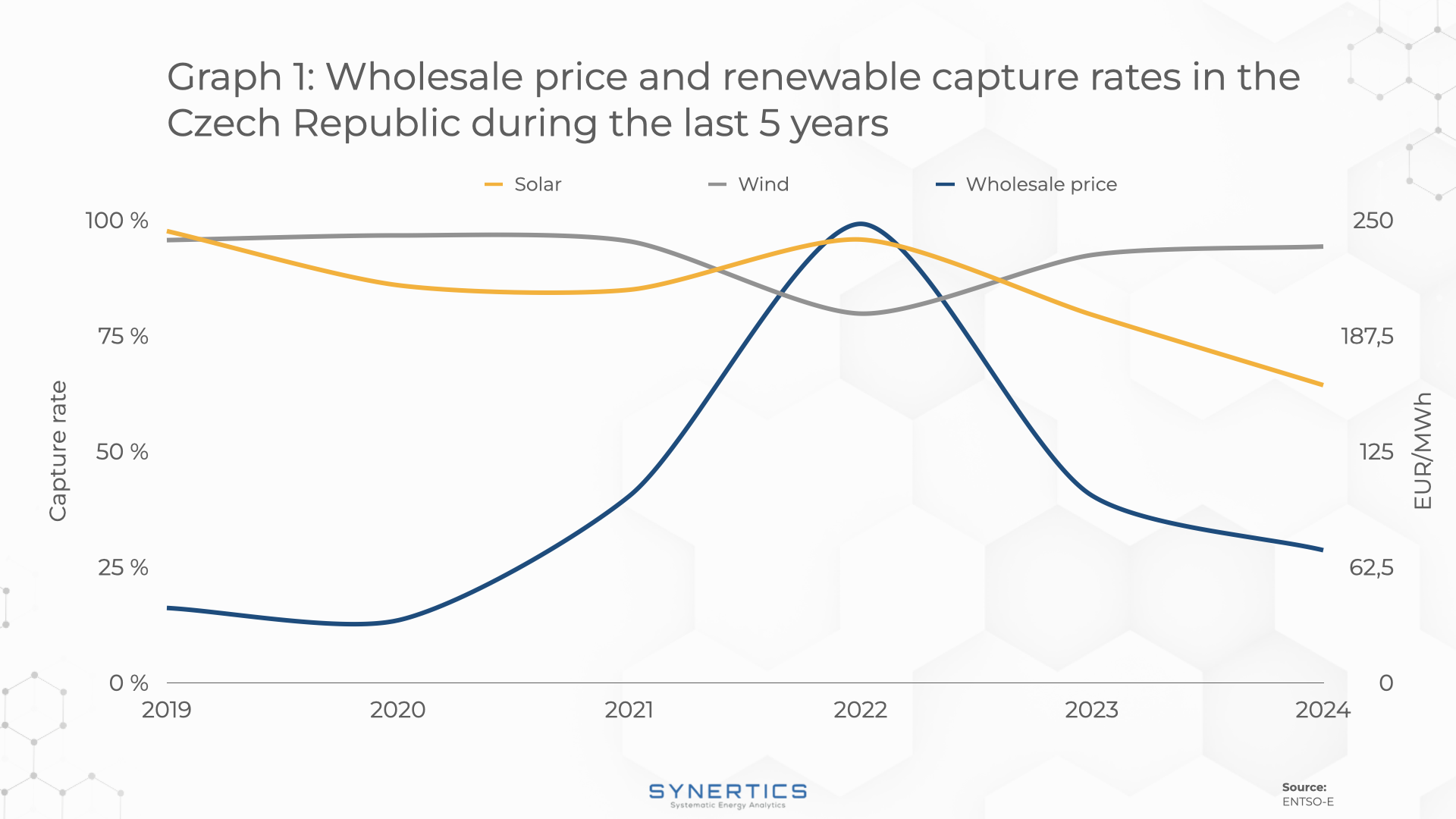

Graph 1 represents the evolution of wholesale prices and capture rates for both solar and wind technologies in Czechia.

Although wind generation has been able to maintain capture rates above 90%, with the exception of the energy crisis in 2022, solar generation has seen a general downward trend in capture prices, again with the exception of 2022. Even with low shares of solar in the overall production, cannibalisation effect might be having an impact in decreasing day-ahead prices during sunlight hours, therefore reducing solar capture rates. With the continuous growth of solar installations, capture rates have the potential to fall further.

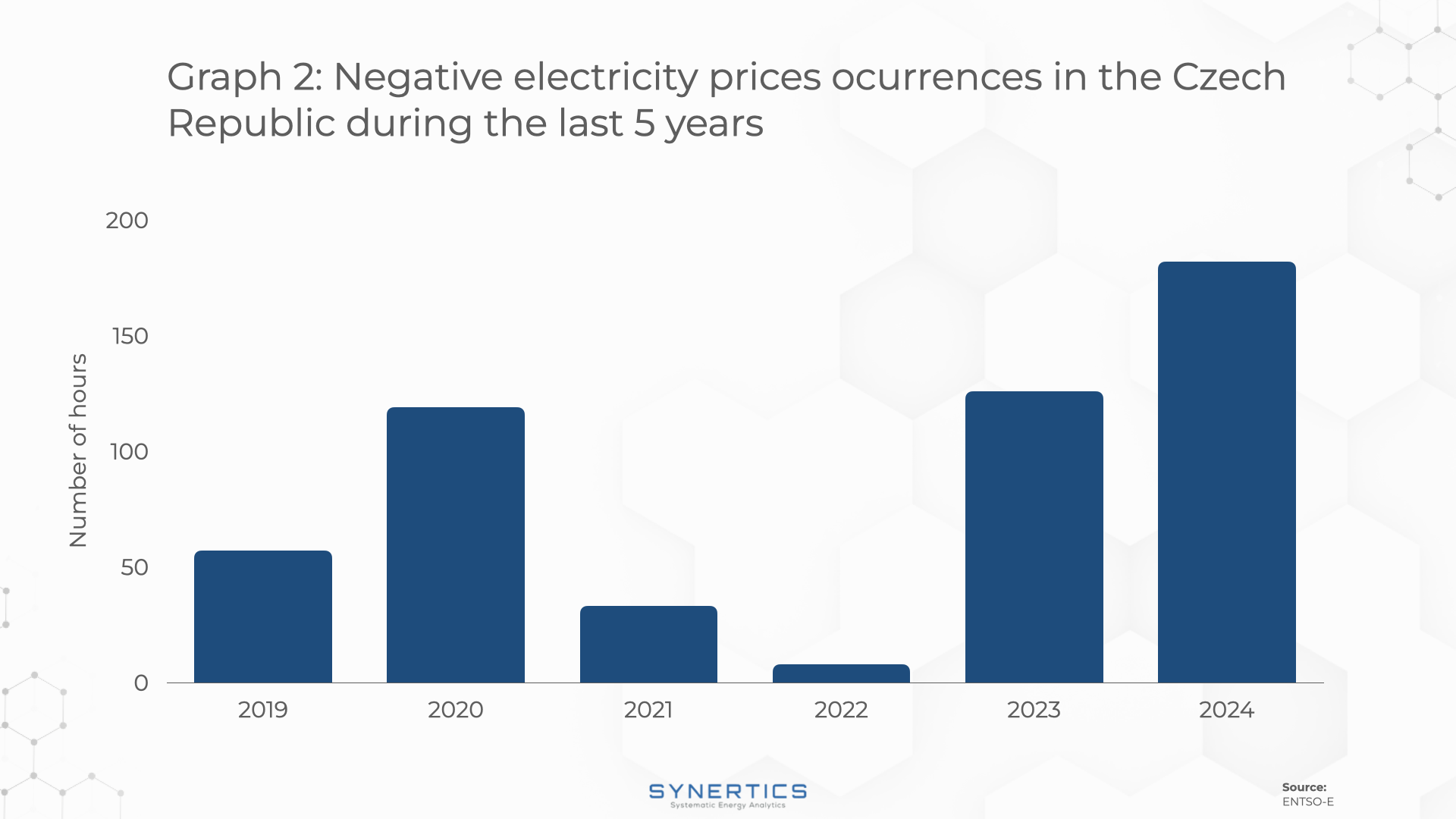

Graph 2 presents the number of hours with negative prices in the past 5 years, and it is clear that, after the energy crisis in 2021 and 2022, negative prices have presented an upward trend.

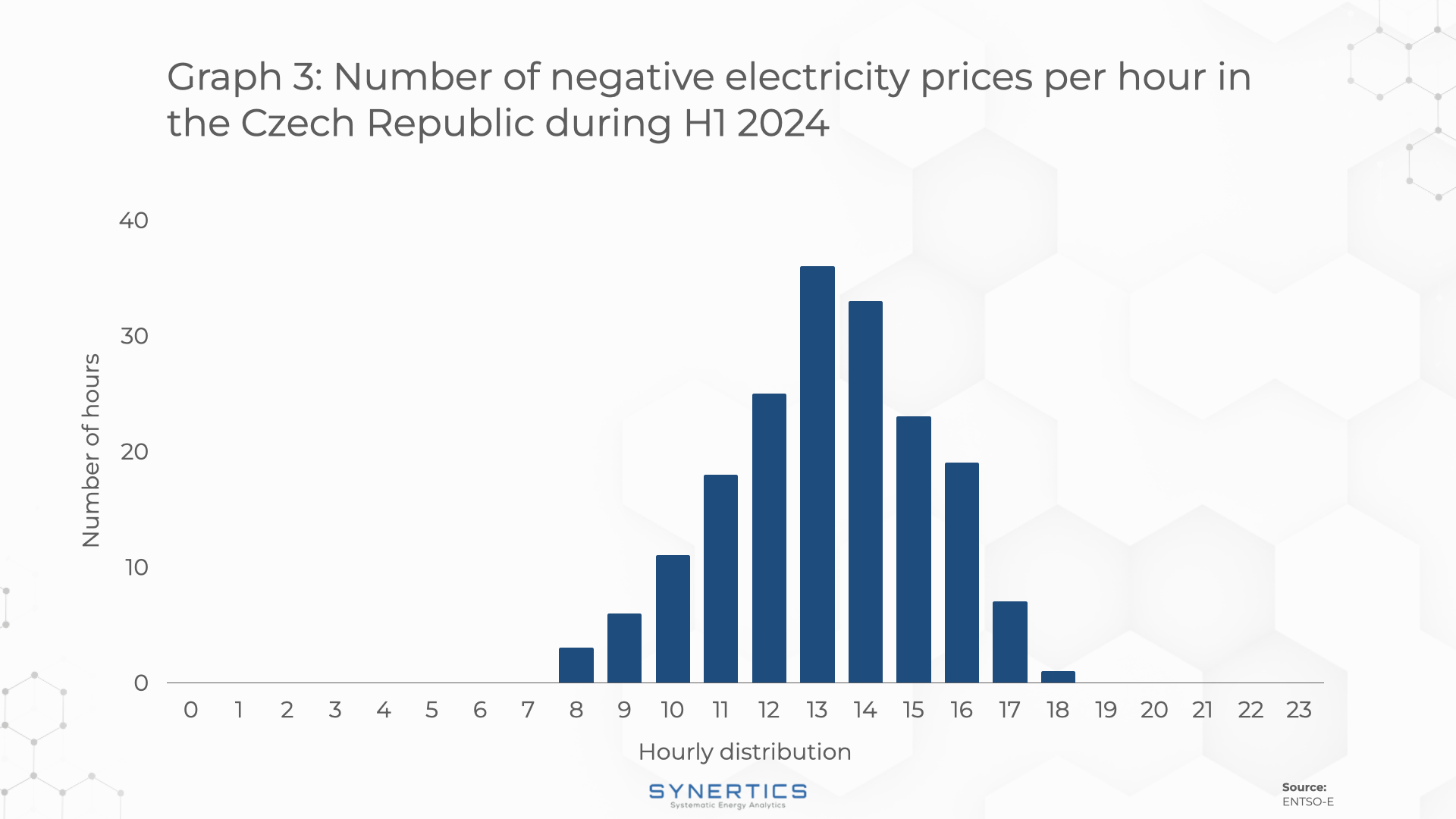

For 2024, all occurrences of negative prices followed a PV generation profile, which is a bad indicator for solar producers, as is clearly seen in Graph 3.

The PPA market in the Czech Republic has significant growth potential given that it is in its early stages. With renewable energy consumption below the EU average, and the presence of a strong industry with large electricity consumers, the country’s potential for developing more PPAs in the coming years is high. Automotive, chemicals, steel and non-metallic mineral activities are expected to be the main PPAs contractors in the near future. However, challenges like lowering solar capture rates and a surge in the occurrences of negative prices can affect PPA pricing and repel investors.

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026