Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Europe has been facing a significant growth trend in its Corporate PPA contracted capacity.

The race for decarbonising electricity consumption has put a pressure especially on large companies, and sourcing renewable electricity directly from the producers has become a common practice in the European electricity market.

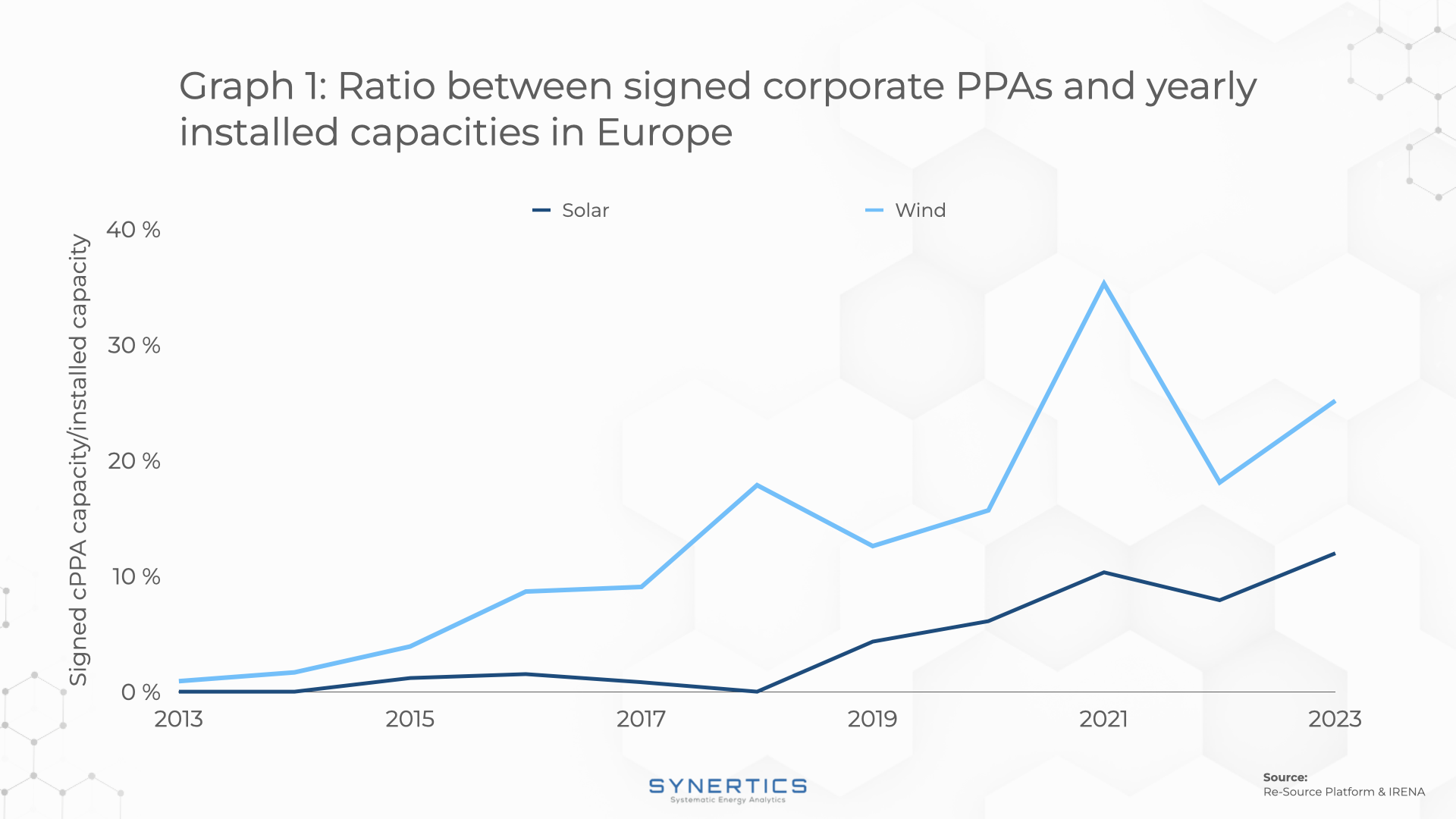

The yearly contracted capacity between 2013 and 2023 grew from 100 MW to 10 GW, with solar and wind technologies being the most relevant.

Despite this surge, how does it compare to the installed capacity of renewables in Europe?

Given the bold target of decarbonisation and the increasing pressures on energy independence, the installed capacity of all solar and wind facilities, including the ones not engaging in PPAs, also presented an impressive growth in the same period.

The added capacity of both technologies in 2013 summed about 21 GW, while in 2023 this was about 70 GW. Solar represented most part of this growth, while wind yearly additions were more steady.

To illustrate how the volume of yearly contracted Corporate PPAs compares to the volume of newly installed solar and wind generation facilities, Graph 1 presents the estimated ratio of both variables.

Although not all Corporate PPAs capacities are contracted from new facilities, the upwards trends for both technologies are clear, showing the growth of PPA market is significant in both absolute and relative terms.

With the gradual phase-out of renewable support mechanisms, and the development of more market-based approaches to promote the continuous decarbonisation of electricity consumption, new solar and wind projects tende to search for PPAs to mitigate financial risks and increase project bankability.

The continuous decarbonisation of electricity production in Europe relies each time more on new installations of solar and wind facilities. However, the gradual phase-out of incentive mechanisms and the risks a renewable generation plant is subjected to, the use of Corporate PPAs as a tool for de-risking projects and granting financing conditions is expected to continuously increase.

Market-trends

6th Feb, 2026

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025