Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Pay-as-Nominated PPAs are gaining traction within the PPA space as they provide a structured yet flexible approach to purchasing electricity, aligning the interests of both the generator and the offtaker.

Pay-as-nominated PPAs, also known as a Pay-as-Forecasted PPAs, are a specific type of PPA where the offtaker agrees to purchase electricity as it is forecasted by the generator.

Here are some key features of Pay-as-Nominated PPAs:

Nominated quantities: The generator provides the offtaker with a schedule of expected electricity production. This can be done on a daily, weekly, monthly, or other periodic basis.

Penalties and incentives: The contract might include clauses for penalties if the nominated quantities are not met within a certain threshold, or incentives for exceeding them.

Pay-as-nominated PPAs are particularly common in the renewable energy sector where production can be unpredictable. They provide a structured yet flexible approach to purchasing electricity, aligning the interests of both the generator and the offtaker.

Pay-as-Nominated and Pay-as-Produced PPAs are related concepts in the realm of power purchase agreements, but they are not the same. Here’s how they differ:

Payment for actual production: In a Pay-as-Produced PPA, the offtaker pays for the electricity that is actually produced and delivered by the generator. The payment is based on the real-time or metered amount of electricity generated.

No advance nominations: There is no need for the generator to frequently nominate or forecast the amount of electricity they will produce. The offtaker pays for whatever amount of electricity the generator produces. However, the annual production can be agreed with some penalties if deviation is above a certain threshold.

Risk on offtaker: The offtaker assumes the risk associated with the variability in electricity production. This is particularly relevant for renewable energy sources like wind and solar, where production can fluctuate.

Payment for nominated quantities: In a Pay-as-Nominated PPA, the offtaker pays for the generator's pre-nominated electricity amount, regardless of actual production.

Advance nominations required: The generator provides a production schedule in advance, and the offtaker commits to purchasing the nominated amount.

Shared risk: Both parties share the risk of production variability; the generator risks penalties for shortfalls.

Nominations: The fundamental difference lies in whether the generator nominates the amount of electricity in advance (Pay-as-Nominated) or if payment is strictly based on actual production (Pay-as-Produced).

Risk allocation: In Pay-as-Produced PPAs, the offtaker assumes more risk related to production variability. In Pay-as-Nominated PPAs, the risk is more balanced, with the generator taking on some responsibility for meeting nominations.

Contract complexity: Pay-as-Nominated PPAs typically involve more detailed contractual terms to manage nominations and discrepancies, while Pay-as-Produced PPAs are simpler and more straightforward.

While some sources may use the terms interchangeably due to their similarities in the overall structure of the agreements, the key distinction is how the quantity of electricity is determined and the associated risk management.

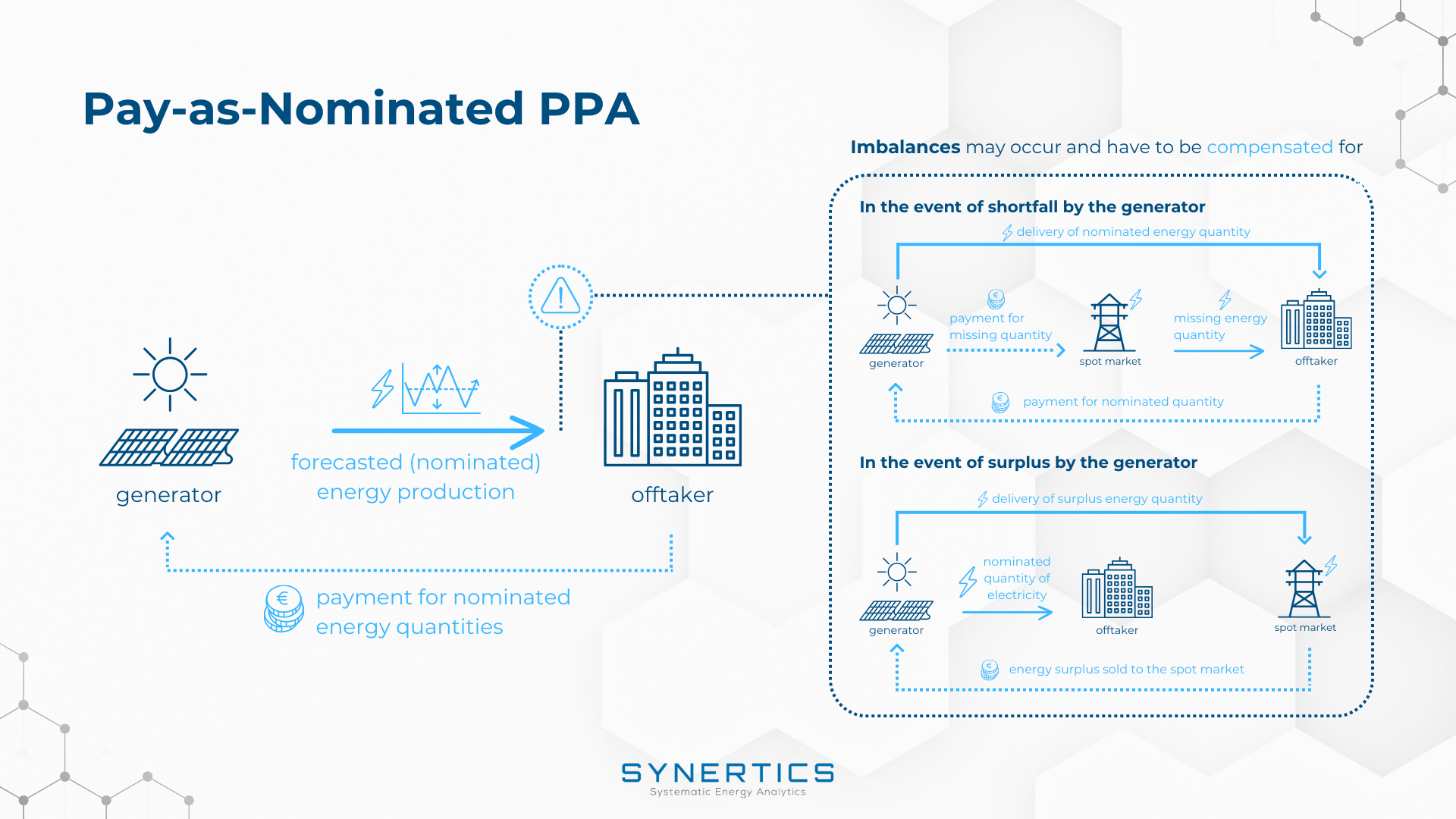

In a Pay-as-Nominated PPA, when actual production differs from the nominated quantities, the imbalances need to be addressed to ensure both parties' interests are protected and the grid remains balanced. Here are several common mechanisms for compensating imbalances:

Imbalance charges/penalties

If the generator fails to meet nominated quantities, they may incur predefined imbalance charges or penalties, while exceeding nominations can result in penalties or payment limited to the nominated amount, as per the contract.

Make-up energy

Some PPAs include provisions for make-up energy, where the generator can compensate for underproduction in one period by overproducing in another period, within certain limits. This helps balance the overall energy delivery over a longer time frame.

Financial settlements

Financial settlements are often used to manage imbalances. If the actual production is less than the nominated amount, the generator might need to buy the shortfall from the spot market at prevailing prices and compensate the offtaker for the difference. If the actual production is more, the surplus energy might be sold back to the grid or to the offtaker at a pre-agreed price or market price.

Rescheduling nominations

Contracts might allow for periodic rescheduling of nominations based on updated forecasts and actual performance. This can help minimise the discrepancies between nominated and actual production, reducing the need for penalties or financial settlements.

Curtailment clauses

In cases where production exceeds the nominated amount, there might be curtailment clauses allowing the offtaker to curtail the excess production without paying for it. Alternatively, the offtaker might pay for the excess energy at a different (often lower) rate.

Underproduction

If the generator nominates 100 MWh for a given period but only produces 80 MWh, the generator might need to compensate the offtaker for the 20 MWh shortfall, possibly by purchasing the deficit from the spot market and providing it to the offtaker at the contract price.

Overproduction

If the generator nominates 100 MWh but produces 120 MWh, the contract might specify that the offtaker only pays for the 100 MWh, or it might have a clause allowing the offtaker to purchase the additional 20 MWh at a discounted rate or at market price.

The specific terms for handling imbalances will be detailed in the PPA, tailored to the needs and risk preferences of both the offtaker and the generator.

Get in touch with our Advisory team to learn how this structure can fit into your PPA strategy.

Insights

3rd Mar, 2026

Insights, Market-trends

27th Feb, 2026

Insights

29th Jan, 2026