Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Power Purchase Agreements are usually signed on a long-term basis, with tenors spanning more than 10 years in many cases. This long-term aspect gives both producer and consumer foreseeable revenues and expenditures, respectively, for many years, while enhancing bankability of the project.

However, PPAs can also have a short-term tenor, like 1-5 years, and it might suit the parties in some cases. In this article we are looking into the short-term PPAs for further understanding. For analytical purposes, we take Germany's electricity market as an example. The reader might also want to check our other article on long- vs short-term PPAs.

The uncertainties inherent to the electricity market are always seen as a driver of risks for involved parties. During periods of high volatility, forecasting wholesale electricity prices can be a hard task and lead to significant errors. Signing a PPA in these times can pose burdens on the offtaker’s expenditures if the wholesale electricity prices go far below the expected. This burden is aggravated when signing a long-term contract, forcing the offtaker to bear higher costs for too long.

Short-term PPAs can also be a good option during periods of high prices. A small tenor can help hedging during these periods and the offtaker can search for new PPAs when prices return to lower levels.

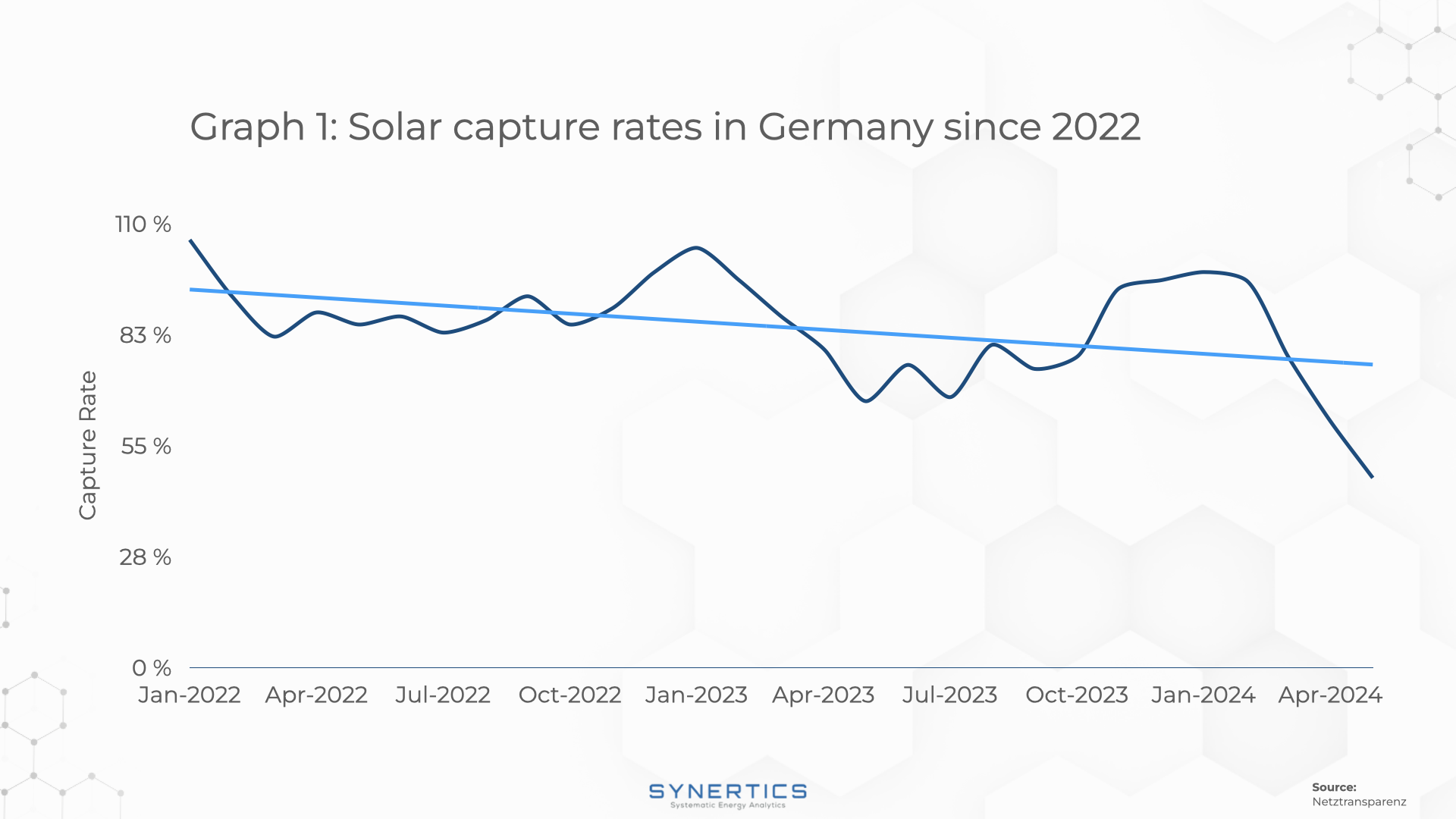

Another case is when electricity prices in the spot market are expected to fall in a mid- to long-term scenario. Taking the case of solar energy, for example, the technology is facing an expressive reduction in its capture rates in many countries.

Graph 1 presents the monthly capture rates of solar energy in Germany since 2022. The downward trend is a reflection of the cannibalisation effect that has been occurring. In this scenario, short-term PPAs can mitigate the risks of consumers overpaying for the electricity if the producer’s capture prices go even lower.

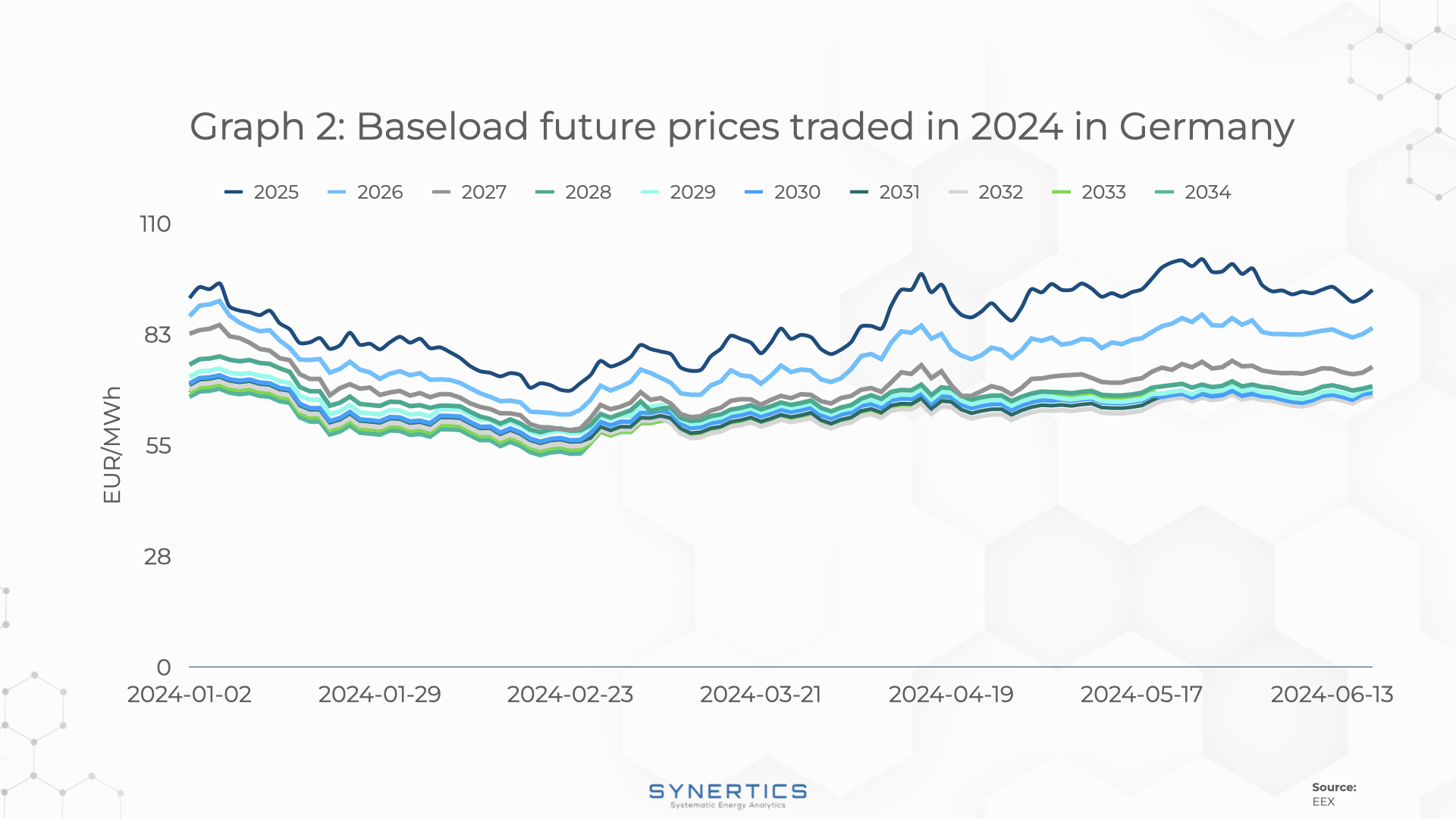

Renewable energy generators usually prefer long-term PPAs because it provides better conditions with financing institutions. However, in some situations it might be interesting to do a short-term PPA. Taking the case of low electricity prices or downward trend in capture rates, signing a long-term agreement if wholesale prices are expected to go up poses a threat to the generator, which could lose significant revenues. In this situation, the short-term contract can be a good option and, in addition, it usually takes higher prices when compared to long-term contracts.

For illustrative purposes, Graph 2 presents the electricity baseload future prices traded in 2024 in Germany for the years from 2025 to 2034. The average baseload future for the years under the PPA are a reference for its pricing. The graph shows that, for almost all trading days, the farther the year of energy delivery, the cheaper the baseload future. The averages for a 1-year, 5-years and 10-years baseload futures starting in January of 2025 are 95 EUR/MWh, 78 EUR/MWh and 73 EUR/MWh, respectively (quotation of 19/06/2024).

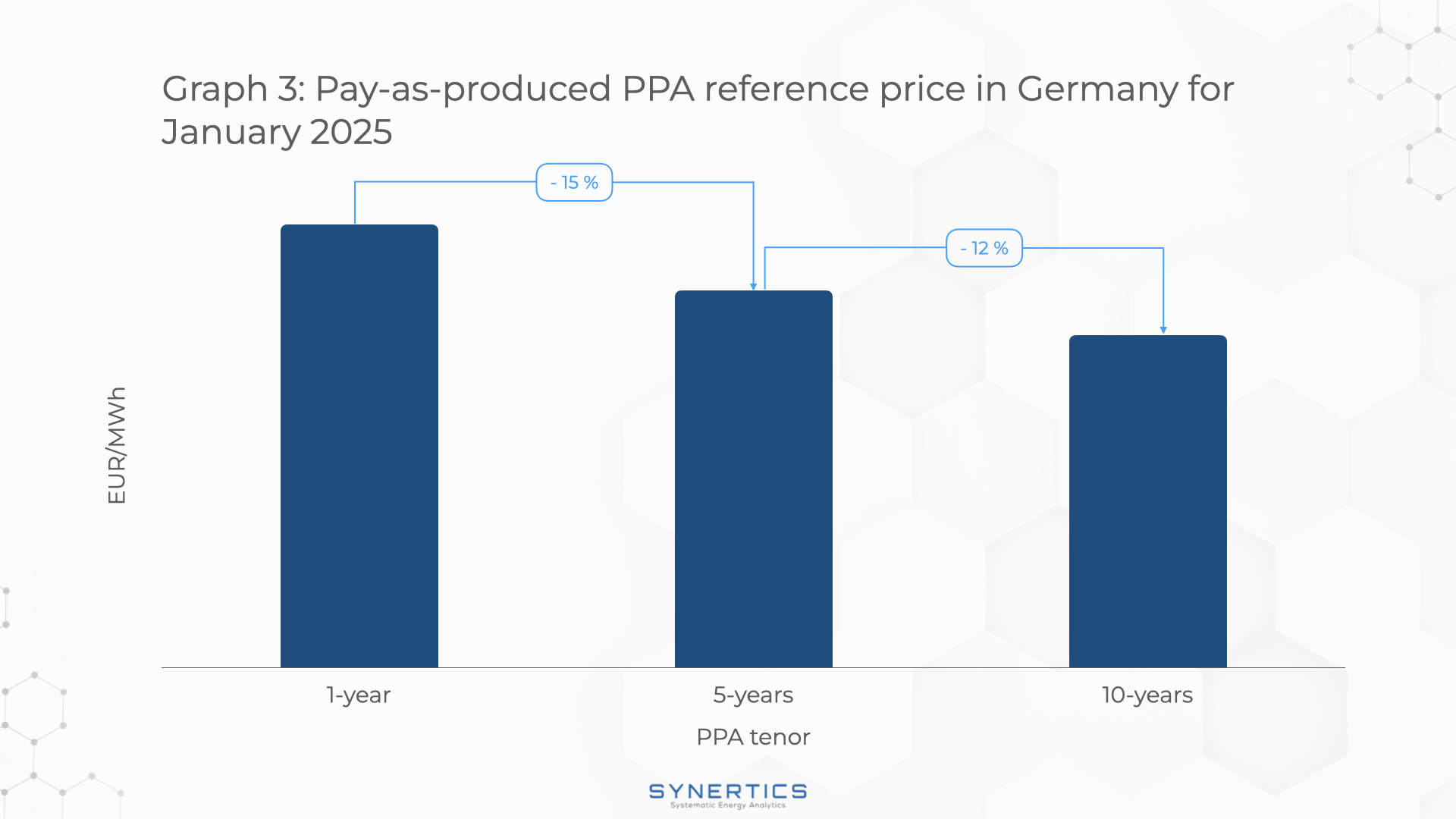

Furthermore, Graph 3 presents a simulation of the Synertics’ reference price for a 1-year, 5-years and 10-years solar PV pay-as-produced PPA starting on the 1st of January of 2025 in Germany. The one year PPA shows a 15% and 25% better pricing when compared to a 5-years and 10-years PPA. Although a 1-year PPA does not provide the same level of hedging for the producer, it can provide better revenues for a short period.

Renewable energy project owners and developers usually seek long-term PPAs for increasing the bankability and acquiring the necessary funds. However, some market conditions, such as high volatility in the wholesale electricity prices, can put both producers and offtakers in a risky situation.

Expecting considerable changes in the average wholesale price in a mid- or long-term scenario can also put one of the parties in an apprehensive position about making decisions for an uncertain future. Short-term PPAs can, therefore, act as a lower-risk alternative and benefit producer and consumer.

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026