Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Effectively allocating risks in energy contracts is crucial as project stages shift exposure between the generator and offtaker. Let's see how strategic risk management can safeguard your renewable energy investments.

When drafting energy contracts, each stage of the project involves specific risks. Some of these risks impact the buyer (offtaker), while others affect the seller (generator).

Depending on the moment of the project, the risk is more allocated to one of the parties, for example, in development there is more exposure for the generator than for the offtaker, whereas, in the case of operations, the risk is reversed. Therefore, effective risk management requires the allocation of these risks to the appropriate parties.

A renewable energy project can be divided into several phases, such as development, construction, and operation. Within each stage, there are specific associated risks, as well as general risks that can occur at any stage of the project (which are harder to mitigate).

One way to mitigate these specific risks at each stage of the project is through the use of securities, which enhance the project's bankability (the ability to attract financing from any source of funds, rather than limiting it to a particular source).

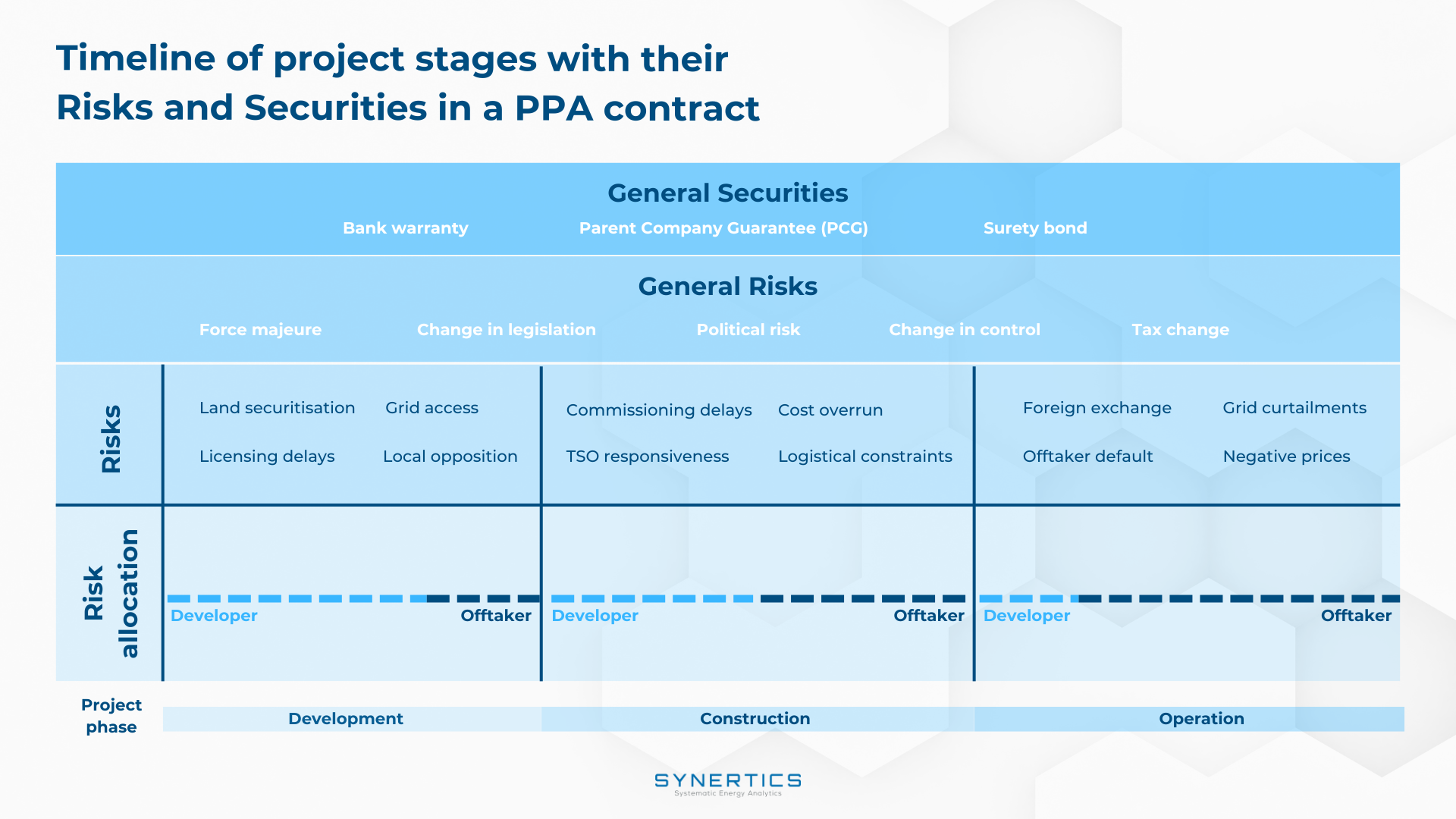

In the following table, we illustrate the three project stages along with their respective risks and securities:

Thus, for proper risk management in PPAs, identifying the risks is crucial for both the offtaker and the generator. These risks can come at various stages of renewable energy projects covered by PPA contracts, as will be explained below:

During the development and construction phase, some risks are the responsibility of the generator. In this context, the development phase of a PPA project is critical as it establishes the groundwork for future execution and operation. The main risks in this phase include:

- Land securitisation: Legal and bureaucratic difficulties in securing the necessary land for the project.

- Licensing delays: Delays in obtaining all necessary permits can significantly postpone the project.

- Grid access: Under the PPA, the project company is required to strictly comply with the dispatch instructions of the grid operator. The project company takes the risk of any operational failure to dispatch.

- Local opposition: Local community opposition can lead to delays and cancellations of wind and solar projects.

During construction, the challenges are predominantly technical and administrative. The specific risks of this phase include:

- Commissioning delays: These may arise from technical issues or delays in material delivery.

- Cost overruns: Risk of exceeding the initial budget due to unforeseen circumstances or poor management.

- Transmission System Operator (TSO) responsiveness: Delays or problems caused by interactions with the electricity grid operator.

- Logistical constraints: Challenges related to the transport and delivery of materials and equipment.

During the operation phase, there are several risks related to the effective production of energy and the proper functioning of the photovoltaic or wind farm, as well as payment security (the parties often put in place mechanisms to prevent interruptions in the stream of payments under the Power Purchase Agreement.

Regarding payment capacity, within the PPA contract, a request can be made for a creditworthy entity (an entity with a credit rating by Moody's, S&P, or equivalent) to serve as the off-taker to secure a financially stable institution or a letter of credit may be requested.

The operational phase is marked by revenue generation but is still exposed to significant risks:

- Foreign exchange: Impact of currency fluctuations on revenues and expenses.

- Buyer default (offtaker): Risks associated with the buyer not fulfilling their financial obligations.

- Grid curtailments: Limitations on the capacity to transmit energy to the market.

- Negative prices: Occurrences where the market price of energy can turn negative.

In addition to the specific risks at each stage of the project, there are also general risks that can affect the project at any stage.

- Political risk: Changes in the political environment that can affect the project's viability.

- Changes in legislation: Changes in laws that can impact the terms of the contract or operation.

- Change in control: Changes in the control of the company responsible for the project can affect its execution.

- Force majeure: Force majeure is a provision in a contract that frees both parties from obligation if an extraordinary event directly prevents one or both parties from performing.

- Tax change: The change may come in the form of a change in tax rate or the creation of a new class of tax, for example.

Below are some guarantees that can be included concerning the stages of the project:

- Bank warranty: A security issued by a bank to ensure payments in case a contractual party does not adhere to its obligations.

- Parent Company Guarantee (PCG): Commitment of the controlling company to fulfill the project's obligations, if necessary.

- Surety Bonds: A security issued by an insurance company to ensure payments in case a contractual party does not adhere to its obligations.

In conclusion, the securities play a pivotal role in PPAs by providing essential safeguards against risks at each project stage. These securities not only enhance the contractual relationship by aligning expectations and obligations between the offtaker and the generator but also foster trust and investment by ensuring operational security and financial stability.

Effective implementation and management of these securities ensure that energy projects progress efficiently and within the agreed parameters, ultimately contributing to the sustainable development of the energy sector.

Insights

3rd Mar, 2026

Insights, Market-trends

27th Feb, 2026

Insights

29th Jan, 2026