Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

In this article, we are looking into the potential savings a large industrial company in Germany can have when signing a PPA with a solar and wind facility.

PPAs consist of a strong mechanism for hedging against electricity prices whilst purchasing a clean and renewable energy source.

In this article, we are looking into the potential savings a large industrial company in Germany can have when signing a PPA with a solar and wind facility. For estimating this analysis, we assumed a flat baseload consumption of 1 MW, to mimic the usual consumption curve of energy-intensive corporates.

Throughout this analysis, we will compare the costs of two strategies in 2023: purchasing 100% of the electricity in the day-ahead market at an average cost of 95 EUR/MWh, or hedging between 10% to 100% of the electricity during the same period with solar PV or onshore wind parks.

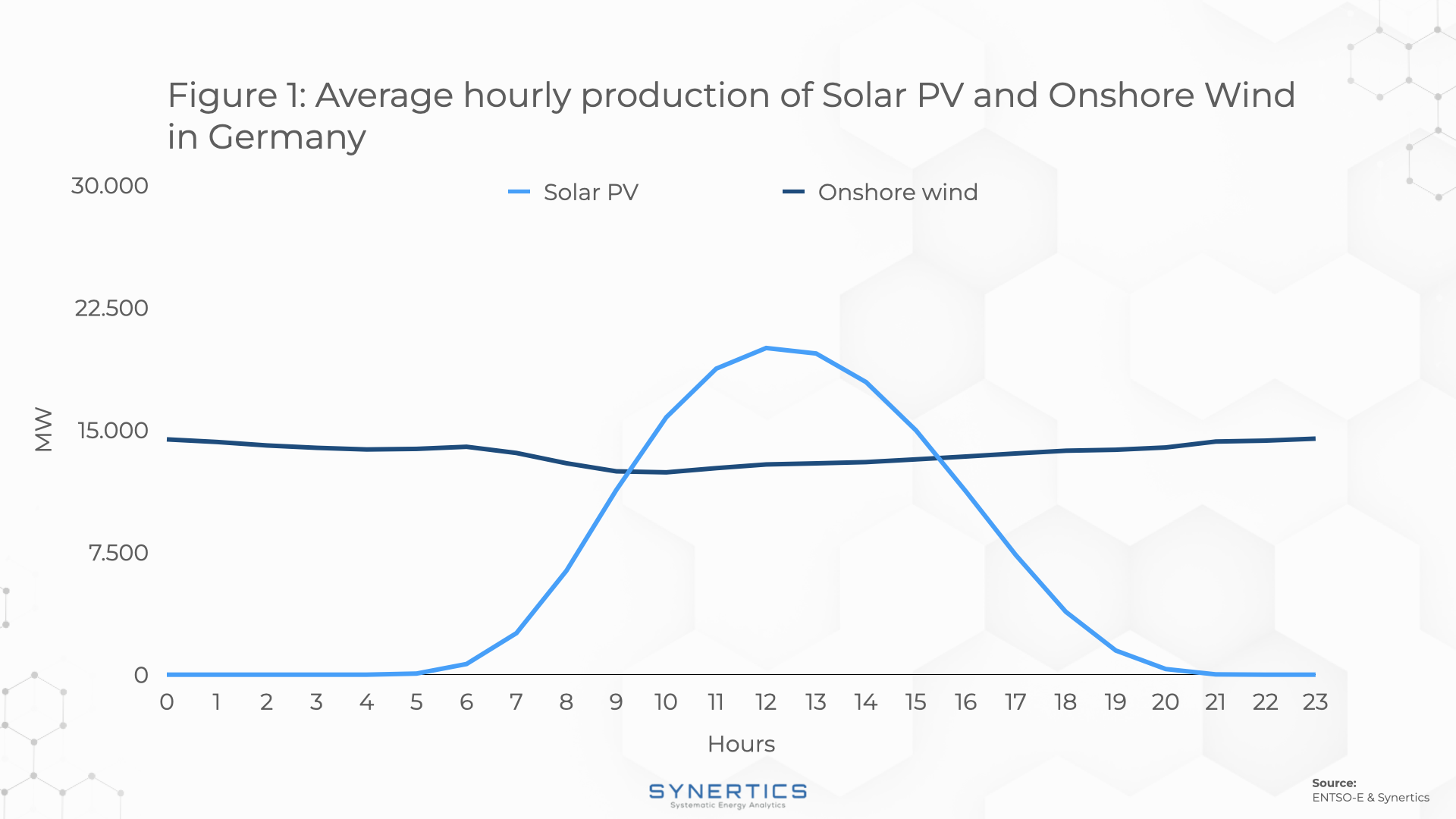

For calculating the generation from a power plant, we used the same production pattern as Germany’s whole solar and wind production.

Graph 1 presents the average generation profile for both solar PV and onshore wind technologies in the country.

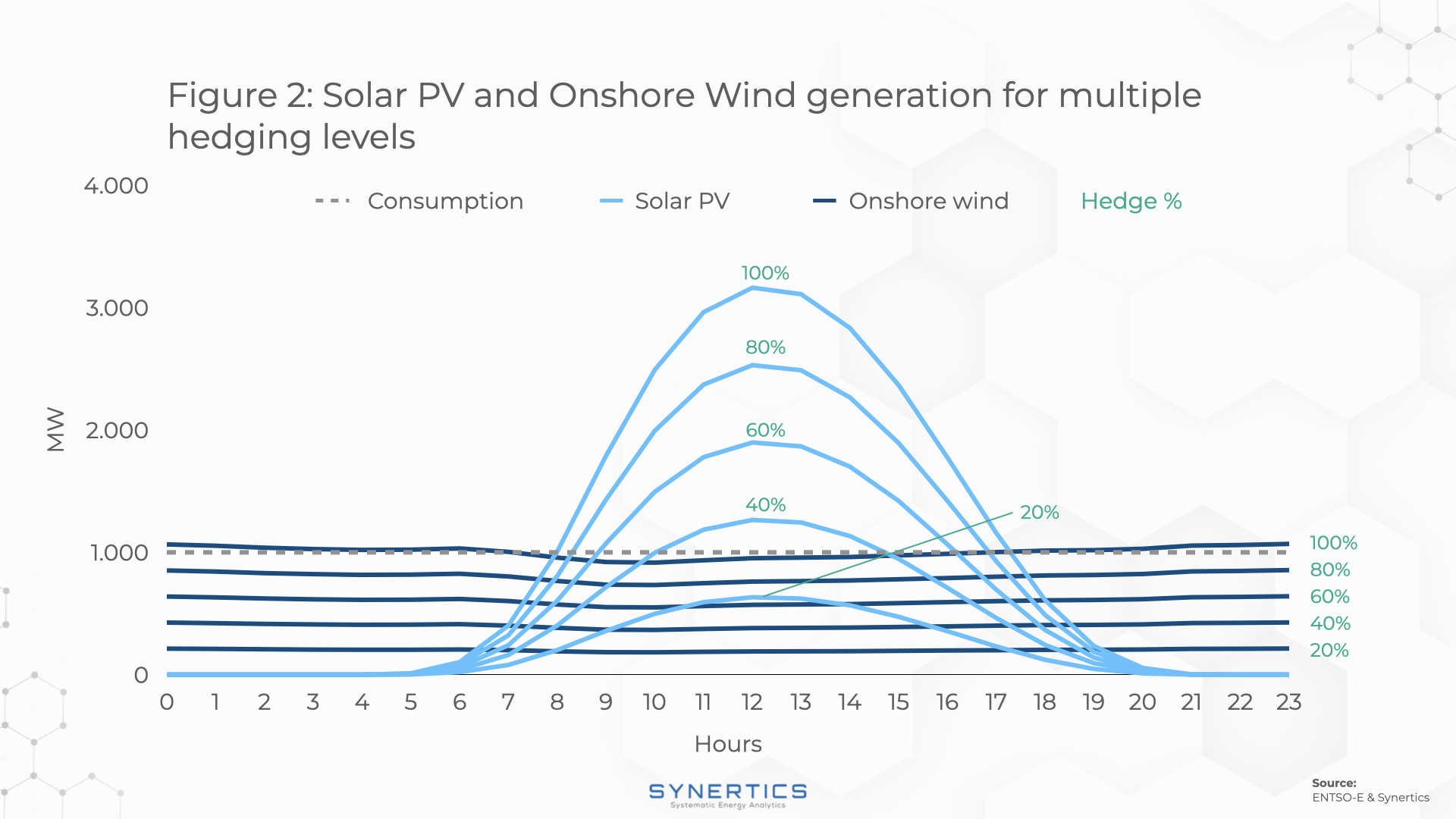

For the simulation, distinct percentages of hedging were tested with a PPA strike price of 57 EUR/MWh. The PPA delivery scheme considered is a Financial PPA, with a Pay-as-Produced structure.

Graph 2 presents the estimated average production profile of a power plant generating from 10% to 100% of the yearly consumption.

Given the solar pattern, hedging over 30% of yearly consumption causes a significantly frequent overproduction, when compared to the offtaker’s consumption. From the offtaker’s perspective, this can configure a risk that shall be properly addressed in the PPA contract.

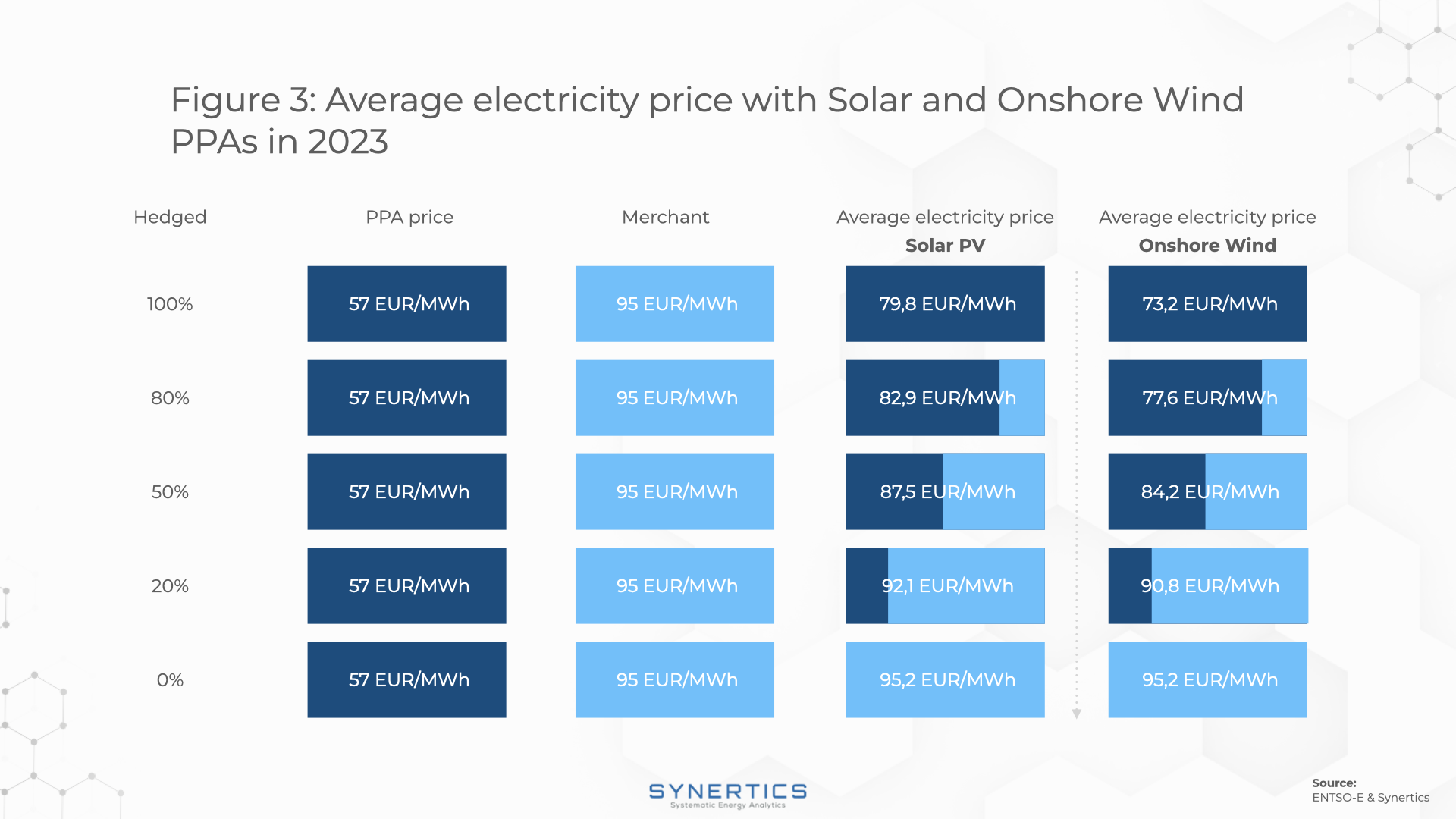

By calculating the electricity costs for each hedging situation, we can estimate the average price paid for electricity by the end of the same year. This gives a good estimation of the savings by entering such a PPA.

Graph 3 presents the average price of electricity for each hedge level for both solar and wind PPAs. Interestingly, solar PPAs can provide savings in the order of 7% when hedging one-third of the yearly consumption, reaching 18% savings if hedging an amount equal to the yearly consumption.

Onshore wind PPAs, on the other hand, can reach higher savings when PPA is at the same price.

A 30% hedging saves around 9% while hedging all the yearly consumption saves around 25%. It is worth pointing out that, despite our simulations using the same PPA price, wind usually costs more than solar, which would change the expected savings.

Hedging electricity consumption with a PPA can provide significant savings for the offtaker. Taking into account the production profile of wind farms, PPAs for wind projects can ultimately provide better savings, when compared to solar, given both follow a pay-as-produced structure with the same fixed price.

As observed in our estimated savings simulation on Graph 3, a 30% hedging, for example, would originate a 7% and a 9% savings for solar and wind, respectively, in 2023.

However, this is not a common practice in the market since wind generators charge higher prices than solar. Therefore, as advantageous as this hedging might be for offtakers, it's essential to keep in mind which technology option will enable the most savings at the end of the day.

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026