Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Looking into the revenues a solar-generating and a wind-generating facility can get from operating in the secondary balancing market in Sweden.

The ancillary services market can provide a second source of revenues for generators, helping to reduce the financial risks of a variable renewable energy asset.

We recently published an article regarding the Ancillary Services market, which you can check here.

During 2023, the Swedish electricity market experienced 429 hours of negative prices, many of them during daylight hours, which poses a large risk to solar and wind generators.

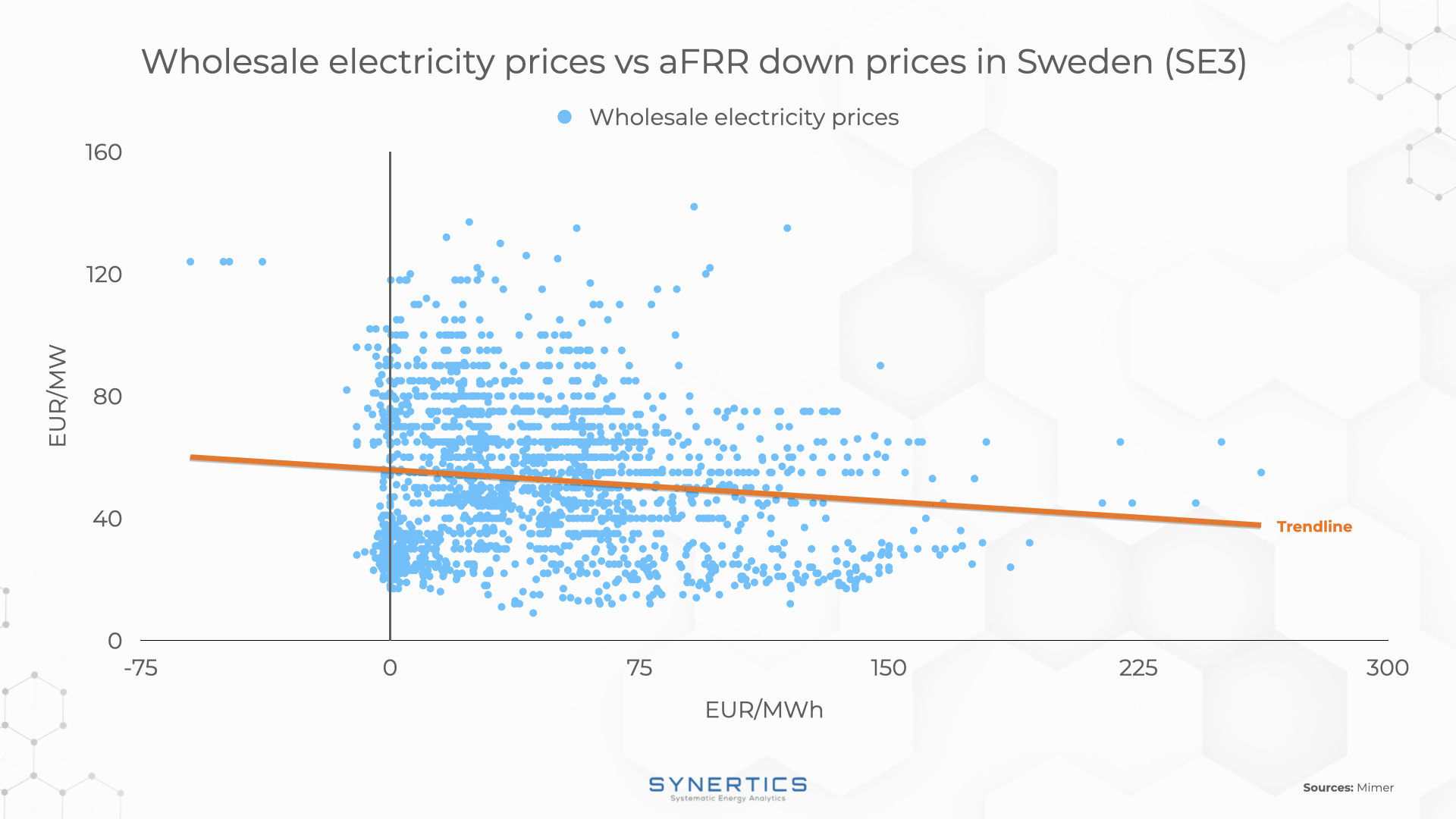

To exemplify the potential of the ancillary services market, Graph 1 presents the relationship between the wholesale electricity prices and the aFRR down capacity prices in Sweden (SE3).

The inverse correlation highlights that when wholesale prices are low, the aFRR prices tend to be higher, thus revealing a revenue opportunity for the generators.

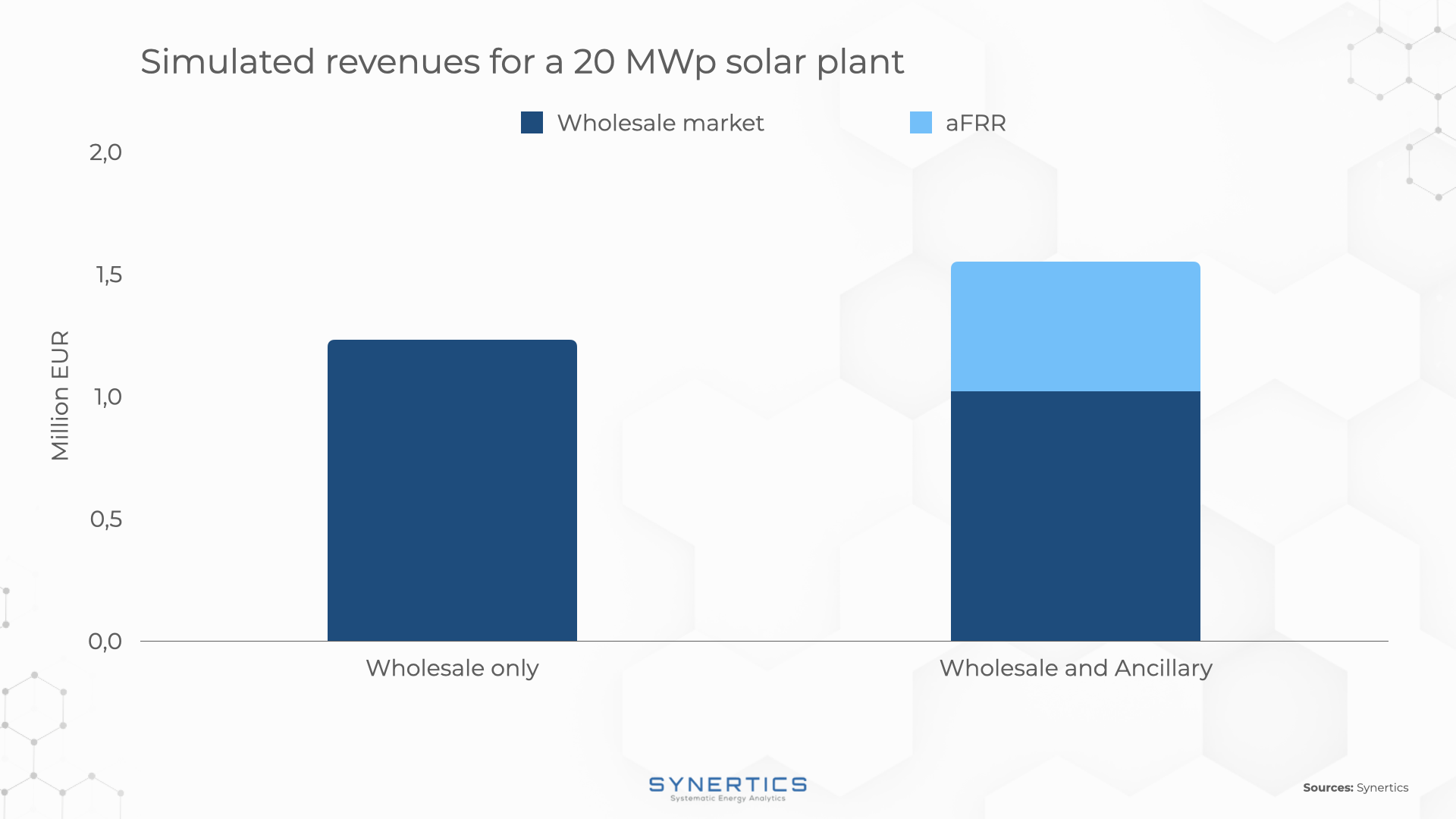

We simulated a 20 MWp solar farm in the SE3 region to understand the impact of operating in the aFRR market in 2023.

The estimated yearly generation of such a solar plant would be 27,3 GWh in 2023. If this power plant operated only in the wholesale market, the total revenue would be 1,23 million EUR in the same year, translating into a capture price of 45 EUR/MWh and a capture rate of 87%.

However, let's suppose that the power plant operator could perfectly optimise its merchant activity, always bidding on the market that gives the maximum revenues. In this situation, the new total revenue would increase to 1,55 million EUR, which is 27% bigger.

Graph 2 presents the total amount of revenues in each case. Although the revenue from the wholesale market would decrease, the total revenue would increase by an expressive amount.

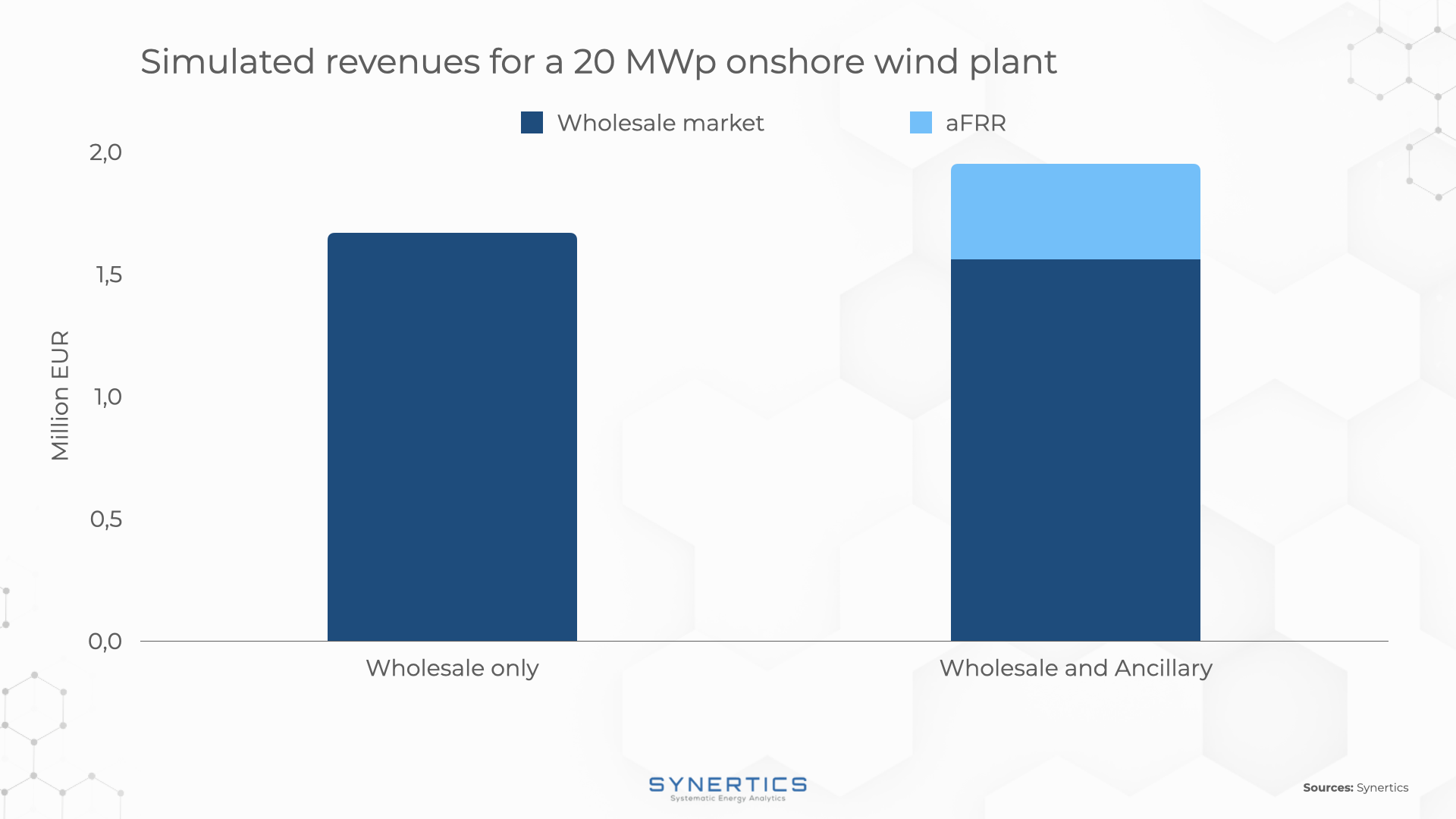

Doing an analogous simulation with a 20 MW onshore wind farm in the SE3 region, the total energy output would account for 39,3 GWh in 2023.

Operating only in the wholesale market, the total revenue would be 1,67 million EUR, translating into a capture price of 42,7EUR/MWh and a capture rate of 82,6%.

However, let's suppose that the power plant operator could also perfectly optimise the merchant activity, always bidding on the market that gives the maximum revenues. In this situation, the new total revenue would increase to 1,95 million EUR, which is 17% bigger compared to not participating in the ancillary service markets.

Graph 3 presents the total amount of revenues in each case. Although the revenue from the wholesale market would also decrease, the total revenue would also increase by a significant amount.

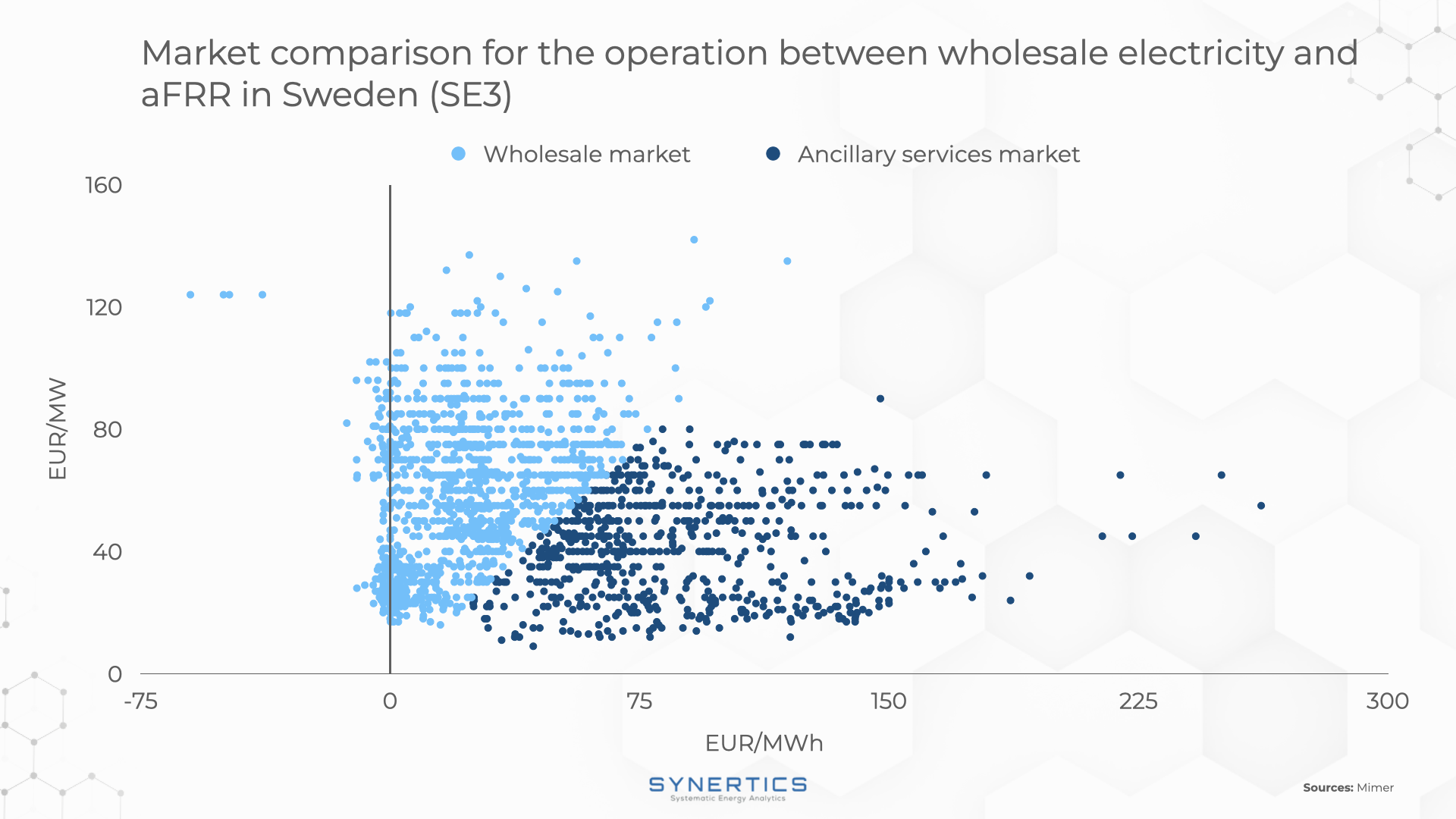

Graph 4 depicts scenarios favoring either the wholesale market or the ancillary services market. It showcases data from Graph 1.

Light blue highlights indicate instances where operating in the wholesale market is optimal, while dark blue highlights situations favoring the ancillary services market.

The ancillary services market offers renewable generators a new revenue stream, as shown in our simulations conducted on solar and wind power plants in Sweden which illustrates such potential for revenue growth.

Even with a portion of the plant's generation hedged with a Power Purchase Agreement (PPA), the revenue portion operating on a merchant basis can be significantly increased through participation in the spot and ancillary service markets.

Market-trends

6th Feb, 2026

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025