Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Understanding how Wind and Solar Capture Prices compare to the Levelized Cost of Energy in four European countries.

The Levelized Cost of Energy (LCOE) defines the minimum average price that an electricity-producing asset requires to offset its investment and operational costs over its lifetime. To learn more about LCOEs, read What is the Levelized Cost of Energy (LCOE).

According to the International Renewable Energy Agency (IRENA), from 2010 to 2022, the global LCOE for solar and wind technologies fell considerably. Solar photovoltaic’s global LCOE experienced the fastest fall going from EUR 0.423/kWh to EUR 0.047/kWh*, representing an 89% reduction. Both onshore and offshore wind technologies also presented large reductions, falling 69% and 59% respectively.

* 2022 USD to 2022 EUR exchange rate of 0.951 EUR/USD.

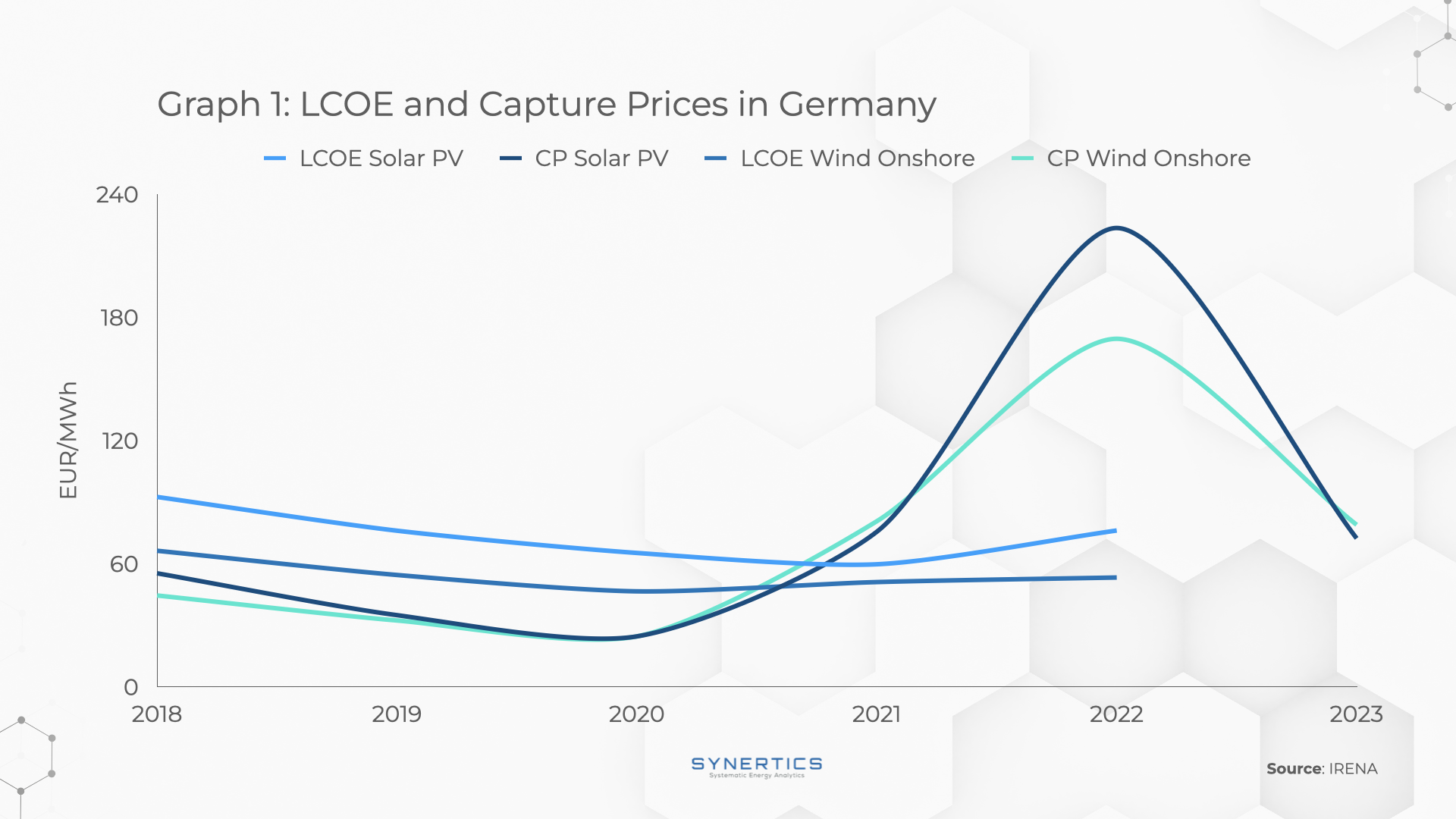

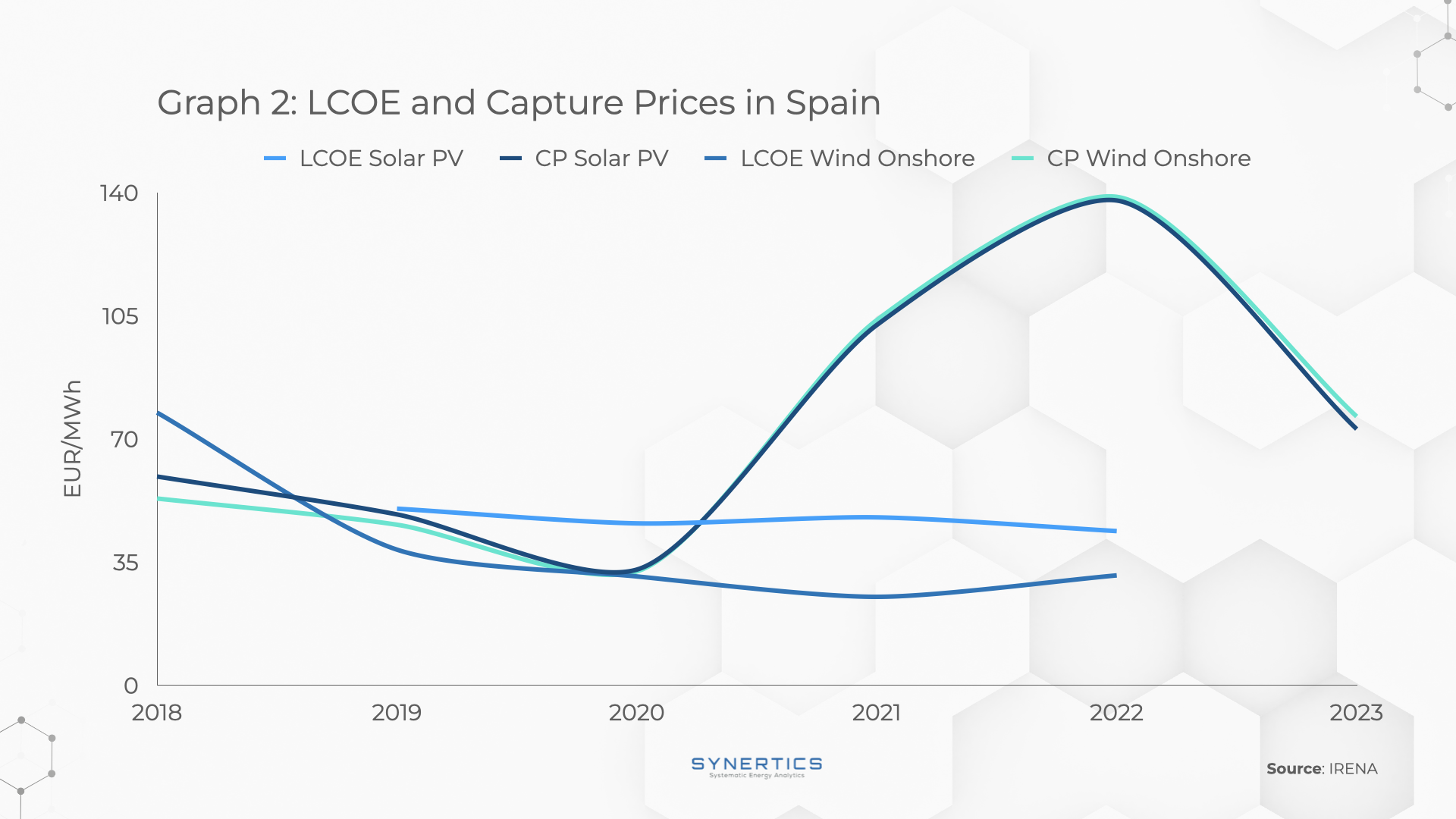

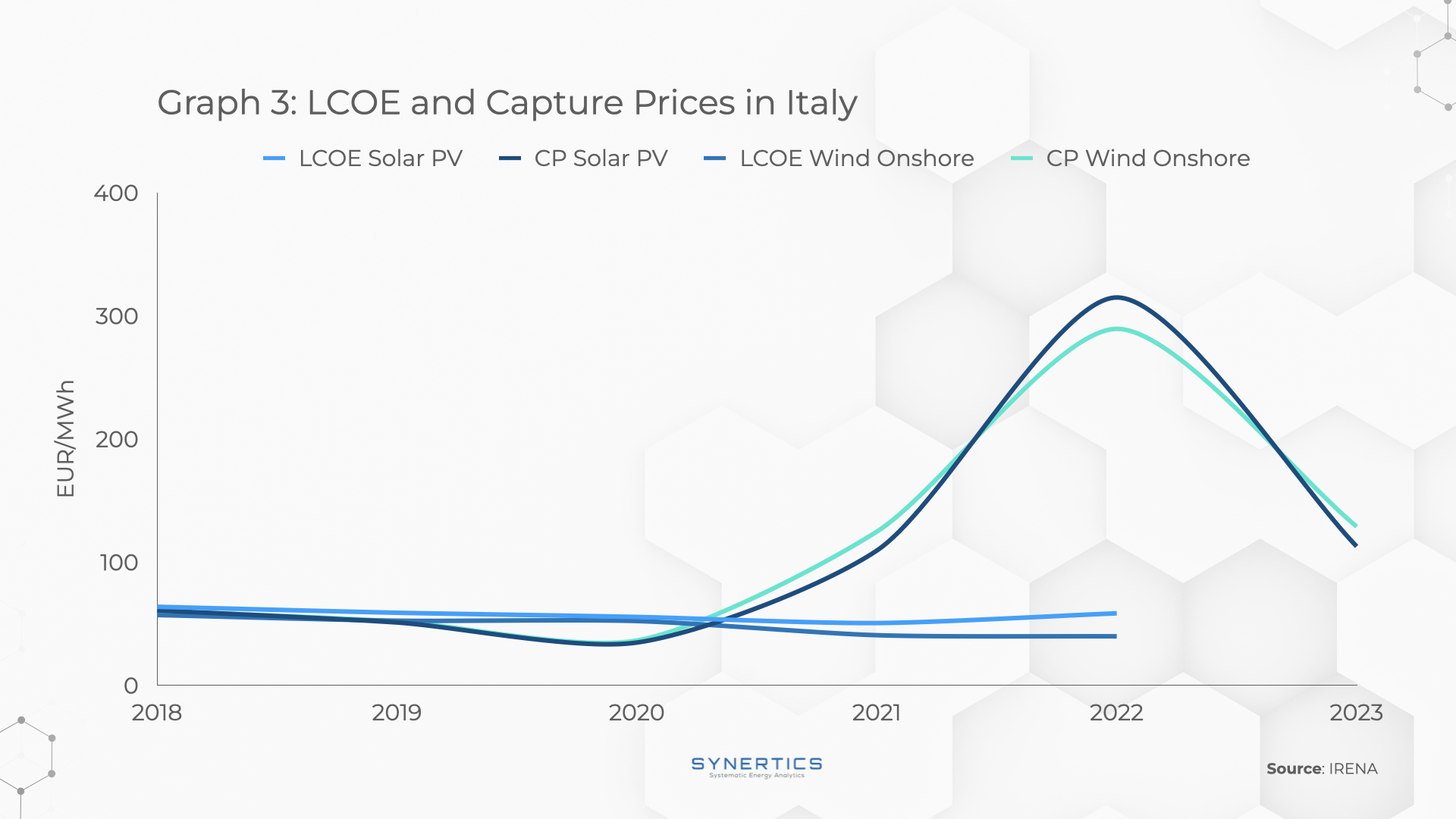

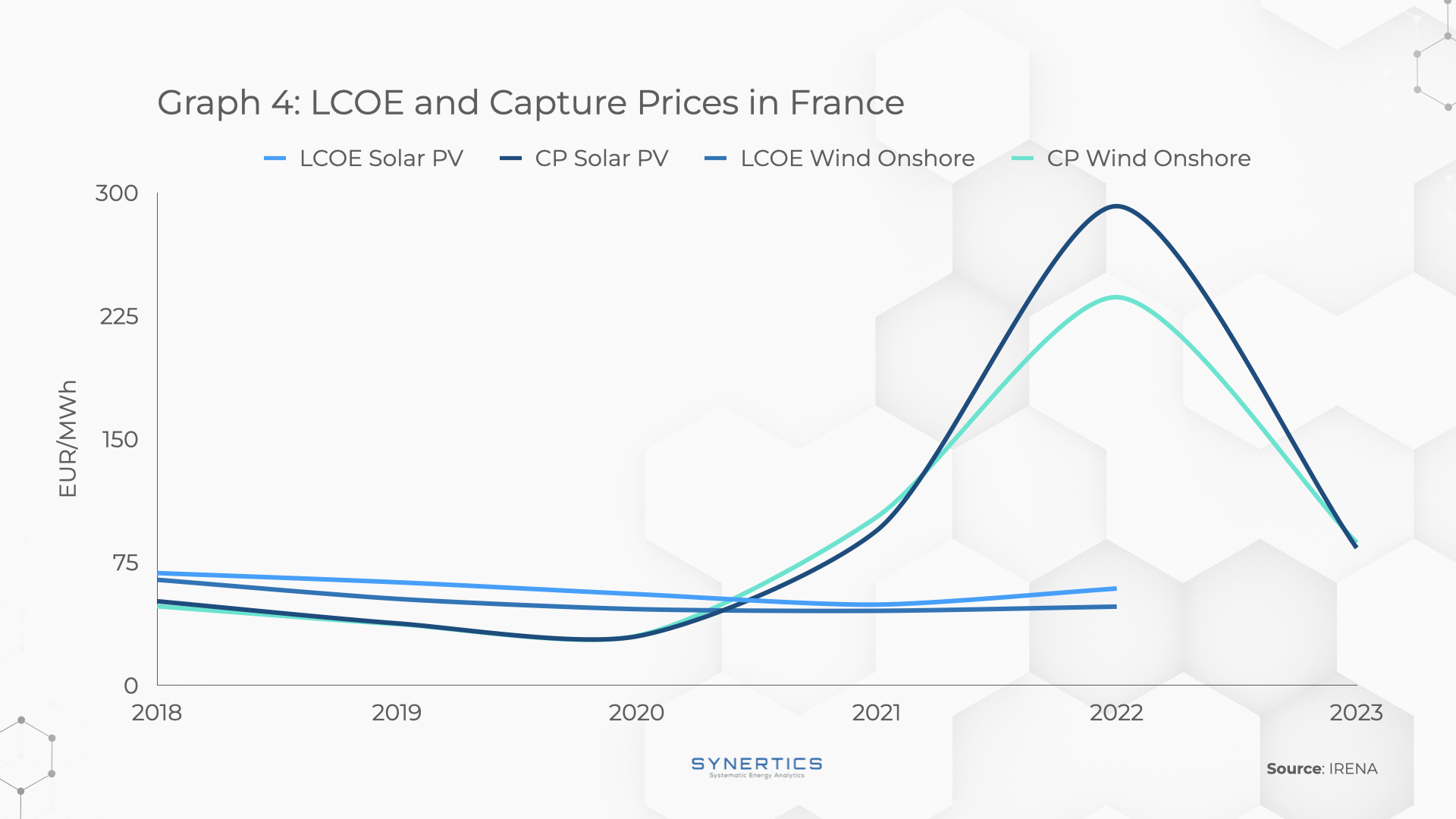

Graphs 1 to 4 present the evolution of Solar PV and Wind Onshore LCOEs from 2018 to 2022 and Capture Prices from 2018 to 2023 in four countries. Despite significant disparities among countries, there is a consistent downward trend in the LCOE for solar PV until 2021, followed by an increase in 2022. However, Spain stands out with a different trend for both 2021 and 2022. A similar pattern is observed for onshore wind technology, with Spain showcasing the lowest LCOE for both solar and wind energy in 2022.

The energy crisis in Europe in 2022 caused a sharp increase in wholesale prices. This can be observed in the graphs through the spike in the Capture Prices during this period, which presented itself as a positive opportunity for investments in renewables. For all countries analysed, the Capture Prices largely exceeded the LCOEs in 2021 and 2022, making the projects more profitable and less risky for developers and investors. In 2022 solar PV capture prices surpassed onshore wind capture prices. This was triggered due to the energy crisis caused by the war in Ukraine, where electricity prices spiked during the summer, during which solar generation is generally higher than onshore wind generation.

Although IRENA currently only provides LCOE data up to 2022, there are some points worth noting about Capture Prices in 2023. The wholesale electricity prices in Europe decreased after a peak in August 2022 and oscillated around more stable values in 2023, closer to the ones seen before the energy crisis. These lower prices have an impact on the renewable facilities, posing risks to the producers’ revenues. Renewable energy plants operating under a PPA/merchant revenue scheme require Capture Prices to be above LCOEs in order to operate profitably.

The scenario above cannot be seen as a determinant for investing in utility-scale renewable generation because wholesale electricity prices can vary largely, as seen in 2022. However, it serves as a crucial risk indicator and provides valuable insights into price trends. Precisely assessing a power plant’s LCOE can aid investors in making informed decisions about whether to invest or not.

Despite the risks associated with fluctuating electricity prices, power plant owners have the option to hedge against them. By entering into PPAs with off-takers, they can secure a predictable revenue stream, thus effectively mitigating these risks.

Market-trends

4th Mar, 2026

Insights, Market-trends

27th Feb, 2026

Market-trends

6th Feb, 2026