Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

In this article, we are going to take a look into the historical values of both the Capture Prices and the Capture Rates in the two leading countries for PPAs in Europe. Our calculations were based on each country’s entire solar generation, rather than focusing on a particular region or Solar PV plant.

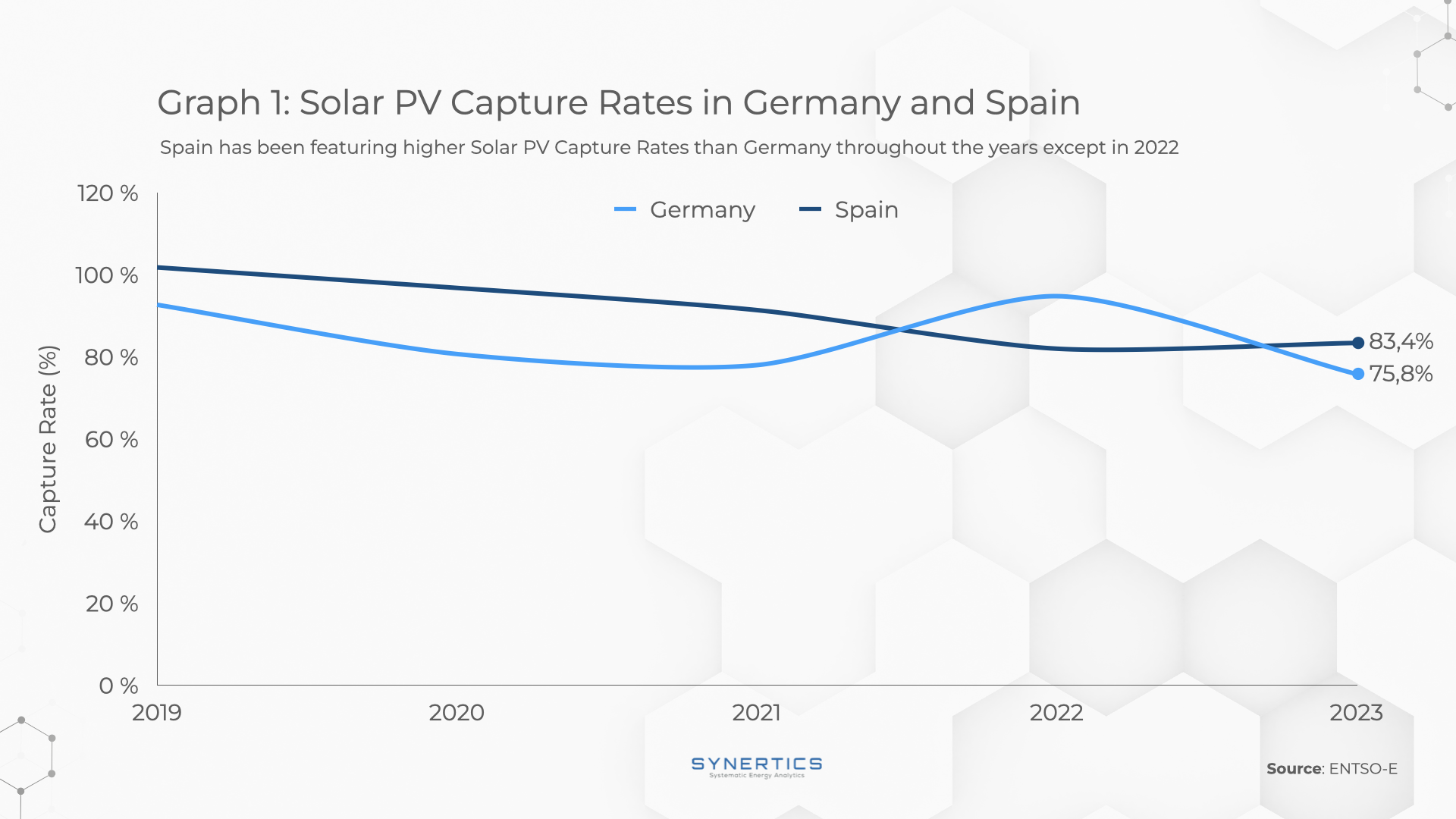

The Capture Rates measures, in %, the ratio between the Capture Price and the Baseload Price a project achieves according to its technology (wind or solar PV) and geographic-specific renewable energy resources (wind speed or solar irradiation) throughout a given period.

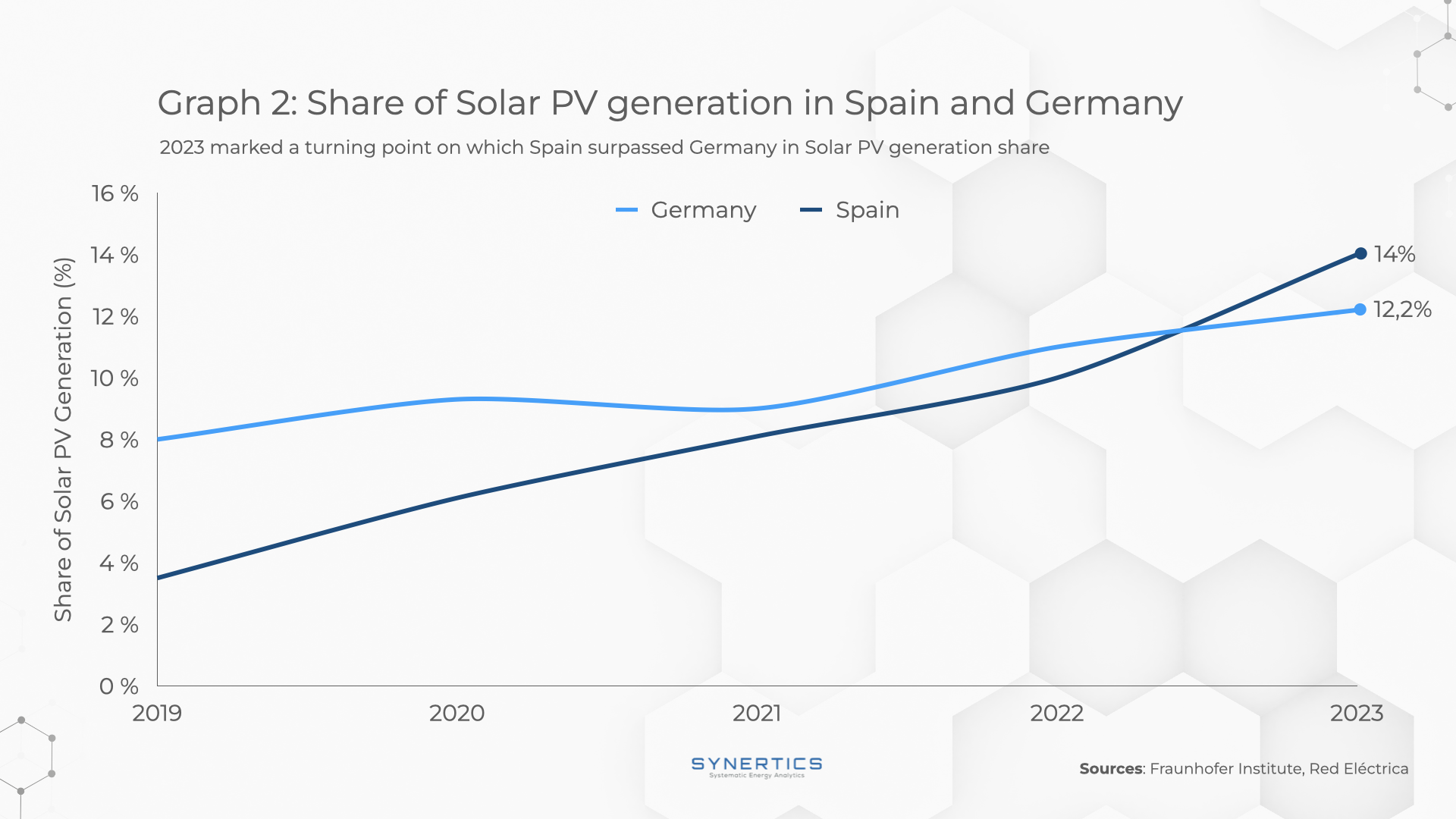

Capture Rates have been steadily decreasing as more generation capacity of a specific technology is introduced into an electricity system.

In this scenario where both Capture Prices and Capture Rates are decreasing, we might expect some risks related to the revenue streams and, therefore, the profitability of solar projects. Both Spain and Germany are putting strong efforts into deploying more renewable generation, which will probably increase competition between generators during sunny hours, pushing down the Capture Rates for solar projects even more.

In this sense, hedging with PPAs is a good option for power plant owners to protect their assets against wholesale price trends and cannibalization effects. The fixed prices of PPAs guarantee a more predictive outcome for developers who need to secure their revenue streams and minimise risks, especially in volatile periods, such as the one we have been experiencing.

In the same way, hybridisation and storage applications may also help by introducing complementarity and allowing for energy arbitrage.

During the past 5 years, the Capture Rates presented a downward trend in both Germany and Spain, with an exception in 2022 for Germany. Due to the growing share of solar generation in both countries, the Capture Rates trend is expected to keep decreasing, as a consequence of a cannibalization effect. At the same time, wholesale prices are in a downward trend in Europe, which pose even more risks for solar PV producers and make PPAs a critical solution to de-risk revenue streams.

Market-trends

6th Feb, 2026

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025