Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

In recent years, Romania has witnessed a notable surge in renewable energy initiatives.

As the country seeks to align its decarbonisation targets to EU’s guidelines, this momentum is driven by both geopolitical considerations and the imperative of addressing climate change.

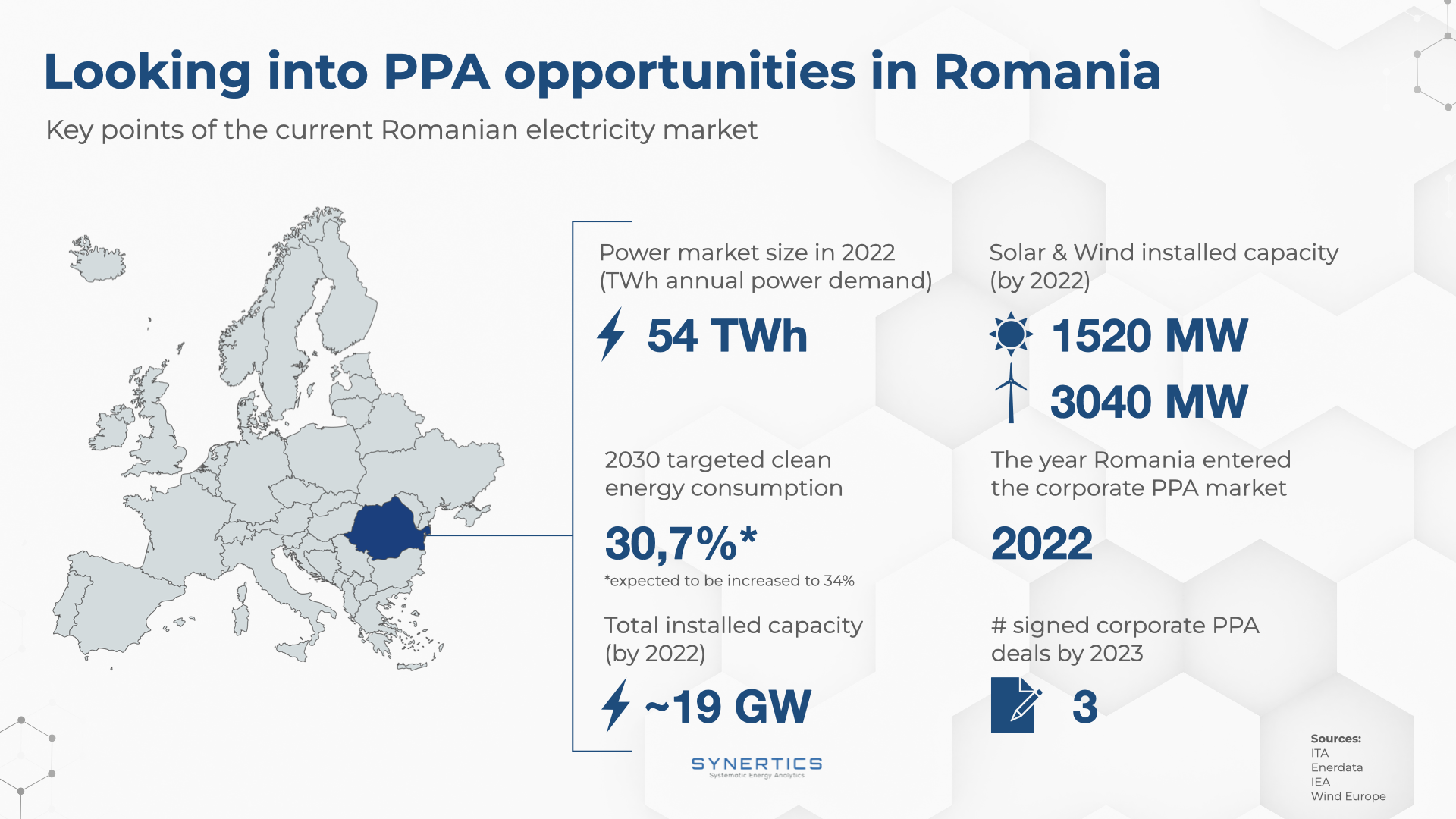

According to the Romanian National Regulatory Authority in the Energy Field (ANRE), as of June 2023, there was an installed power production capacity of approximately 19 GW. Within this capacity, around 4,560 MW are attributed to wind and solar projects.

With a considerable amount of projects in the pipeline, it's also worth mentioning that the power grid can absorb only 9 GW of new renewable energy capacities, as stated by the national TSO, Transelectrica.

Romania has set ambitious targets to reduce its dependence on fossil fuels. The plan is to increase the share of renewable energy in the energy mix to 30,7% by 2030. However, as recent projects reach a Ready-to-Build (RTB) phase, the target is now to be potentially increased to 34%.

To contribute to this ambition, the country intends to install net capacities of 5.1 GW in solar and 5.3 GW in wind projects in the next years.

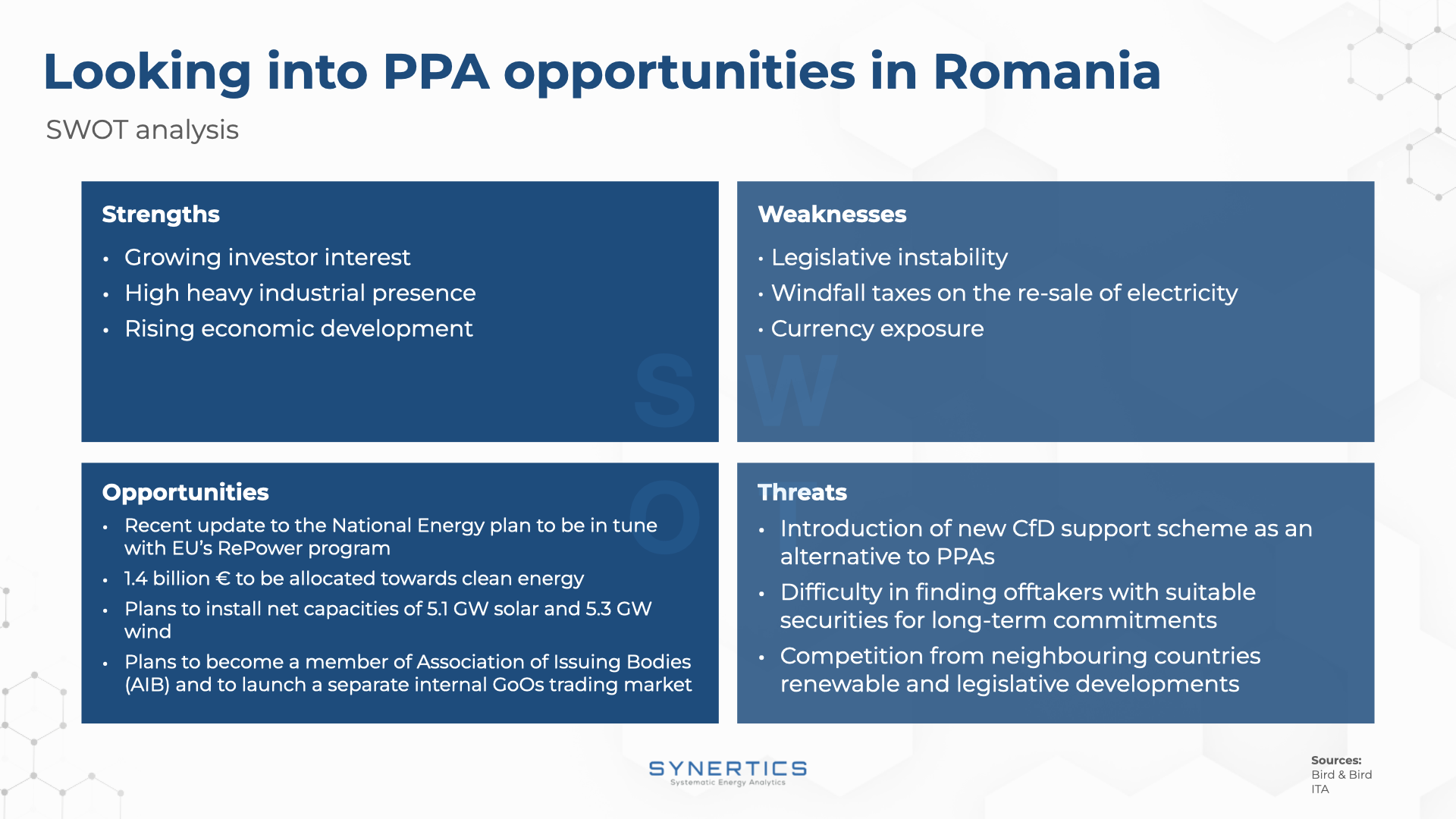

From our SWOT analysis of the current Romanian PPA scenario, we were able to propose a TOWS matrix with the following approaches:

- Overcoming windfall taxes by collaborating with the government and industry stakeholders to develop more favorable taxation policies for renewable energy projects.

- Countering the threat of a new CfD support scheme by highlighting the advantages and efficiency of PPAs.

- Overcoming competition from neighbouring countries by showcasing the unique advantages of investing in Romanian renewable energy, possibly through policy advocacy and international collaborations.

- Leveraging the rising economic development to create strategic partnerships and secure long-term commitments from potential offtakers, especially in the industrial sector with a greater need to decarbonise their consumption.

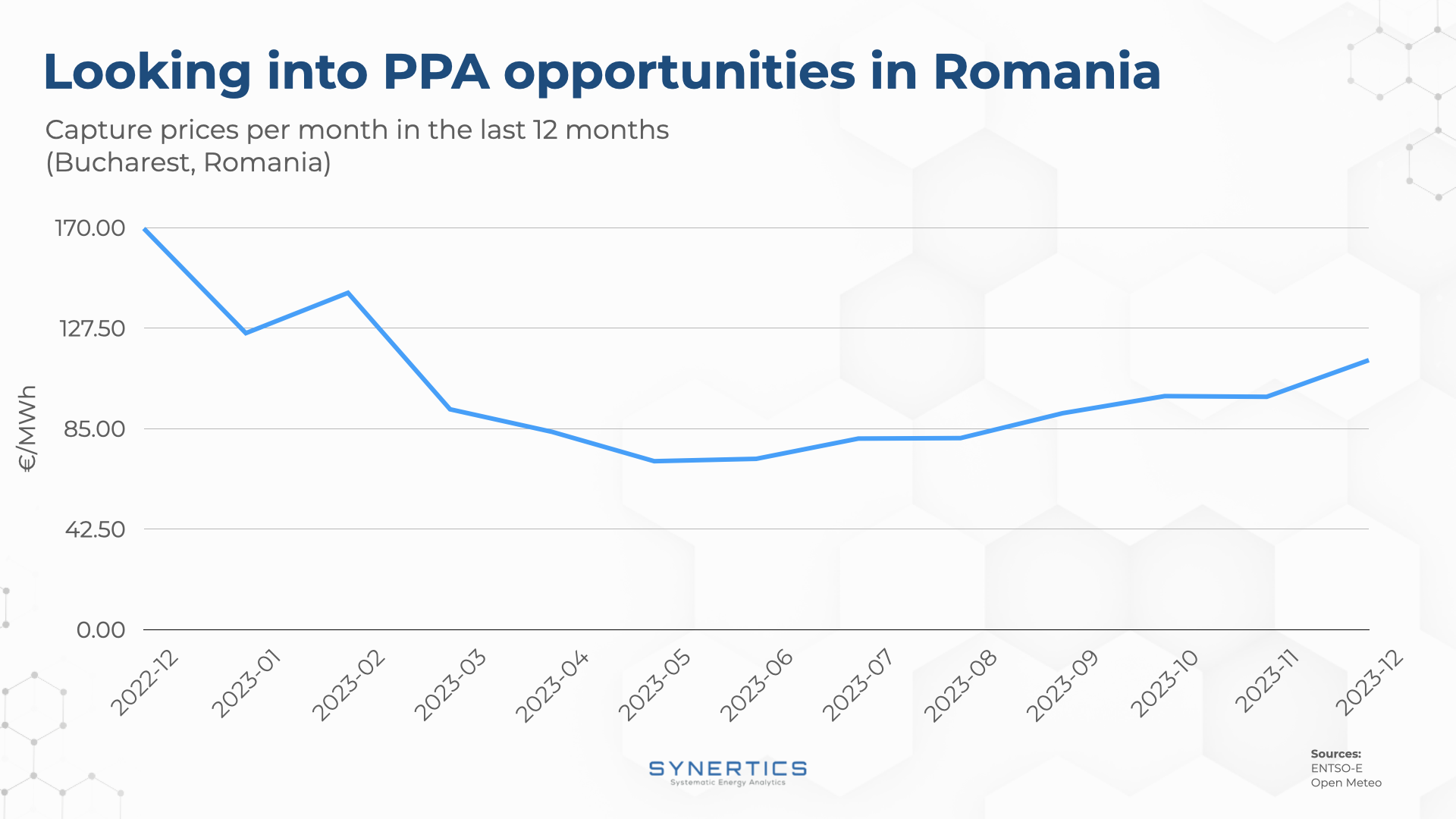

In 2023, the Capture prices reduced significantly in comparison to the previous year, accounting to an almost 70% price reduction.

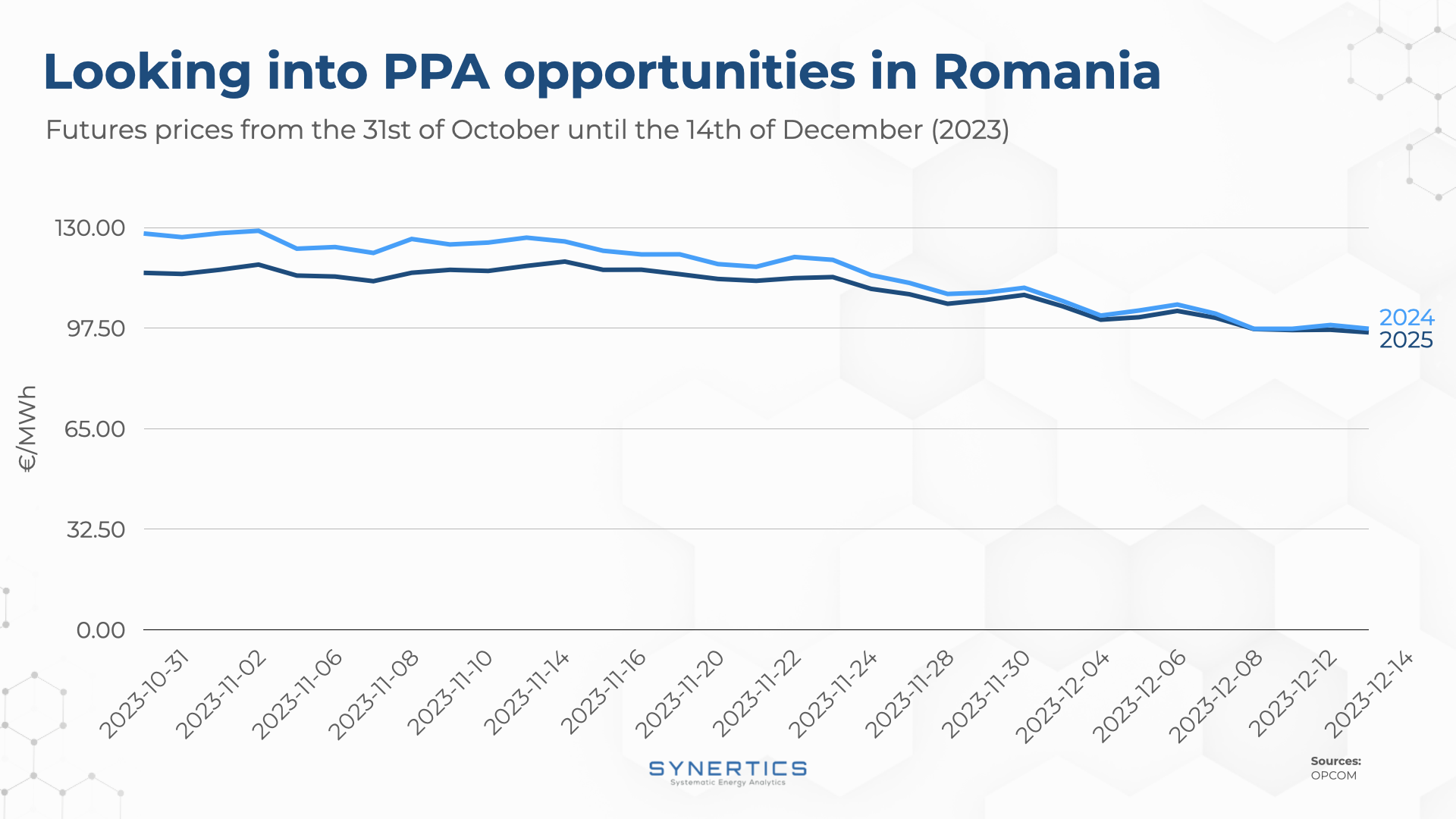

Looking at recent Futures prices for the years 2024 and 2025, we have seen a decrease from 130 €/MWh to 96 €/MWh, suggesting that there is a decreasing price expectation for the coming years.

Driven by renewable targets, government support, and a desire for green energy, the interest for PPAs in Romania remains high, despite the ongoing regulatory uncertainties.

As a substantial number of projects reach the RTB phase, developers seek financial backing from credit institutions. The ability to secure such support often depends on developers closing a PPA, stating the pivotal role these agreements play in advancing the energy transition.

Market-trends

6th Feb, 2026

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025