Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Europe's shift towards renewables, driven by the volatility of fossil fuels, brings the relationship between natural gas and day-ahead electricity prices to the spotlight.

Electricity and natural gas intertwine as both competitors and allies. They play dual roles in energy production and domestic/commercial applications.

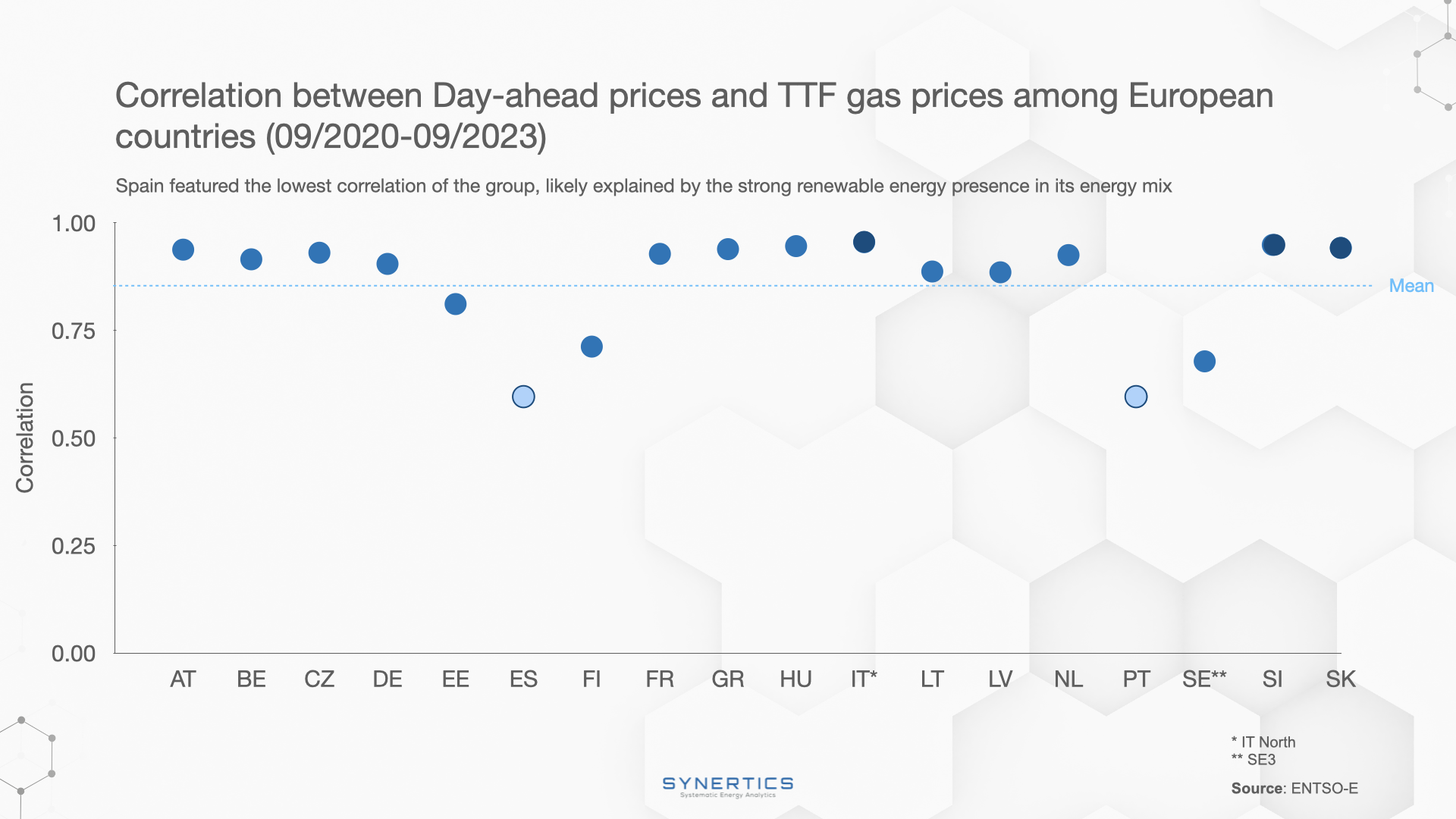

A nation's energy mix often dictates the correlation intensity with TTF prices. Therefore, countries deeply anchored to natural gas tend to resonate more with TTF price shifts. Furthermore:

- Energy diversification can buffer against gas price swings.

- Shifting energy policies, particularly leaning towards renewables, can accentuate this correlation.

- Infrastructure, both in storage and distribution, weighs in this dynamic.

Strong correlation:

Italy, Hungary, Slovenia, Slovakia, and the Netherlands stand out due to their geographic positioning, infrastructure, energy stances, and European market integration.

Moderate correlation:

Countries like Germany and the Baltics (Estonia, Finland, Lithuania, Latvia) present a balanced interplay, with other energy sources or local dynamics softening the TTF's impact.

Low correlation:

Portugal and Spain, with their distinct energy strategies, display a milder correlation, signaling robust buffers against gas price spikes.

Deciphering the correlation between gas and electricity prices across Europe is a layered task, influenced by a country’s energy mix. In our sustainability-driven times, understanding these intricacies becomes pivotal for a resilient European energy future.

Synertics provides advisory services and develops digital data-driven solutions for the energy industry with the purpose of driving productivity and transferring knowledge.

Market-trends

6th Feb, 2026

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025