Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

As renewable energy capacity rises, Germany’s electricity market faces an increasing number of hours with negative electricity prices.

Negative prices pose a significant threat to electricity producers and can harm the return on investments, especially in the case of solar and wind technologies, which are characterised by their inflexible production nature. During PPA negotiation it is crucial to set the correct terms for the event that negative prices occur, ensuring the attractiveness of the contract.

In a previous article we have investigated this phenomenon in Europe, understanding the differences in each country and when they tend to occur. In this article we will take you along on a further deep dive into the landscape of negative electricity prices in Germany specifically.

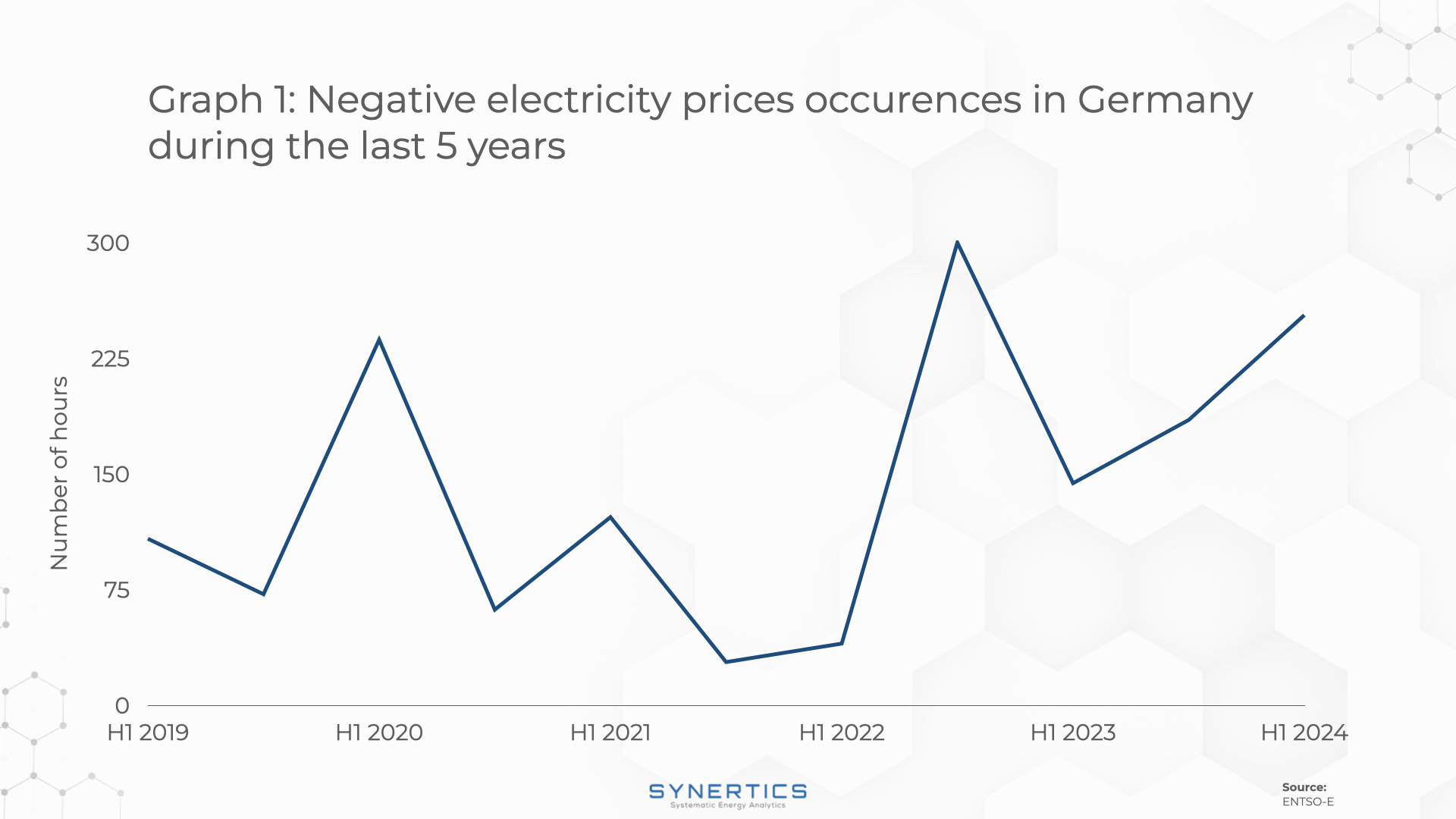

Graph 1 illustrates the frequency of negative price occurrences in Germany over a period of five and a half years from January 2019 until June 2024. The data, segmented into half-year periods, highlights significant fluctuations in the number of hours with negative electricity prices.

Several key trends and events likely influenced these fluctuations. Firstly, the sharp spikes in negative prices observed around early 2020 can be attributed to the economic impacts of the COVID-19 pandemic, which drastically reduced electricity demand due to lockdowns and decreased industrial activity. The subsequent recovery phase also shows variability as the economy adjusted to post-pandemic conditions, alongside several smaller localised lockdowns in early 2021.

Another notable factor is the increasing usage of renewable energy sources, particularly wind and solar power, in the German energy mix. The high availability of renewable energy, especially during periods of low demand, can lead to an oversupply of electricity, thus driving prices into negative territory. Countries with higher renewable energy capacities, such as Germany, exhibit more pronounced fluctuations, reflecting the impact of renewables on the market.

Additionally, the geopolitical tensions stemming from the Russia-Ukraine war since early 2022 have contributed to energy market instability. The conflict has led to volatility in natural gas prices and supply concerns, indirectly affecting electricity markets such as Germany especially heavily given its previous dependance on foreign natural gas. The increase in electricity prices during this period have led to a decrease in the occurrence of negative prices.

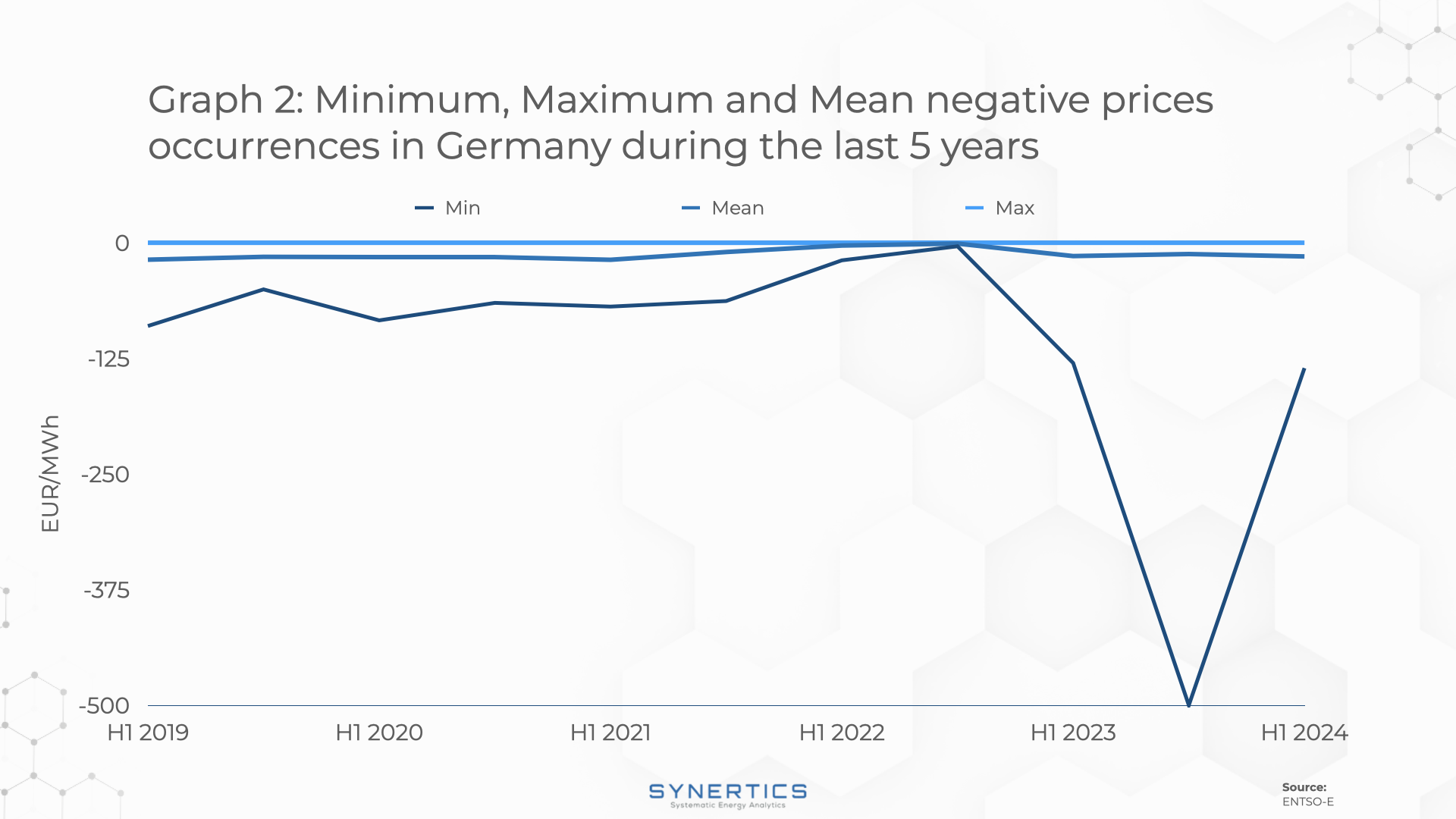

Graph 2 describes the negative price trends in Germany over the same period of five and a half years from January 2019 until June 2024. It clearly shows that negative prices are not a new development. Most recently, since January 2023 Germany has seen an increase in values lower than -100 EUR/MWh.

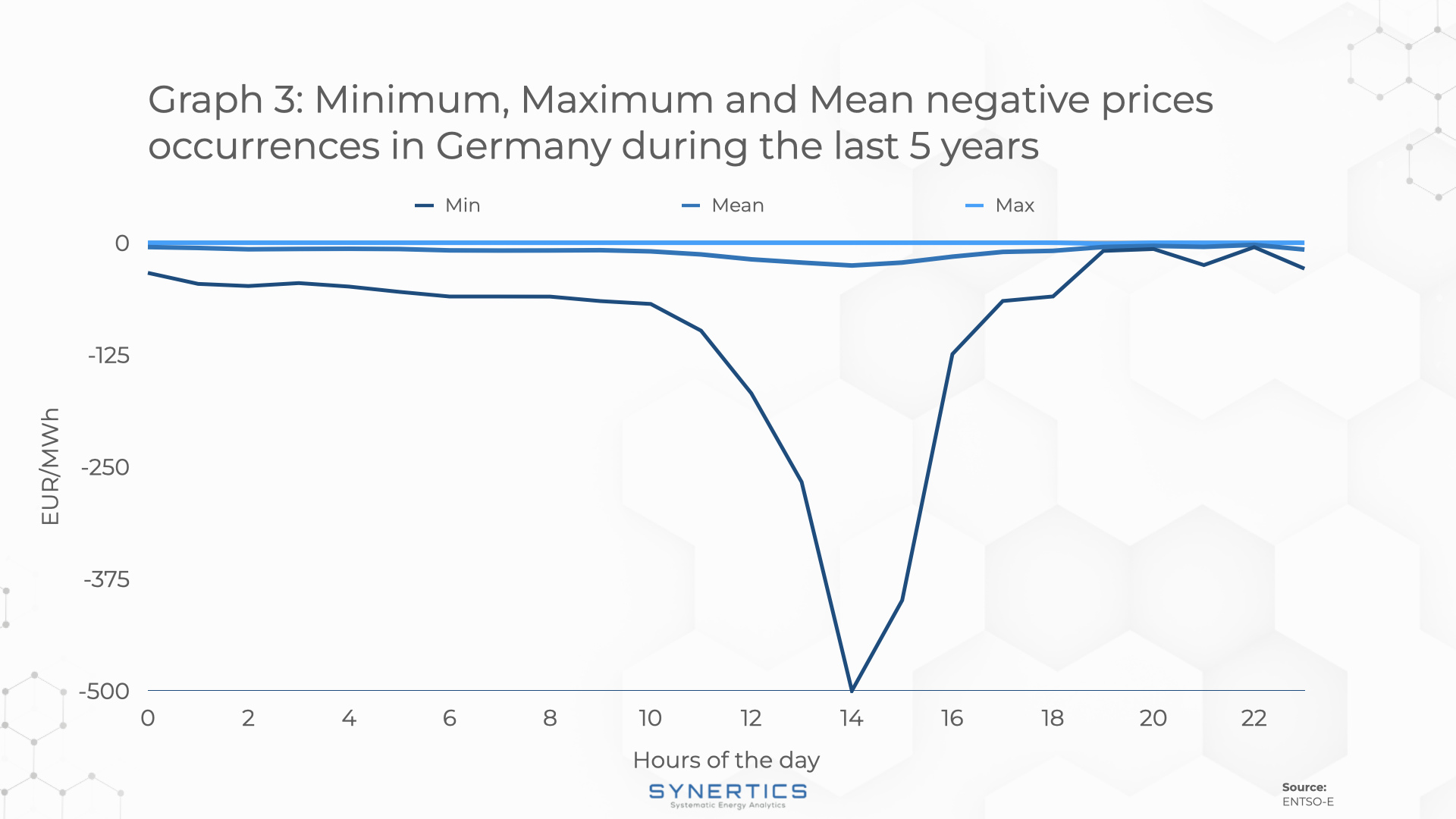

Graph 3 presents the hourly distribution of negative prices over the same period of time and demonstrates clearly that every hour of the day sees the occurrence of negative prices, both during the day and at night. The large dip around 2 PM in Graph 3 can be attributed to the all-time low price event described in more detail in Graph 4.

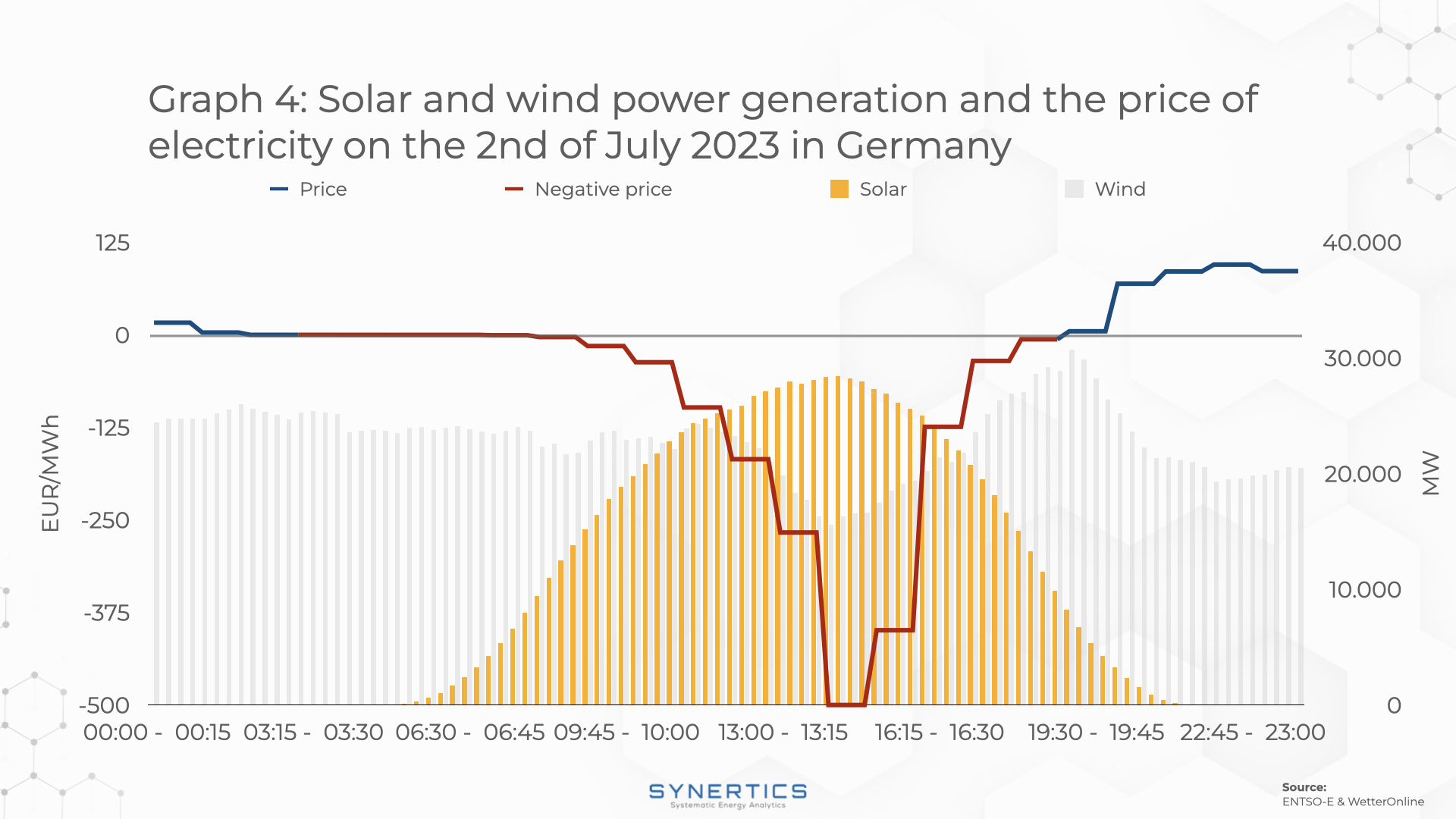

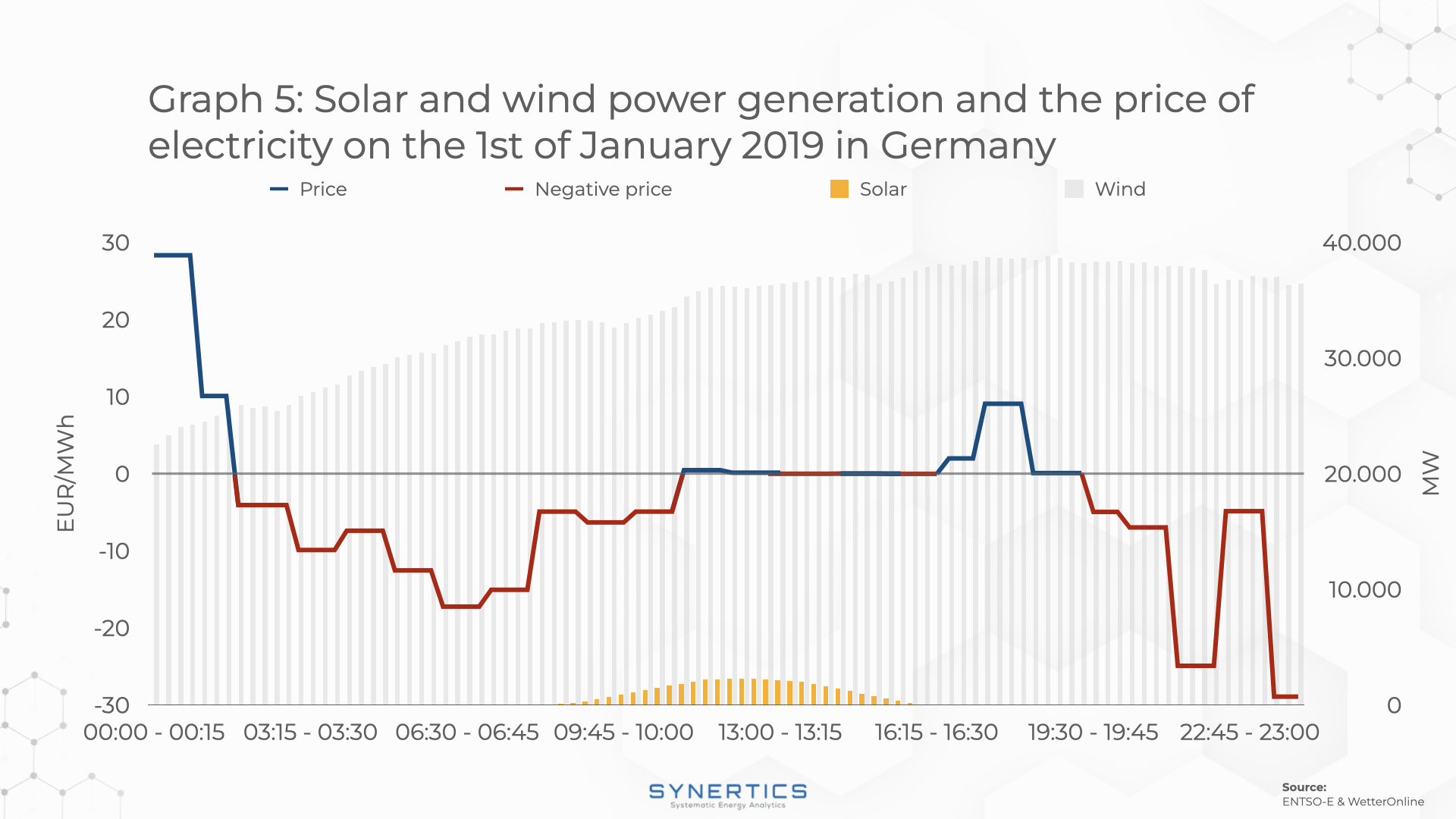

We studied two exemplary days since 2019 in particular to illustrate the influence of solar and wind on the occurrence of negative prices.

Graph 4 shows an especially sunny Sunday in Germany (July 2, 2023). In addition to high solar production, wind energy production was also significant. However, given that this occurred on a Sunday, there was little demand for this energy. Exporting the surplus energy across different bidding zone borders in the form of cross border trade was likewise of little uses. Thus, an imbalance between supply and demand existed, sending prices into the most significant dip since 2019, reaching an all-time low of -500 Euros per MWh that day.

Graph 5 depicts the production of solar and wind power and the price of electricity on a windy national holiday (January 1, 2019). Despite high wind power generation, the overall electricity demand was significantly lower due to the holiday. Industrial activities and businesses were largely inactive, leading to reduced demand for electricity. Consequently, the surplus wind energy could not be fully utilised, resulting in an oversupply. This imbalance between supply and demand led to negative electricity prices, as the market adjusted to incentivize consumption and manage the excess generation.

The increasing frequency of negative electricity prices in Germany highlights the complexities introduced by the rising share of renewable energy sources in the power mix. Factors such as economic disruptions, renewable energy surges, and geopolitical tensions have all impacted this phenomenon. To stabilise supply and demand and mitigate negative prices, it is essential to invest heavily in energy storage solutions, enhance inter-bidding-zone trade, and improve grid management strategies as well as grid infrastructure itself. These measures will help ensure a more balanced and resilient electricity market, accommodating the growing contributions of wind and solar power.

Market-trends

6th Feb, 2026

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025