Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Fluctuations in Futures curves and their differences to the spot price can provide essential information for energy generators concerning the pricing of their PPA contracts, and for Corporate offtakers, who usually have an intensive demand for electricity and need to renew their contracts.

In this article, we will briefly analyse a recent trend: the reduction in price differences between contracts expiring within the next five years compared to previous years.

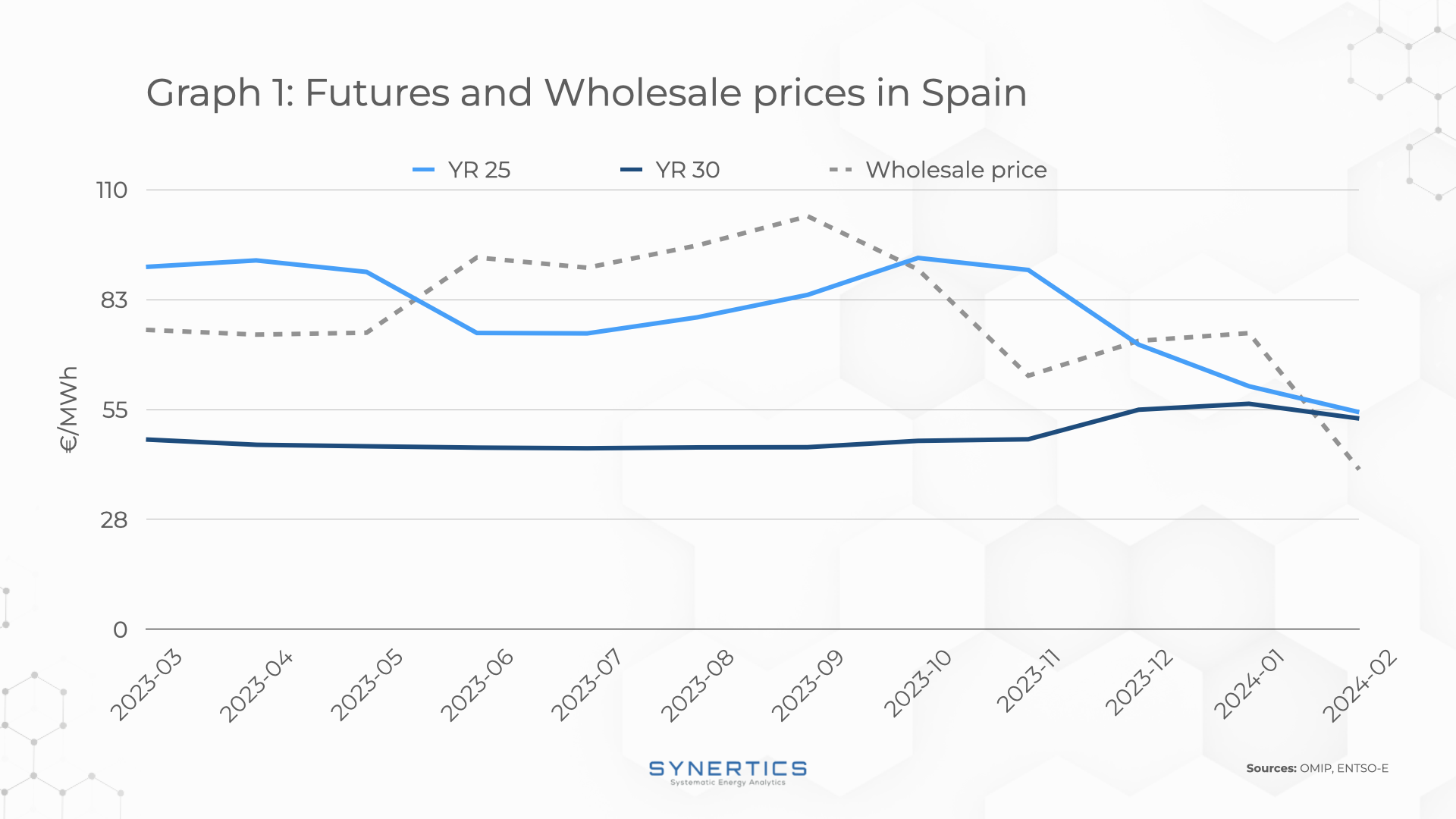

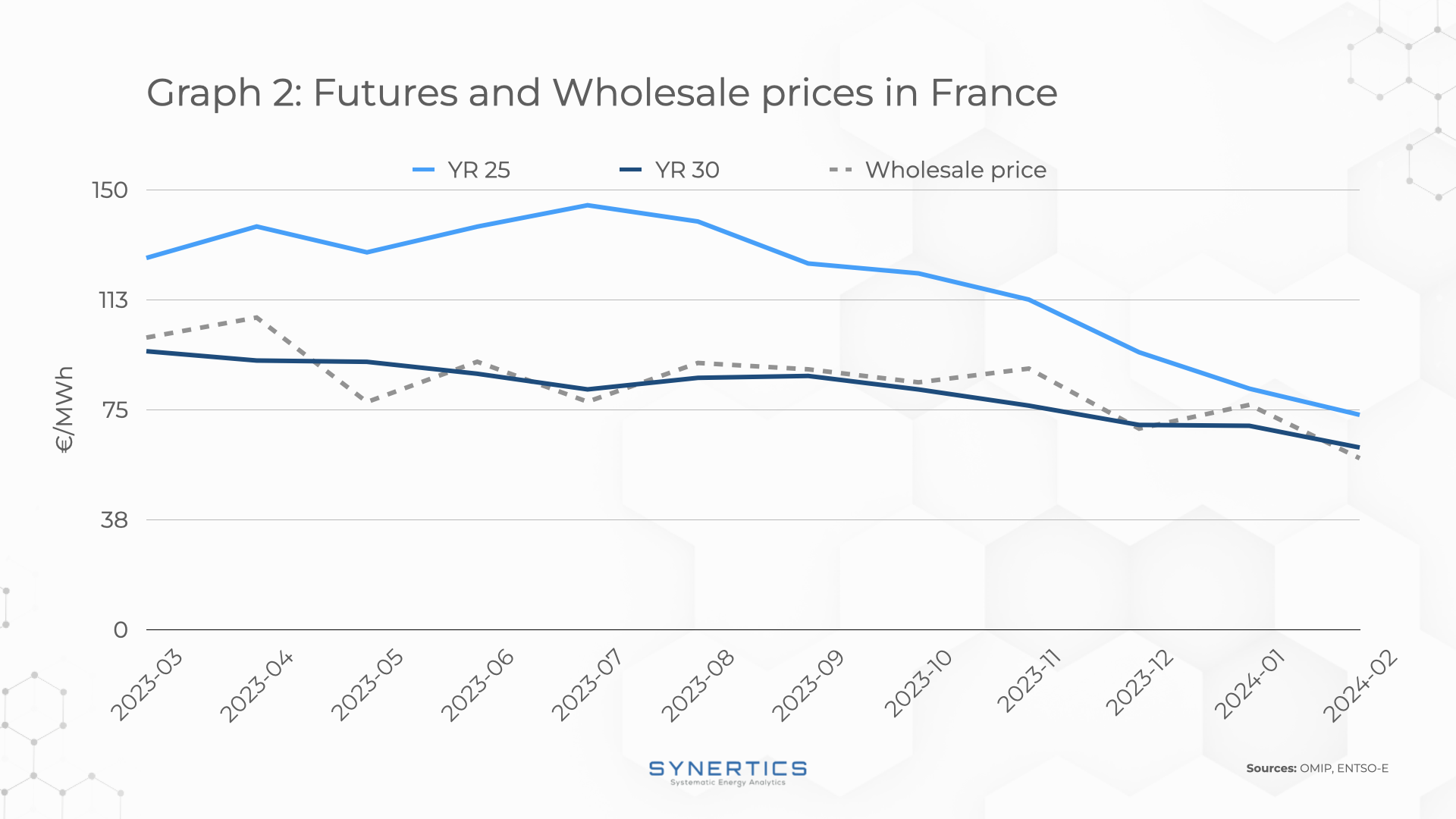

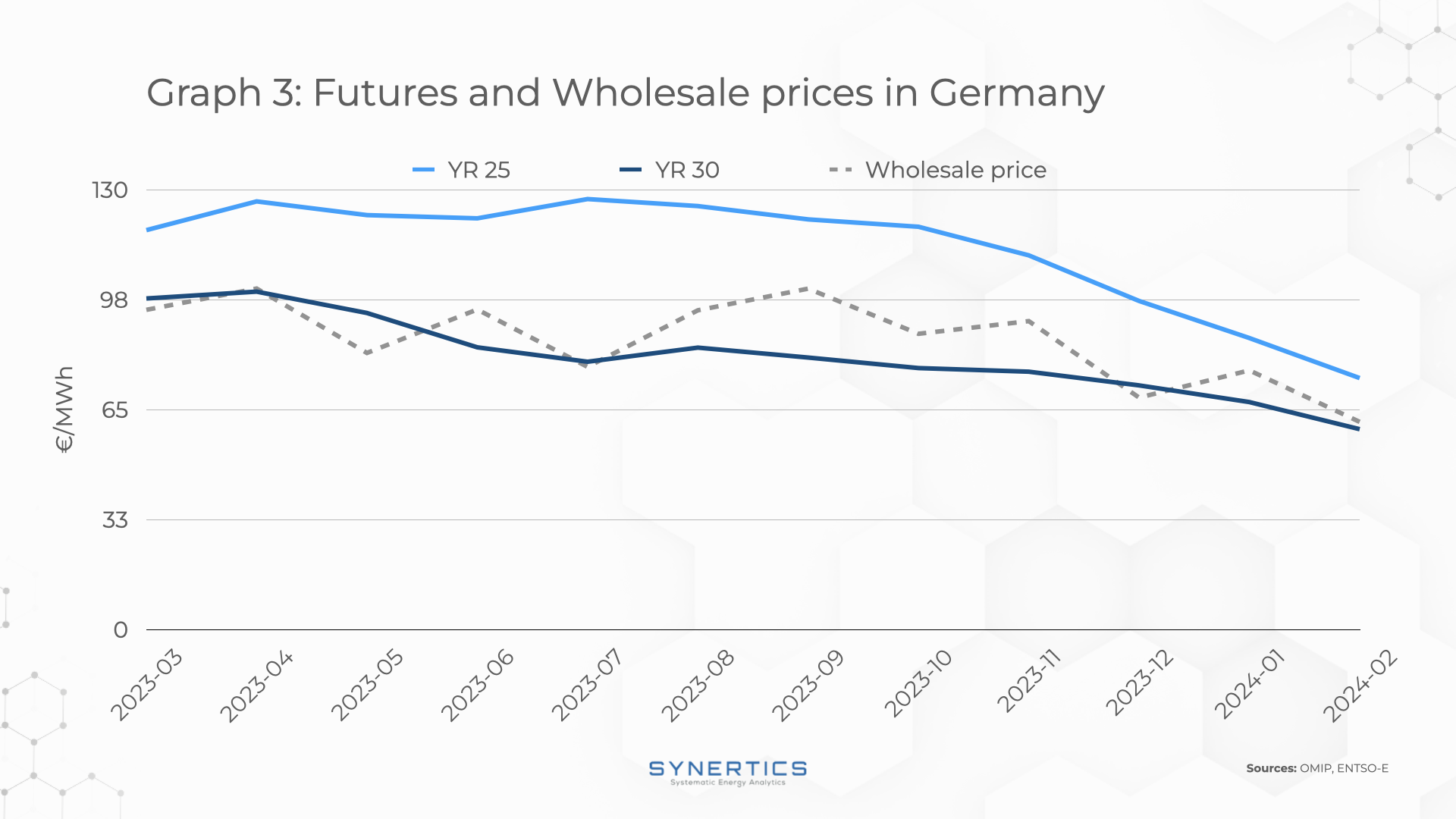

We have chosen to examine three markets:

Across all three, we observe a consistent pattern: the disparity in prices between the base futures year expiring in 2025 and 2030 (Y25 and Y30) is diminishing.

This trend suggests an interesting market dynamic that can be influenced by distinct factors:

1. Spot Market

Current prices in the spot market act as a reference for setting the prices of Futures contracts, establishing a basis for pricing.

2. Interest Rates

Stabilization or convergence of future interest rate expectations can minimize differences in carrying costs between contracts, more closely aligning the prices of long-term futures with those of the short-term.

3. Risk Perception

A decrease in the risk perception related to the energy sector or events impacting supply and demand can lead to lower price differentiation between contracts of different durations.

4. Market expectations

An alignment in market participants' expectations about future supply and demand conditions can mitigate volatility and price discrepancies between contracts of different maturities. The transition from a contango curve (when future prices are higher than wholesale price) to a flatter configuration or even to backwardation (when future prices are lower than wholesale price) reflects these shifts in market outlooks.

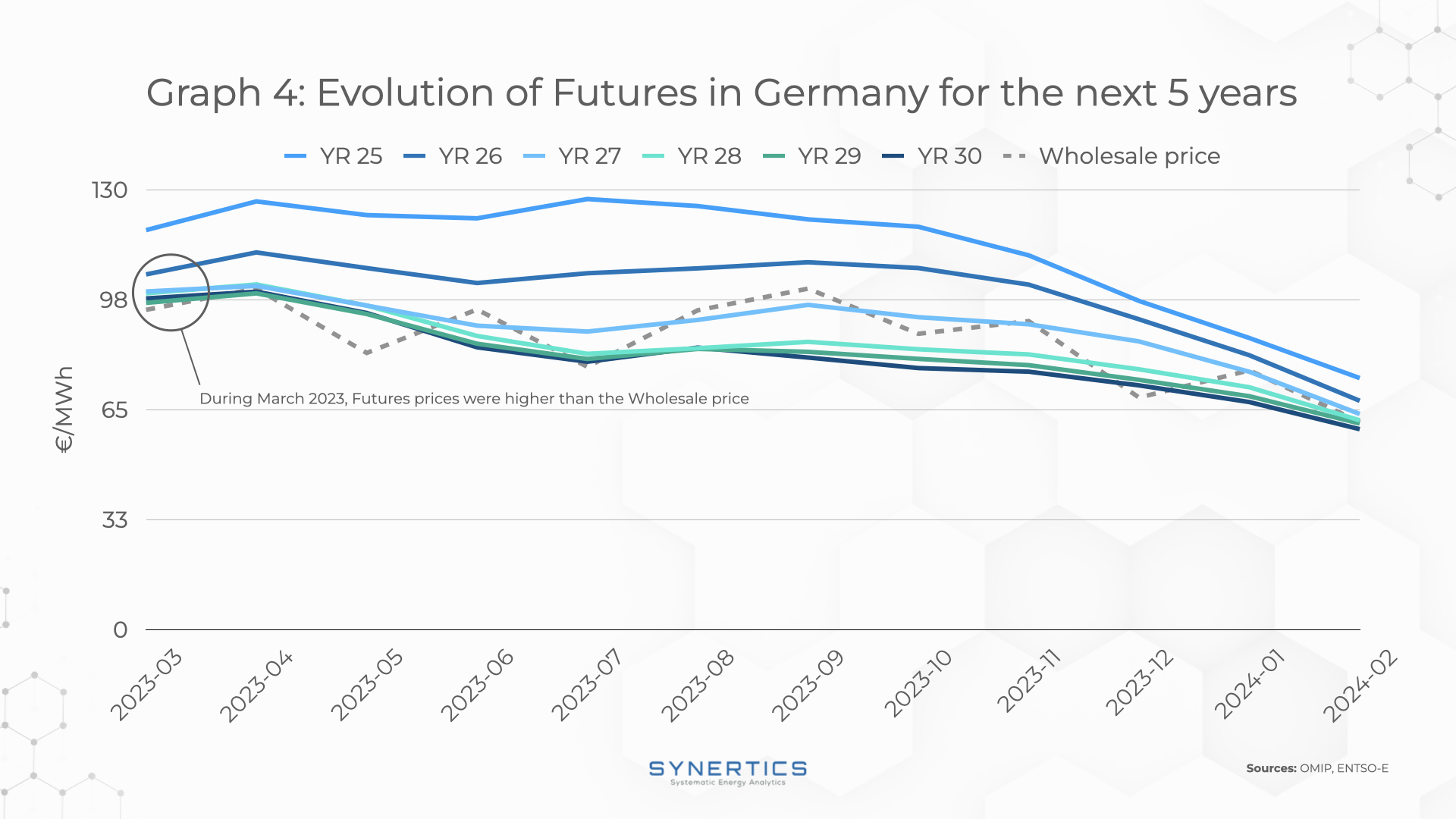

To delve deeper into the topic of the Futures curve, let's take the example of the German Futures:

In March 2023, it was observed that the cost of securing energy for future delivery exceeded the cost of immediate delivery. This situation could be attributed to various factors such as supply risks, transmission expenses, delivery costs, or the pricing dynamics favoring shorter-term contracts over longer ones. Notably, the price curves were changing, with longer-term contracts exhibiting lower prices compared to the spot price, and the price differentials between contracts were diminishing.

The aforementioned factors highlight the complex mechanisms that drive the energy futures market. They illustrate how shifts in risk perceptions, market expectations, and economic conditions can influence future prices and investor decision-making. Monitoring this trend is essential to discern whether it represents a consistent pattern or mere market fluctuations.

Furthermore, it is important to note how these variables are interconnected with the final price of your PPA. As such, expert guidance can help you handle risks associated with market fluctuations and perform accurate pricing assessments.

Reach our PPA Advisory team to learn more about how we can assist with your pricing activities.

Market-trends

6th Feb, 2026

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025