Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

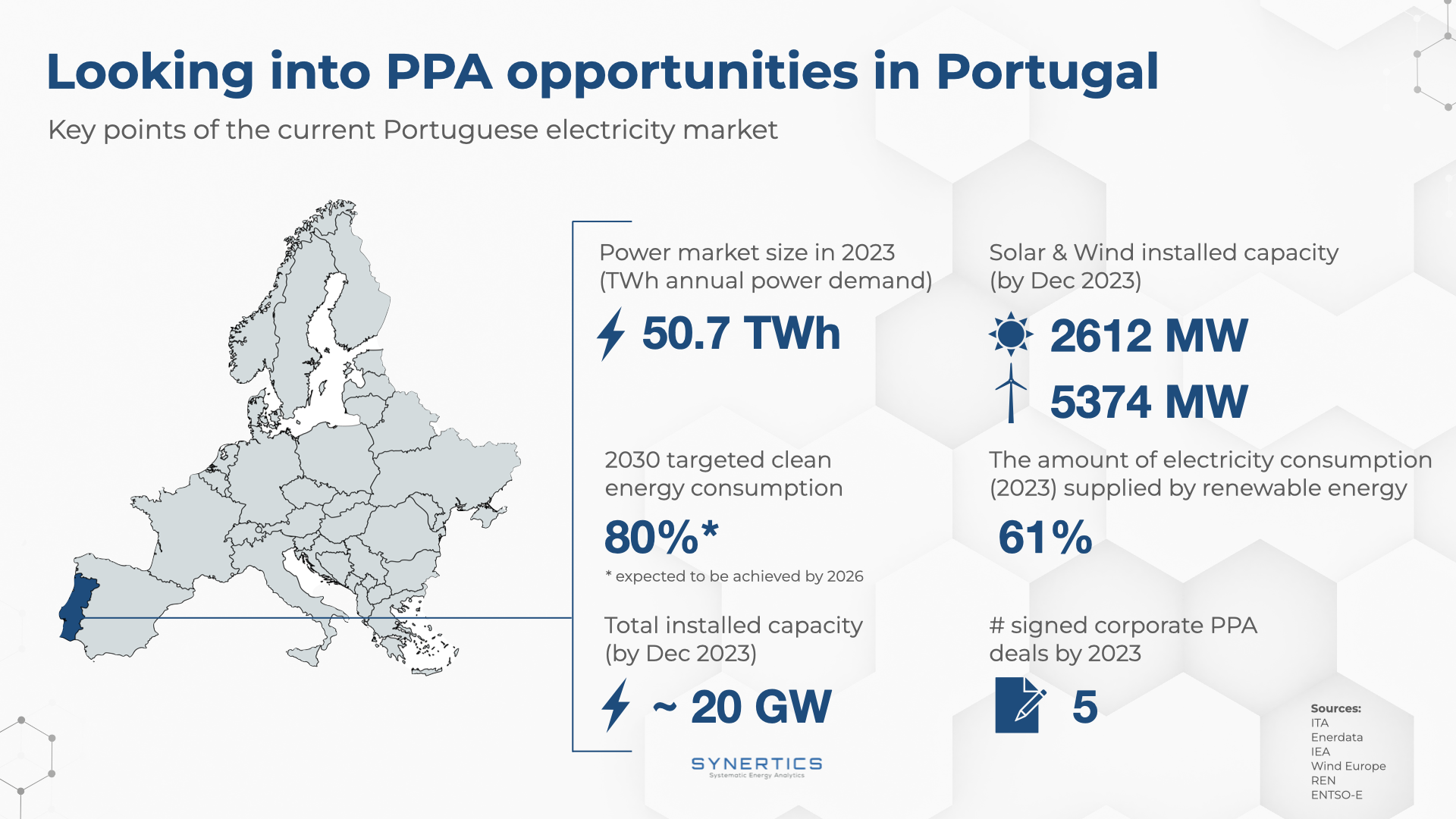

The market for PPAs in Portugal is growing, with a significant milestone being its first closed corporate PPA transaction in 2023.

In this article, we'll explore the factors that are driving the growth of the Portuguese PPA market, making it a noteworthy country compared to other European markets, as well as the challenges that need to be addressed.

In 2023, 61% of Portugal's electricity was produced from renewable energy, with a notable increase in solar capacity, with approximately a 35% increase from January 2023 to January 2024.

Updating its transmission networks is crucial to meet Portugal's target of 80% clean energy production coming from renewables by 2030. In mid-2023, the European Investment Bank agreed to provide funding support to REN (National TSO) to enhance Portugal's electrical grid efficiency. This funding plan seeks to cater to REN's 2026 plans to modernise the grid, increase renewable capacity, and ensure a reliable electricity supply while aligning the country with RePower EU’s 2030 guidelines.

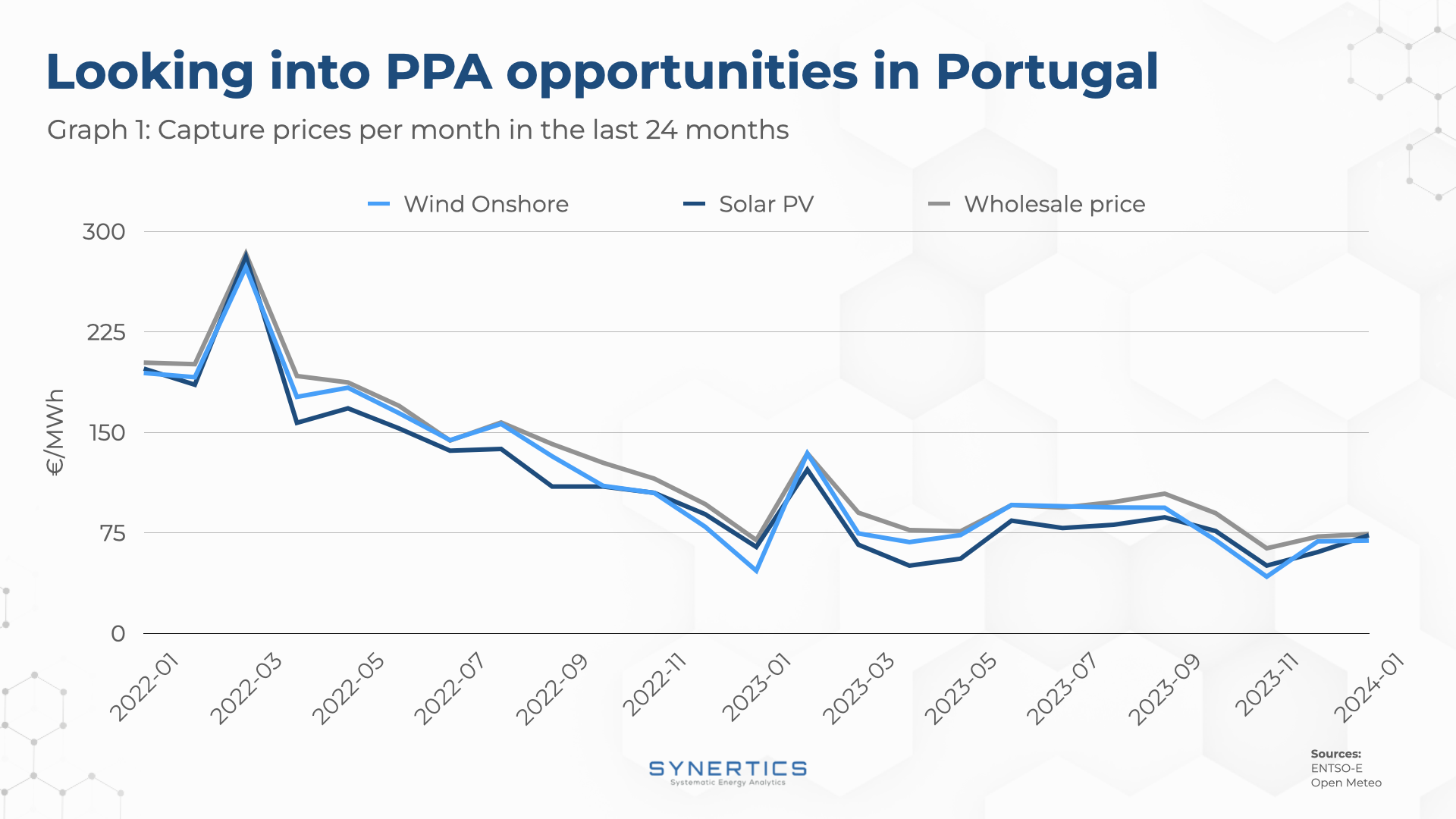

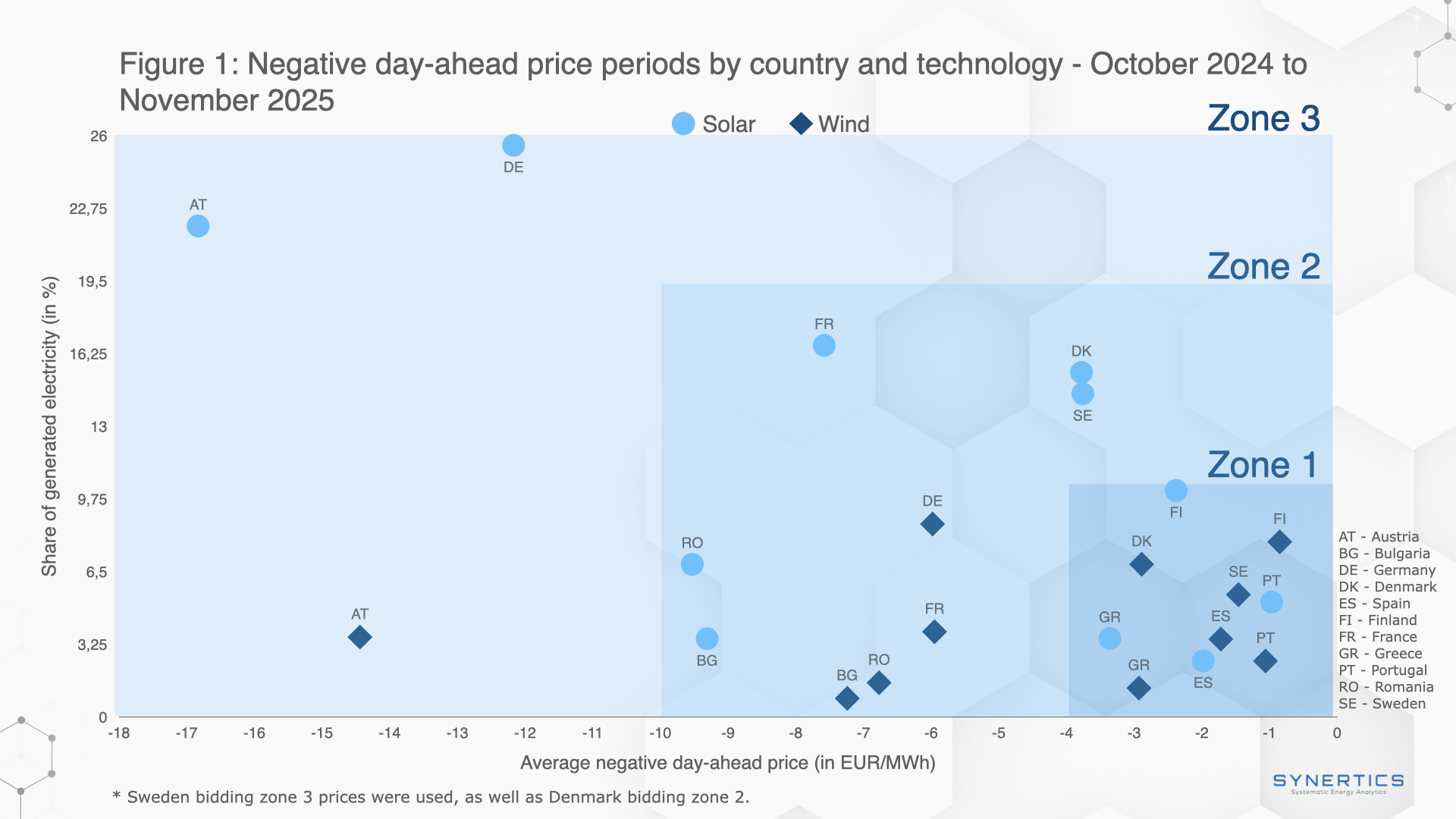

In 2023, the average wholesale electricity price in Portugal was around 88 €/MWh, a significant decrease from 168 €/MWh in 2022. This drop can be attributed to factors such as declining gas prices and favourable weather conditions leading to higher wind energy production. For instance, the Portuguese electricity spot market experienced 69 instances of zero prices in 2023, compared to just 4 in 2022.

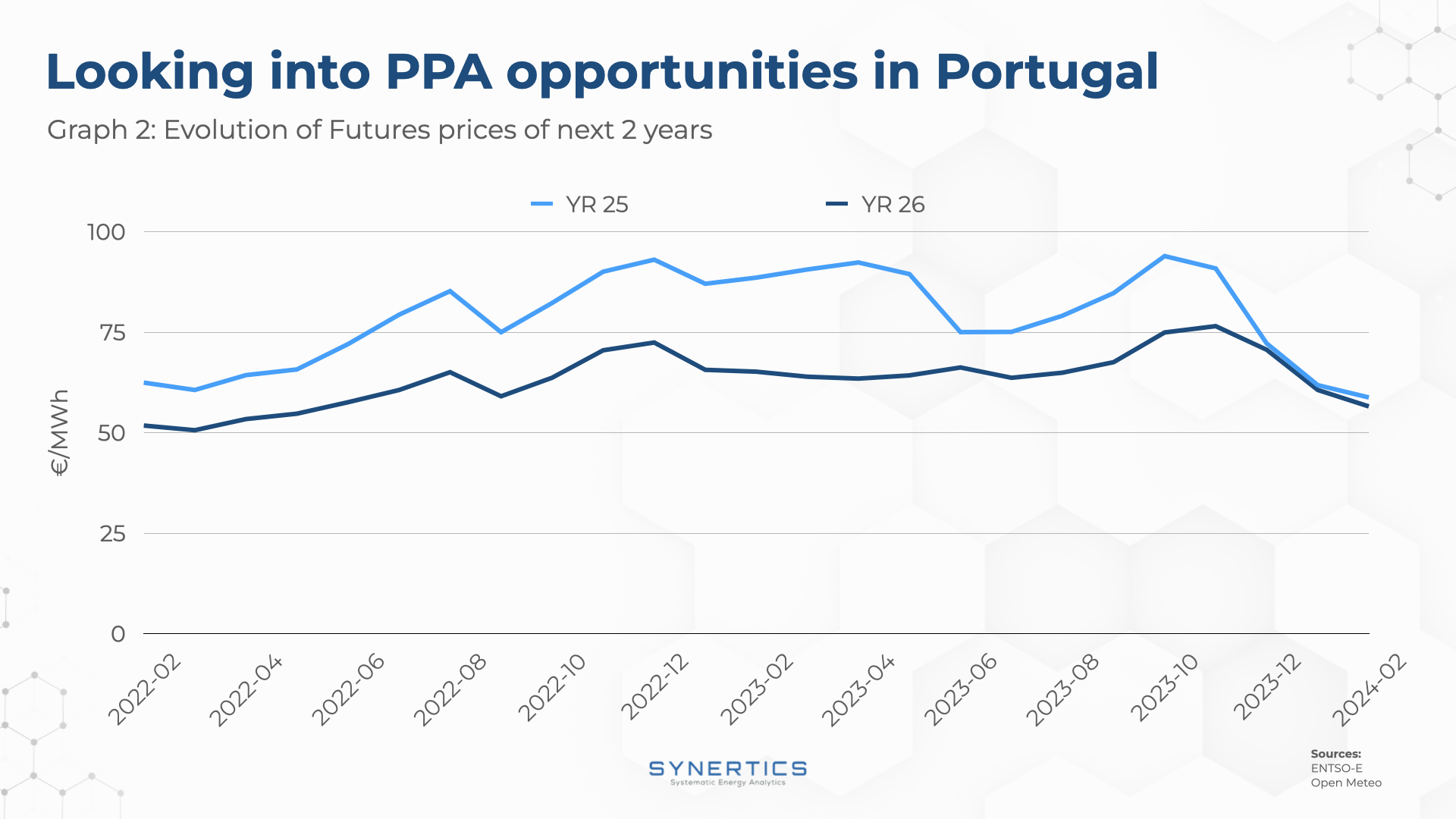

Looking at recent Futures prices for 2025 and 2026 in Graph 2, it is possible to note a downward trend in the last quarter of 2023, revealing participants' expectations about the pricing of Baseload contracts for the coming years.

When assessing the potential profitability of a project amid fluctuating wholesale market prices, one method is to monitor Capture Prices in production. Notably, there was a significant decline of around 52% in Solar Capture Prices and 48% in Wind Capture Prices from 2022 to 2023, aligning with the trend observed in wholesale prices.

From our SWOT analysis of the current Portuguese PPA scenario, we were able to highlight the following:

Strengths:

Positive aspects of Portugal's renewable energy industry include the low incidence of curtailments, through the diversification of its energy matrix (presence of hydroelectric plants), and the ability to export energy to Spain. Additionally, the expanding market for green certificates provides an extra source of profitability for producers.

Weaknesses:

Frequent regulatory changes have increased the execution risks of renewable energy projects in Portugal. An example of such a policy is the Clawback, which was implemented in 2013 to address distortions in the formation of the average price of electricity in the wholesale market in Portugal caused by extra-market events. This policy created uncertainty for energy producers who had to modify their contracts (PPA) for physical energy delivery.

Opportunities:

Government incentives encourage sustainable practices and prompt local companies to align with the GHG Protocol (Greenhouse Gas Protocol). Another opportunity arises from the Portugal-Spain interconnection agreement, facilitating cross-border capacity exchange. As per REN, the project is projected to prevent a loss of renewable energy generation ranging from 185 to 2,400 GWh/year by 2030, depending on the scenarios.

Threats:

The lack of alignment between energy market participants and state policies can hinder project advancement and discourage new entrants. For instance, if renewable energy production capacity increases without corresponding network preparations, it creates challenges. Additionally, there's a noticeable shortage of human resources in projects, leading to delays in the completion dates. This underscores the importance of aligning renewable energy industry growth with infrastructure and workforce supply.

Portugal's participation in the Corporate PPA market since 2023 has revealed substantial opportunities, such as the increasing demand, fueled by government incentives for sustainability, which presents significant potential for PPA developments. Moreover, the push for decarbonisation from a growing number of Portuguese companies is driving the necessity for new corporate PPA contracts.

Despite challenges like grid infrastructure issues and zero-price trends, there are viable solutions to explore, such as:

In the end, Portugal's current challenges can serve as avenues for innovation and improvement, further strengthening the country's competitiveness in the European PPA space.

Market-trends

6th Feb, 2026

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025