Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Properly addressing curtailment risks is one of the most important topics when signing a PPA.

Given the variable generation of solar and wind, the increasing share of both sources may affect the grid stability over time. The need for matching supply and demand can make Transmission System Operators (TSO) require a partial or total reduction of the generation.

Read more on curtailments here.

In Spain, the pipeline of wind and solar projects is scaling at a pace that hasn’t been followed by the country’s grid developments. Within this context, the frequency and volume of curtailments may escalate, consequently impacting the revenue streams of renewable projects.

On April 17th, 2022, for the first time, a solar PV plant was curtailed. Since then, the volume of curtailments in Spain has grown considerably. The country has two main forms of managing grid constraints, the Technical Restrictions of the Base Daily Operating Program (PDBF in the Spanish acronym) Phase I, and the Technical Restrictions in Real Time. In addition to not being able to issue Guarantees of Origins for curtailed electricity, the power volumes curtailed during the Technical Restrictions of the PDBF Phase I are also not compensated.

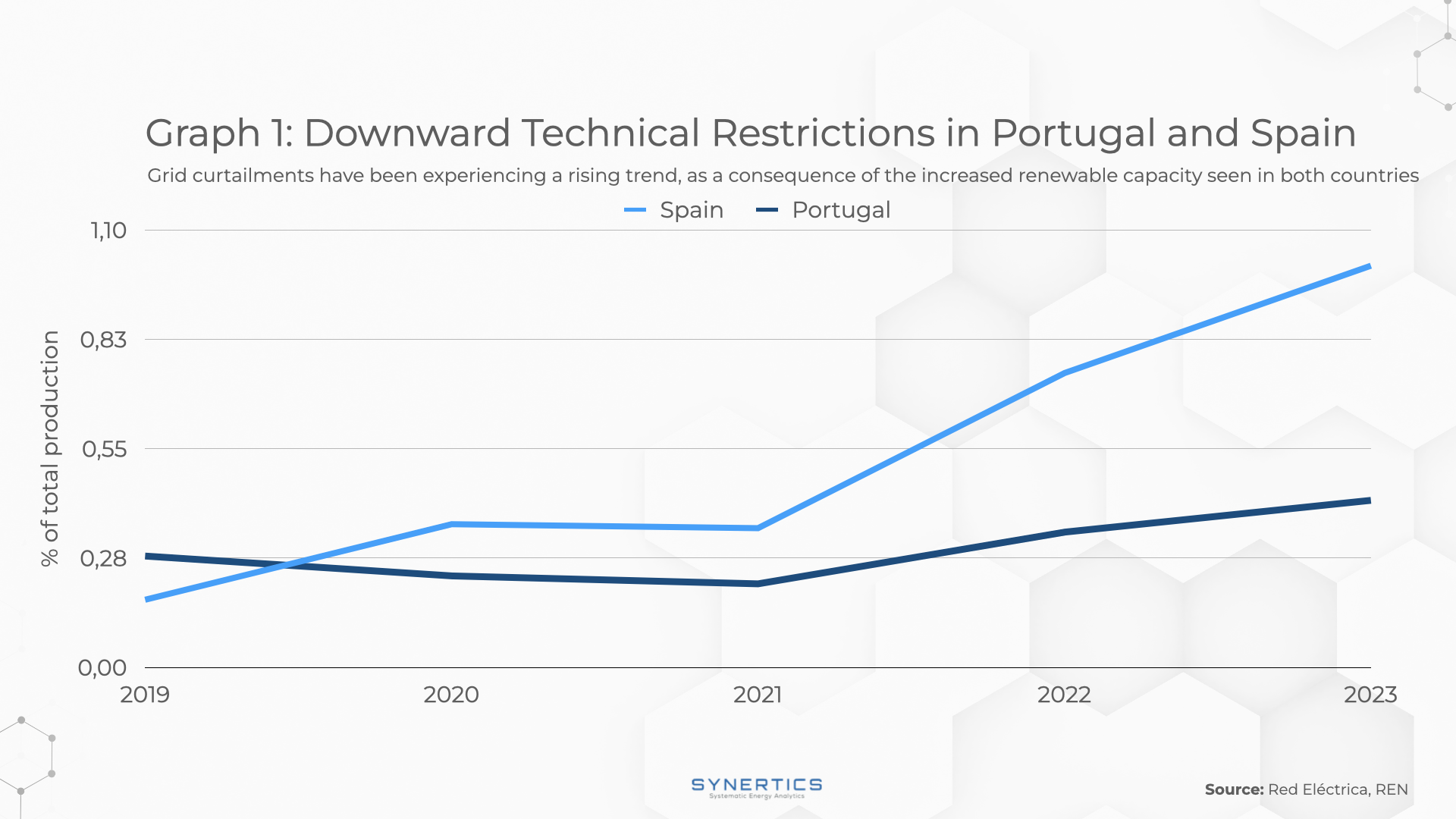

Graph 1 presents the percentage of downward restrictions requested by the national TSO in the past 5 years in both Phase I and Real-time in Portugal and Spain. According to the TSO in Spain, 82% of the downward restrictions on Phase I in 2022 were requested for renewables - wind and solar. This value accounts for 1.08 TWh, representing almost 1% of the total renewable generation.

With a slow grid enhancement rate and a trend of increasing installed renewable capacity, Spain is seen as a promising market for storage applications due to the anticipated flexibility that the electrical system will demand (read more on flexibility in Spain).

Even though Portugal’s mechanisms of managing grid constraints are the same as in Spain, the country faces fewer issues as the Portuguese electrical system has a relatively large capacity for pumped hydro storage and for exporting electricity to Spain. In this sense, wind and solar curtailment is practically zero. Nevertheless, the country's grid technical restrictions have increased since 2021, as shown in Graph 1, reaching an amount of 0.4% in 2023, accounting for 213 GWh. This trend can be linked to the nation’s growth in variable renewable energy generation capacity.

Both countries are expected to increase their shares of renewables and like in many other countries, they are facing an increasing volume of technical restriction measures due to grid constraints. As lower curtailment levels ultimately reduce risks for both producers and consumers, the path for decarbonising electricity generation calls for improvements in the electrical networks’ flexibility, especially when considering large-scale renewable energy projects. In summary, Portugal presents a market with lower curtailment risks for PPAs, when compared to Spain.

Market-trends

6th Feb, 2026

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025